USAA Car Insurance Guide [Data + Expert Review]

USAA insurance is on average 33.66% lower across every U.S. state, but it's only available to military personnel and their families. USAA is also one of the top-rated insurers in the country. This USAA insurance guide will tell you everything you need to know to get affordable USAA insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| USAA Overview | Details |

|---|---|

| Year Founded | 1922 |

| Current Executives | CEO: Stuart Parker |

| Number of Employees | 32.7 thousand |

| Total Assets | $30.6 billion |

| HQ Address | USAA 9800 Fredericksburg Rd. San Antonio, TX 78288 |

| Phone Number | 800-531-8722 |

| Company Website | https://www.usaa.com/ |

| Auto Insurance Premiums Written 2017 | $13,154,939 |

| Best For | Military personnel/veterans and their families |

First off, who is eligible for USAA car insurance?

USAA car insurance is well known. It is one of the largest car insurance companies for military members and their families, and it has earned a reputation for having great service and rates.

However, you don’t want to just go off what you hear and be surprised later when your policy doesn’t meet your expectations. An insurer may promise things that it doesn’t fulfill, so we want to see if USAA lives up to the hype.

In this review, we are going to cover everything from USAA’s ratings to its usage-based app. Keep reading to discover if USAA is the right provider for you, including financial ratings and how to cancel your USAA auto insurance if it isn’t right for you.

The best way to find the best rates is to shop around with different car insurers. Want to start comparison shopping rates today? Before jumping into this USAA car insurance guide, check out our FREE tool above.

Cheap Car Insurance Rates

Since states legally require car insurance, vehicle owners must budget for car insurance if they don’t want to break the law.

But if you find that too much of your monthly budget is being consumed by car insurance payments, it’s time to start shopping around. Before you commit to an insurance company, you need to learn about their rates.

This way, you can determine if a company will fit into your budget.

So stick with us as we go through Quadrant’s data on USAA’s car insurance per month and what makes rates increase.

So, how much does USAA car insurance cost? Up next.

USAA Availability & Car Insurance Rates by State

The last thing you need to deal with when moving is finding a new insurance provider. Sometimes, though, providers only supply insurance in certain states. Luckily, USAA provides insurance in all U.S. states. So no matter where you move to, you can stick with USAA.

Although we do want to point out that your rates will change if you move to a new state. The table below shows USAA’s rate changes.

USAA Car Insurance Rates By State| State | USAA Annual Premium | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Alabama | $2,124.09 | -$1,442.87 | -40.45% |

| Alaska | $2,454.21 | -$967.31 | -28.27% |

| Arizona | $3,084.29 | -$686.68 | -18.21% |

| Arkansas | $2,171.06 | -$1,953.92 | -47.37% |

| California | $2,693.87 | -$995.06 | -26.97% |

| Colorado | $3,338.87 | -$537.52 | -13.87% |

| Connecticut | $3,190.00 | -$1,428.92 | -30.94% |

| Delaware | $2,325.98 | -$3,660.34 | -61.15% |

| District of Columbia | $2,580.44 | -$1,858.80 | -41.87% |

| Florida | $2,850.41 | -$1,830.05 | -39.10% |

| Georgia | $3,157.46 | -$1,809.37 | -36.43% |

| Hawaii | $1,189.35 | -$1,366.29 | -53.46% |

| Idaho | $1,877.61 | -$1,101.48 | -36.97% |

| Illinois | $2,770.21 | -$535.28 | -16.19% |

| Indiana | $1,630.86 | -$1,784.11 | -52.24% |

| Iowa | $1,852.57 | -$1,128.71 | -37.86% |

| Kansas | $2,382.61 | -$897.02 | -27.35% |

| Kentucky | $2,897.89 | -$2,297.51 | -44.22% |

| Louisiana | $4,353.12 | -$1,358.23 | -23.78% |

| Maine | $1,930.79 | -$1,022.49 | -34.62% |

| Maryland | $2,744.14 | -$1,838.56 | -40.12% |

| Massachusetts | $1,458.99 | -$1,219.86 | -45.54% |

| Michigan | $3,620.00 | -$6,878.64 | -65.52% |

| Minnesota | $2,861.60 | -$1,541.65 | -35.01% |

| Mississippi | $2,056.13 | -$1,608.44 | -43.89% |

| Missouri | $2,525.78 | -$803.15 | -24.13% |

| Montana | $2,031.89 | -$1,188.96 | -36.91% |

| Nebraska | $2,330.78 | -$952.90 | -29.02% |

| Nevada | $3,069.07 | -$1,792.64 | -36.87% |

| New Hampshire | $1,906.96 | -$1,244.81 | -39.50% |

| New Jersey | Data Not Available | - | - |

| New Mexico | $2,296.77 | -$1,166.87 | -33.69% |

| New York | $3,761.69 | -$528.20 | -12.31% |

| North Carolina | Data Not Available | - | - |

| North Dakota | $2,006.80 | -$2,159.04 | -51.83% |

| Ohio | $1,478.46 | -$1,231.25 | -45.44% |

| Oklahoma | $3,174.15 | -$968.17 | -23.37% |

| Oregon | $2,587.15 | -$880.62 | -25.39% |

| Pennsylvania | $1,793.37 | -$2,241.13 | -55.55% |

| Rhode Island | $4,323.98 | -$679.38 | -13.58% |

| South Carolina | $3,424.77 | -$356.37 | -9.42% |

| South Dakota | Data Not Available | - | - |

| Tennessee | $2,739.28 | -$921.61 | -25.17% |

| Texas | $2,487.89 | -$1,555.39 | -38.47% |

| Utah | $2,491.10 | -$1,120.79 | -31.03% |

| Vermont | $1,903.55 | -$1,330.58 | -41.14% |

| Virginia | $1,858.38 | -$499.49 | -21.18% |

| Washington | $2,262.16 | -$797.16 | -26.06% |

| West Virginia | $1,984.62 | -$610.74 | -23.53% |

| Wisconsin | $2,975.74 | -$630.33 | -17.48% |

| Wyoming | $2,779.53 | -$420.55 | -13.14% |

| Median | $2,489.49 | -$1,171.40 | -32.00% |

Is USAA car insurance cheaper than other companies? Yes, USAA’s average rate is less than the average rate by state across the U.S. This means that no matter where you go, your rates will be cheaper than average.

Comparing the Top 10 Car Insurance Companies by State Rates

While USAA is cheaper than the state average, other companies are, too. Let’s look at the top 10 companies’ rates by state.

The Top Ten Insurance Providers' Rates by State| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

Read more:

- Arizona Auto Insurance (The Only Guide You’ll Ever Need)

- Connecticut Car Insurance (The Only Guide You’ll Ever Need)

- Florida Car Insurance (The Only Guide You’ll Ever Need)

- American Family Car Insurance Guide [Data + Expert Review]

- Kentucky Auto Insurance (Cheap Rates, Best Companies, and More)

- Alaska Car Insurance (The Only Guide You’ll Ever Need)

- Idaho Car Insurance (The Only Guide You’ll Ever Need)

Is USAA the cheapest car insurance? In the majority of states, USAA has the cheapest rates by far. However, Geico sometimes is close to USAA in rates, making Geico a good option for non-military members.

Average USAA Male vs. Female Car Insurance Rates

You probably already know that insurers consider age when creating rates, but a less-known demographic is gender. Insurers use accident data to determine rates, and most have come to the conclusion that males are riskier drivers.

However, some states have banned using gender as a basis for rates — California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan.

In states where this isn’t banned, though, USAA has the following average demographic rates.

USAA Average Rates by State, Based on Gender| Demographic | USAA Average of Annual Premium |

|---|---|

| Single 17-year-old female | $4,807.54 |

| Single 17-year-old male | $5,385.61 |

| Single 25-year-old female | $1,988.52 |

| Single 25-year-old male | $2,126.14 |

| Married 35-year-old female | $1,551.43 |

| Married 35-year-old male | $1,540.32 |

| Married 60-year-old female | $1,449.85 |

| Married 60-year-old male | $1,448.98 |

USAA varies on whether it charges males or females more. While USAA charges males under age 25 more, it charges males less past age 25. This is probably because a male driver’s driving habits improve as they become older. (For more information, read our “Best Car Insurance For Under 25 Males“).

Average USAA Auto Insurance Rates by Make & Model Last-5-Year Average

Do you look at crash safety ratings before buying a new vehicle? Insurers certainly do, and car insurance companies use this crash test data to determine rates.

Based on a car’s safety rating and upkeep expense, insurers charge some vehicle owners more.

Average USAA Auto Insurance Rates by Make & Model, 5-Year Average| Make and Model | USAA Average Annual Premium |

|---|---|

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $2,551.56 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $2,409.67 |

| 2015 Toyota RAV4 XLE | $2,454.58 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $2,855.69 |

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $2,422.66 |

| 2018 Toyota RAV4 XLE | $2,529.63 |

At USAA, a Ford F-150 SuperCab costs the most to insure. A Honda Civic is the cheapest to insure, costing about $450 less than a Ford F-50 SuperCab. This difference isn’t enormous, but it does show that the safer your car is, the less you will pay. So make sure to thoroughly research a car beforehand.

Average USAA Commute Car Insurance Rates

USAA does change prices based on how far customers drive each year. It may seem unfair to have to pay more on your premium when you are already paying more for gas, but a longer commute means more time on the road, which means more time to get into an accident.

So let’s see what USAA charges.

| Group | 10 Miles Commute / 6,000 Annual Mileage | 25 Miles Commute / 12,000 Annual Mileage |

|---|---|---|

| USAA | $2,482.69 | $2,591.91 |

USAA charges an average of $109 more for a long commute, which is a normal price increase. This means drivers with a long commute will need to budget an extra $9 a month.

Average USAA Coverage Level Car Insurance Rates

Some companies have outrageous price increases for coverage upgrades. Luckily, USAA isn’t one of those companies.

| Coverage Type | High | Medium | Low |

|---|---|---|---|

| USAA Average Annual Premium | $2,667.92 | $2,539.87 | $2,404.11 |

On average, it costs less than $300 to upgrade from low to high coverage. The upgrade from low to medium coverage is even more economical, costing only $135. At other companies, the jump from low to high coverage can be over $1,000, so USAA is on the lower end.

Because high coverage is vital in an accident, we recommend you take advantage of USAA’s low rates and purchase a high coverage level. Otherwise, you may have to pay out of pocket in an accident because your low or medium coverage doesn’t completely cover your accident costs.

Average USAA Credit History Car Insurance Rates

A bad credit score can be hard to remedy, especially when your car insurer increases your rate, making it harder to pay off bills.

U.S. citizens’ average credit score is 675, which is generally considered a good credit score.

However, not all car insurance providers charge an unreasonable amount for a bad credit score. Below are USAA’s rates based on credit score.

| Credit Score | Good | Fair | Poor |

|---|---|---|---|

| USAA Average Annual Premium | $1,821.20 | $2,219.83 | $3,690.73 |

At USAA, the drop from good fair credit costs an average of $398, while good to poor credit costs an average of $1,869. Since other insurers charge an average of $1,000 for a drop from good to poor credit, USAA’s rate increase is on the higher end.

However, USAA’s overall rate is still lower than most companies’ resulting rate for poor credit. So if you have poor credit, USAA may still be the cheaper option.

Average USAA Driving Record Car Insurance Rates

Accidents, DUIs, and speeding tickets all have a negative impact on insurance rates. The worse a driver’s record is, the more insurers will charge. However, not all insurers increase rates the same. Let’s take a look at USAA’s price increases.

| Driving Offense | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| USAA Average Annual Premium | $1,933.68 | $2,193.25 | $2,516.24 | $3,506.03 |

Drunk driving is a serious offense, which is why USAA increases rates an average of $1,573 for DUIs. Accidents are the next-most-serious offense at USAA, raising rates an average of $583.

As for speeding tickets, they will cost drivers much more than just the price of the ticket. At USAA, a speeding ticket will also result in a $360 price increase. And these high price increases are just for first offenses. If you have more than one offense in a category, your rates will quickly become astronomical.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rating Agencies & USAA

Is USAA a good auto insurance company? While word of mouth can be a way to find a new company, it is also important to look at what official reviewers are saying. This section will cover USAA’s ratings, from financial creditworthiness to customer satisfaction.

So keep reading to see what people think of USAA.

A.M. Best

Let’s start with A.M. Best. This company is a well-known reviewer that looks at companies’ financial standings. A.M. Best grades companies on a letter scale, from A++ to C-. So what grade did USAA earn?

USAA has an A++ rating from A.M. Best.

An A++ rating means companies have “a superior ability to meet their ongoing insurance obligations.” Since these obligations include paying out claims, USAA’s strong financial standing is good news.

Better Business Bureau

The Better Business Bureau (BBB) accredits companies by looking at multiple factors dealing with a company’s ethical business practices.

These factors are:

- Complaint history

- Business type

- Time in business

- Transparency of business practices

- Failure/success in honoring commitments to the BBB

- Licensing and government actions

- Advertising issues

Unfortunately, USAA only has a B- rating from the BBB. Why is this rating low?

It could be because of recent government action taken in 2019 against USAA.

- Bureau of Consumer Financial Protection versus USAA. Charges were brought against USAA for violating the Electronic Fund Transfer Act, Regulation E., and the Consumer Financial Protection Act of 2010.

- Office of the Comptroller of the Currency versus USAA. USAA failed to put a proper risk-management system in place.

While USAA settled with the Bureau of Consumer Financial Protection, this is still a mark on USAA’s record, as the charges were brought against USAA because it failed to stop payments when requested and opened deposit accounts without notification.

As for USAA’s failure to put a proper risk-management system in place, the court-appointed a compliance committee to USAA to fix it. Since USAA has worked to correct these issues with the courts, hopefully, it will earn a better BBB rating in the future.

Moody’s Rating

Moody’s is another financial rating company. USAA has another solid financial rating from Moody’s.

USAA has an Aa1 rating.

This rating is the second-highest rating possible. It means that USAA has a strong ability to repay debts (such as claims) and is a low credit risk.

S&P

Another company that looks at financial strength, Standard and Poor (S&P) rates companies on their ability to pay back debts. USAA has an AA rating from S&P, which is the second-highest rating.

Once again, USAA has a strong financial rating.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) collects information on complaints. NAIC then compares the number of complaints to the number of total customers, creating a complaint index.

USAA’s complaint index in 2017 was 0.74.

This is a decent complaint index. In comparison, the national median complaint index in 2017 was 1.0.

So USAA seems to have a normal number of complaints, which is good news. Complaints are a normal part of owning a company, so a low index shows that USAA isn’t displeasing too many customers.

J.D. Power

Another customer satisfaction rating we want to look at is J.D. Power’s 2019 study. J.D. Power surveyed over 42,500 insurance customers and rated companies according to customer satisfaction levels.

Below is J.D. Power ratings of USAA in different U.S. regions.

J.D. Power Ratings of USAA, By Region| U.S. Region | Customer Satisfaction (out of 1,000) | J.D. Power Circle Ranking (out of 5) |

|---|---|---|

| California | 884 | 5-Among the Best |

| Central | 907 | 5-Among the Best |

| Florida | 898 | 5-Among the Best |

| Mid-Atlantic | 898 | 5-Among the Best |

| New England | 898 | 5-Among the Best |

| New York | 884 | 5-Among the Best |

| North Central | 891 | 5-Among the Best |

| Northwest | 894 | 5-Among the Best |

| Southeast | 878 | 5-Among the Best |

| Southwest | 887 | 5-Among the Best |

| Texas | 894 | 5-Among the Best |

Read more: California Car Insurance (The Only Guide You’ll Ever Need)

USAA has absolutely fantastic ratings in every region. It has the highest power circle rating in every area, which is great. Clearly, most customers are happy with the service they receive from USAA.

Consumer Reports

How does Consumer Reports rate companies? Like J.D. Power, Consumer Reports studies customer satisfaction levels at companies.

USAA has a total score of 95 out of 100 from Consumer Reports.

This is a great score, and it is based on customer satisfaction levels in the following areas.

USAA Customer Service Ratings Based on Consumer Report Scores| USAA Customer Service | Consumer Report Score |

|---|---|

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Excellent |

| Promptness of the Response | Excellent |

| Damage Amount | Excellent |

| Agent Courtesy | Excellent |

| Timely Payment | Excellent |

| Freedom to Select Repair Shop | Excellent |

| Being Kept Informed of Claim Status | Excellent |

A score of excellent is the highest possible, and USAA has one in every category.

Consumer Affairs

Let’s take a look at one more rating from Consumer Affairs.

USAA only has two out of five stars on Consumer Affairs.

This score is based on only 285 reviews in the past year (2019). While this rating is discouraging, it is only based on a small percentage of USAA customers.

Since USAA earned fantastic ratings from J.D. Power and Consumer Reports, Consumer Affairs rating shouldn’t be taken as a completely accurate representation of USAA.

Coverages Offered by USAA

Now that we know what prices you’ll pay at USAA, we want to make sure the coverage is just as good as the prices. Sometimes, insurers’ cheaper rates mean fewer coverage options.

So stick with us as we go through USAA’s coverage, discounts, programs, and more. This way, you can determine if USAA’s offerings fit your needs as well as your budget. Let’s jump right in.

Types of Car Insurance Coverages Offered

What does USAA auto insurance cover? We want to make sure that USAA has all the basic insurance coverages. Below is a complete list of the auto insurance coverages that USAA offers.

- Bodily Injury Liability — If you cause an accident, this coverage will help cover the costs of the other driver’s medical bills.

- Classic Car — Own a classic car? Classic car insurance is based on mileage driven, so it will be cheaper than regular auto insurance.

- Collision— Protects you if you are in an accident with another vehicle or an object (such as a mailbox).

- Commercial — If you have a vehicle that is used for business, such as a delivery vehicle, then you need commercial coverage.

- Comprehensive — If your vehicle is damaged from an accident other than a collision with another vehicle, this coverage will help. It covers natural disasters, animal collisions, theft, and vandalism.

- Extended Benefits Coverage — This coverage must be combined with medical payments coverage. It will help provide death benefits, disability service benefits, and wage-earner benefits after an accident.

- Personal Injury Protection — This coverage helps with medical bills after an accident.

- Property Damage Liability — Covers the cost of property damage bills in an accident you cause.

- Ridesharing Gap Coverage — This coverage covers the gaps between driving on rideshare insurance and driving on personal insurance.

- Roadside Assistance — Helps with the following situations: locked car, out of gas, dead battery, and flat tires. It also covers towing.

- Umbrella — Provides extra liability coverage, which is useful in lawsuits.

- Uninsured and Underinsured Motorist Coverage — These coverages are useful for run-ins with drivers with little or no insurance and who can’t pay your accident bills. Uninsured coverage is also useful for hit-and-run accidents.

USAA has an impressive range of coverages. It even has a few coverages that most insurers don’t have, such as extended benefits coverages. However, USAA only offers rideshare gap coverage, not rideshare coverage. Still, USAA has a well-rounded list of coverage options.

Factors That Affect Your Auto Insurance Rates

So how can you lower your rates at USAA?

- Keep a clean driving record

- Have a good credit score

- Take advantage of discounts

Discounts are a great way to lower costs. A discount you should consider is a bundling discount. By bundling an auto policy with another policy at USAA, such as a home or life policy, you can earn a significant discount. Besides auto insurance, USAA offers the following types of insurance (in addition to banking and investment services):

- Health insurance

- Homeowners, renters, and condo insurance

- Life insurance

- Small business insurance

- Valuable personal property insurance

- Vehicle insurance (motorcycle, RV, and boat insurance)

If you like to keep things simple, bundling policies at one provider means you won’t have multiple insurers to keep track of.

Getting the Best Car Insurance Rates with USAA

Bundling is just one discount option. If you want to get the best rate possible with USAA, check out the complete list of discounts below.

USAA Auto Insurance Discounts| USAA Discounts | Percentage Saved (when known) |

|---|---|

| Anti-lock Brakes | x |

| Anti-Theft | x |

| Claim Free | 12% |

| Daytime Running Lights | x |

| Defensive Driver | 3% |

| Distant Student | x |

| Driver's Ed | 3% |

| Driving Device/App | 5% |

| Early Signing | 12% |

| Family Legacy | 10% |

| Garaging/Storing | 90% |

| Good Student | 3% |

| Low Mileage | x |

| Loyalty | x |

| Married | x |

| Military | x |

| Military Garaging | 15% |

| Multiple Policies | x |

| Multiple Vehicles | x |

| Newer Vehicle | 12% |

| Occasional Operator | x |

| Paperless/Auto Billing | 3% |

| Passive Restraint | x |

| Safe Driver | 12% |

| Senior Driver | x |

| Vehicle Recovery | x |

| VIN Etching | x |

| Young Driver | $75 |

| Total Discounts Provided | 28 |

USAA has a total of 28 discounts. While this is lower than other providers’ number of discounts (the highest number is 38), USAA’s rates are already lower than average.

As well, USAA has easy discounts to get, such as signing up for automatic billing. So make sure to take advantage of what discounts USAA has to offer to lower your rates even more.

USAA’s Additional Car Insurance Programs

We already know USAA has a nice selection of coverage options, but what about its additional program coverage?

- Accident Forgiveness — Customers who remain accident-free for five years won’t have to pay increased rates with their first accident at USAA.

- Car Buying Service — USAA partnered with TrueCar, which allows drivers to check prices on cars and make sure they aren’t overpaying.

- Usage-Based Insurance — SafePilot™ is a safe-driving, usage-based app that gives discounts to drivers with safe driving habits.

These programs all help USAA members save money, which is great.

Read more: USAA SafePilot Auto Insurance Review

What Stands Out & What’s Missing

Now that we’ve covered USAA’s coverage choices and discounts, we want to recap what stands out and what’s missing.

- What Stands Out — USAA has cheap rates and a full list of coverage options. It also has a good amount of discounts.

- What’s Missing — USAA offers rideshare gap insurance, but not ridesharing insurance. It also doesn’t have a program like other insurers where rental cars are provided while cars are in the shop after an accident.

USAA’s lower prices make up for the few things it is missing, but it would be nice if USAA rounds out its coverages more in the future.

Canceling Your Auto Insurance Policy

How do I cancel my USAA membership? Planning on leaving USAA? Then this section is for you. We are going to go through everything from cancellation fees to when customers can cancel.

Why is this important to cover? The last thing you want is a long process of haggling when you leave USAA, trying to avoid cancellation fees and attempts to make you stay.

So keep reading to see what the process of leaving USAA is like.

Cancellation Fee

Luckily, USAA doesn’t charge cancellation fees, no matter when you cancel. Make sure you officially cancel your policy, though, instead of letting it lapse by not paying. Otherwise, you’ll have to pay premiums and late fees.

Is there a refund?

USAA will refund customers who cancel before the renewal period. This means that if you prepay for six months of coverage but cancel in the fourth month, USAA will refund you two months’ coverage.

If you don’t have any unused monthly premiums, though, USAA will have nothing to refund you for.

How to Cancel

How can I cancel my USAA auto insurance? To make the cancellation process go as smoothly as possible, follow our steps of canceling a USAA insurance policy. How do you cancel your USAA auto insurance online?

Step One: Have a New Insurer Beforehand

It is important to have a new insurer in place before you cancel your USAA auto insurance account. Otherwise, you may accidentally have a lapse in coverage. This isn’t good, as insurers see lapses in coverage and will raise rates. (For more information, read our “Auto Insurance Companies That Accept Lapses in Coverage“).

So have a new insurer before canceling. You will also need to have your new insurer’s name and policy number to give USAA.

If you are canceling USAA because you don’t need insurance any longer, though, you will instead need proof of a bill of vehicle sale or license plate relinquishment.

Step Two: Prepare Information

You also need to make sure you collect the information and documents you’ll need to cancel beforehand. Below is a list of what you’ll need.

- Personal information: name, date of birth, and Social Security Number

- Current USAA policy number

- Reason for canceling the policy (sold car, switching insurers, etc.)

- Name of the new insurer/new policy number (if switching companies)

- Bill of sale or proof of license relinquishment (if no longer need car insurance)

Having this information beforehand will ensure the cancellation goes as smoothly and quickly as possible.

Step Three: Choose a Cancellation Method

There are three ways to cancel your USAA policy.

- Online — You can log into your USAA policy and contact an insurance agent to cancel.

- Mail — You can send a letter to USAA’s headquarters (include the desired policy end date and signature in addition to the information in step two).

- Phone — Call 800-531-USAA (8722) or at 210-531-USAA (8722) to cancel.

Using the mail option will take longer than going online or calling, so make sure to send a letter long before your desired cancellation date.

Step Four: Cancel

You’ve collected your information and chosen your cancellation method. Now all you have to do is contact USAA and tell them you want to cancel your policy.

A representative will likely try to convince you to stay with USAA. Stick with canceling, though, and you will be done in no time.

When can I cancel?

Can you cancel a car insurance policy at any time with USAA?

You can cancel your USAA policy at any time. Your cancellation will go into effect immediately on your desired end date unless you mailed in a letter. To make sure USAA properly canceled your policy, you can sign in to your account online or call USAA again. Make sure to also check your account if you had automatic billing to make sure no charges occur after cancellation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Make a Car Insurance Claim

Unfortunately, the fact of the matter is that everyone has a high likelihood of being in at least one accident. There are so many uncontrollable factors on the road, from animals darting across the road to distracted drivers.

After an accident, it helps to know that your insurer will help as quickly as possible. It also helps to know that your insurer will accept and pay your claim.

Keep reading to learn about USAA’s claim process, from the ease of making a claim to the likelihood of claim acceptance.

Ease of Making an Auto Insurance Claim

It is easy to file a claim at USAA, as there are four different ways to file.

- Online — Sign in to your account on USAA’s website and file a claim online.

- App — If you have USAA’s mobile app, you can file a claim from your smartphone.

- In-Person — You can only use this option if you have a USAA agent near you.

- Phone — Call customer service at 800-531-8722.

Filing from the app is convenient, as you can directly submit pictures of damages. All options are available 24/7 (except for in-person).

So what information do you need to file a claim?

- Time, date, location of the accident

- Description of accident

- Names of involved parties/vehicles

- Insurance information of the at-fault party

The more information you get at the scene of the accident, the better.

https://youtu.be/5VxNXLnBnlw

Continue reading our guide on USAA car insurance to learn more about premiums written.

USAA Premiums Written

The number of premiums a company writes each year is important.

Premiums written show if a company is growing. If a company doesn’t have many written premiums but writes out a large number of claims, they will have to charge customers higher premiums to make up for the losses. Below is the NAIC’s information on USAA’s loss ratios.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| USAA Written Premiums | $9,843,321,000 | $11,691,051,000 | $13,154,939,000 | $14,467,936,000 |

USAA has a fantastic growth rate. Its premiums written increased significantly from 2015, which is a factor in keeping costs low at USAA.

Loss Ratio

Premiums written also tie into loss ratios.

A loss ratio compares written premiums to paid claims. So if a company pays out $60 in claims for every $100 earned in claims, it will have a 60% loss ratio.

As a result, a company with a high loss ratio is losing more than it earns, risking bankruptcy. A company with a low loss ratio isn’t at risk of bankruptcy, but it is at risk of losing customers because it pays out too few claims.

Now that we’ve covered what loss ratios are, let’s look at the NAIC’s data on USAA’s loss ratios.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| USAA Loss Ratio | 77.28 | 86.24 | 79.6 | 77 |

USAA’s loss ratio looks good. They haven’t dropped below 70% and have stayed mostly steady (besides a spike in 2016). So if you go with USAA, rest assured that they pay out a decent amount of claims to customers.

Design of Website & App

When you check your USAA app or log in to the website, you want the process to be as easy and fast as possible. Because of the advancements with today’s technology, few people have the patience for glitchy apps or slow-loading websites.

So stick with us as we go through the design of USAA’s website and apps.

Website

USAA’s website is easily navigated. On the upper left side of the home screen, there are four options: products, advice, join USAA, or help.

Products and advice are both dropdown menus. Below is an example of what happens when a user selects products.

If the array of options seems overwhelming, you can also use the search button on the upper right side of the home page rather than searching through the subtopics.

Because USAA has both menu options and a search bar, it is easy to find answers. However, if you use the search bar, make sure to enter specific word searches, as USAA offers more than auto insurance. For example, if you enter discounts instead of auto discounts, you will probably have results for multiple different insurance types.

All in all, though, USAA has a nice website design that is easy to navigate.

Mobile Apps

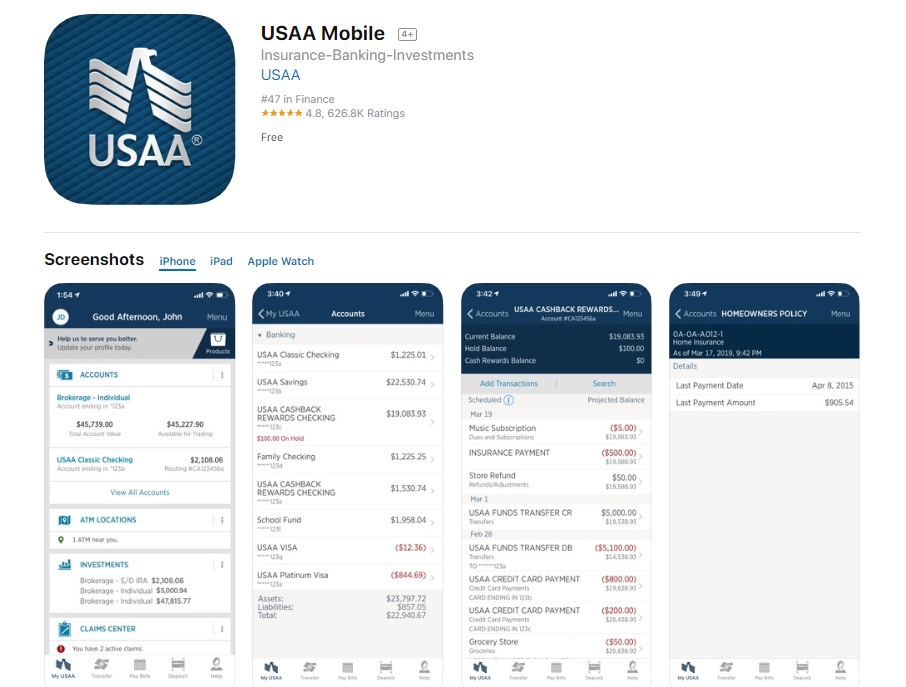

Now that we’ve covered USAA’s website, let’s see if its mobile apps function as well as the website. The first app we want to look at is USAA’s general app.

The USAA general app currently has 4.8 stars out of five on Apple (based on 626,800 ratings). Below is a snapshot of what the app’s screen options look like.

On the app, USAA customers can do the following:

- Pay bills

- Access auto insurance ID card

- Roadside assistance

- Report a claim

- Ask questions

Customers can also access their banking info if they have a banking or investment account with USAA. Overall, the app has good reviews and makes it easy to manage an account from a smartphone.

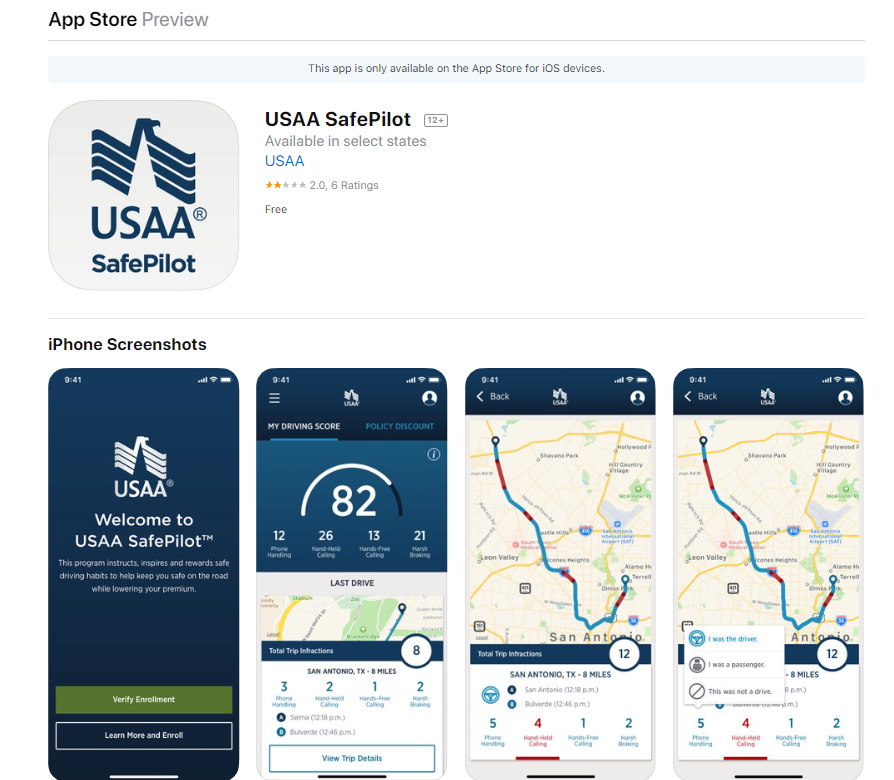

As for USAA’s usage-based driving app, it hasn’t done well. On Apple, it only has 1.9 stars out of five. To be fair, though, only a handful of people have reviewed the app.

The main complaint with the app isn’t about bugs, but that the app is only available in select states — currently Arizona, Ohio, Texas, and Virginia. This has resulted in a number of disappointed customers who downloaded the app without realizing it wasn’t available in their state.

Pros & Cons

Still having trouble deciding if USAA is right for you? Check out our list of pros and cons below.

| Pros | Cons |

|---|---|

| Cheaper rates than most providers | Rates go up significantly with a bad driving record (but generally still cheaper than other providers) |

| Multiple discounts | Fewer add-ons (doesn't have ridesharing insurance or car repair program) |

| Strong financial ratings | Some negative customer ratings on review sites |

| Highly-rated general app | Driving app is only available in select states |

USAA’s pros seem to outweigh the cons, though hopefully, USAA will expand its usage-based driving app to other states.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

USAA History

In the 1920s, a group of army officers decided to insure each other’s vehicles. USAA was born at that moment, and since then, the company has blossomed.

While USAA originally just insured army member’s vehicles, it eventually began insuring different military branches, such as Navy members.

And in 1970, USAA began to venture outside auto insurance, opening a USAA Federal Savings Bank. Today, the company provides auto, business, home, life, and health insurance.

This means that members can have all their major insurance policies at one company, as well as using USAA’s bank.

Since USAA has done a fantastic job of building its company in the past, we want to see how USAA will fare in the future. To do this, we are going to go through USAA’s market shares, future position, online presence, and other important factors.

So keep reading to see if USAA will still be around in a decade.

USAA Market Share

The first thing we want to look at is USAA’s market shares from the NAIC.

| USAA Market Shares 4-Year Trend | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Market Share | 5.17 | 5.45 | 5.68 | 5.87 |

USAA has managed to increase its market share over a four-year period. While the increase is only slight, it shows USAA is staying competitive. To put this increase in perspective, some companies only have 1% market share.

USAA’s Position for the Future

USAA isn’t going under any time soon. It has incredibly strong financial ratings, showing it can handle its finances and pay claims. While it had a poor rating from Consumer Affairs, other customer satisfaction ratings more than balanced out this poor rating.

As well, USAA has managed to increase its market share, which can be hard to do. Based on USAA’s growth and ratings, it is well-positioned for the future. This means that you won’t be stuck without an insurer if you choose USAA, as there is little to no risk of it closing.

USAA’s Online Presence

So how can you get in touch with USAA and find information?

- Online — USAA’s website provides customers with the ability to find information, to get free quotes, and to sign in to their accounts.

- Agents — USAA also has agents. If you want to meet in-person to discuss a USAA policy, this is a great option. However, agents are not available in every area in the U.S.

- App — USAA’s app allows customers to manage their accounts, such as paying bills.

These multiple online and in-person contact methods give USAA a strong presence. This is important, as USAA needs to pop up in the web browser immediately when people type USAA.

USAA’s Commercials

Have you ever bought something after watching a commercial? As kids, most of us begged our parents for a toy after seeing an infomercial on TV.

As adults, we are still influenced by the commercials we see on a daily basis. This is why insurers need to make themselves stand out to attract new customers. USAA does this by placing a sentimental emphasis on family, rather than using humor.

USAA also has videos that show how USAA is focused on honoring service members and their stories.

USAA’s Service and Ink videos help highlight the customers it serves. It is a smart marketing move, as it personalizes USAA as a company, giving USAA’s customers a face.

USAA in the Community

We know USAA is focused on serving its customers, but what about community involvement? According to USAA, it serves the community by donating and volunteering in the following areas.

- Poverty — USAA helps families and individuals who struggle with poverty, homelessness, and hunger.

- Education — USAA supports programs that teach students critical skills.

- Safety and Natural Disaster Response — USAA supports programs that teach natural disaster preparation and recovery skills.

Nonprofit organizations can request volunteers and grants from USAA, and USAA will help out qualifying organizations. So USAA is not only focused on helping military members, but also on the community.

This is great, as it shows USAA cares about people, not just revenue.

USAA Employees

We know that USAA’s customers are happy, but what about USAA’s employees? Employees have an inside look at how a company operates, so we want to take a look at what employees think of working at USAA.

Let’s start with A Great Place to Work’s information on USAA.

89% of USAA employees think USAA is a great place to work.

This is a fairly high percentage. So what demographics make up these contented employees?

| Age | Percentage |

|---|---|

| Millennials (born between 1981 and 1997) | 42% |

| Gen X (born between 1965 and 1980) | 42% |

| Baby Boomers (born between 1945 and 1964) | 15% |

Most of the employees are millennials and Generation Xers. Below, you can see how long most employees stay at USAA.

| Tenure | Percentage |

|---|---|

| <2 years | 19% |

| 2-5 years | 33% |

| 6-10 years | 18% |

| 11-15 years | 13% |

| 16-20 years | 8% |

| 20+ years | 11% |

The largest percentage of employees stay for two to five years. However, there is also a small percentage (11%) that have stayed with USAA for over 20 years.

How long employees stay, though, is not completely indicative of how happy they are. So let’s see what percentage of employees agree with the following statements.

| Employee Experience | Percentage in Agreement |

|---|---|

| I feel good about the ways we contribute to the community. | 96% |

| When you join the company, you are made to feel welcome. | 96% |

| We have special and unique benefits here. | 92% |

| I'm proud to tell others I work here. | 92% |

| Our facilities contribute to a good working environment. | 91% |

An impressive 92% of employees say they feel good about the ways USAA contributes to the community, which reinforces USAA’s statement that it helps others.

Another employee satisfaction rating site we want to look at is Payscale’s assessment of USAA.

USAA has a total of 3.9 stars out of five from Payscale.

Payscale gave USAA this rating based on the following category scores.

| Factor | Rating (out of 5) |

|---|---|

| Appreciation | 3.9 |

| Company Outlook | 4.3 |

| Fair Pay | 2.8 |

| Learning and Development | 4.0 |

| Manager Communication | 3.9 |

| Manager Relationship | 4.0 |

| Pay Policy | 3.1 |

| Pay Transparency | 2.6 |

USAA struggled the most in the categories of fair pay and pay transparency. However, the company outlook earned a high score.

Finally, the last employee rating we want to look at is Glassdoor’s.

Employee ratings at Glassdoor resulted in an overall score of 3.5 stars (based on almost 3,000 reviews).

On Glassdoor, 64% of employees said they would recommend USAA to a friend, and 73% said they approve of the CEO.

Common complaints about USAA are that the call center is stressful and there is a poor work/life balance. However, other reviews praise USAA’s work/life balance, as well as USAA’s benefits and work environment.

So overall, employees seem to be happy with USAA’s work environment and values.

Awards & Accolades

Let’s take a look at A Great Place to Work’s list of awards and accolades USAA has received.

| USAA 2017 Awards | USAA 2018 Awards | USAA 2019 Awards |

|---|---|---|

| #50 in Best Workplaces for Millennials 2017 | #19 in Fortune 100 Best Companies to Work For | #17 in Best Workplaces in Financial Services & Insurance |

| #1 in Best Workplaces in Financial Services & Insurance 2017 | #15 in Best Workplaces in Texas | #47 in Best Workplaces in Texas |

| #20 in Best Workplaces for Women 2017 | #9 in Best Workplaces in Financial Services & Insurance | #30 in 2019 Fortune 100 Best Companies to Work For |

| #11 in Best Workplaces for Diversity 2017 | #40 in Best Workplaces for Millennials | #8 in PEOPLE 2019 Companies that Care |

| #15 in Best Workplaces for Working Parents 2017 | #35 in Best Workplaces for Women | #75 in Best Workplaces for Millennials 2019 |

| #35 in Fortune 100 Best Companies to Work For® 2017 | #50 in Best Workplaces for Parents | - |

| #3 in Best Workplaces in Texas 2017 | #27 in Best Workplaces for Diversity | - |

| #34 in PEOPLE 2017 Companies that Care® | - | - |

| Glassdoor's Best Places to Interview (#72) |

USAA also has a Glassdoor 2009 award for being one of the Best Places to Work (#36) and a Glassdoor 2014 award for Top CEOs (#22).

How to Get a Car Insurance Quote Online

While we’ve already covered rates in-depth, sometimes it is easiest to simply get a quote rather than calculating your own overall rate. Then you can compare your quote to USAA’s average rates to see if you got a good deal.

USAA offers free quotes, so keep reading to learn the steps to getting a quote from USAA.

Step One: Visit Website

The first step is to go to USAA’s website.

USAA’s free quote option is not front and center on the homepage. Instead, you will have to scroll down the page until you see the quote option.

Click get a free quote under auto insurance, and you will be taken to the next step.

Step Two: Login or Create an Account

After clicking get a free quote, the website will redirect you to this page.

If you aren’t a member, you will have to click join online on the right side of the screen. After you click join online, you will see the following screen.

If you click continue, you will be taken to the free quote form. Along the way, you will set up an account so you can view your quote.

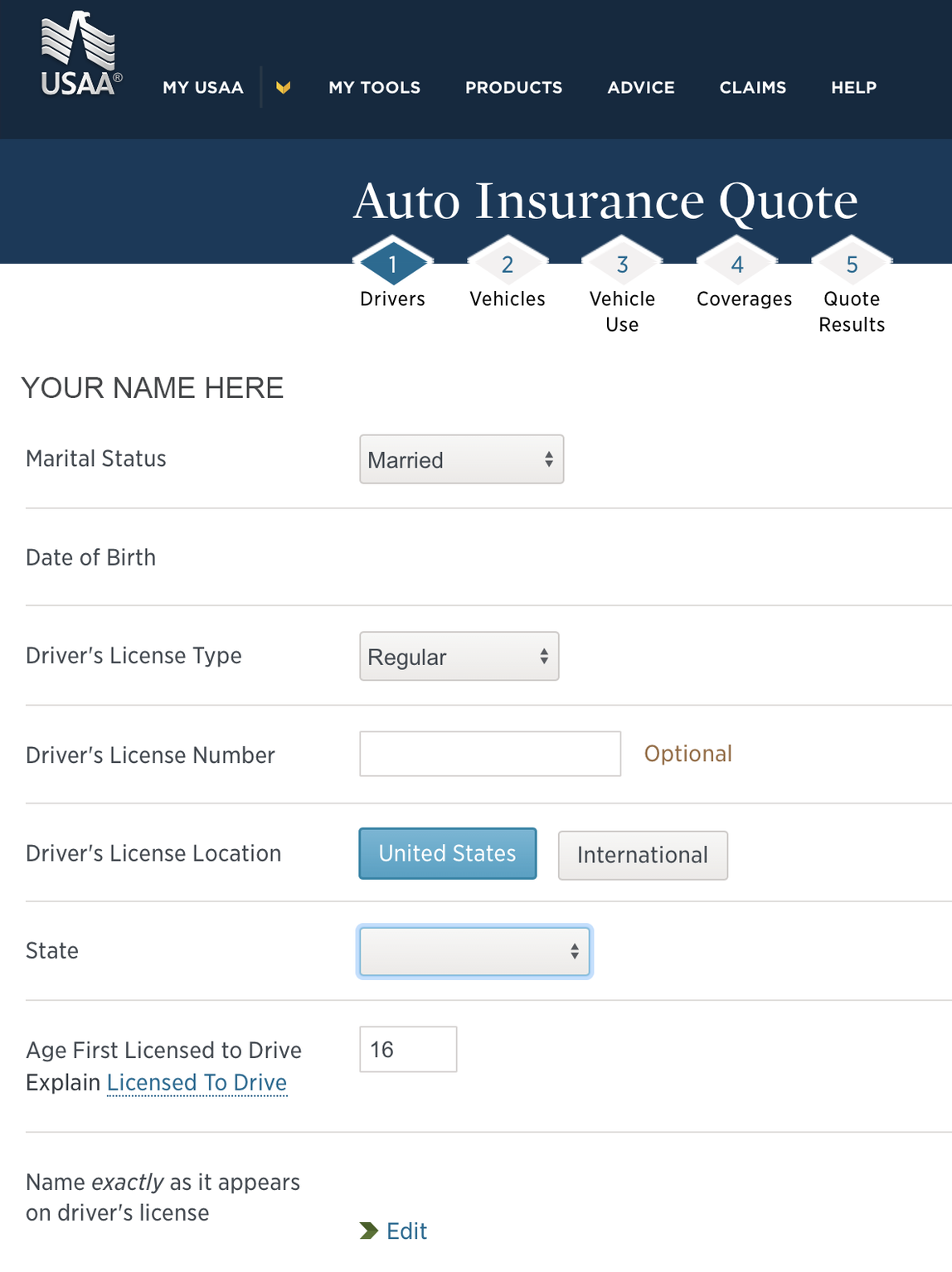

Step Three: Fill Out Personal Information

The first step in filling out the form is entering personal information, such as your name, birth date, and driver’s license number (optional).

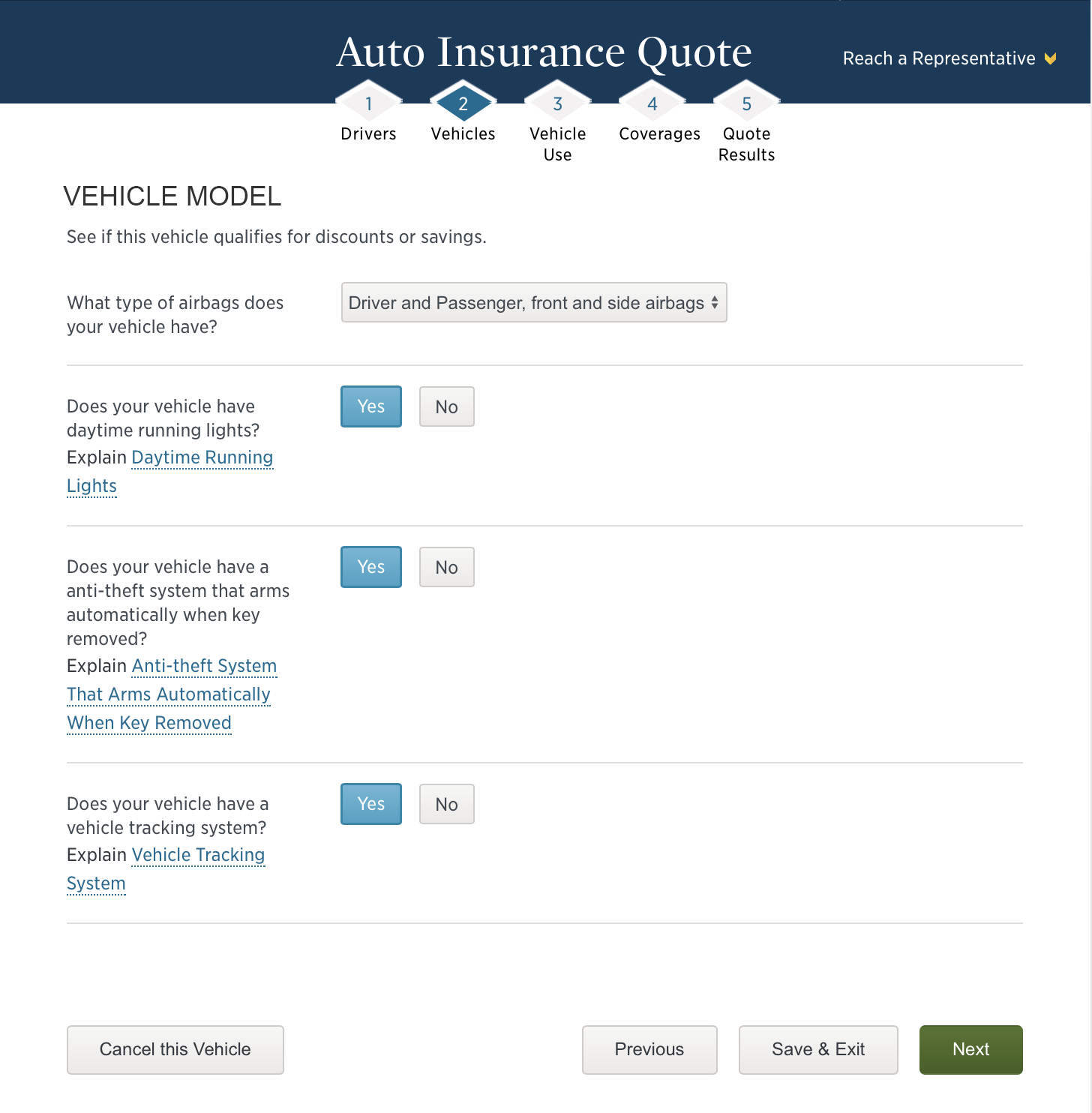

Step Four: Fill Out Vehicle & Vehicle Use Information

After you’ve entered your personal information, USAA will ask for information about your vehicle(s).

Fill out the information as completely as possible, as a lot of the questions are related to discounts for car safety features. You will also be asked questions about the use of your vehicle.

Step Five: Fill Out Coverage Need Information

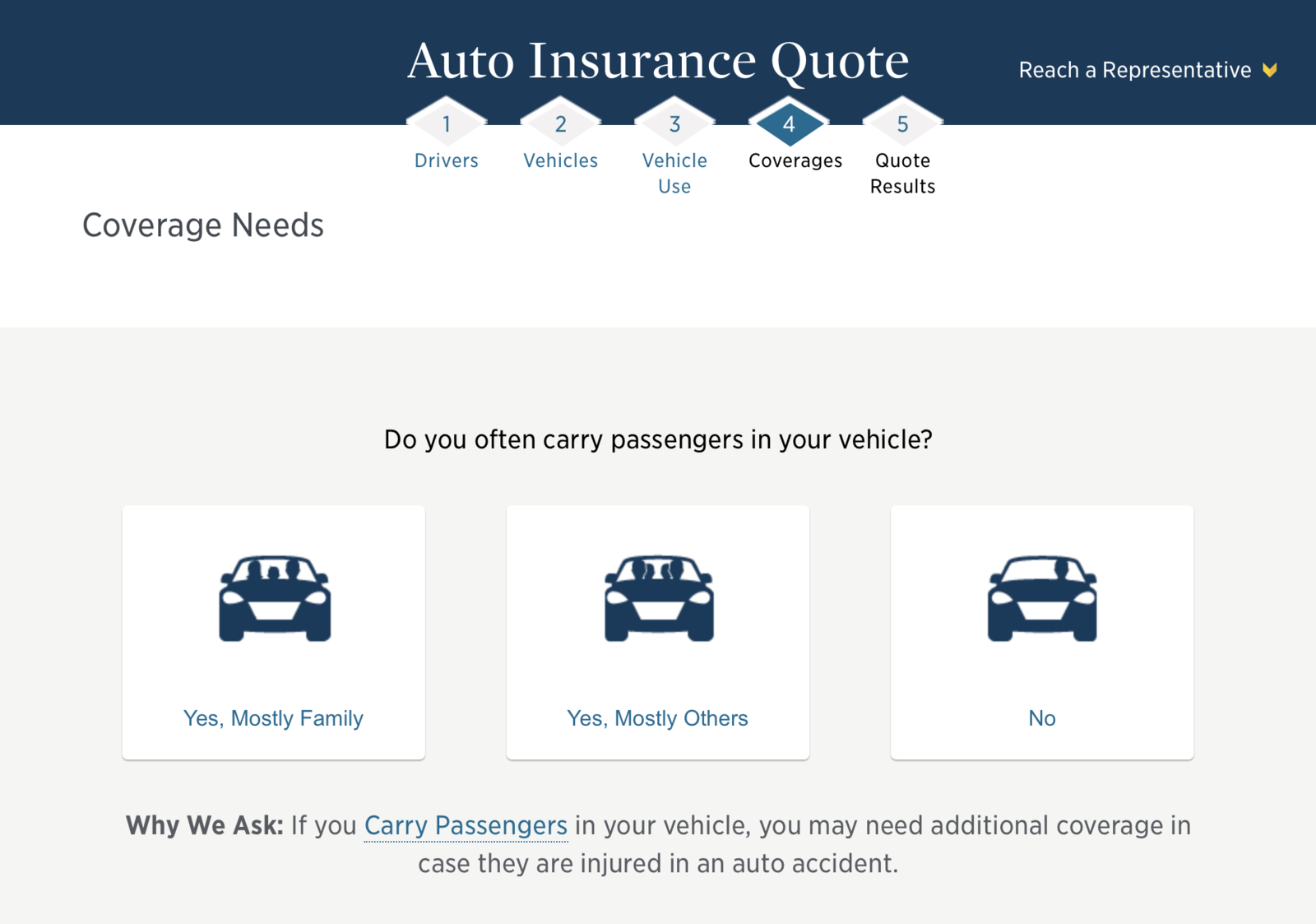

The form will also ask questions to determine what coverages you need.

Step Six: Get Quote

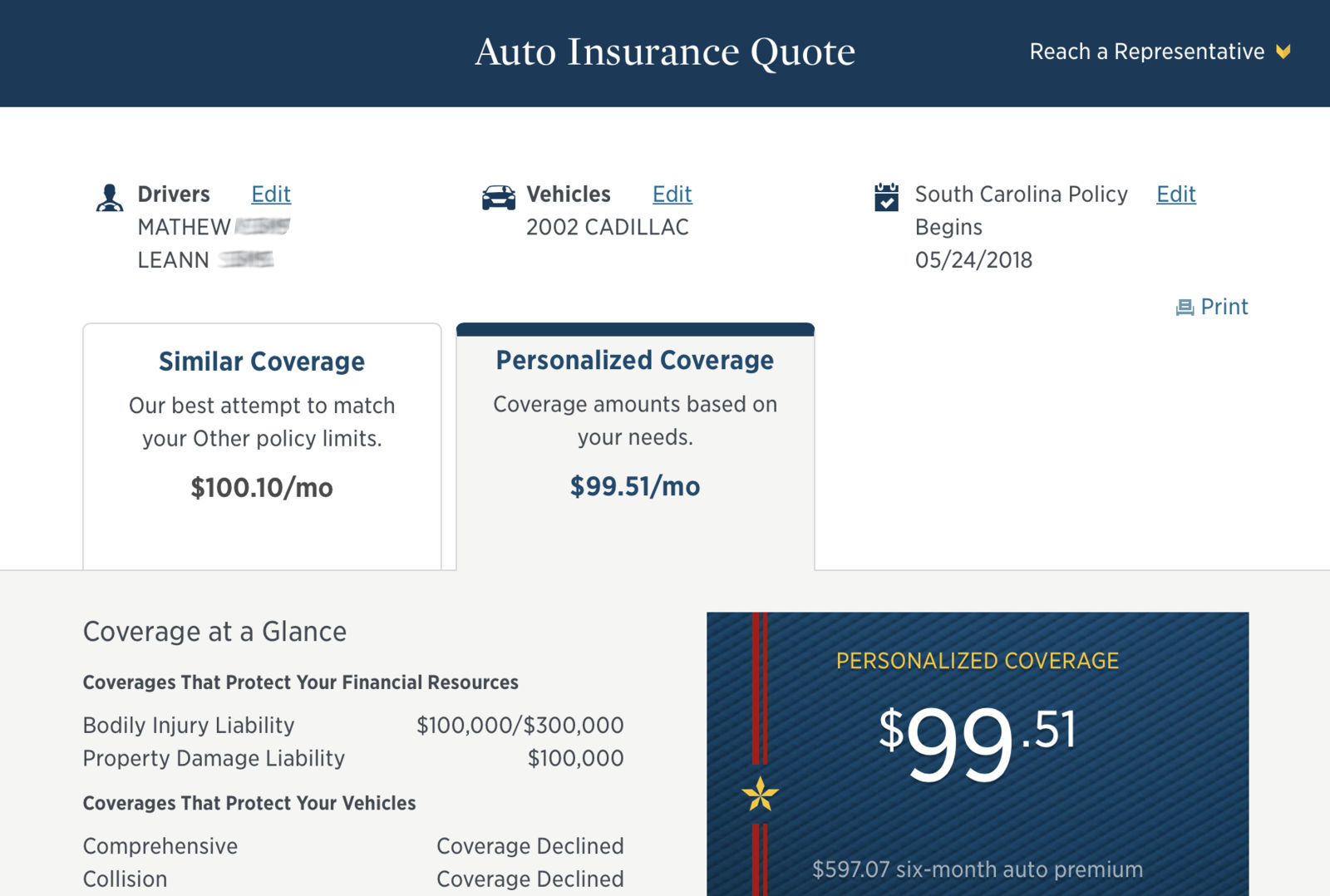

Now that you’ve filled out all your information, you can see your quote.

Now that you have your personalized quote, you can compare it to other insurers to see if USAA is right for you.

To recap, you need the following information for a USAA quote.

| Information | Required? |

|---|---|

| Social Security Number | No |

| Date of Birth | Yes |

| Contact Information | Yes |

| Driver's License | Optional |

| Vehicle Identification Number | No |

| Driver's History | Yes |

| Vehicle Information | Yes |

| Details about You or Your Family Member's Military Service | Yes |

| Passport or Permanent Resident Card (for non-U.S. citizens) | Yes |

While you don’t need an SSN for a quote, you will need it if you purchase a policy.

USAA Auto Insurance Review: The Bottom Line

USAA is a great option for an insurer. It has lower rates than the majority of providers, as well as a respectable number of discounts.

The company has also rated highly on customer satisfaction sites, which shows most customers are satisfied with USAA’s service. While USAA doesn’t have all the coverages other companies offer, such as ridesharing insurance, it still offers a great selection for the price.

USAA is also very strong financially, as it has great ratings and continued growth in market shares and premiums written. So if you are military personnel, USAA is a solid choice of insurer.

Now that you’ve read our USAA car buyer’s guide, are you interested in finding the best car insurance company for your needs? Use what you’ve learned with this USAA auto insurance review and start comparison shopping today. Try out our FREE online tool below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions: USAA Auto Insurance Review

If you are still unsure about a few things, we’ve compiled a list of the most commonly asked questions about USAA. Keep reading to see what other people are asking.

#1 – Does USAA auto insurance cover other drivers who borrow my car?

Yes, it does. If your friend borrows your car and gets into an accident, USAA should cover the costs. Since the insurance you have is on your vehicle (not necessarily the driver), most insurance policies will pay claims after an accident.

#2 – Is USAA auto insurance only for military personnel?

Yes, USAA is only for active military personnel. However, this coverage also extends to military personnel’s spouses and their children. So while a sibling can’t be put on a policy, a wife or husband can.

#3 – Does USAA cover rodent damage?

Mice chewed a hole in your leather seats? As long as you have comprehensive coverage, USAA will cover the costs of repairs from animal damage.

#4 – Does USAA have accident forgiveness?

USAA does have accident forgiveness for drivers who have been accident-free at USAA for five years. USAA will forgive drivers’ first at-fault accident by not raising premiums, which is a huge amount saved in the long run.

#5 – Does USAA cover towing?

USAA does cover towing for customers who have roadside assistance.

Is USAA roadside assistance free? The USAA towing policy is included with roadside assistance, which is generally very cheap — we’re talking a dollar or two— each month when you already have an auto insurance policy with them. (For more information, read our “Dollar-a-Day Insurance“).

#6 – Is USAA cheaper than Geico?

It depends. Generally, USAA is cheaper. However, rates also depend on your demographics, driving record, and location. Occasionally, Geico may end up having cheaper rates than USAA.

We hope we answered all your questions, and that you are now ready to make the important decision of signing up with a provider.

References:

- https://www.bbb.org/us/tx/san-antonio/profile/insurance-companies/usaa-0825-23452

- https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/sourceId/504352

- https://www.moodys.com/credit-ratings/USAA-Capital-Corporation-credit-rating-183200

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.