Travelers Car Insurance Guide [Data + Expert Review]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Travelers Insurance Overview | Stats |

|---|---|

| Year Founded | 1864 |

| Current Executives | Alan D. Schnitzer Chairman and Chief Executive Officer |

| Numbers of Employees | Approx. 30,000 employees & 13,500 independent agents |

| Total Revenues/Assets | Total Revenue $30.2 billion Total Assets $104.2 billion |

| Headquarters Address | 1 Tower Sq Hartford, CT 06183 |

| Phone Number | Billing and Policy: 1.800.842.5075 Customer Advocacy: 1-866-336-2077 |

| Company Website | https://www.travelers.com |

| Premiums Written | 4,697,743 |

| Loss Ratio | 60% |

| Best For | Personal Property and Casualty Business Specialty Insurance |

It’s a scenario no driver wants to experience.

You’ve been involved in a collision, and you’re pulled over on the side of the road. As you wait for the police to arrive, you go through your belongings, pulling out a small piece of paper that will undoubtedly play an enormous role in the process — Your insurance ID card.

There’s no denying it — the company you choose to insure your car with is important, and it’s a decision you shouldn’t take lightly. If you’re reading this article, it’s likely you’re considering Travelers as your provider. But, some lingering questions may remain:

- Is Travelers really the best company for my car insurance needs?

- What do the company’s rates look like?

- What kind of coverage does Travelers offer?

- Does the company have a good reputation?

We get it. Trying to find answers to all of these questions may feel overwhelming. Separating fact from fiction may seem daunting.

But it doesn’t have to be.

Through this comprehensive guide, we promise to deliver. You’ll find everything from Travelers rates, customer reviews, company ratings, discounts, and more.

Bottom line? You don’t have to spend hours on the web, or on the phone, searching for answers. You can find it all right here.

Get a head start in comparing rates by entering your zip code into our free car insurance comparison tool at the bottom of this page.

Now, let’s begin by taking a look at how Travelers measures up with some of the world’s leading ratings-issuers.

Travelers Insurance Ratings

Think about it.

Students in school turn in assignments and take tests. Whether a student earns an A or an F is evidence of how well they’ve mastered the topic, and if there’s room for improvement.

When it comes to insurance companies, ratings are a lot like grades, providing important evidence to the consumer.

Through the eyes of entities like AM Best, S&P and Moody’s, these ratings speak to financial health and the company’s ability to meet its obligations. And for others like the Better Business Bureau and J.D. Power, the focus is on the consumer, and whether these companies are succeeding in their customer service relations.

At the end of the day, knowing how Travelers is measuring up in areas like financial strength and customer satisfaction is an important part of the decision-making process. Before we break down Travelers’ ratings, here’s an overview:

| Agency | Rating |

|---|---|

| AM Best | A++ (Superior) |

| Better Business Bureau | A+ |

| Consumer Affairs | 1 out 5 Stars (out of 41 Reviews) |

| Consumer Reports | 90 (Reader Score) |

| JD Power | 3/5 Auto Claims Satisfaction 3/5 Insurance Shopping |

| Moody’s Rating | Aa2 |

| NAIC Complaint Index Ratio | 5.52 |

| S&P Rating | AA |

AM Best Ratings

AM Best is known for providing ratings and data specific to the insurance industry. In fact, the story behind its Financial Strength Ratings (FSR) is simple — to measure an insurer’s financial strength, and “its ability to meet its ongoing insurance policy and contract obligations.”

AM Best’s FSRs come in the form of letters, ranging from an A++ (Superior) to a D (Poor). As for Travelers, here’s what you need to know:

Travelers not only has the highest-possible “A++” rating, but it has also maintained a superior rating for several years.

But it doesn’t stop there.

AM Best also provides something called Issuer Credit Ratings (ICR). This is an opinion of an entity’s ability to meet ongoing financial obligations on a long-term or short-term basis. As for Travelers, AM Best has given the insurer a Long-Term ICR of an aa+, which is its second-highest rating in the category. In short, with this aa+ rating,

Travelers has demonstrated a superior ability to meet its ongoing senior financial obligations.

Better Business Bureau Ratings

The Better Business Bureau’s (BBB) ratings are seen through the lens of a very important question — How does a particular business interact with its customers?

The BBB attempts to answer this question by issuing letter grades, which are based on several factors:

- A business’s complaint history with BBB

- The type of business

- The amount of time the business has been operating

- Transparent business practices

- Failure to honor commitments to BBB

- Licensing and government actions that are known to BBB

The BBB uses a 100-point scale to issue its letter grades. An A+ (97-100 points) is the highest, and an F (zero points) is the lowest. We checked and discovered that —

Travelers Insurance has the highest-possible BBB grade, at an A+

Moody’s Ratings

Where lenders and banks will look to your credit score to assess your risk and reliability, entities like Moody’s do the same with companies. And keep in mind, when Moody’s issues ratings, the business world is at attention. After all, according to the Corporate Finance Institute, Moody’s is considered to be one of the “Big Three” Credit Ratings Agencies, along with S&P and the Fitch Group.

Moody’s ratings also come in the form of letters and range from Aaa (the highest quality) to C (the lowest quality).

Right now, Travelers Insurance has an “Aa2” designation, Moody’s 3rd highest rating out of 21 possible designations. This means that Travelers is seen as a “high quality” company with very low credit risk.

S&P Ratings

Another member of the “Big Three,” S&P Global ratings represent a trusted barometer among industry experts.

S&P Ratings range from an AAA at its highest, to a D as its lowest. As of July 2019, we know that Travelers:

- Has an AA rating in its issuer financial strength

- Has an A rating in its long-term issuer credit rating on the parent holding company

NAIC Complaint Index

Now we’re transitioning from financial indicators to customer relations. And with that, we begin with complaints.

For a look at Travelers’ most recent complaint history, we turn to the National Association of Insurance Commissioners (NAIC) The association houses an online resource in which one can view complaint trends for an insurance company.

NAIC data comes from closed, confirmed consumer complaints provided by state insurance departments. Here’s what we pulled for Travelers Indemnity:

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 4 | 4 | 5 |

| Complaint Index (better or worse than National Index) | 1.98 (worse) | 3.95 (worse) | 6.37 (worse) |

| National Complaint Index | 0.78 | 1.2 | 1.15 |

| US Market Share | 0.01% | 0.01% | 0.01% |

| Total Premiums | $16,954,131 | $13,757,424 | $12,446,084 |

At first sight, this data presents a seemingly troubling view of Travelers’ complaints.

From 2016 to 2018, the provider has consistently registered Complaint Indexes higher than the National Complaint Index — going from 1.98 in 2016 to 6.37 in 2018.

However, a closer look provides a much-needed perspective.

Namely, that the actual number of complaints filed against the company in the private passenger auto category is low, with four complaints filed in both 2016 and 2018, and five complaints filed in 2018. This is important when one notes that the number of complaints is low in proportion to the number of policies written.

J.D. Power Ratings

Real customers, real experts.

For J.D. Power, these two groups serve as the foundation of its work, and the primary sources behind its 2019 U.S. Auto Insurance Study.

According to J.D. Power, this study examines customer satisfaction in five key areas (in order of importance): interaction, policy offerings, price, billing process and policy information, and claims. Additionally, experts say these results are based on responses from 42,759 auto insurance customers.

In addition to measuring customer satisfaction, J.D. Power also assigns each insurer with a “Power Circle Rating”:

- “Among the Best’ (five out of five circles)

- “Better than Most” (four out of five circles)

- “About Average” (three out of five circles), and

- “The Rest” (two out of five circles).

J.D. Power doesn’t have a Power Circle Rating lower than two circles.

Here’s a look at how Travelers performed by region:

| Region | Overall Customer Satisfaction (out of 1,000) | Power Circle Rating |

|---|---|---|

| California | n/a | n/a |

| Central | 832 | About Average |

| Florida | 820 | The Rest |

| Mid-Atlantic | 821 | The Rest |

| New England | 810 | The Rest |

| New York | 845 | Better than Most |

| North Central | 803 | The Rest |

| Northwest | n/a | n/a |

| Southeast | 822 | The Rest |

| Southwest | 789 | The Rest |

| Texas | n/a | n/a |

Read more:

- 60 Day Waiting Period on New Texas Auto Insurance Policies

- California Car Insurance (The Only Guide You’ll Ever Need)

Of the 11 regions listed, ratings for Travelers could be found in eight. Of those, Travelers received a Power Circle Rating of “The Rest” in six regions. According to J.D. Power, this means Travelers scored in the lowest 20 percentof all providers.

Travelers received a “Better than Most” Power Circle Ranking in the New York region. The provider received its highest Power Circle Rating in the Central Region (consisting of Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, and Oklahoma) with “About Average.”

Consumer Reports Ratings

The news for Travelers improves when turning to Consumer Reports, which examines how customers rate Travelers in its day-to-day interactions.

Some key questions answered in its findings —

- How easy is it to reach a Travelers agent?

- Are Travelers agents courteous?

- How well does Travelers keep drivers informed of the claims process?

The answers can be seen below:

| Claims Handling | Score/Rating |

|---|---|

| Agent courtesy | Excellent |

| Being kept informed of claim status | Very good |

| Damage amount | Very good |

| Ease of reaching an agent | Excellent |

| Freedom to select repair shop | Excellent |

| Promptness of response - very good | Excellent |

| Reader Score | 90 |

| Simplicity of the process | Very good |

| Timely payment | Excellent |

We can see that these Travelers customers were very satisfied across the board, giving the company “Very Good” and “Excellent” ratings throughout. It should also be noted that the overall Reader Score for Travelers is 90, which is on the high end of the scale.

What accounts for such a sharp difference between J.D. Power Ratings and Consumer Reports? Here’s a video that attempts to breaks down the difference:

Consumer Affairs Ratings

“Smarter buying decisions.”

It’s what experts with ConsumerAffairs.com say drives their work, whether that’s in producing buyers guides, or in publishing over 1.9 million verified customer reviews.

ConsumerAffairs.com experts say that in order to ensure reviews are “verified” they:

- Require contact information to ensure reviewers are real.

- Use intelligent software to help maintain integrity.

- Have moderators read all reviews for quality and helpfulness.

Based upon 41 submitted reviews, Travelers has an aggregate rating of one out of five stars. In going through the reviews, one of the most common complaints centered around the claims process following a collision.

On the other hand, those who positively reviewed the company complimented agents for their professionalism and responsiveness.

https://www.youtube.com/watch?v=yWfmgJZQS3A

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travelers Company History

From its founding on April 1, 1864, and to the present day, Travelers has taken pride in establishing many “firsts” in the car insurance industry. This includes the introduction of accident insurance, the issuance of an automobile insurance policy, and the opening an insurance school.

Over the years, Travelers has grown leaps and bounds. A Fortune 500 Company with an increasing market share, Travelers not only offers personal, business, and specialty insurance, but Travelers is also the only property casualty company in the Dow Jones Industrial Average.

At the end of the day, we know drivers are most interested in knowing where the company is now. Is Travelers continuing in a pattern of growth and progress? And, what is the ultimate impact on drivers? Let’s begin by looking at Travelers’ market share.

Company Market Share

What is market share?

According to InvestingAnswers.com, market share is “a company’s portion of sales within the entire market in which it operates.” Market shares are given in percentages, which represent a company’s total revenue divided by the total revenue of the entire industry. Bottom line,

The larger the market share, the bigger the company is within that market.

We turned to the NAIC to see what Travelers’ market share looked like from 2015 to 2018, according to the number of direct premiums written. What we saw was a story of continued growth:

Between 2015 and 2017, we can see Travelers’ market share has increased steadily, rising from 1.66 percent to 1.9 percent. The company’s market share remained unchanged in 2018.

If those numbers seem low to you, keep this in mind — in 2018, Travelers had the 9th highest market share of all car insurance companies in the U.S.

Travelers Online Presence

Travelers customers looking to access their accounts online can do so through MyTravelers® This is a portal that allows online and mobile access to do the following:

- Pay your bill

- Sign up for automatic payments

- View or print your auto insurance cards

- See your policy and billing information

- Report a claim

- Go paperless

Customers using the program have 24/7 access to their accounts and these services. To create an account, click here.

https://youtu.be/YOw6Gd6Nmpk

Commercials

Watch any of Travelers’ commercials, and it’s obvious — they’re going straight for the heart. With overriding themes like family and relationships, it’s clear Travelers wants to convey the timelessness of their product, while tugging at your heartstrings.

In “The Drive,” Travelers tells a story of its dependability through the relationship of a mother and daughter:

In “Footsteps,” we see Travelers once again tell a story through family dynamics:

https://youtu.be/ovonxza767U

Finally, in “Legacy,” Travelers follows a family business through tragedy and triumph:

https://www.youtube.com/watch?v=xGE5yDDop88&t=3s

Travelers in the Community

250,000 volunteer hours in two years, and $218 million invested in 10.

They’re figures Travelers Chairman and CEO Alan Schnitzer say help quantify the company’s commitment to communities across the country.

When breaking down how Travelers is giving back, you’ll find most of their work falls under one of three categories:

- Academic and Career Success — Focuses on low-income and minority students in grades five through 12, college, and those pursuing careers in the insurance industry

- Thriving Neighborhoods — Supports economic development and community programs “to ensure families live safely, find employment, and are prepared for natural disasters”

- Culturally Enriched Communities — Supports organizations that foster “more vibrant and accepting communities”

An example of what a Travelers community outreach project looks like can be seen in Travelers “EDGE” (Empowering Dreams for Graduation and Employment. The program, which falls under the Academic and Career Success category, focuses on increasing students’ access to higher education.

The video below celebrates the program’s 10-year anniversary:

https://www.youtube.com/watch?v=FxIPfhAR-q0&feature=youtu.be

Travelers Employees

Without a doubt — employees are the foundation of any successful company. With more than 30,000 employees and 13,500 agents, Travelers has a large base of workers contributing to its day-to-day operations.

But what do those employees have to say about working for the insurance provider? To learn more, we turned to Glassdoor.com and Payscale.com. Both sites provide a place for current and former employees to evaluate and rank their experiences.

At Glassdoor.com, we discover that:

- The average employee review for Travelers is 3.8 out of 5 stars (out of more than 2,400 reviews).

- 76% of those who submitted reviews would recommend Travelers to a friend.

- Employe reviews resulted in Travelers being named to Glassdoor’s “Best Places to Work” list four times: in 2019 (#70), 2018 (#80), 2011 (#31), and 2010 (#39).

At Payscale.com, we found that:

- Travelers averaged 3.6 out of 5 stars in overall satisfaction.

- Travelers received its highest rankings for Company Outlook (4.2 out of 5), followed by top rankings in Manager Communication, Learning and Development, and Manager Relationship.

- On the flip side, Travelers received its lowest scores in categories tied to pay — Fair Pay, Pay Policy, and Pay Transparency.

Awards and Accolades

The Travelers website boasts a list of more than a dozen awards recognizing the company as an employer and for its culture. Just to name a few under the corporate category:

- Fortune 500, Fortune, 1995-2018

- FTSE4Good Index Series, 2001-2018

- World’s Most Admired Company, Fortune, 2006-2018

- America’s Most JUST Companies list, JUST Capital and Forbes, 2019

And, under the culture category:

- Military Friendly® Company, VIQTORY, 2018-2019

- America’s Best Employers, Forbes, 2015-2018

- Employer of the Year, Lifeworks, 2019

- Best Place to Work, Glassdoor, 2018-2019

For a complete list, click here.

How is Travelers Positioned for the Future?

When it comes to Travelers’ strengths, the company is hitting it out of the park.

Thanks to top ratings from AM Best, S&P, and Moody’s, Travelers shows itself as a financially stable and healthy company. It also doesn’t hurt that the company experienced consistent market share growth from 2015 to 2017, and remained steady in 2018, giving it the ninth-highest share among all U.S. car insurance providers.

However, when it comes to its customer-service relations, the outlook is mixed.

While Travelers received stellar ratings from Consumer Reports readers, its ratings were not nearly as impressive with J.D. Power’s Auto Insurance Study.

And when looking to Consumer Affairs, the ratings for the company were even lower, particularly when it comes to claims. Granted, those reviewing the company online may not necessarily represent, or speak for, the whole. But they may give drivers a reason to do a bit more research before fully committing to the company.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Car Insurance Rates

We get it — you have bills, and you have financial obligations. That’s why when it comes to selecting the right car insurance provider, you want as much affordability as you do value.

Whether Travelers is the best fit will, for many, come down to price. The good news? Knowing what Travelers may charge you doesn’t have to remain a mystery. Below, we’re breaking down Travelers’ rates in several important categories:

Travelers Availability

First thing’s first — drivers with Travelers can purchase car insurance policies in 42 states, and in Washington, D.C.

States where Travelers car insurance is not available include:

- Alaska

- Hawaii

- Louisiana

- Michigan

- North Dakota

- South Dakota

- Wyoming

- West Virginia

Read more: Alaska Car Insurance (The Only Guide You’ll Ever Need)

Rates by State

We compiled a list of the average rates Travelers customers throughout the country are paying, where data was available:

Travelers Rates by State| State | Annual Premium |

|---|---|

| Alabama | $3,697.80 |

| Arizona | $3,084.74 |

| Arkansas | $5,973.33 |

| California | $3,349.54 |

| Connecticut | $6,004.29 |

| Delaware | $4,182.36 |

| Idaho | $3,226.29 |

| Illinois | $2,499.76 |

| Indiana | $3,393.75 |

| Iowa | $5,429.38 |

| Kansas | $4,341.43 |

| Kentucky | $6,551.68 |

| Maine | $2,252.97 |

| Massachusetts | $3,537.94 |

| Mississippi | $3,729.32 |

| Nevada | $5,360.41 |

| New Jersey | $4,254.49 |

| New York | $4,578.79 |

| North Carolina | $3,132.66 |

| Ohio | $3,135.16 |

| Oregon | $2,892.19 |

| Pennsylvania | $7,842.47 |

| Rhode Island | $6,909.45 |

| Tennessee | $2,738.52 |

Read more: Delaware Car Insurance (The Only Guide You’ll Ever Need)

According to these figures, Pennsylvania residents are paying the highest average rates, at $7,842.47 a year. The states with the next-highest rates are Rhode Island ($6,909.45), Kentucky ($6,551.68), and Connecticut ($6,004.29).

Maine residents are paying the lowest average rates at $2,252.97. Next on the list are Illinois ($2,499.76), Tennessee ($2,738.76), and Oregon ($2.892.19)

Read more: Connecticut Car Insurance (The Only Guide You’ll Ever Need)

Comparing Rates of the Top 10 Companies

Next, we compared Travelers’ average state rates against the average rates of the top 10 providers:

| Company | Average Premium |

|---|---|

| Allstate | $4,887.95 |

| American Family | $3,443.09 |

| Farmers | $4,194.27 |

| Geico | $3,125.01 |

| Liberty Mutual | $6,073.45 |

| Nationwide | $3,450.00 |

| Progressive | $4,035.52 |

| State Farm | $3,260.00 |

| Travelers | $4,434.91 |

| USAA | $2,537.30 |

Our data shows that the average rate for Travelers customers is the third-highest among the nation’s top 10 providers, at $4,434.91. Travelers was only surpassed by Liberty Mutual (averaging just over $6,000) and Allstate (at nearly $4,900).

Travelers Male vs. Female Rates

You’ve probably heard that gender can play a role in what you pay in car insurance premiums. But what you may not know is why.

With Esurance Insurance Services, we find three answers — accident frequency, speeding tickets, and DUIs. The insurance provider goes on to say that when comparing men and women, statistics suggest that:

- Women are less likely to get into an accident than men (source: NAIC)

- With fatal accidents, speeding was more likely to be a factor for men (source: National Highway Traffic Safety Administration)

- More men were arrested for DUIs in 2013 than women (source: FBI)

We took a look at rates among male and female Travelers customers:

| Age and Marital Status | Average Premium |

|---|---|

| Married 35-year old female | $2,178.66 |

| Married 35-year old male | $2,199.51 |

| Married 60-year old female | $2,051.98 |

| Married 60-year old male | $2,074.41 |

| Single 17-year old female | $9,307.32 |

| Single 17-year old male | $12,850.91 |

| Single 25-year old female | $2,325.25 |

| Single 25-year old male | $2,491.21 |

We find that no matter the age or demographic, female drivers insured with Travelers are paying lower rates than their male counterparts.

For the most part, the differences in each subgroup were fairly minimal, with the exception of 17-year-old drivers. The difference between males and females in that age group is substantial, with 17-year-old men paying an average $12,850.91, and 17-year-old females paying an average $9,307.32

Travelers Rates by Make and Model

And then, there’s your car.

According to the Insurance Information Institute, the cost of your car will play a large role in what companies will charge to insure it. Other risk factors tied to your car will include the likelihood of theft, the cost of repairs, the size of its engine, and its safety record.

We compared Travelers’ rates among several popular vehicles, from Ford F-150s to Honda Civics:

| Vehicle Make and Model | Average Premium |

|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $4,023.47 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,420.37 |

| 2015 Toyota RAV4: XLE | $4,383.78 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $4,412.42 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,661.22 |

| 2018 Toyota RAV4: XLE | $4,708.19 |

Bottom line? The 2018 Toyota RAV4: XLE has the highest average premium on the list, at just over $4,700. The car with the lowest average premium was the 2015 Ford F-150, at just over $4,000.

Travelers Rates by Commute

For some insurance companies, it’s pretty simple — more miles, higher rates.

We’re speaking about your daily commute, and while it’s not standard across the board, some insurance companies will assess lower rates to those who put fewer miles on their car.

As for Travelers? We found that drivers with longer commutes are paying higher rates — but only by about $70.

| Distance Travelled | Average Premium |

|---|---|

| 10 miles commute. 6000 annual mileage. | $4,399.85 |

| 25 miles commute. 12000 annual mileage. | $4,469.96 |

Travelers Rates by Coverage Level

Drivers who choose to increase their coverage levels should not be surprised by higher-than-normal rates. We looked at rates among Travelers drivers with low, medium and high levels of coverage:

| Coverage Level | Average Rate |

|---|---|

| Low | $4,223.63 |

| Medium | $4,462.02 |

| High | $4,619.07 |

Some key takeaways:

- The difference between high coverage and low coverage? $395.44

- The difference between high coverage and medium coverage? $157.05

- The difference between medium and low coverage? $238.39

Travelers Rates by Credit History

When it comes to car insurance, your use of credit matters…a lot. So much so, many providers will look to your credit as an indicator of risk (however, this practice is illegal in Massachusetts, Hawaii, and California).

According to the Insurance Information Institue, companies will look to something called insurance scores (also called credit-based scores) when determining risk. These scores are based largely on your credit, and some variables include:

- Outstanding debt

- Length of credit history

- Late payments, collections, and bankruptcies

- New applications for credit

- The number of installment accounts,

- Types of credit used

- Unused credit

With this in mind, we wanted to see what rates Travelers drivers with good, fair, and poor credit are paying:

| Credit History | Average Rate |

|---|---|

| Good | $4,058.97 |

| Fair | $4,344.10 |

| Poor | $5,160.22 |

It’s plain to see — drivers with poor credit are indeed paying the price. In fact, Travelers customers with poor credit are paying over $1,100 more in premiums than those with good credit.

Travelers Rates by Driving Record

When it comes to past infractions like tickets, DUIs, or accidents, here’s what you need to know —

Your record can have a significant impact on what you pay in premiums.

We broke down rates for Travelers drivers with varying records:

| Driving Record | Average Rate |

|---|---|

| Clean | $3,447.69 |

| With 1 Speeding Violation | $4,260.80 |

| With 1 Accident | $4,289.74 |

| With 1 DUI | $5,741.40 |

In comparing these driving records, we can clearly see that those with one DUI are paying the highest rates, at $5,741.40. That figure is nearly $2,300 more than what a driver with a clean record will pay.

Coverage Offered by Travelers

Here’s the deal — in the world of car insurance, you have basic coverage, and then you have additional coverage.

Drivers ultimately want to know what Travelers offers, and if the company’s options will satisfy their needs.

We’re breaking it all down below:

Basic Coverages

- Liability— This includes both Bodily Injury and Property Damage Liability. This covers injuries sustained by others, as well as property damage, in an accident you caused.

- Comprehensive — This covers non-collision related damage from unexpected events such as weather (like a windstorm or flooding), vandalism, or hitting an animal.

- Collision —This covers damage to your car resulting from a collision with another car or an object.

- Personal Injury Protection (PIP) — This goes towards medical expenses (and in some cases, lost wages) for you or your passengers, regardless of who was at fault. This also satisfies the requirements of no-fault states.

- Uninsured/Underinsured Motorist— This addresses collisions with an uninsured driver, or a driver with insufficient insurance.

- Medical Payments— This covers medical expenses for you and your passengers, regardless of who was at fault.

https://youtu.be/qyF48gvWSIU

Additional Coverages

- Loan/Lease Gap Insurance — In the instance that a car you are financing or leasing is totaled, this insurance covers the difference between what your vehicle is worth and what you owe. For instance, let’s say that you have a car worth $7,000, but you have a loan or lease balance of $10,000. If your car were to be totaled, loan/lease gap insurance would pay the $3,000 difference.

- Rental Coverage — Also known as extended transportation expenses coverage. If your car is damaged in a covered accident, and it’s out of commission for more than 24 hours, this will cover a rental car.

- Roadside Assistance — In the instance that your car breaks down, this covers towing and labor costs

- New Car Replacement — This coverage pays to replace your car with a new one of the same make and model if it’s totaled in the first five years.

- Accident Forgiveness — Under the Travelers’ “Responsible Driver Plan,” you can choose to have either one accident or one minor violation forgiven every 36 months. Under the “Premier Responsible Driver Plan,” you can opt for a “Decreasing Deductible” or a “Total Loss Deductible Waiver.” Click here to learn more.

- Ridesharing — Available in Colorado and Illinois, this coverage is tailored toward those who drive for ridesharing companies. Speak to an agent to learn more.

- Umbrella Insurance — This goes beyond car and home insurance policies, and provides extra liability coverage protecting assets such as your home, car, and boat. It also helps cover defense costs, attorney fees and other charges associated with lawsuits.

https://youtu.be/-4mJICy2FDE

Travelers Bundling Options

Looking to bundle? Here’s what you need to know:

Travelers advertises discounted rates to drivers who purchase multiple policies with the company.

According to the Travelers site:

- Bundling car and home policies can result in up to 10 percent savings on your car insurance

- Homeowners can save up to 15 percent on their home insurance when they bundle with car insurance

- Renters can save up to five percent on their car insurance when purchasing car and renters insurance together.

The site goes on to say that additional savings may be available through the purchase of other policies like boat, umbrella, or valuable items coverage.

You can learn more by getting a quote or speaking to an agent.

Discounts

We get it — saving money is important. For Travelers customers looking to get the most bang out of their buck, discounts are the way to go.

The good news? Travelers offers nearly 30 discounts, encompassing a variety of drivers. We’ve compiled a list below, along with additional details (when availalbe):

Travelers Available Discounts| Discount | Amount (%) and Info (when available) |

|---|---|

| Anti-lock Brakes | Consult with an agent or representative |

| Anti-Theft | Consult with an agent or representative |

| Claim Free | 23% 5 yrs 10% 3 yrs must be accident free and violation free |

| Continuous Coverage | 15 |

| Daytime Running Lights | Consult with an agent or representative |

| Defensive Driver | 10 |

| Distant Student | 7 25 and under 100+ miles away |

| Driver's Ed | 8 Under 21 |

| Driving Device/App | 10% for signing up Up to 30% at policy renewal if under 13,000 miles/yr |

| Early Signing | 3% at one to three days before current policy's expiration 10% at fifteen+ days before current policy's expiration |

| Full Payment | 7.5 |

| Further Education | California only |

| Garaging/Storing | Based on usage |

| Good Student | 16-25 yrs old Full-time student B average or better |

| Green Vehicle | 10 Hybrid or electric |

| Homeowner | 5 |

| Low Mileage | Discount only available if using IntelliDrive |

| Membership/Group | "Affinity Auto Program" discount available for those at specific associations, organizations and credit unions |

| Multiple Policies | 13 |

| Multiple Vehicles | 8 |

| Newer Vehicle | 10 Less than 3 years old |

| Occupation | "Affinity Auto Program" discount available for those at specific associations, organizations and credit unions |

| On Time Payments | 15 |

| Paperless/Auto Billing | 2% with Electronic Funds Transfer (EFT) 3% Payroll Deduction discount through eligible worksite programs. |

| Passive Restraint | Consult with an agent or representative |

| Safe Driver | Must be accident and violation free to qualify 23% - 5 yrs 10% - 3 yrs |

| Vehicle Recovery | Consult with an agent or representative |

| VIN Etching | Consult with an agent or representative |

Some discounts worth highlighting include:

EFT, Paid in Full and Good Payer Discounts are based upon how you pay for your insurance:

- Receive up to 7.5 percent if you pay your policy in full,

- Receive 2-3 percent by paying through electronic funds transfer (EFT) or payroll deduction,

- Receive up to 15 percent by consistently paying your premium on time.

Travelers’ New Car Discount applies to drivers who have purchased a car less than three years old and can be as high as 10 percent.

The Good Student Discount applies to drivers who maintain a “B” average or its equivalent or are in the upper 20 percent of their class scholastically. Age restrictions may apply.

To qualify, Travelers asks you to present one of the following:

- A report card or online transcript

- A Dean’s List or Honor Roll Certificate

- Confirmation of grades on the school’s letterhead

- A Home School certification signed by a parent, and co-signed by a home school certifying body

- A printout from a Parent Access Account including the student’s name

Travelers Programs

Think you’re a safe driver? Travelers invites you to put those claims to the test through its IntelliDrive® Program.

IntelliDrive utilizes a smartphone app to capture and score driving behavior of those covered on your policy. Simply enrolling in the 90-day program may lead to savings. When it’s time to renew, good driving habits can result in savings up to 20 percent. However, drivers need to be aware — riskier driving habits can result in higher premiums.

It’s important to note that IntelliDrive is not available in all states serviced by Travelers. Additionally, discounts, rates, and savings will vary from state-to-state. You can learn more by visiting this page, or by speaking with an agent.

Through the Affinity Group Discount Program employees of certain companies, or members of participating groups (such as credit unions or association groups), may be eligible for savings that are not available to the general public. Certain groups may also provide payroll deductions with no down payment or service fees. To see if you are eligible, call Travelers at 855-914-5530.

What Stands Out, What’s Missing

In terms of its basic coverages and its discounts, Travelers has a lot to offer.

Drivers can be confident that they’ll not only be able to meet the minimum coverage requirements of their state, but they also have a number of add-ons to choose from, including GAP insurance and roadside assistance. Drivers can also be assured that whether they’re a student or a seasoned driver, Travelers likely has a discount in place that applies to them.

What may hurt Travelers is that its auto insurance is not available in all 50 states.

Drivers also should note that not all Travelers’ discounts are created equal. Some are only available in certain states, and some are available at lower rates. Travelers additionally does not have a discount in place for the military, which could alienate a large segment of potential customers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Drivers can cancel their policy with Travelers in one of two ways — by calling a customer service representative (the preferred method), or by working directly with an agent. No matter what method you choose, you will need to supply the following:

- Contact information (name, address, and phone number)

- Policy number

- The date you want your policy to end

- If you’re switching providers, your new insurer’s name and policy number

- You may need to provide a proof of sale, or similar documentation, if you’re selling your car

Keep in mind that a cancellation can either go into effect immediately, or at a future date that of your choosing. Travelers advises giving ample notice if you’re on an automatic payment plan. You’ll also want to consult with your agent or customer service representative about any remaining financial obligations.

Finally, we can’t forget to mention this —

If you’re switching car insurance providers, be sure that you don’t have a gap in coverage. Not being prepared can lead to costly consequences, including tickets, fines, or the financial responsibility of a collision.

How to Make a Claim with Travelers

It’s something no driver wants to go through. But, if you find that you must make a claim through Travelers, we’ve assembled information to make the process easier.

Ease of Making a Claim

When it comes to filing claims, Travelers offers this advice —em> the sooner, the better.

- Drivers can make claims online, 24/7 through their MyTravelers account

- They can also make claims over the phone at 1.800.252.4633, also available 24/7.

Here’s what you’ll need to provide:

- Your contact information

- Photos of the damage,

- The name, contact, and policy information of any other involved parties

- The date the incident occurred

- A description of what happened, and any injuries that may have been sustained

Premiums Written and Loss Ratio

It’s simple – the number of direct premiums written by Travelers is on the rise, and the numbers prove it:

Between 2015 and 2018, the company has seen an increase of over 1.5 million direct premiums written — no doubt a sign of growth. What makes these numbers even more significant, is when we compare them against the company’s loss ratio.

What is a loss ratio?

Simply stated, a loss ratio is exactly that — a ratio of loss (how much a company is paying out in claims) to gains (how much the company is receiving in premiums). An insurance company with a loss ratio over 100 is paying out more in claims than what they’re making in premiums written.

So now, let’s take a look at Travelers’ direct premiums and its loss ratio:

| Year | Direct Premium | Loss Ratio |

|---|---|---|

| 2015 | $31,535,070 | 59.87% |

| 2016 | $38,967,860 | 65.45% |

| 2017 | $43,967,05,0 | 66.6% |

| 2018 | $46,977,430 | 60% |

Though the company’s loss ratio has consistently remained under 100 percent, it steadily increased between 2015 and 2017. However, Travelers’ loss ratio decreased by more than six percentage points between 2017 and 2018, from 66.6 percent to 60 percent.

How to Get a Quote Online (Step-by-Step Instructions)

Gone are the days where a car insurance quote could only be obtained by phone, or in person. In this digital age, getting an online quote is as simple as a point and a click.

Below, we’re breaking down the steps in how to get an online quote with Travelers Insurance:

How to Start

To begin, head to www.travelers.com and look for the “Get a Quote Now” prompt. Be sure to select “Auto,” then enter your zip code to begin.

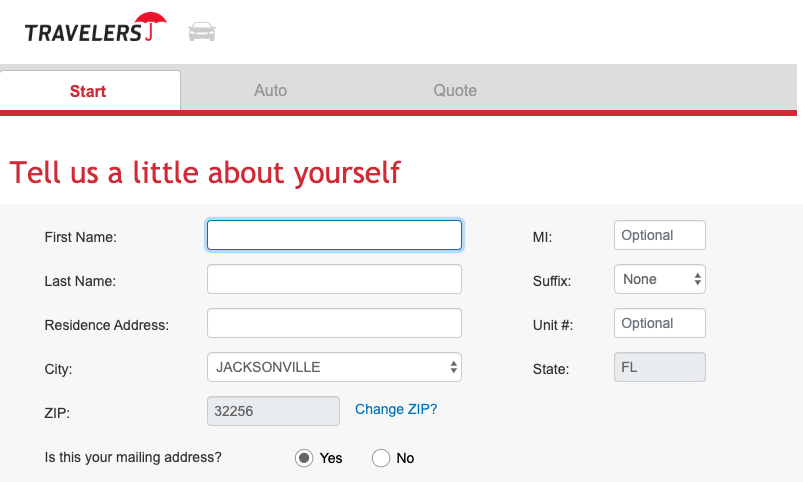

Personal Information

Next, you’ll need to provide your name, address, as well as your email address.

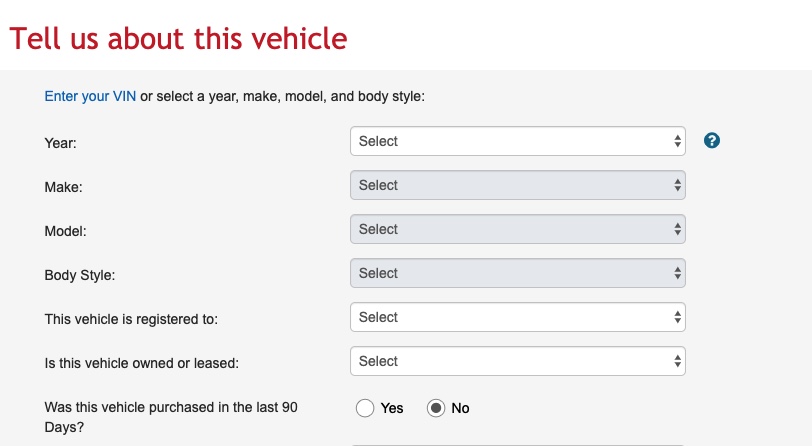

Vehicle Information

Now, you’ll need to tell Travelers about your car (or cars). This can be done either through the VIN (Vehicle Identification Number) or by entering your car’s year, make, model, body style, and estimated miles driven on your commute.

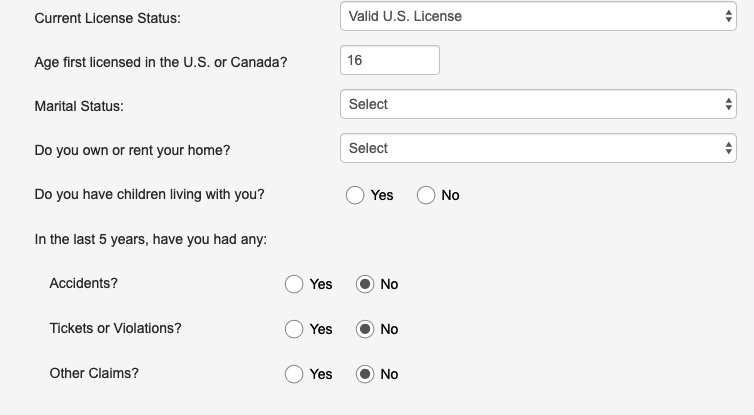

Driver Information and Driver History

Travelers will then ask you for more detailed information, including when you were first licensed, marital status, and how many children you have. You will also be asked about the last five years of your driving history — including accidents, tickets, DUIs, and claims.

Once you’ve completed the online form, you’ll be presented with a quote as well as contact information for your nearest agent.

What You Need to Apply

In summary, this is the information you’ll need to apply for a quote:

| Category | Information Needed |

|---|---|

| Personal | Full address, date of birth, and email (phone number is optional) |

| Vehicle | VIN (Vehicle Identification Number) OR car year, make, model, and body style. Estimated length of commute (one way) |

| Driver | Driving history in the last five years (accidents, tickets, DUIs, past claims) |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

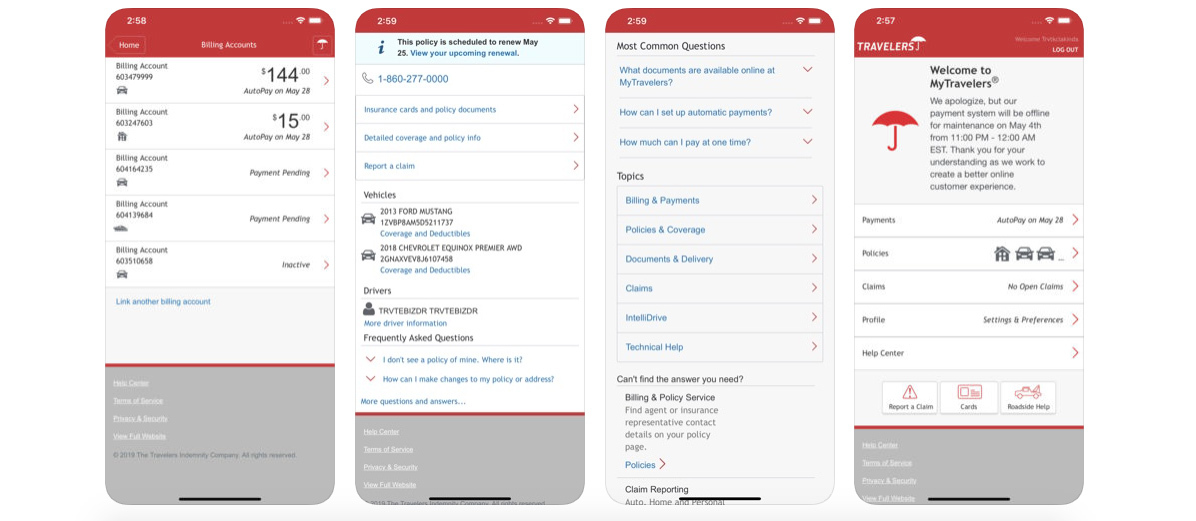

Design of Website and App

With Travelers, it’s not just about getting quotes. Customers can also access the company’s website and app to do everything from pay bills, file claims, and review their policies.

Mobile App

When it comes to its mobile app, Travelers uses three words to describe its functionality — “Anywhere, Anytime Access”

The Travelers app can be downloaded in the Apple App Store, or in Google Play, and allows customers to pay their bills, set up automatic payments, access insurance cards, view policy information, file claims, get roadside assistance, and go paperless.

What are customers saying about the app?

iPhone users have given the app an average customer review of 2.6 out of 5 stars.

- The most prevalent criticism we saw was in the number of bugs customers were encountering. Many also complained that the Touch ID function did not work properly.

- Conversely, many felt the app was easy to use, and complimented its convenience.

The average customer rating for the Travelers app in Google Play was 3 out of 5 stars.

- Customers similarly criticized the app’s inability to function properly.

- However, others praised the app for roadside assistance, and ease of use.

The Travelers Website

Let’s face it — trying to navigate a poorly-designed or out-of-date website is not only frustrating, but it’s also time-consuming.

However, that is not the case with Travelers. We find that locating what you need on the company’s site is simple and pretty intuitive.

Travelers Home Page

Beginning with the homepage, visitors are met with a menu across the top in which they can choose the category that best applies to them

Narrow Down Your Search

Hovering over one of these options will reveal an expanding menu with more specific options. To get to the car insurance section, we selected “For Individuals.” You can see a number of options tied to various types of insurance.

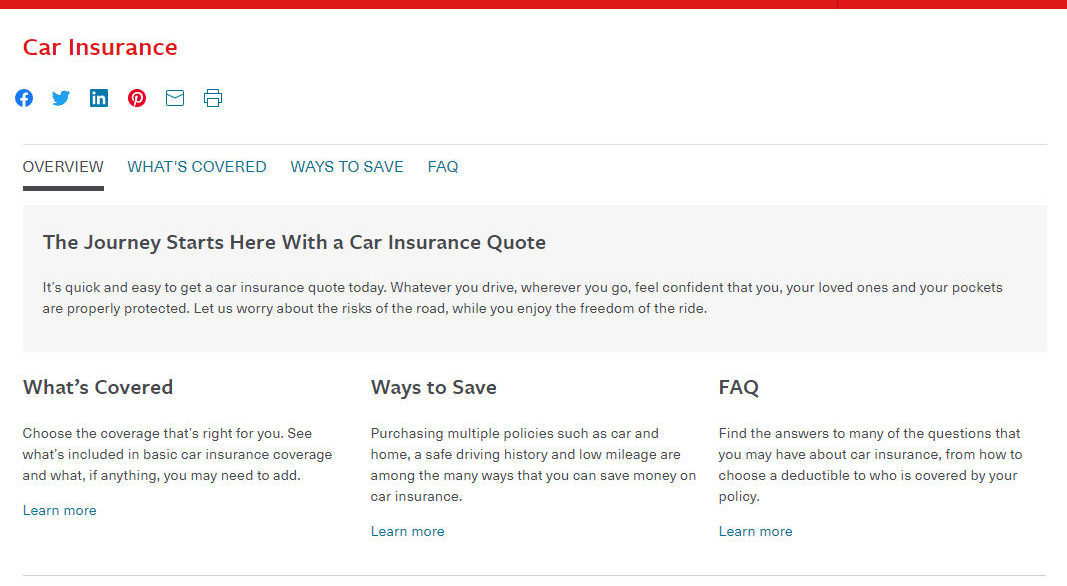

Travelers’ Car Insurance Page

Once you’ve selected “Car,” you’re lead to an easy-to-follow section outlining Travelers’ car insurance coverage options, ways to save, and FAQs:

Travelers Pros and Cons

As we near the end of this comprehensive guide, let’s review some important pros and cons:

| Pros | Cons |

|---|---|

| Strong financial standing and outlook according to entities like AM Best, S&P, and Moody's | Not available in all 50 states |

| Continued growth within the industry, including market share and premiums written | Third-highest average rate among top 10 insurers. |

| Plenty of discounts and add-ons, including gap insurance and new car replacement | Customer service reviews are inconsistent, and negative regarding claims |

| Offers a lot of access online and through the app | Consistent negative feedback on mobile app's functionality |

Let’s begin with the pros:

- As we’ve stated previously, Travelers is doing an outstanding job of proving itself to be a financially stable and healthy company.

- Travelers has top marks from several important ratings-issuers, and a sizable market share that has shown significant growth over the years.

- Customers can rest easy in knowing they’ll have plenty of coverage options to choose from

- And, customers can also be assured that they can access their accounts online, and through a mobile app

Now, the cons:

- Travelers is not available in all 50 states

- Travelers’ average rates are also higher than most of the top 10 providers on our list. Of note is the staggering $12,850.91 rate for 17-year-old drivers

- Customer service reviews for the company are inconsistent, to say the least, ranging from some of the highest highs to the lowest lows. Many reviewers cited dissatisfaction with the claims process.

- And speaking of reviews, Travelers’ mobile app has received a considerable amount of negative feedback on its functionality

The Bottom Line

The fact that Travelers is writing more premiums and is growing in market share certainly says something — drivers keep choosing the company. When looking at Travelers’ financial standing, it’s hard to deny that the company is holding its own, and is likely poised for continued growth. A lot of that growth will come from its ability to attract and retain drivers.

Yes, Travelers customers may end up paying higher rates. But for some, a higher financial investment may be worthwhile if they feel they’re getting a return in quality.

And speaking of quality, how drivers perceive the quality of the company’s customer service remains a mixed bag, as some reviews rank the company much lower than its counterparts. When people are unhappy with customer service, whether from a car insurance company, an internet provider, or any other service provider, they’re usually not afraid to voice their opinion in online reviews.

Whether Travelers will sustain this growth, or overcome some negative customer feedback, will only be revealed in time.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

Before we go, we want to address some of your most commonly-asked questions.

What Forms of Payment Does Travelers Insurance Take?

Travelers will accept checks, money orders, credit cards, and payments by home banking. Payments can also be made online, by phone, by mail, and by bank draft.

To learn more about payment options, click here

How can I contact Travelers Insurance?

For a quote, you can call 1.888.284.7313 or click here

For Billing and Policy Service Questions, you can call 1.800.842.5075 or go through your MyTravelers account.

To report a claim, call 1.800.252.4633 or begin the process online

To check the status of a claim, call 1.800.252.4633 or click here

What are the Deductibles with Travelers?

Deductibles with Travelers generally range from $100 to $1,000, and they only apply to certain coverages like comprehensive and collision.

Keep in mind, what you decide to pay in premiums will often determine your deductible. The higher your deductible, the lower your premium.

How Long Does it Take For Travelers to Pay For a Claim?

The time that it takes for an insurer to pay out a claim will vary on a person-to-person and case-to-case basis. However, the less complex the claim, the faster it will be processed.

Is Window Damage and Replacement Covered?

Here’s what Travelers has to say about glass and windshield repairs:

- Windshield repairs or replacement as a result of a chip or crack can be done at the shop of your choice.

- If you select one of Travelers’ partner vendors, they’ll handle your claim and guarantee your repairs for as long as you own the vehicle.

- No matter where you go, that shop will bill Travelers directly for the work, and you’ll be responsible for any applicable deductible.

- Generally speaking, you won’t have to pay a deductible for fixing chips or cracks. There are, however, exceptions

- Be sure to view your policy and deductibles online, or by speaking with an agent

You’ve officially reached the end of our comprehensive guide to Travelers Car Insurance. From cheap rates, to coverage options, and to customer reviews — we believe you now have a fuller picture of what it means to be insured with Travelers.

Now it’s your turn to get behind the wheel and drive into a more informed decision. You can begin shopping rates with our free car insurance comparison tool. Simply enter your zip code below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.