State Farm Car Insurance Guide [Data + Expert Review]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| State Farm Overview | Stats |

|---|---|

| Year Founded | 1922 |

| Current Executives | Michael L. Tipsord Chairman, President, and CEO |

| Numbers of Employees | Nearly 58,000 employees & 19,000 independent contractor agents |

| Total Revenue and Total Assets | Total Revenue $81.7 billion Total Assets $159.9 billion |

| Headquarters Address | State Farm Insurance One State Farm Plaza Bloomington, IL 61710 |

| Phone Number | 800-STATE-FARM (800-782-8332) |

| Company Website | www.statefarm.com |

| Premiums Written | 65,868,839 |

| Loss Ratio | 0.62 |

| Best For | Drivers with clean records |

State Farm is one of the largest auto insurers in the U.S. With almost a century of experience in the insurance market, State Farm has marketed its company around the jingle, “Like a good neighbor, State Farm is there.”

But if you are hesitant to trust a company just on its advertising, our review goes into much more than just State Farm’s commercials and promises.

To decide if a company is right for you, you need to know about their customer satisfaction ratings, premium costs, coverages, and much more. After all, it is your hard-earned dollar going to a company, and you need to be able to trust they will come through for you in an accident.

So keep reading to learn everything you need to know about State Farm as a company.

Want to start comparison shopping for rates today? Enter your zip code in our free tool at the bottom of this post.

Rating Agency

You can never just go off a company’s promises. Instead, it’s important to look at what trusted sites say about State Farm — does State Farm’s promises match its service?

Stick with us as we go through both financial and customer satisfaction ratings. Doing so will provide a complete picture of State Farm, so you can decide if State Farm sounds like the right company for you.

Let’s begin.

A.M. Best

What is A.M. Best? On its website, A.M. Best describes its ratings as “recognized indicator[s] of insurer financial strength and creditworthiness.”

Ratings are on a letter scale, from A++ to D. So what rating does State Farm has?

State Farm has an A++ rating, which is the highest rating possible.

This rating is fantastic. It means A.M. Best believes State Farm has a superior ability to fulfill its financial obligations. Since A.M. Best is an independent reviewer (like all the reviewers we are going to go through), this rating is unbiased and based purely on State Farm’s finances.

Better Business Bureau (BBB)

The Better Business Bureau (BBB) is a private organization that rates insurers on a number of factors. These rating factors focus on ethical business practices within a company:

- Complaint history with BBB

- Business type

- Time company has been in business

- Transparency of business practices

- Failure or success in honoring commitments with BBB

- Licensing and government actions

- Advertising issues

Companies are rated on a 100 point scale. However, BBB rates companies on a state or local level, which means that there isn’t an overall, nationwide score.

State Farm did earn good ratings in most states, though.

For example, State Farm has an A+ grade in Wisconsin. If you want to see the exact score for State Farm in your local area or state, visit the BBB website.

Moody’s Rating

Moody’s is a well-known corporation that rates companies’ creditworthiness. The rating scale goes from Aaa (highest) to C (lowest).

State Farm has an Aa1 rating from Moody’s.

What does this rating signify?

It means Moody’s believes State Farm has a stable future because State Farm has little credit risk.

S&P Rating

Standard and Poor (S&P) is another credit rating corporation that has been around for over a century. The corporation’s ratings are on a letter scale, with AAA being the highest score possible.

So what did State Farm earn?

S&P gave State Farm an AA rating, which is the second-highest rating.

An AA rating means State Farm is highly capable of fulfilling its financial commitments, such as paying claims.

NAIC Complaint Index

It doesn’t matter how financially strong a company is if customers aren’t satisfied. A company that has multiple complaints and problems with customer service will start losing customers to other companies.

To see if State Farm actually acts like a good neighbor, we want to start our customer service analysis with the National Association of Insurance Commissioners’ (NAIC) data.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 9,206 | 1,481 | 1,402 |

| Complaint Index (better or worse than National Index) | 2.16 (worse) | 0.52 (better) | 0.57 (better) |

| National Complaint Index | 0.78 | 1.2 | 1.16 |

State Farm’s complaint index was high in 2016. You may be wondering why over 9,000 complaints only resulted in a complaint index of 2.16. Because State Farm is one of the largest insurers in the U.S., 9,000 customers are only a small percentage of State Farm’s total customers.

All this to say, 2.16 percent isn’t high. As well, in 2017 and 2018, State Farm’s complaint index was below the national average.

So while the number of complaints may seem high, the complaint index puts the number into proportion.

J.D. Power

Let’s continue diving into customer satisfaction ratings by looking at J.D. Power’s ratings. J.D. Power surveyed over 42,000 customers in 2019 to rate companies’ customer satisfaction.

The companies were rated on a 1,000 point scale and assigned a power circle rating.

- Five Power Circles: “Among the best”

- Four Power Circles: “Better than most”

- Three Power Circles: “About average”

- Two Power Circles: “The rest”

So let’s take a look at what State Farm rated in multiple U.S. regions.

| U.S. Region | Customer Satisfaction (out of 1,000) | J.D. Power Circle Ranking |

|---|---|---|

| California | 824 | Better than most |

| Central | 828 | About average |

| Florida | 834 | About average |

| Mid-Atlantic | 834 | About average |

| New England | 844 | Better than most |

| New York | 845 | Better than most |

| North Central | 841 | Better than most |

| Northwest | 820 | About average |

| Southeast | 853 | Better than most |

| Southwest | 831 | Among the best |

| Texas | 835 | About average |

State Farm has some great ratings. It earned “better than most” in five regions, and “among the best” in the Southwest region. While the rest of the regions rated State Farm as “about average,” State Farm never had less than three power circles.

Not bad at all! State Farm has done fairly well in J.D. Power’s survey study.

Consumer Reports

Another independent corporation that rates customer satisfaction, Consumer Reports grades customer’s satisfaction on a 100 point scale.

State Farm has a score of 89 out of 100.

This score is decent. Let’s look at the rating broken down.

| Claims Handling | Score/Rating |

|---|---|

| Reader Score | 89 out of 100 |

| Ease of reaching an agent | Excellent |

| Agent courtesy | Excellent |

| Being kept informed of claim status | Excellent |

| Simplicity of the process | Very good |

| Promptness of response - very good | Very good |

| Damage amount | Very good |

| Timely payment | Very good |

| Freedom to select repair shop | Very good |

Excellent is the highest category grade possible, while very good is second. State Farm earned three excellent ratings out of the eight categories.

While we’d like to see some more excellent ratings in the mix, State Farm has a solid score from Consumer Reports.

Consumer Affairs

The last customer satisfaction rating we want to look at is from Consumer Affairs.

State Farm has four out of five stars in 2019, based on over 2,700 reviews in the last year.

This is an excellent rating. Companies on Consumer Affairs tend to have poor ratings, as Consumer Affairs is an ideal platform to submit complaints. However, State Farm has four stars, which tells us State Farm’s service is better than most.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Company History

In 1922, the founder of State Farm sold the first auto insurance policy for $11.17. While an auto insurance policy costs much more than $11 now, State Farm has grown and changed with the times.

Today, State Farm offers insurance, banking, and investment options for customers. These services have helped launch State Farm into the position of one of the largest insurers in the U.S.

While State Farm’s history is interesting, we want to focus on how State Farm’s past drives its future.

We are going to look at State Farm’s market shares, employee satisfaction, and more. Doing so will allow us to speculate on what State Farm’s future in the insurance market will be.

After all, the last thing you need is to sign up with an insurer that goes bankrupt.

Let’s dive right in.

State Farm Market Share

While we already know that State Farm is one of the largest insurers, we want to to make sure that it’s maintained its position. Companies can go downhill if they don’t stay competitive with other companies.

Below is the NAIC’s data on State Farm’s market shares over a four year period.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Market Share | 18.68% | 18.26% | 18.07% | 17.01% |

State Farm’s overall market share dropped almost 2 percent from 2015 – 2018. However, State Farm’s market share is still incredibly high. It would take a much larger drop than 2 percent to put State Farm out of commission.

State Farm’s Position for the Future

State Farm is in no danger of going under. It has dominated the market for decades, and while its market share has dropped slightly, it is still one of the largest insurers.

Additionally, State Farm has solid financial ratings from multiple financial gurus. The great ratings don’t stop at finances, either. State Farm also has respectable ratings from customer satisfaction surveys.

Based on these factors, State Farm is positioned well for the future. If it keeps on the same path, it will continue to have strong finances and customer service.

State Farm’s Online Presence

State Farm has multiple ways to access information, creating a strong presence. People can easily access State Farm information online on the website.

However, you can also talk in-person to a local agent.

Both these methods give you access to State Farm’s information and free quotes.

State Farm’s Commercials

So how does State Farm convince people to visit an agent or check out State Farm’s website? One word — commercials.

With so many ads clamoring for our attention, State Farm needs to make its commercials interesting. If they don’t grab viewers’ attention, State Farm will have trouble attracting new customers.

Well, if “like a good neighbor” pops into your head when you hear the name State Farm, then State Farm’s advertising has already stuck with you.

While some of the situations State Farm portrays aren’t probably something that will happen to you, the message is that State Farm will help after accidents. State Farm also uses celebrity appearances in its commercials, which helps interest sports fans.

Overall, State Farm uses its commercials to its advantage, using clever and humourous situations to advertise its products.

State Farm in the Community

State Farm follows through on being a good neighbor. As a major corporation, State Farm is heavily involved in the community.

So what does State Farm do to help?

- Good Neighbor Citizenship® grants

- State Farm Companies Foundation

- Science Technology Engineering and Math (STEM) Initiative

- Auto and Home Safety Programs

- Community Reinvestment Act

- National Community Relationships

- Neighborhood of Good®

State Farm has a large number of programs that focus on improving the community through education, grants, safety courses, and volunteerism. State Farm has taken an interest in giving back, and it shows.

https://youtu.be/X2HCuQm8ni0

State Farm’s Employees

While we know most customers are satisfied with State Farm, what about State Farm employees? They have an inside look at how State Farm functions, so we want to see what they think about State Farm.

On Payscale, State Farm employees rated State Farm 3.3 stars out of five. This rating is broken down into the following satisfaction categories.

| Category | Rating (out of 5) |

|---|---|

| Appreciation | 3.2 |

| Company Outlook | 3.5 |

| Fair Pay | 2.7 |

| Learning and Development | 3.6 |

| Manager Communication | 3.8 |

| Manager Relationship | 4.0 |

| Pay Policy | 2.6 |

| Pay Transparency | 2.8 |

State Farm struggles the most in the categories of fair pay, pay policy, and pay transparency. However, State Farm rated well in manager relationship and manager communication.

So while the work environment seems to be good at State Farm, the company has issues with employee’s salaries.

Let’s take a look at another employee rating site.

On Glassdoor, State Farm employees gave State Farm 3.1 stars out of five (based on over 8,000 reviews). Glassdoor also gave State Farm the following awards for its workplace.

- Best Places to Work: 2011 (#38)

- Top CEOs: 2014 (#34) and 2013 (#37)

State Farm won these awards a while ago, but it’s still a good indication that State Farm has a decent work environment.

So what do employees say about the workplace at State Farm?

- Positives: Great work benefits and great work/life balance.

- Negatives: No medical or dental benefits. Pay is not the best.

As on Payscale, employees believe State Farm’s pay could be improved (as well as benefits). Besides the pay issues, though, employees seem happy with the work environment and relationships they form.

State Farm’s Awards and Accolades

State Farm has won a number of awards over the last decade. But to save you time scrolling, we’ve only listed the last 10 recent awards to give you an idea of what State Farm has been recognized for.

| Last 10 Employer Recognition Awards | Last 10 Community Recognition Awards | Last 10 Environmental Recognition Awards |

|---|---|---|

| 2019 Top 100 Most Military Friendly® Employer | 2017 Corporate Social Responsibility Leadership Award | 2012 Charlottesville, Virginia, Operations Center won award for energy efficiency |

| 2019 Most Admired Company | 2016 Corporate Social Responsibility Leadership Award | 2009 41st in the U.S. Environmental Protection Agency's ranking |

| 2019 National Recognition for Equality | 2014-2015 Junior Achievement Volunteer Service Award | 2009 Illinois Recycling Association's Excellence in Recycling Award |

| 2019 Top Companies for Executive Women | 2015 Corporate Social Responsibility Leadership Award | 2009 Outstanding Corporate Recycling Program |

| 2018 AnitaB.org Top Company for Women Technologists | 2013-2014 Junior Achievement Volunteer Service Award | 2008 California Integrated Waste Management Board's Waste Reduction Award |

| 2018 LATINA Style's 50 Best Companies for Latinas to Work | 2011 Corporate Social Responsibility Index | 2009 & 2008 Environmental Stewardship Award from the City of Greeley |

| 2018 Best Companies for Multicultural Women | 2010 Top 100 Employers | 2008 Best Practices Award from the Business Environmental Alliance of Sonoma County, California |

| 2018 Best Companies for Diversity | 2010 Top Diversity Business Advocate in U.S. Asian Markets | 2010 Top 50 greenest employers in Canada's Greenest Employers competition |

| 2018 Hispanic Association on Corporate Responsibility (HACR) - Corporate Inclusion Index (CII) | 2010 Hispanic Federation | 2009 Uptime Institute's 2009 Global Green 100 for Corporate Leadership in IT Energy Efficiency |

| 2017 CEO Cancer Gold Standard Accreditation™ | 2009 50 Best Companies for Latinas to Work | 2008 Automotive Fleet Magazine's third largest non-governmental eco-friendly fleet in the United States |

This isn’t a complete list of State Farm’s awards, but you can see that State Farm has done well in becoming a top insurer.

Not only has State Farm won awards for its workplace, but also for its community involvement and environmental efforts.

Cheap Car Insurance Rates

We’ve looked at ratings and what customers think, but we haven’t yet tackled price. How much you pay for an insurer is important, as the last thing you want to find out later is that you’ve been paying inflated rates.

To give you a complete picture of State Farm’s rates, we’ve partnered with Quadrant to bring you extensive data.

Keep reading to learn about where State Farm is available, as well as price changes for gender, driving record, and more.

State Farm Availability and Rates by State

If you move around frequently, you’ll need an insurer who is in every state. Otherwise, you’ll have to find a new insurer.

Luckily, State Farm is available in all U.S. states.

However, this doesn’t mean that your rates will stay the same when you move to another state.

State Farm Sample Rates by State| State | State Farm Annual Premium | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Alabama | $4,798.15 | $1,231.19 | 34.52% |

| Alaska | $2,228.12 | -$1,193.39 | -34.88% |

| Arizona | $4,756.25 | $985.28 | 26.13% |

| Arkansas | $2,789.03 | -$1,335.95 | -32.39% |

| California | $4,202.28 | $513.35 | 13.92% |

| Colorado | $3,270.77 | -$605.63 | -15.62% |

| Connecticut | $2,976.24 | -$1,642.68 | -35.56% |

| Delaware | $4,466.85 | -$1,519.48 | -25.38% |

| District of Columbia | $4,074.05 | -$365.20 | -8.23% |

| Florida | $3,397.67 | -$1,282.79 | -27.41% |

| Georgia | $3,384.88 | -$1,581.95 | -31.85% |

| Hawaii | $1,040.28 | -$1,515.36 | -59.29% |

| Idaho | $1,867.96 | -$1,111.13 | -37.30% |

| Illinois | $2,344.88 | -$960.60 | -29.06% |

| Indiana | $2,408.94 | -$1,006.03 | -29.46% |

| Iowa | $2,224.51 | -$756.77 | -25.38% |

| Kansas | $2,720.00 | -$559.62 | -17.06% |

| Kentucky | $3,354.32 | -$1,841.09 | -35.44% |

| Louisiana | $4,579.12 | -$1,132.22 | -19.82% |

| Maine | $2,198.68 | -$754.60 | -25.55% |

| Maryland | $3,960.87 | -$621.83 | -13.57% |

| Massachusetts | $1,361.86 | -$1,316.99 | -49.16% |

| Median | $2,731.48 | -$929.41 | -25.39% |

| Michigan | $12,565.52 | $2,066.88 | 19.69% |

| Minnesota | $2,066.99 | -$2,336.27 | -53.06% |

| Mississippi | $2,980.48 | -$684.09 | -18.67% |

| Missouri | $2,692.91 | -$636.03 | -19.11% |

| Montana | $2,417.74 | -$803.11 | -24.93% |

| Nebraska | $2,438.71 | -$844.97 | -25.73% |

| Nevada | $5,796.34 | $934.64 | 19.22% |

| New Hampshire | $2,185.46 | -$966.32 | -30.66% |

| New Jersey | $7,527.16 | $2,011.94 | 36.48% |

| New Mexico | $2,340.66 | -$1,122.98 | -32.42% |

| New York | $4,484.58 | $194.70 | 4.54% |

| North Carolina | $3,078.65 | -$314.46 | -9.27% |

| North Dakota | $2,560.53 | -$1,605.32 | -38.54% |

| Ohio | $2,507.88 | -$201.84 | -7.45% |

| Oklahoma | $2,816.80 | -$1,325.53 | -32.00% |

| Oregon | $2,731.48 | -$736.29 | -21.23% |

| Pennsylvania | $2,744.23 | -$1,290.27 | -31.98% |

| Rhode Island | $2,406.51 | -$2,596.85 | -51.90% |

| South Carolina | $3,071.34 | -$709.80 | -18.77% |

| South Dakota | $2,306.23 | -$1,676.05 | -42.09% |

| Tennessee | $2,639.30 | -$1,021.59 | -27.91% |

| Texas | $2,879.94 | -$1,163.34 | -28.77% |

| Utah | $4,645.83 | $1,033.94 | 28.63% |

| Vermont | $4,382.84 | $1,148.71 | 35.52% |

| Virginia | $2,268.95 | -$88.92 | -3.77% |

| Washington | $2,499.78 | -$559.55 | -18.29% |

| West Virginia | $2,126.32 | -$469.04 | -18.07% |

| Wisconsin | $2,387.53 | -$1,218.53 | -33.79% |

| Wyoming | $2,303.55 | -$896.53 | -28.02% |

In the majority of states, State Farm’s rates are lower than the average. This is great, as it means State Farm is reasonably priced. However, there are a few states where State Farm’s rates go up.

For example, State Farm is over 36 percent more than the state average in New Jersey.

This isn’t the norm for State Farm, though, so your rates shouldn’t change too drastically after a move.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing the Top 10 Companies by Rates

We know State Farm’s rates are usually below average, but how do State Farm’s rates compare to other major companies?

The Top Ten Insurance Providers' Rates by State| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

Read more:

- Florida Car Insurance (The Only Guide You’ll Ever Need)

- American Family Car Insurance Guide [Data + Expert Review]

- Kentucky Auto Insurance (Cheap Rates, Best Companies, and More)

State Farm tends to be one of the cheaper companies. In Connecticut, State Farm is actually the cheapest provider, beating out USAA. However, in New Jersey, State Farm is the most expensive provider.

So make sure to check states’ rates when moving, as there are always exceptions.

Average State Farm Male vs. Female Car Insurance Rates

State Farm does use gender to determine car insurance rates, except for in states where this practice is outlawed.

California, Hawaii, Massachusetts,, Montana, Pennsylvania, North Carolina, and parts of Michigan have outlawed basing rates on gender.

Why does State Farm change rates between males and females? Well, most insurers look at demographic accident data to calculate rates. For instance, young teenagers are more prone to accidents and therefore are charged more.

The same is true of gender. Insurers believe males to be riskier drivers and generally, charge male drivers more than female drivers.

So let’s take a look at State Farm’s demographic rates for age and gender.

| Marital Status, Gender, and Age | State Farm Average Premium |

|---|---|

| Married 60-year old female | $1,873.89 |

| Married 60-year old male | $1,873.89 |

| Married 35-year old female | $2,081.72 |

| Married 35-year old male | $2,081.72 |

| Single 25-year old female | $2,335.96 |

| Single 25-year old male | $2,554.56 |

| Single 17-year old female | $5,953.88 |

| Single 17-year old male | $7,324.34 |

State Farm doesn’t change rates based on gender for 60-year-olds and 35-year-olds. In the other age and gender categories, though, State Farm does charge male drivers more.

As well, you can see that older drivers pay significantly less for car insurance than young drivers.

Average State Farm Rates by Make and Model Last-5-Year Average

When you shop for a new car, you probably don’t stop to consider how much your insurance premium may go up.

According to the Insurance Information Institute (III), insurers look at the type of car you have to determine prices.

“Insurers not only look at how safe a particular vehicle is to drive and how well it protects occupants, but also how much potential damage it can inflict on another car. If a specific vehicle model has a higher chance of inflicting damage when in an accident, an insurer may charge more for liability insurance.”

If a car rates well in safety and doesn’t cost a ton to repair, that car will cost less to insure.

So let’s take a look at how much State Farm’s rates vary based on vehicle models.

| Make and Model | State Farm |

|---|---|

| 2015 Ford F-150 | $3,204.23 |

| 2015 Honda Civic Sedan | $3,024.24 |

| 2015 Toyota RAV4 XLE | $3,226.02 |

| 2018 Ford F-150 | $3,497.17 |

| 2018 Honda Civic Sedan | $3,189.99 |

| 2018 Toyota RAV4: XLE | $3,418.33 |

| Average | $3,260.00 |

There is only about a $200 difference between the most and least expensive models of car. This is fairly low, so State Farm shouldn’t vastly increase its rates when you buy a new car.

Average State Farm Commute Rates

State Farm is among the companies that increase rates on commute distance.

| Commute | Average Premium |

|---|---|

| 10 miles/ 6,000 annual mileage | $3,175.98 |

| 25 miles/ 12,000 annual mileage | $3,344.01 |

State Farm charges an average of $169 extra for a longer commute. This is higher than the average at most companies, as generally, companies charge about $100 extra for longer commutes.

Average State Farm Coverage Level Rates

In the unfortunate event of an accident, high coverage protects drivers the best. Some companies charge such high premiums, though, that drivers stick to low or medium coverage.

| Coverage Type | State Farm Average Premium |

|---|---|

| High | $3,454.80 |

| Medium | $3,269.80 |

| Low | $3,055.40 |

State Farm’s rate increase from low to high coverage is economical, costing about $400. This isn’t bad. Usually, an upgrade from low to high coverage costs about $1,000.

So if you choose State Farm, high coverage should be affordable.

Average State Farm Credit History Rates

A credit score has a huge impact on rates.

The average credit score in the U.S. is 675.

A credit score of 675 is generally considered a good credit score. So if you have a credit score that is lower than this, insurers may place you in the categories of a fair or a poor credit score.

However, how much insurers penalize drivers for fair or poor credit varies.

| Credit History | State Farm Average Premium |

|---|---|

| Poor | $4,951.20 |

| Fair | $2,853.00 |

| Good | $2,174.26 |

State Farm’s rate from good to fair credit increases $679. This is fairly high, and it gets worse when the credit score drops to poor.

State Farm customers who go from good to poor credit will end up paying an average of $2,777.

This is higher than most companies, where the rate increase is normally $1,000. However, make sure to look at the overall amount rather than just the rate increase.

State Farm may charge more of a penalty, but its rate could still be lower than other companies’ totals.

Average State Farm Driving Record Rates

State Farm, like every other insurer, also penalizes drivers with poor driving records. So let’s take a look at how much State Farm charges on average for DUIs, accidents, and speeding tickets.

| Driving Record | State Farm Average Premium |

|---|---|

| Clean Record | $2,821.18 |

| With One Speeding Violation | $3,186.01 |

| With One Accident | $3,396.01 |

| With One DUI | $3,636.80 |

State Farm’s penalties for driving record offenses are fairly low. A DUI, the worst offense, will cost drivers under $1,000. However, these rate increases are just for first offenses.

If drivers have a poor record with multiple accidents, DUIs, or speeding tickets, they will find their rates will shoot up. If this happens, some drivers may have to purchase high-risk insurance.

Coverages Offered

We’ve covered prices, but what are you paying for? The types of coverages available are important. If you have a classic car or need extra liability insurance, you want to make sure an insurer offers the coverages you need before signing up.

While all insurers will cover the basic requirements, not all insurers offer a complete list of useful add on coverages.

So keep reading to see what coverages, discounts, and programs State Farm offers.

Types of Coverages Offered

Let’s take a look at what auto insurance coverages State Farm has.

- Classic Car Coverage — Have a vintage car? Classic car insurance costs less, so check to see if your car qualifies as a classic at State Farm.

- Collision Coverage — This coverage protects you in accidents with another vehicle.

- Comprehensive Coverage — Live in an area prone to theft or hurricanes? Comprehensive coverage protects you in collisions that aren’t with another vehicle (such as an animal collision), and it also covers natural disasters and theft/vandalism.

- Liability Coverage — Required in every state, liability coverage steps in if you cause an accident that injures another person or results in property damage.

- Uninsured Motorist Coverage — If the driver who causes the accident is uninsured and can’t pay your medical or property damage bills, uninsured motorist coverage will help.

- Underinsured Motorist Coverage — Likewise, if a driver has poor insurance and can’t completely pay your costs, this coverage will protect you.

- Medical Payments Coverage — Medpay will help if you have medical treatment bills after an accident.

- Rideshare Driver Coverage — Driving for a rideshare company (like Uber) requires rideshare insurance. Rideshare insurance is in addition to your personal insurance.

State Farm has s decent array of coverage options. While it doesn’t have Personal Injury Protection (PIP) coverage, PIP is similar to medical payments coverage.

Factors That Affect Rates

There are multiple factors that can bring down rates. While a clean driving record is one way to reduce costs, bundling an auto policy with a home or life insurance policy can also reduce prices.

Since State Farm offers the following types of insurance, it is easy to bundle policies.

- Home and Property

- Life

- Health

- Disability

- Small Business

- Liability

- Identity Restoration

Bundling will earn customers a discount. If you like the ease of having multiple policies at one provider, bundling is a great option.

Getting the Best Rate With State Farm

While bundling is a great discount, it can only save you so much. Luckily, State Farm offers a variety of discounts.

| Discount | Amount |

|---|---|

| Anti-lock Brakes | 5% |

| Anti-Theft | 15% |

| Claim Free | 15% |

| Defensive Driver | 5% |

| Distant Student | speak with your agent to learn more |

| Driver's Ed | 15% |

| Driving Device/App | 50% |

| Good Credit | speak with your agent to learn more |

| Good Student | 25% |

| Homeowner | 3% |

| Low Mileage | 30% |

| Married | speak with your agent to learn more |

| Military | speak with your agent to learn more |

| Multiple Policies | 17% |

| Multiple Vehicles | 20% |

| Newer Vehicle | 40% |

| Paperless/Auto Billing | $2 |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Vehicle Recovery | 5% |

| Total Discounts | 20 |

Read more: Auto Insurance Companies That Are Good for Low-Use Vehicles

State Farm provides fewer discounts than its competitors (the highest number offered is 38). This may make it harder to save larger amounts, but luckily, State Farm’s rates are usually lower than average.

Still, a larger number of discounts would be nice.

State Farm’s Programs

State Farm has many useful programs for customers.

- Accident Forgiveness — This program can save drivers a lot of money. If you’ve been accident-free for three years at State Farm, your rates won’t go up for your first at-fault accident.

- Car Rental and Travel Expense — Car in the shop? State Farm will pay for a rental car in a claimable accident. If you’re in an accident more than 50 miles from your home residence, State Farm will also pay for lodging, meals, and transportation.

- Emergency Road Coverage — If you purchase this coverage, State Farm will help you with multiple situations. For example, being locked out of your car or running out of gas.

- Usage-Based App — State Farm has a Drive Safe & Save™ App that offers discounts for safe driving habits. It also has a Steer Clear® app for young drivers.

These programs are great to have in case of accidents or mishaps on the road.

What’s Missing and What Stands Out

Now that we’ve covered prices, coverages, and discounts, let’s take an overall look at State Farm.

- What’s Missing — State Farm has fewer than average discounts. It is also lacking coverages like PIP.

- What Stands Out — State Farm has a great collection of coverages and programs. The company also has lower-than-average rates in most states.

While State Farm lacks some discounts, generally it is still cost-effective.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Ready to leave State Farm behind? Because some insurers can make it difficult to leave, we want to go through every aspect of canceling a policy at State Farm.

From fees to when you can cancel, we will cover it all in this section, so keep reading to learn how to break up with State Farm as a provider.

Cancellation Fee

State Farm doesn’t mention cancellation fees on its website. However, sometimes insurers will charge a small fee if customers cancel in the middle of a policy period.

If customers cancel after the renewal cycle is up, though, there should be no fee.

So call and talk to your State Farm agent to ask if you’ll be charged a cancellation fee.

Is there a refund?

Yes, there should always be a refund if customers cancel before the end of a renewal cycle. For example, if you prepay for six months of coverage but cancel in month four, State Farm should refund you for the remaining two months.

How to Cancel

Now that we’ve covered fees and refunds, let’s go through how to cancel a State Farm Policy.

Have a New Insurer Before Canceling

We can’t stress this step enough. Before you even begin to prepare to cancel your State Farm policy, you need a new insurer beforehand. State Farm will ask during the cancellation process for your new insurer’s policy number.

Why?

Because if you cancel your State Farm policy and have a gap period until your new insurer kicks in, you’ll be heavily penalized. Driving without insurance is illegal, and insurers take notice of gaps in coverage.

So have a new policy that will be effective as soon as you cancel your State Farm policy.

If you are getting rid of State Farm because you no longer need car insurance (such as selling your vehicle), then you need proof that you no longer need it.

For example, you’ll need a bill of sale or proof you turned in your license plate.

Canceling Over Phone

We covered what you need to do beforehand, so let’s dive into the cancellation methods. One of the first ways you can cancel your policy is over the phone.

State Farm doesn’t have a main hotline to call to cancel. Instead, you’ll have to call your local agent to cancel. When you call, you’ll need the following information (you will need this information for every method of cancellation):

- Social Security Number

- State Farm Policy Number

- Name/Policy Number of New Insurer (or Bill of Sale)

State Farm agents may try to convince you to stay by asking if there’s anything they can fix for you. For example, they may discuss adjustments that can change the price of your policy.

Canceling by Mail

You can also cancel by mail. The letter will need to be mailed to the following corporate address.

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

This method takes longer than calling by phone, so make sure to send it in well before your intended cancellation date. In your dated and signed letter, you need to include the following:

- Name, address, and phone number

- State Farm policy number

- Date of desired policy end

- New insurer’s name, policy number, and policy start date

- OR Bill of Sale

Be as thorough as possible. Since mail takes longer, you won’t know if you missed something until State Farm receives your letter.

Canceling In-Person

The last method of cancellation is an in-person visit to a local agent. You will need to bring along the same information needed for canceling by phone or mail. This method may be more inconvenient, depending on how far away an agent is from you.

When can I cancel?

You can cancel at any time. However, if you cancel your State Farm policy halfway through a renewal cycle, then State Farm may charge you a small fee.

So how do you know if the cancellation was effective?

State Farm should notify you of successful cancellation. You can also call State Farm or check your online account.

How to Make a Claim

Car insurance only exists to help drivers after accidents. If you find yourself in an accident and need to make a claim, you may be overwhelmed by where to start.

Not to worry.

We are going to cover how to make a claim at State Farm, as well as important claim information (State Farm’s written premiums and loss ratio).

Let’s get started.

Ease of Making a Claim

Like most providers, State Farm has used technology to its advantage. While calling by phone is still an option, there are also ways to file online.

Below are the methods to file a claim at State Farm.

- Online — Customers can file online at State Farm’s website.

- Mobile App — State Farm’s mobile app allows customers to file on their smartphones.

- Phone — Call 800-SF-CLAIM (800-732-5246).

- In-Person — Customers can visit a local agent to file a claim.

If you choose the in-person option, you are restricted to agents’ working hours. All the other methods, though, are available 24/7.

So what do you need to file a claim?

- Date, time, and location of the incident

- Names of involved parties

- Vehicles involved

- Description of damages and injuries

- Description of accident

If you can, take pictures of the damages as proof to submit to State Farm. This will help speed up the process.

Premiums Written

State Farm is a large insurer, which means it will be writing out a ton of premiums every year. This is good, as generally, the more premiums a company writes the lower costs are.

This is because insurers have to pay out claims. If a company has few written premiums but a high number of claims, it will have to charge customers more to pay claims.

So let’s take a look at the NAIC’s data on State Farm’s written premiums.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Written Premiums | $35,588,209,000 | $39,194,660,000 | $41,817,416,000 | $41,963,578,000 |

State Farm has steadily increased its premiums over a four-year period. There was a huge increase from 2015 – 2017, which is impressive.

These increases show State Farm is well established in its position as one of the largest providers in the U.S.

Loss Ratio

State Farm’s loss ratio is important, too. It directly ties into State Farm’s written premiums.

A loss ratio is calculated by comparing the amount paid in claims to the amount earned from written premiums. For example, a 65 percent loss ratio means a company is spending $65 on claims for every $100 earned in written premiums.

Based on this, it’s easy to see that a company with a loss ratio over 100 percent is at risk of going bankrupt. On the other hand, a company with a low loss ratio is clearly not paying out many claims.

Now that you know how important loss ratio is, let’s see what the NAIC has recorded for State Farm’s loss ratios.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Loss Ratios | 66.1% | 77.02% | 68.79% | 63% |

State Farm’s loss ratios have fallen and risen over the years. However, they have stayed in a respectable range (not too high or low). The dip and rise could be due to various factors, such as a rise in vehicle crashes. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get a Quote Online

Filing out a free quote form is a great way to get an idea of what prices State Farm will charge you. It also makes it easy to compare prices of different companies.

So if you want to see what you’ll have to budget for, keep reading for our step-by-step guide about State Farm’s online quote process.

Step One: Visit State Farm’s Website

The first step is to visit State Farm’s website. Right away, you will see a quote box on the homepage.

Simply select auto insurance in the quote box and you will be taken to the quote form.

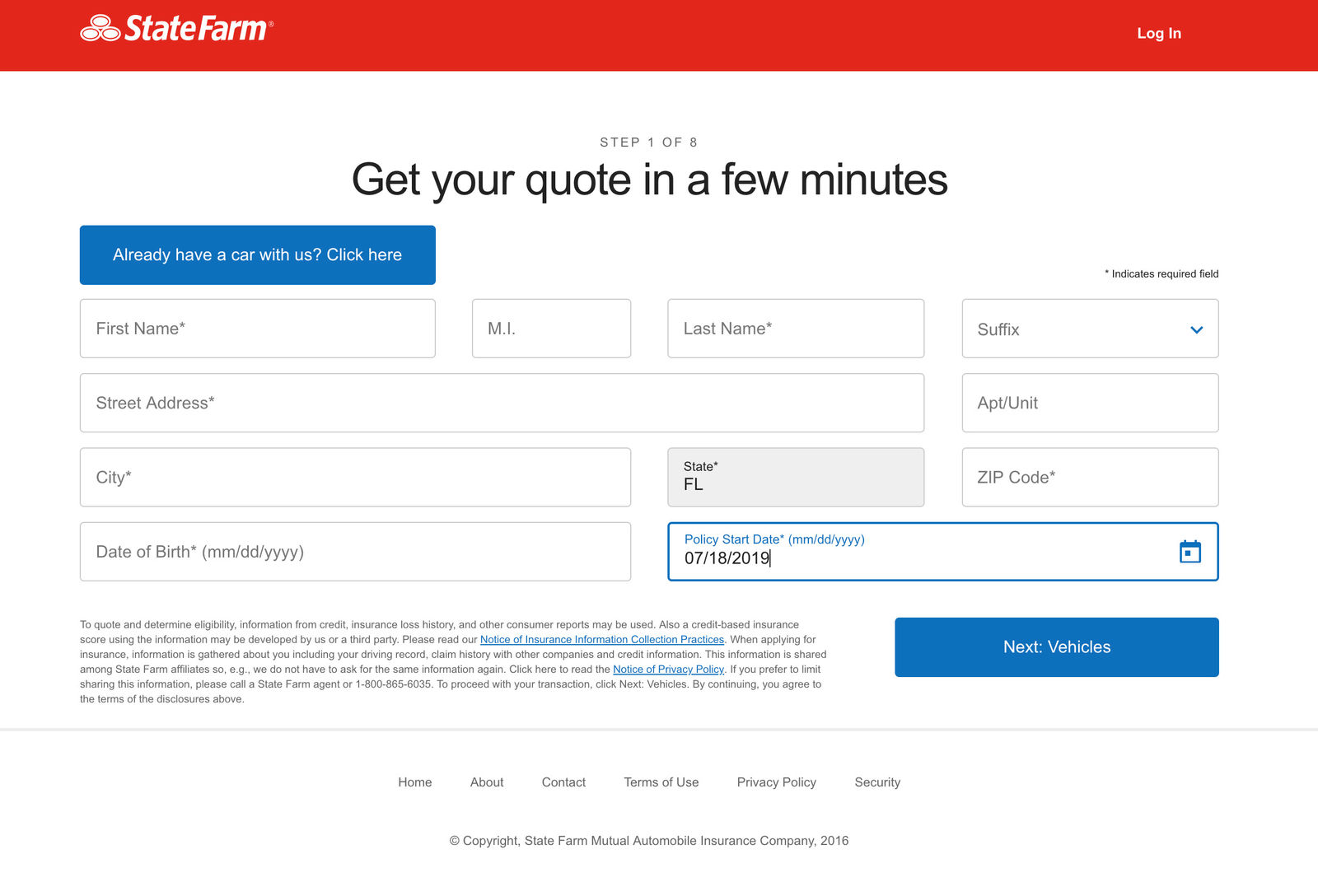

Step Two: Enter Personal Information

State Farm will ask for some personal information: name, address, date of birth, and desired policy start date.

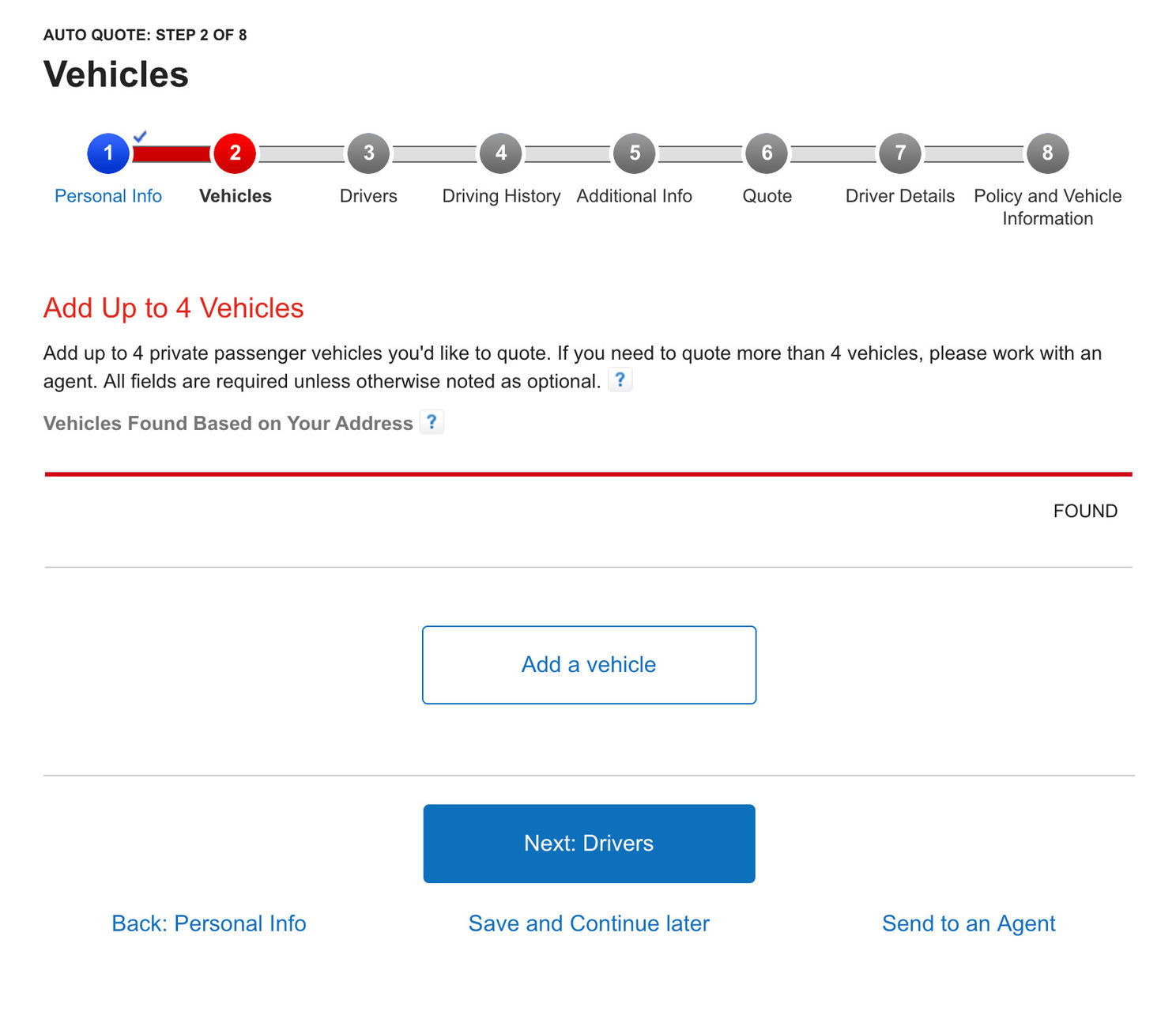

Step Three: Enter Vehicle Information

After entering your personal information, you will have to enter in information about your vehicles. You can enter up to four vehicles.

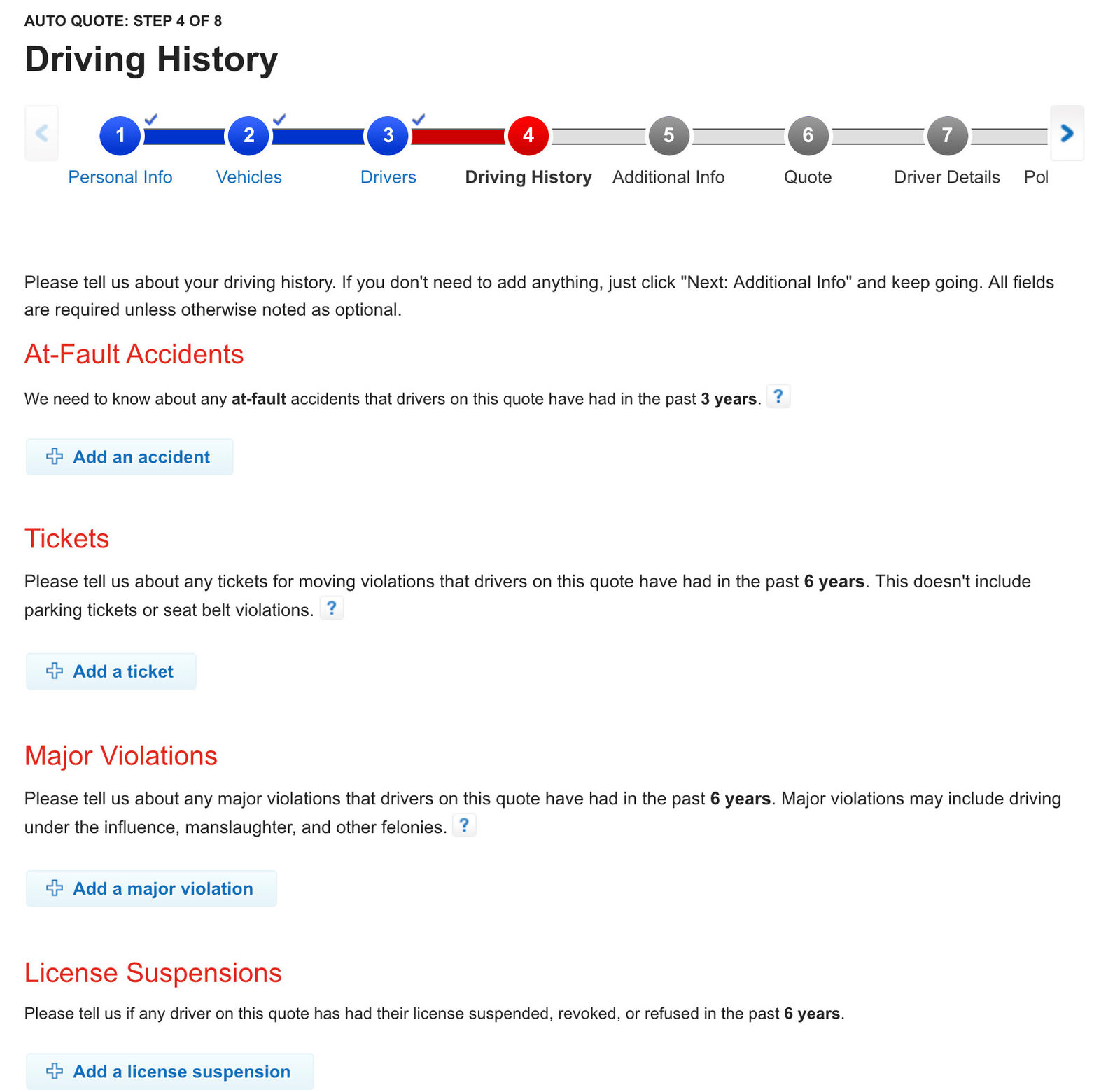

Step Four: Enter Driving Information

State Farm will also ask you about your driving record, such as at-fault accidents and license suspensions.

Step Five: Enter Additional Information

The last bit of information State Farm will ask for is simple details. For example, it will ask how long you’ve been with your current provider.

State Farm will also give you coverage options to choose from so you can get a customized quote.

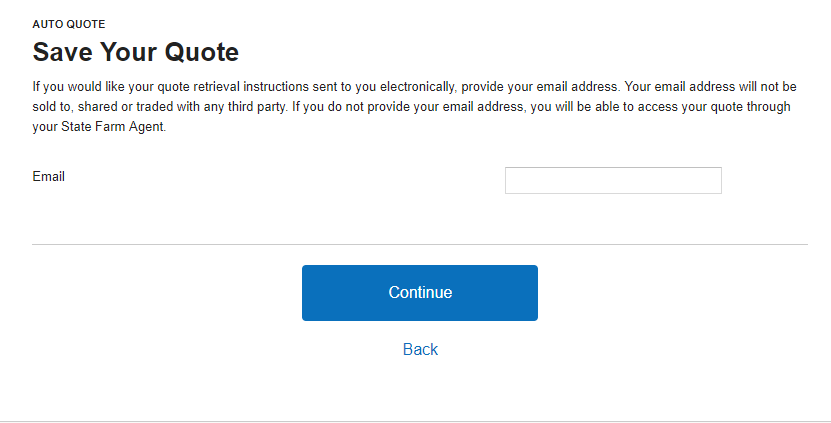

Step Six: Save Quote

The final step is to enter your email address so State Farm can send you your quote.

If you don’t enter your email address, you’ll have to contact a State Farm agent to go over your quote.

Now that you know the steps to get a quote, take a quick look at the table below, which details what information you need.

| Information Required | Document Types |

|---|---|

| Vehicle Information | Year, Make, Model, Body style (or VIN) Vehicle mileage Ownership Garaged address Name of registered owner Prior insurance carrier and expiration date Purchase date |

| Driver Information | Driver name and date of birth Driver's license number and state issued |

| Driving History | Ticket and accident history License suspension information |

You will need your driver’s license to get a quote from State Farm, although not an SSN.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website and App

Have you ever given up on reading a webpage because it took too long to load or had too many popups? Or perhaps you’ve deleted an app because of technology glitches?

If so, you know the importance of well-designed websites and apps.

Keep reading to learn about State Farm’s website and app design.

Website Design

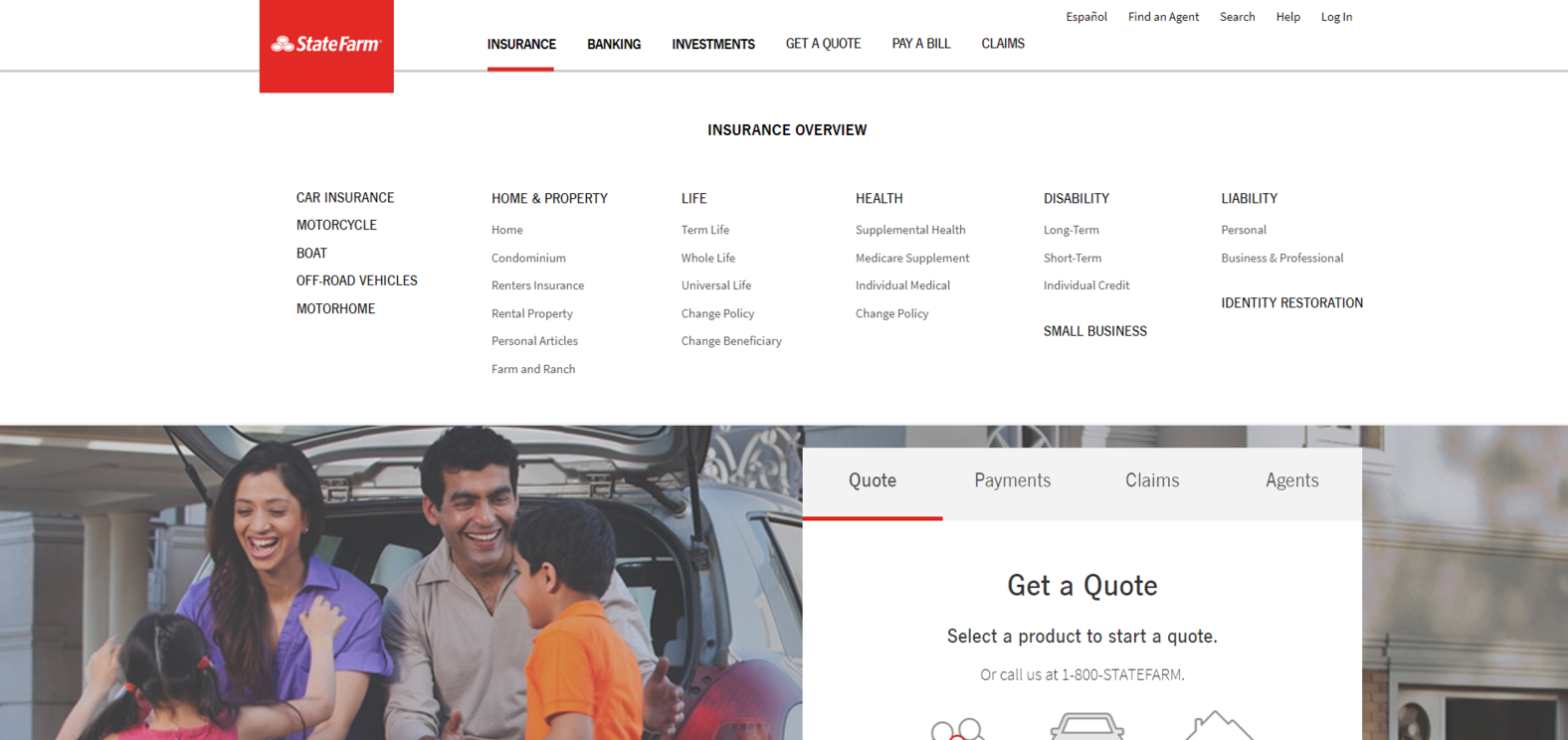

State Farm’s homepage has a simple design. The white background helps the menu options stand out and the menu options are simple and straightforward.

Each of the menu options gives viewers subtopics that lead to more information about that topic.

For example, the snapshot below shows what appears when viewers select insurance.

State Farm also has options on the upper right side of the screen to change the language to Spanish, search for an agent, and log in. Users can also click the help or search button if they are having trouble finding information.

As you can see, State Farm’s website is well designed. The well-organized menus and search button makes it easy to find information.

So if you pick State Farm as a provider, the website shouldn’t be a deterrent.

Design of Mobile Apps

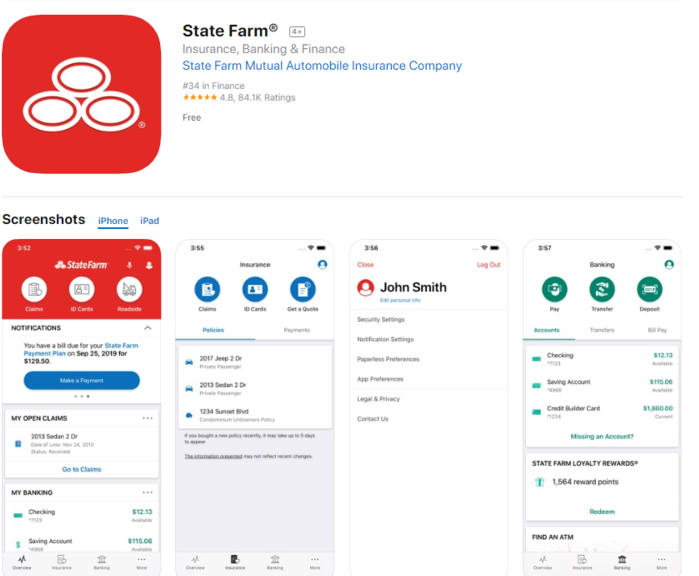

State Farm’s general app was created to allow customers to manage their accounts from their smartphones. On Apple, the app has great ratings.

The app has a 4.8-star rating (out of five stars), which was calculated from over 84,00 ratings.

- File and manage claims

- Access ID cards

- Get roadside assistance

- Upload photos (of damages) and documents

- Contact a State Farm agent

The app allows customers to do the same tasks they could do on a computer. Now that we’ve covered State Farm’s main app, let’s look at State Farm’s discount apps.

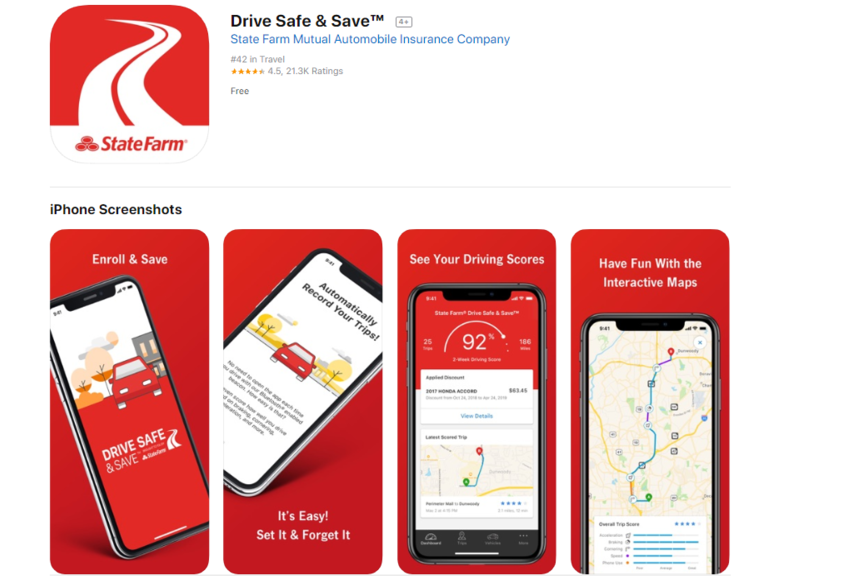

The Drive Safe & Save™ app also has fantastic ratings.

The app has 4.5-stars, calculated from over 21,000 ratings. This is great, especially for a usage-based app.

Another discount app is State Farm’s Steer Clear® program. Drivers under age 25 can earn a discount for completing programs on the app, which is a great way to encourage young drivers to practice safe driving habits.

On Google Play, the app didn’t earn as a high of a rating as State Farm’s other apps. However, the app still did well.

Calculating the percentage from over 580 reviews, Google Play gave 3.6 stars to the app.

Clearly, State Farm has done well in designing its apps, as all of them have earned solid reviews and ratings.

Pros and Cons

We have nearly reached the end of this review, so let’s recap.

| Pros | Cons |

|---|---|

| Has the third-lowest average premium among the top 10 providers | Rates can be pricey depending on where you live |

| Consistently strong financial standing and solid rankings | Could stand to offer more discounts, like federal employees, green vehicles, and occupational |

| Policies are available in all 50 states | Received an "about average" Power Circle Ranking in 5 out of 11 regions |

| Customers have a variety of online options and an easy-to-use app | Limited add-ons are available |

State Farm has a number of great pros, such as cheaper rates, great apps, and strong financial ratings. However, State Farm’s rates can become high if you move to a different state, and it doesn’t have high J.D. Power ratings in most regions.

Still, State Farm has a number of strong pros that help balance out the negatives.

The Bottom Line

State Farm hasn’t dominated the insurance market just to go under in the near future. It has great financial ratings and solid customer reviews.

Its apps are among the best in the market, and State Farm offers multiple coverages and add-ons that are great for the lower price.

The company also has consistently grown over the last decade, which shows State Farm is still keeping up with the times and staying a major competitor in the insurance field.

So if you chose State Farm, you’ll be picking a well-known insurance giant with lower than average rates. Not bad at all.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

FAQ

Still unsure about a few things? Not to worry. We’ve compiled a list of the most frequently asked questions about State Farm to conclude this review.

Let’s jump in.

Will Drive Safe & Save™ penalize me for bad driving?

Some usage-based apps will add to premium costs for consistent bad driving habits. However, State Farm’s usage-based app doesn’t follow this practice.

The Drive Safe & Save™ app only subtracts from premiums, it doesn’t add on (although bad driving will not subtract anything from a premium). So if you want to save with the app, good driving is essential.

Does State Farm cover flooding?

Unfortunately, State Farm will only cover damages from natural disasters like flooding if you have comprehensive coverage. This coverage will also protect you in cases of animal collisions and vehicle theft.

Can I make payments online?

Yes, you can sign into State Farm’s website or mobile app to make payments. You can also set up an auto-pay option.

Does State Farm cover windshield repairs and replacements?

You will have to check with your provider to see if your policy covers this. State Farm does cover windshield repairs and replacements, but only if the customer’s coverage extends to this.

How can I show my State Farm ID card to law enforcement?

While you can always show your paper version from State Farm, you can also use an electronic version.

State Farm’s mobile app allows drivers to access an electronic version of their insurance ID, which can be used at traffic stops, after an accident, or while registering a vehicle.

We hope we’ve answered any questions you may have about State Farm. Now that you’ve read our review, you should be ready to decide if State Farm is the right provider for you.

Want to start comparing rates today? Enter your zip code in our free tool below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.