New Hampshire Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Live free or die: Death is not the worst of evils. These were the words of General John Stark, the most famous soldier from New Hampshire during the Revolutionary War. It became—and still is—New Hampshire’s most cherished motto.

How? Think no seat belts. No mandatory car insurance. Freedom before regulations. Think driving in the snow and ice against whipping winds that lash windshields and pressure cars, their snow tires and chains, to stay on the rugged and hilly terrain.

It is a state that cherishes liberty before all else.

So, what does this all have to do with car insurance—the reason we’re all here today?

It’s simple: Car insurance may not be mandatory but it can save you from financial ruin. Car damage and medical bills can add up, and that’s not a situation anyone wants to be in. If you’re on this page today, you’re likely looking for car insurance for yourself, a family member, or a friend.

And you’ve come to the right place.

You may have found in your research that car insurance is confusing. There are technical terms, rates that seem arbitrary, and penalties for crimes you didn’t know about. You may have gotten a headache from beating your head against the wall.

We understand. We feel your pain.

In this guide, we cover all the important points—the coverages, the rates, the companies, the rules of the road, the traffic fatalities—and drill deep.

This is the car insurance guide to New Hampshire—the only guide you’ll ever need.

Strap on those snow tires. We’re heading out into the wild!

Ready to compare rates? Try our FREE online tool.

| New Hampshire Overview | Details |

|---|---|

| Road Miles | Total in State: 16,138 Vehicle Miles Driven: 13,094 |

| Vehicles | Registered: 1,222,146 Total Stolen: 891 |

| State Population | 1,356,458 |

| Most Popular Vehicle | Silverado 1500 |

| Uninsured Motorists | 9.9% State Rank: 35th |

| Total Driving Fatalities | 2008-2017 Speeding: 522 Drunk Driving: 351 |

| Average Premiums by Coverage Type | Liability: $400.56 Collision: $307.42 Comprehensive: $110.77 |

| Cheapest Providers | Geico USAA |

New Hampshire Car Insurance Coverage and Rates

Every inquisition into insurance starts with a question: What are the types of coverages and what are the rates I can get?

And of course—they are the two most important parts of car insurance, the ones that affect you the most personally.

In this section, we’ve got you covered.

Don’t understand what the core coverage costs are in New Hampshire or what they are compared to the national average? Don’t understand what the options are for additional liability like Med Pay and add-ons like personal umbrella policies?

We’ve got you covered.

New Hampshire’s Car Culture

The Hartford is an insurance company with some researchers; these researchers teamed up with AARP to deliver detailed reports on car cultures of states.

Here, we’ve got New Hampshire’s. What is the verdict?

New Hampshire drivers favor the obvious kind of vehicle: A truck or something with four-wheel drive, this to handle the ice, slush, and snow.

They also love their classic cars. An entire article in New Hampshire Magazine explores numerous car restorers and talks about the class car culture in the state.

There is the practical, and there is the cool. New Hampshire drivers have them both.

New Hampshire Minimum Coverage

Now, for that minimum coverage. New Hampshire does not require drivers to have auto insurance; it is one of three states in the country that don’t.

However, as the State of New Hampshire Insurance Department writes,

“New Hampshire Motor Vehicle Laws do not require you to carry Auto Insurance, but you must be able to demonstrate that you are able to provide sufficient funds to meet New Hampshire Motor Vehicle Financial Responsibility Requirements in the event of an “at-fault” accident.”

What does that mean?

In the end, if you’re found responsible for an accident, you’ll pay for the damages somehow: either through insurance or out-of-pocket.

Or else your driving privileges will be suspended.

If you select the safest route and get car insurance, minimum car insurance is 25/50/25 according to Nolo and AAA, a legal authority.

- $25,000 for the injuries or death of one person

- $50,000 for the injuries or death of more than one person

- $25,000 for property damage

This is liability insurance, which kicks in when you are found at-fault in an accident.

If you choose to buy personal auto insurance, you must legally get two more coverages: medical payments and uninsured/underinsured motorist.

Med Pay covers your medical bills if you are injured in an accident. $1,000 if the minimum amount you are required to purchase. UM/UIM covers your car if an uninsured motorist hits you. The requirements for UM/UIM are the same as the liability coverage: 25/50/25.

After that, you’re free and clear. You can always choose to not get insurance. However, just 10 percent of drivers in New Hampshire are uninsured according to the Insurance Information Institute.

It’s a financial risk to not have insurance. It can ruin someone financially with a major accident.

Forms of Financial Responsibility

You may ask: what happens if I get into an accident in New Hampshire?

The answer: it’s complicated.

At the end of the day, you need to show a form of financial responsibility. This proves you have the minimum liability requirements: 25/50/25, even if you don’t have insurance. There are a few ways to do this. Some of these come from the New Hampshire Revised Statutes, courtesy of Justia, which offers free access to laws.

- An insurance card, whether physical or electronic (according to Allstate)

- A certificate of insurance, possibly a continuous certificate

- A bond equal to the value of the liability coverage

The New Hampshire Statute 264.21 has one last way to prove insurance:

“By satisfying the director that any corporation has financial ability to comply with the requirements of this chapter.”

Of course, there are penalties if you don’t have proof. According to Statute 264.3, the government can suspend your license, take you registration, and take your plates.

Sounds like a very not fun time. There is, of course, a way to prove insurance that few will use: the SR-22. We’ll cover later, when we talk about high-risk drivers.

Premiums as a Percentage of Income

We understand: You most likelywant to pay the least amount possible for car insurance while getting the most value.

And that premium can cost hundreds, if not thousands of dollars. But is that the real impact?

Here, at insurantly.com, we have a statistic that shows real impact and answers this question: what is the percentage of your income you’re spending on premiums?

We call it premium as a percentage of income (PaPI). It turns out, New Hampshire residents pay the least of all surrounding states. And some of the lowest in the country.

These numbers and all raw numbers about car insurance (unless other specified) come from our partner Quadrant, who has the insider track on the insurance industry.

| Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| New Hampshire | 1.60% | 1.66% | 1.65% |

| Nationwide | 2.34% | 2.43% | 2.40% |

New Hampshire residents spend around 1.6 percent of their income on premiums. That’s almost .8 percent less than the average U.S. citizen.

| Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Maine | 1.85% | 1.90% | 1.86% |

| Massachusetts | 2.12% | 2.23% | 2.20% |

| Vermont | 1.78% | 1.79% | 1.77% |

New Hampshire residents pay .1-.2 less than its nearest competitor—Vermont—and lower than all three states.

Read more: Maine Car Insurance (The Only Guide You’ll Ever Need)

Average Monthly Car Insurance Rates in NH (Liability, Collision, Comprehensive)

You may have heard it before, bandied around my insurance agents or companies: core coverage. But what does it mean and why is it important?

Think about an HE3 atom (helium; three particles). It has one very weighty particle in the neutron and two protons.

Within car insurance, you have liability insurance, which is your neutron. But you have two additional coverages that complete the core.

Those are collision and comprehensive. Collision covers damages to your car in an accident and comprehensive covers everything but an accident.

The cost for all three is much cheaper than nationwide.

| Core Coverage Insurance Costs | New Hampshire | National Average |

|---|---|---|

| Liability | $400.56 | $538.73 |

| Collision | $307.42 | $322.61 |

| Comprehensive | $110.77 | $148.04 |

| Foll Coverage | $818.75 | $1,009.38 |

Liability is the most expensive, followed by collision, then comprehensive. Full coverage is almost $200 cheaper in New Hampshire than in the U.S. at large.

Additional Liability

However, insurance is contextual. If you have a specific context and need protection but don’t have it, you’ll pay out of pocket. That’s where additional liability comes in.

Here are some scenarios:

- You’re in an accident and you’ve gotten injured; your medical bills are piling up. You’ll want Med Pay.

- You’re in an accident and you’ve gotten injured and you’re losing money from not working. You’ll want PIP.

- You’re in an accident, an uninsured motorist has hit you, your car has $4,000 in damage. You’ll want UM/UIM.

Med Pay and UM/UIM we’ve covered. PIP is personal injury protection; this policy pays for your medical bills and reimburses your lost wages.

However — there’s always a however — sometimes these claims can be submitted, and they can be denied.

That’s why we have a handy statistic that shows how the percentage of how many claims companies are paying out on.

It’s called the loss ratio and it works by taking the number of claims being paid out on and dividing it by the number of premiums.

- If the loss ratio goes above 1, it means the company is losing money

- If the loss ratio goes below .5, the company might not be paying on claims

- A loss ratio between .6 to .8 is the sweet spot

These are New Hampshire loss ratio numbers from the National Association of Insurance Commissioners, a leading organization in the insurance field.

PIP isn’t available, but Med Pay and UM/UIM are.

Med Pay looks good; it’s between that .6 to .8 range. UM/UIM is a little low; the 2013 loss ratio even cross that .5 number.

It’s conjecture as to how the no-mandatory-car-insurance law affects the UM/UIM numbers but it is possible that it does.

Add-ons, Endorsements, and Riders

And there’s more. For nearly every situation, there’s car insurance.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Each has its own place and can be useful, in the right circumstances.

Average Monthly Car Insurance Rates by Age & Gender in NH

Lived experience: It’s taught us the greatest lessons—don’t mess with a wasp nest, put the toilet paper on top of the box in a move, keep our legs under the covers at night.

And then there’s this: prepare yourself for that insurance note. Why is it like this? Many of us believe, based on our driving record, that we should be entitled to better rates. But when that envelope gets opened, we shake our heads.

And it’s mystifying. “How did they get that rate?” we ask.

Starting in this section, we’ll cover over ten factors insurance companies use to set rates. In this section, we’ll cover three: gender, age, and marital status.

Have you ever heard the question “who are better drivers, males or females?”

According to the Insurance Institute for Highway Safety (IIHS), the answer is not that black and white, and they have the stats to back that up.

The IIHS did a study analyzing data from the National Highway Traffic Safety Administration’s FARS system from 1975 to 2017. The results? Men are far more likely to die in traffic accidents than women.

The IIHS writes, “Men typically drive more miles than women and more often engage in risky driving practices including not using safety belts, driving while impaired by alcohol, and speeding.”

Insurers understand that. They set their rates accordingly. Almost always, until the last few years or so, females have had lower rates than males.

Being young versus old is also a factor. If you’re a 17-year-old male, you’re more likely to get into an accident; in part because of lack of experience; also, you’re more inclined to take risks.

A 60-year-old male is probably not in the same rush. They’ll make it to the arcade just three minutes later and be just fine. Of course, if you’re married, insurance companies will think you’re responsible. Doubled for financially secure. Your rates will drop.

Those are three quick factors. Now: how do these factors play out in New Hampshire?

Like before, these numbers come from Quadrant.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $1,971.11 | $2,091.82 | $2,108.93 | $2,311.91 | $4,044.64 | $5,099.29 | $2,074.05 | $2,199.82 |

| Geico General | $1,057.44 | $1,046.60 | $946.66 | $946.66 | $2,567.96 | $3,560.95 | $1,102.51 | $1,664.55 |

| Nationwide Mutual | $1,585.61 | $1,608.07 | $1,429.82 | $1,499.99 | $4,405.75 | $5,590.99 | $1,823.61 | $1,956.81 |

| Progressive Universal | $1,366.59 | $1,244.66 | $1,188.47 | $1,199.26 | $6,320.20 | $6,980.91 | $1,610.65 | $1,618.31 |

| Safeco Ins Co of America | $4,942.38 | $5,338.33 | $4,025.54 | $4,521.69 | $18,139.34 | $20,118.55 | $5,209.68 | $5,519.33 |

| State Farm Mutual Auto | $1,352.09 | $1,352.09 | $1,231.58 | $1,231.58 | $4,066.25 | $5,031.12 | $1,508.29 | $1,721.50 |

| USAA | $992.31 | $973.40 | $926.28 | $927.55 | $4,269.45 | $4,673.07 | $1,246.20 | $1,361.16 |

For now, we’ll do away with SafeCo; it has the highest rates by thousands. Check out the difference between genders, ages, and marital statuses.

- Single 17-year-old male most expensive premium: Progressive $7,000

- Married 60-year-old male most expensive premium: Allstate $2,300

- Single 17-year-old female most expensive premium: Progressive $6,300

- Married 60-year-old female most expensive premium: Allstate $2,100

What’s it like going from a single 17-year-old male to a married 60-year-old female (it is possible in this day and age)?

A savings of $6,075.

But that’s just the tip of the iceberg when it comes to rates. There are still at least seven factors to go.

Also, soon, companies may not use gender to set rates. Why? Because it’s being outlawed.

Rates in New Hampshire’s 10 Largest Cities

So, you’re a male, 17 years old, and single. You want to lower your rates. Do you move to the city or the countryside?

Old adages say that living in a city raises your rates. If this is true, the largest cities in New Hampshire should have the highest rates. But is it so? The following population numbers come from the City-Data.com.

| City | Population | County | Rates |

|---|---|---|---|

| Manchester | 111,196 | Hillsborough | $3,798.09 |

| Nashua | 88,341 | Hillsborough | $3,411.92 |

| Concord | 43,019 | Merrimack | $2,927.59 |

| Dover | 31,398 | Strafford | $3,124.15 |

| Rochester | 30,797 | Strafford | $2,982.71 |

| Salem | 28,776 | Rockingham | $3,678.46 |

| Merrimack | 25,494 | Hillsborough | $3,201.58 |

| Keene | 23,034 | Rockingham | $2,894.88 |

| Derry | 22,015 | Rockingham | $3,394.58 |

| Portsmouth | 21,598 | Hillsborough | $3,046.47 |

Like with everything, there is a mix. Some of the top cities have the most expensive rates, like Manchester and Salem. Some have the cheapest, like Keene and Concord.

But, yes, where you live changes your rates. By how much? Let’s find out.

Cheapest Rates by ZIP Code

Have you heard this story?

It’s about the two neighbors with the same company. They have the same agent and plan too. But what do they not have? The same rates.

Consumer Federation of America did a study that analyzed rates of six major companies in ten cities across America.

Its findings were a surprise. Not only did rates vary from city to city but within cities as well.

It found that premiums in adjacent ZIP codes fluctuated by the hundreds of dollars. This was even true if the ZIP code bisected a neighborhood.

Two neighbors with the same companies and plans could have rates differing the hundreds, just because they lived in different ZIP codes.

So, why is this?

When insurance companies calculate rates, they are looking at one important factor: what is the probability that this person will file a claim?

And when it comes to ZIP codes, the probability that you will file a claim is not based just on you.

There’s vehicle theft. There are other drivers. There are differences in police presence.

Your rate might be higher than your neighbor’s or lower. What does this look like in New Hampshire? Search for your ZIP code by typing it into the search bar; just drop the zero at the front.

| Zipcode | Average | Allstate F&C | Geico General | Safeco Ins Co of America | Nationwide Mutual | Progressive Universal | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|

| 3031 | $3,277.35 | $2,959.49 | $1,689.50 | $8,483.24 | $2,740.73 | $2,785.35 | $2,322.10 | $1,961.04 |

| 3032 | $3,404.93 | $3,132.62 | $1,747.47 | $8,513.56 | $3,153.58 | $2,923.20 | $2,403.01 | $1,961.04 |

| 3033 | $3,187.78 | $2,853.05 | $1,689.50 | $8,382.59 | $2,469.60 | $2,720.14 | $2,278.87 | $1,920.69 |

| 3034 | $3,161.67 | $2,653.66 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,306.11 | $1,920.69 |

| 3036 | $3,213.97 | $3,023.44 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,302.44 | $1,920.69 |

| 3037 | $3,146.95 | $2,578.08 | $1,731.34 | $8,382.59 | $2,421.57 | $2,621.90 | $2,372.50 | $1,920.69 |

| 3038 | $3,394.58 | $2,863.36 | $1,886.80 | $8,483.24 | $3,153.58 | $2,749.60 | $2,664.42 | $1,961.04 |

| 3040 | $3,103.42 | $2,653.66 | $1,731.34 | $8,201.11 | $2,421.57 | $2,578.15 | $2,217.39 | $1,920.69 |

| 3041 | $3,185.18 | $2,863.36 | $1,886.80 | $8,201.11 | $2,421.57 | $2,785.35 | $2,217.39 | $1,920.69 |

| 3042 | $3,074.73 | $2,652.33 | $1,583.08 | $8,201.11 | $2,421.57 | $2,602.73 | $2,141.64 | $1,920.69 |

| 3043 | $3,140.88 | $2,799.54 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,244.60 | $1,920.69 |

| 3044 | $3,176.64 | $2,809.25 | $1,650.93 | $8,476.40 | $2,421.57 | $2,790.16 | $2,167.45 | $1,920.69 |

| 3045 | $3,294.84 | $2,966.90 | $1,731.34 | $8,483.24 | $2,740.73 | $2,681.54 | $2,499.12 | $1,961.04 |

| 3046 | $3,227.36 | $2,971.51 | $1,731.34 | $8,483.24 | $2,367.40 | $2,681.54 | $2,435.78 | $1,920.69 |

| 3047 | $3,126.80 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,152.63 | $1,920.69 |

| 3048 | $3,173.94 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,422.50 | $1,920.69 |

| 3049 | $3,331.53 | $2,936.83 | $1,689.50 | $9,141.45 | $2,469.60 | $2,785.35 | $2,336.95 | $1,961.04 |

| 3051 | $3,242.99 | $2,732.39 | $1,747.47 | $8,483.24 | $2,528.63 | $2,785.35 | $2,462.81 | $1,961.04 |

| 3052 | $3,214.50 | $2,761.92 | $1,747.47 | $8,483.24 | $2,528.63 | $2,785.35 | $2,233.82 | $1,961.04 |

| 3053 | $3,324.24 | $2,761.92 | $1,747.47 | $8,483.24 | $3,153.58 | $2,785.35 | $2,377.07 | $1,961.04 |

| 3054 | $3,201.58 | $2,690.79 | $1,628.13 | $8,483.24 | $2,740.73 | $2,785.35 | $2,121.76 | $1,961.04 |

| 3055 | $3,200.23 | $2,853.05 | $1,689.50 | $8,476.40 | $2,469.60 | $2,720.14 | $2,272.24 | $1,920.69 |

| 3057 | $3,143.93 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,212.46 | $1,920.69 |

| 3060 | $3,451.59 | $2,959.49 | $1,847.27 | $9,141.45 | $2,842.24 | $2,848.25 | $2,637.91 | $1,884.55 |

| 3062 | $3,400.72 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,478.49 | $1,884.55 |

| 3063 | $3,389.41 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,399.32 | $1,884.55 |

| 3064 | $3,405.94 | $2,960.04 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,514.48 | $1,884.55 |

| 3070 | $3,263.40 | $2,886.16 | $1,731.34 | $8,476.40 | $2,740.73 | $2,736.25 | $2,352.22 | $1,920.69 |

| 3071 | $3,160.05 | $2,792.98 | $1,572.74 | $8,382.59 | $2,469.60 | $2,578.15 | $2,403.60 | $1,920.69 |

| 3073 | $3,314.36 | $3,132.62 | $1,762.82 | $8,382.59 | $2,421.57 | $3,289.60 | $2,290.65 | $1,920.69 |

| 3076 | $3,611.18 | $3,103.08 | $1,747.47 | $9,646.10 | $2,528.63 | $3,289.60 | $2,562.23 | $2,401.14 |

| 3077 | $3,083.74 | $2,657.49 | $1,583.08 | $8,201.11 | $2,421.57 | $2,602.73 | $2,199.49 | $1,920.69 |

| 3079 | $3,678.46 | $3,132.62 | $1,762.82 | $9,646.10 | $3,153.58 | $3,289.60 | $2,363.39 | $2,401.14 |

| 3082 | $3,144.30 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,215.03 | $1,920.69 |

| 3084 | $3,168.50 | $2,799.54 | $1,572.74 | $8,476.40 | $2,469.60 | $2,578.15 | $2,362.35 | $1,920.69 |

| 3086 | $3,159.94 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,324.53 | $1,920.69 |

| 3087 | $3,648.72 | $3,132.62 | $1,747.47 | $9,646.10 | $3,153.58 | $2,946.89 | $2,513.28 | $2,401.14 |

| 3101 | $3,835.72 | $3,133.15 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,883.13 | $2,265.12 |

| 3102 | $3,825.66 | $3,002.18 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,994.46 | $2,265.12 |

| 3103 | $3,762.33 | $2,762.47 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,790.88 | $2,265.12 |

| 3104 | $3,845.88 | $3,137.78 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,949.61 | $2,265.12 |

| 3106 | $3,268.15 | $2,677.93 | $1,731.34 | $8,513.56 | $2,367.40 | $2,995.98 | $2,629.77 | $1,961.04 |

| 3109 | $3,720.88 | $2,787.74 | $1,747.47 | $10,234.44 | $3,322.91 | $3,081.80 | $2,606.71 | $2,265.12 |

| 3110 | $3,272.93 | $3,002.18 | $1,628.13 | $8,483.24 | $2,740.73 | $2,681.54 | $2,413.65 | $1,961.04 |

| 3215 | $3,143.86 | $2,732.30 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3216 | $3,070.06 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,076.98 | $1,920.69 |

| 3217 | $3,089.85 | $2,467.84 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,098.25 | $1,918.91 |

| 3218 | $3,103.25 | $2,545.54 | $1,583.08 | $8,476.40 | $2,357.73 | $2,621.90 | $2,217.39 | $1,920.69 |

| 3220 | $3,089.09 | $2,500.56 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,153.42 | $1,920.69 |

| 3221 | $2,967.97 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,210.05 | $2,165.89 | $1,920.69 |

| 3222 | $3,087.63 | $2,467.84 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,082.71 | $1,918.91 |

| 3223 | $3,086.71 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,444.07 | $2,062.84 | $1,918.91 |

| 3224 | $3,106.71 | $2,500.56 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,304.41 | $1,920.69 |

| 3225 | $3,117.31 | $2,579.94 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,411.05 | $1,920.69 |

| 3226 | $3,057.79 | $2,461.67 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,112.73 | $1,920.69 |

| 3227 | $3,126.14 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,087.78 | $1,918.91 |

| 3229 | $2,913.60 | $2,509.52 | $1,497.18 | $7,713.25 | $2,367.40 | $2,324.36 | $2,274.75 | $1,708.76 |

| 3230 | $3,063.98 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,044.53 | $1,920.69 |

| 3231 | $3,100.58 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 3233 | $3,099.14 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 3234 | $3,143.33 | $2,550.40 | $1,731.34 | $8,476.40 | $2,469.60 | $2,578.15 | $2,276.70 | $1,920.69 |

| 3235 | $3,068.97 | $2,504.87 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,035.91 | $1,920.69 |

| 3237 | $3,132.54 | $2,596.74 | $1,677.77 | $8,476.40 | $2,357.73 | $2,578.15 | $2,320.34 | $1,920.69 |

| 3238 | $3,143.86 | $2,732.30 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3240 | $3,094.36 | $2,461.29 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,042.55 | $1,918.91 |

| 3241 | $3,091.74 | $2,461.29 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3242 | $3,139.93 | $2,809.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,228.19 | $1,920.69 |

| 3243 | $3,070.38 | $2,461.67 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,088.96 | $1,920.69 |

| 3244 | $3,147.66 | $2,803.12 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,288.50 | $1,920.69 |

| 3245 | $3,029.02 | $2,467.84 | $1,667.83 | $7,986.70 | $2,398.41 | $2,695.12 | $2,068.34 | $1,918.91 |

| 3246 | $3,149.74 | $2,500.56 | $1,677.77 | $8,697.05 | $2,497.26 | $2,597.59 | $2,157.72 | $1,920.28 |

| 3249 | $3,151.96 | $2,516.00 | $1,677.77 | $8,697.05 | $2,497.26 | $2,597.59 | $2,157.41 | $1,920.69 |

| 3251 | $3,118.08 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,031.37 | $1,918.91 |

| 3252 | $3,064.63 | $2,498.70 | $1,497.18 | $8,382.59 | $2,357.73 | $2,578.15 | $2,217.39 | $1,920.69 |

| 3253 | $3,082.56 | $2,471.73 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,136.54 | $1,920.69 |

| 3254 | $3,127.11 | $2,745.13 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,081.80 | $1,918.91 |

| 3255 | $3,120.94 | $2,799.15 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,105.44 | $1,920.69 |

| 3256 | $3,085.51 | $2,461.67 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,167.23 | $1,920.69 |

| 3257 | $3,066.31 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,060.85 | $1,920.69 |

| 3258 | $2,993.83 | $2,631.15 | $1,731.34 | $7,713.25 | $2,469.60 | $2,210.05 | $2,280.73 | $1,920.69 |

| 3259 | $3,130.46 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3260 | $3,052.95 | $2,471.42 | $1,497.18 | $8,382.59 | $2,469.60 | $2,578.15 | $2,051.05 | $1,920.69 |

| 3261 | $3,172.67 | $2,579.94 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,456.83 | $1,920.69 |

| 3262 | $3,123.89 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,072.05 | $1,918.91 |

| 3263 | $3,137.04 | $2,596.74 | $1,583.08 | $8,382.59 | $2,469.60 | $2,621.90 | $2,384.70 | $1,920.69 |

| 3264 | $2,994.72 | $2,461.29 | $1,667.83 | $7,986.70 | $2,398.41 | $2,444.07 | $2,085.85 | $1,918.91 |

| 3266 | $3,091.88 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,077.16 | $1,918.91 |

| 3268 | $3,079.41 | $2,476.03 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,137.85 | $1,920.69 |

| 3269 | $3,073.67 | $2,461.67 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,084.32 | $1,920.69 |

| 3272 | $3,038.38 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 3273 | $2,991.56 | $2,471.42 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 3274 | $2,977.73 | $2,503.17 | $1,497.18 | $7,713.25 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3275 | $2,962.53 | $2,658.84 | $1,626.68 | $7,713.25 | $2,367.40 | $2,396.82 | $2,265.95 | $1,708.76 |

| 3276 | $3,083.36 | $2,498.70 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,142.81 | $1,920.69 |

| 3278 | $3,081.47 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,156.84 | $1,920.69 |

| 3279 | $3,124.58 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,076.87 | $1,918.91 |

| 3280 | $3,055.34 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,023.80 | $1,920.69 |

| 3281 | $3,260.44 | $2,803.12 | $1,731.34 | $8,476.40 | $2,740.73 | $2,736.25 | $2,414.54 | $1,920.69 |

| 3282 | $3,129.14 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,064.56 | $1,918.91 |

| 3284 | $3,033.79 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,872.95 | $1,920.69 |

| 3285 | $3,118.72 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,035.90 | $1,918.91 |

| 3287 | $3,063.82 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,043.45 | $1,920.69 |

| 3289 | $3,126.81 | $2,500.56 | $1,497.18 | $8,476.40 | $2,357.73 | $2,917.70 | $2,217.39 | $1,920.69 |

| 3290 | $3,124.15 | $2,657.49 | $1,583.08 | $8,476.40 | $2,421.57 | $2,621.90 | $2,187.95 | $1,920.69 |

| 3291 | $3,013.06 | $2,657.49 | $1,583.08 | $7,669.32 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 3301 | $2,935.65 | $2,577.37 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,231.73 | $1,708.76 |

| 3303 | $2,919.52 | $2,469.86 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,226.33 | $1,708.76 |

| 3304 | $2,960.07 | $2,572.77 | $1,731.34 | $7,713.25 | $2,367.40 | $2,324.36 | $2,302.61 | $1,708.76 |

| 3307 | $3,070.22 | $2,544.83 | $1,497.18 | $8,476.40 | $2,469.60 | $2,210.05 | $2,372.83 | $1,920.69 |

| 3431 | $2,887.77 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,633.58 | $1,924.88 | $1,612.39 |

| 3435 | $2,901.99 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,722.03 | $1,935.95 | $1,612.39 |

| 3440 | $3,131.41 | $2,799.54 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,178.28 | $1,920.69 |

| 3441 | $3,101.79 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3442 | $3,132.50 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,192.50 | $1,920.69 |

| 3443 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3444 | $3,081.03 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.65 | $1,920.69 |

| 3445 | $3,085.58 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,939.47 | $1,920.69 |

| 3446 | $3,037.08 | $2,799.15 | $1,533.97 | $8,476.40 | $2,340.52 | $2,587.81 | $1,909.36 | $1,612.39 |

| 3447 | $3,118.97 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,097.66 | $1,920.69 |

| 3448 | $3,090.10 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,971.16 | $1,920.69 |

| 3449 | $3,120.67 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,109.67 | $1,920.69 |

| 3450 | $3,064.85 | $2,799.15 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,888.17 | $1,920.69 |

| 3451 | $3,108.29 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,022.88 | $1,920.69 |

| 3452 | $3,101.63 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,976.30 | $1,920.69 |

| 3455 | $3,085.99 | $2,792.98 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,948.52 | $1,920.69 |

| 3456 | $3,105.83 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,081.28 | $1,920.69 |

| 3457 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3458 | $3,142.33 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,261.30 | $1,920.69 |

| 3461 | $3,107.24 | $2,792.98 | $1,572.74 | $8,382.59 | $2,387.99 | $2,578.15 | $2,115.56 | $1,920.69 |

| 3462 | $3,098.02 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,951.03 | $1,920.69 |

| 3464 | $3,097.91 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,025.79 | $1,920.69 |

| 3465 | $3,107.78 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,019.35 | $1,920.69 |

| 3466 | $3,082.21 | $2,799.15 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $2,009.74 | $1,920.69 |

| 3467 | $3,087.03 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,952.01 | $1,920.69 |

| 3468 | $3,146.12 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,287.82 | $1,920.69 |

| 3470 | $3,113.18 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,057.16 | $1,920.69 |

| 3561 | $3,137.67 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,124.23 | $1,918.91 |

| 3570 | $3,170.23 | $2,776.57 | $1,619.58 | $8,382.59 | $2,398.41 | $2,878.16 | $2,199.02 | $1,937.28 |

| 3574 | $3,125.16 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,080.98 | $1,918.91 |

| 3575 | $3,162.30 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,873.72 | $2,118.06 | $1,918.91 |

| 3576 | $3,160.98 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,287.45 | $1,918.91 |

| 3579 | $3,159.78 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,279.04 | $1,918.91 |

| 3580 | $3,136.50 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,116.04 | $1,918.91 |

| 3581 | $3,098.48 | $2,776.57 | $1,619.58 | $7,932.06 | $2,398.41 | $2,878.16 | $2,147.33 | $1,937.28 |

| 3582 | $3,159.77 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,278.98 | $1,918.91 |

| 3583 | $3,138.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,132.10 | $1,918.91 |

| 3584 | $3,149.75 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,208.83 | $1,918.91 |

| 3585 | $3,150.03 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,210.75 | $1,918.91 |

| 3586 | $3,161.98 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,871.51 | $2,118.06 | $1,918.91 |

| 3588 | $3,152.90 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,230.88 | $1,918.91 |

| 3589 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3590 | $3,164.31 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,310.72 | $1,918.91 |

| 3592 | $3,154.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,244.06 | $1,918.91 |

| 3593 | $3,156.04 | $2,776.57 | $1,619.58 | $8,382.59 | $2,398.41 | $2,878.16 | $2,118.06 | $1,918.91 |

| 3595 | $3,131.61 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,081.82 | $1,918.91 |

| 3597 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3598 | $3,135.81 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,111.26 | $1,918.91 |

| 3601 | $3,108.67 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,103.54 | $1,920.69 |

| 3602 | $3,108.89 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,102.66 | $1,920.69 |

| 3603 | $3,109.13 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,106.76 | $1,920.69 |

| 3604 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3605 | $3,102.34 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,059.25 | $1,920.69 |

| 3607 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3608 | $3,094.82 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,006.57 | $1,920.69 |

| 3609 | $3,101.57 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,053.80 | $1,920.69 |

| 3740 | $3,149.45 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,206.70 | $1,918.91 |

| 3741 | $3,071.72 | $2,461.29 | $1,667.83 | $8,382.59 | $2,398.41 | $2,642.42 | $2,030.57 | $1,918.91 |

| 3743 | $3,126.71 | $2,796.76 | $1,497.71 | $8,463.32 | $2,387.99 | $2,763.09 | $2,057.38 | $1,920.69 |

| 3745 | $3,089.09 | $2,796.76 | $1,497.18 | $8,463.32 | $2,387.99 | $2,578.15 | $1,979.53 | $1,920.69 |

| 3746 | $3,088.79 | $2,796.76 | $1,497.18 | $8,463.32 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3748 | $3,039.66 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,958.34 | $1,920.69 |

| 3749 | $3,112.22 | $2,458.89 | $1,497.18 | $8,476.40 | $2,398.41 | $2,917.70 | $2,118.06 | $1,918.91 |

| 3750 | $3,065.88 | $2,458.89 | $1,497.18 | $8,382.59 | $2,387.99 | $2,917.70 | $1,897.91 | $1,918.91 |

| 3751 | $3,090.66 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3752 | $3,092.66 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,991.46 | $1,920.69 |

| 3753 | $3,023.42 | $2,503.17 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,894.16 | $1,920.69 |

| 3754 | $3,077.33 | $2,796.76 | $1,497.71 | $8,382.59 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3755 | $3,032.36 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.21 | $1,920.69 |

| 3765 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3766 | $3,030.03 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,890.89 | $1,920.69 |

| 3768 | $3,087.85 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,048.92 | $1,918.91 |

| 3769 | $3,097.73 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3770 | $3,077.25 | $2,796.76 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 3771 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3773 | $3,125.79 | $2,796.76 | $1,497.71 | $8,463.32 | $2,387.99 | $2,893.76 | $1,972.39 | $1,868.58 |

| 3774 | $3,138.01 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,126.64 | $1,918.91 |

| 3777 | $3,094.76 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,097.27 | $1,918.91 |

| 3779 | $3,097.73 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3780 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3781 | $3,070.81 | $2,796.76 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,932.30 | $1,920.69 |

| 3782 | $3,084.02 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,931.00 | $1,920.69 |

| 3784 | $3,068.10 | $2,458.89 | $1,497.18 | $8,382.59 | $2,398.41 | $2,917.70 | $1,903.04 | $1,918.91 |

| 3785 | $3,148.85 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,202.51 | $1,918.91 |

| 3801 | $3,046.47 | $2,894.93 | $1,535.71 | $7,669.32 | $2,556.64 | $2,728.12 | $2,138.99 | $1,801.58 |

| 3809 | $3,084.47 | $2,516.00 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,245.12 | $1,920.69 |

| 3810 | $3,066.17 | $2,516.00 | $1,497.18 | $8,382.59 | $2,357.73 | $2,578.15 | $2,210.87 | $1,920.69 |

| 3811 | $3,725.58 | $3,212.02 | $1,798.02 | $9,804.60 | $2,827.31 | $3,434.34 | $2,724.21 | $2,278.55 |

| 3812 | $3,130.25 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,072.29 | $1,918.91 |

| 3813 | $3,132.06 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,084.96 | $1,918.91 |

| 3814 | $3,126.34 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,032.10 | $1,918.91 |

| 3815 | $3,102.44 | $2,569.88 | $1,583.08 | $8,382.59 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 3816 | $3,129.85 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.66 | $1,918.91 |

| 3817 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3818 | $3,124.54 | $2,738.86 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,070.03 | $1,918.91 |

| 3819 | $3,424.28 | $2,918.41 | $1,650.93 | $9,804.60 | $2,421.57 | $2,790.16 | $2,463.63 | $1,920.69 |

| 3820 | $3,124.15 | $2,649.28 | $1,533.81 | $8,433.03 | $2,682.03 | $2,792.35 | $2,134.00 | $1,644.58 |

| 3823 | $3,144.79 | $2,683.68 | $1,510.82 | $8,433.03 | $2,682.03 | $2,886.53 | $2,172.86 | $1,644.58 |

| 3824 | $3,136.38 | $2,659.34 | $1,533.81 | $8,433.03 | $2,682.03 | $2,792.35 | $2,209.50 | $1,644.58 |

| 3825 | $3,139.52 | $2,659.34 | $1,583.08 | $8,476.40 | $2,421.57 | $2,621.90 | $2,293.66 | $1,920.69 |

| 3826 | $3,695.88 | $3,456.72 | $1,798.02 | $9,804.60 | $2,827.31 | $2,790.16 | $2,915.78 | $2,278.55 |

| 3827 | $3,640.47 | $3,060.96 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,619.70 | $2,278.55 |

| 3830 | $3,127.00 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,036.71 | $1,918.91 |

| 3832 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3833 | $3,197.59 | $2,897.03 | $1,650.93 | $8,433.03 | $2,583.08 | $2,834.52 | $2,196.82 | $1,787.68 |

| 3835 | $3,072.68 | $2,569.88 | $1,667.83 | $7,743.08 | $2,682.03 | $2,873.72 | $2,327.62 | $1,644.58 |

| 3836 | $3,125.50 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,026.25 | $1,918.91 |

| 3837 | $3,085.25 | $2,516.00 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,250.59 | $1,920.69 |

| 3838 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3839 | $2,986.51 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,215.18 | $1,644.58 |

| 3840 | $3,153.42 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,034.67 | $1,787.68 |

| 3841 | $3,735.99 | $3,212.02 | $1,731.34 | $9,804.60 | $2,827.31 | $3,434.34 | $2,863.76 | $2,278.55 |

| 3842 | $3,174.72 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,174.70 | $1,787.68 |

| 3844 | $3,163.02 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,092.76 | $1,787.68 |

| 3845 | $3,133.95 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,098.20 | $1,918.91 |

| 3846 | $3,133.18 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,092.86 | $1,918.91 |

| 3847 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3848 | $3,689.28 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,712.14 | $2,278.55 |

| 3849 | $3,129.06 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,063.99 | $1,918.91 |

| 3850 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3851 | $3,081.10 | $2,540.34 | $1,497.18 | $8,476.40 | $2,421.57 | $2,578.15 | $2,133.37 | $1,920.69 |

| 3852 | $3,140.95 | $2,789.42 | $1,667.83 | $8,476.40 | $2,421.57 | $2,642.42 | $2,068.33 | $1,920.69 |

| 3853 | $3,090.41 | $2,496.07 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,073.93 | $1,918.91 |

| 3854 | $3,049.39 | $2,894.93 | $1,535.71 | $7,669.32 | $2,556.64 | $2,728.12 | $2,159.45 | $1,801.58 |

| 3855 | $3,097.12 | $2,540.34 | $1,497.18 | $8,476.40 | $2,421.57 | $2,578.15 | $2,245.51 | $1,920.69 |

| 3856 | $3,180.82 | $2,904.06 | $1,650.93 | $8,288.13 | $2,583.08 | $3,007.19 | $2,044.64 | $1,787.68 |

| 3857 | $3,112.71 | $2,659.34 | $1,533.81 | $8,433.03 | $2,583.08 | $2,792.35 | $1,999.69 | $1,787.68 |

| 3858 | $3,694.35 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,747.63 | $2,278.55 |

| 3859 | $3,512.48 | $3,163.14 | $1,798.02 | $9,804.60 | $2,421.57 | $2,790.16 | $2,689.18 | $1,920.69 |

| 3860 | $3,127.97 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.33 | $1,918.91 |

| 3861 | $3,129.92 | $2,659.34 | $1,533.81 | $8,433.03 | $2,421.57 | $2,792.35 | $2,148.63 | $1,920.69 |

| 3862 | $3,194.47 | $2,904.06 | $1,630.33 | $8,476.40 | $2,583.08 | $2,824.12 | $2,155.66 | $1,787.68 |

| 3864 | $3,126.70 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,034.60 | $1,918.91 |

| 3865 | $3,653.43 | $2,918.41 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,705.88 | $2,278.55 |

| 3867 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 3868 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 3869 | $3,028.86 | $2,649.28 | $1,533.81 | $7,743.08 | $2,682.03 | $2,836.64 | $2,112.63 | $1,644.58 |

| 3870 | $3,161.79 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,093.29 | $1,787.68 |

| 3871 | $3,164.19 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,110.10 | $1,787.68 |

| 3872 | $3,126.15 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,030.78 | $1,918.91 |

| 3873 | $3,269.18 | $3,212.02 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,500.32 | $1,920.69 |

| 3874 | $3,610.79 | $2,904.06 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,568.83 | $2,278.55 |

| 3875 | $3,129.12 | $2,776.95 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,063.99 | $1,918.91 |

| 3878 | $2,978.65 | $2,649.28 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,080.76 | $1,644.58 |

| 3882 | $3,125.99 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,029.63 | $1,918.91 |

| 3883 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3884 | $3,136.05 | $2,604.28 | $1,583.08 | $8,382.59 | $2,421.57 | $2,621.90 | $2,418.21 | $1,920.69 |

| 3885 | $3,173.12 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,163.51 | $1,787.68 |

| 3886 | $3,130.37 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,060.34 | $1,918.91 |

| 3887 | $3,111.28 | $2,540.34 | $1,667.83 | $8,476.40 | $2,421.57 | $2,642.42 | $2,109.74 | $1,920.69 |

| 3890 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3894 | $3,094.29 | $2,540.34 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.80 | $1,918.91 |

| 3896 | $3,103.04 | $2,540.34 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 3897 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

Cheapest Rates by City

Like with ZIP codes, premiums can vary from city to city. Part of this is location: Urban centers often have higher premiums than rural towns. Does this hold up in New Hampshire? As before, you can search for your city by typing it into the box.

| City | Average Grand Total |

|---|---|

| ACWORTH | $3,108.67 |

| ALSTEAD | $3,108.89 |

| ALTON | $3,084.47 |

| ALTON BAY | $3,066.17 |

| AMHERST | $3,277.35 |

| ANDOVER | $3,070.06 |

| ANTRIM | $3,131.40 |

| ASHLAND | $3,089.85 |

| ASHUELOT | $3,101.79 |

| ATKINSON | $3,725.58 |

| AUBURN | $3,404.93 |

| BARNSTEAD | $3,103.25 |

| BARRINGTON | $3,139.52 |

| BARTLETT | $3,130.25 |

| BATH | $3,149.45 |

| BEDFORD | $3,272.93 |

| BELMONT | $3,089.09 |

| BENNINGTON | $3,132.50 |

| BERLIN | $3,170.23 |

| BETHLEHEM | $3,125.16 |

| BOW | $2,960.07 |

| BRADFORD | $2,967.97 |

| BRETTON WOODS | $3,162.30 |

| BRISTOL | $3,087.63 |

| BROOKLINE | $3,187.78 |

| CAMPTON | $3,086.71 |

| CANAAN | $3,071.72 |

| CANDIA | $3,161.67 |

| CANTERBURY | $3,106.71 |

| CENTER BARNSTEAD | $3,117.31 |

| CENTER CONWAY | $3,132.06 |

| CENTER HARBOR | $3,057.79 |

| CENTER OSSIPEE | $3,126.34 |

| CENTER SANDWICH | $3,126.14 |

| CENTER STRAFFORD | $3,102.44 |

| CENTER TUFTONBORO | $3,129.85 |

| CHARLESTOWN | $3,109.13 |

| CHESTER | $3,213.97 |

| CHESTERFIELD | $3,091.00 |

| CHICHESTER | $2,993.83 |

| CHOCORUA | $3,138.62 |

| CLAREMONT | $3,126.71 |

| COLEBROOK | $3,160.98 |

| CONCORD | $2,927.59 |

| CONTOOCOOK | $2,913.60 |

| CONWAY | $3,124.54 |

| CORNISH | $3,089.09 |

| CORNISH FLAT | $3,088.79 |

| DANBURY | $3,063.98 |

| DANVILLE | $3,424.29 |

| DEERFIELD | $3,146.95 |

| DERRY | $3,394.58 |

| DOVER | $3,124.15 |

| DREWSVILLE | $3,091.00 |

| DUBLIN | $3,081.03 |

| DUNBARTON | $3,227.36 |

| DURHAM | $3,136.38 |

| EAST ANDOVER | $3,100.58 |

| EAST CANDIA | $3,103.42 |

| EAST DERRY | $3,185.18 |

| EAST HAMPSTEAD | $3,695.88 |

| EAST KINGSTON | $3,640.47 |

| EAST WAKEFIELD | $3,127.00 |

| EATON CENTER | $3,136.79 |

| EFFINGHAM | $3,125.99 |

| ELKINS | $3,099.14 |

| ENFIELD | $3,039.66 |

| ENFIELD CENTER | $3,112.22 |

| EPPING | $3,074.74 |

| EPSOM | $3,143.33 |

| ERROL | $3,159.78 |

| ETNA | $3,065.88 |

| EXETER | $3,197.58 |

| FARMINGTON | $3,072.68 |

| FITZWILLIAM | $3,118.97 |

| FRANCESTOWN | $3,140.88 |

| FRANCONIA | $3,136.50 |

| FRANKLIN | $3,068.97 |

| FREEDOM | $3,125.50 |

| FREMONT | $3,176.64 |

| GEORGES MILLS | $3,090.66 |

| GILFORD | $3,151.97 |

| GILMANTON | $3,132.54 |

| GILMANTON IRON WORKS | $3,085.25 |

| GILSUM | $3,090.10 |

| GLEN | $3,136.79 |

| GLENCLIFF | $3,143.86 |

| GOFFSTOWN | $3,294.84 |

| GORHAM | $3,098.49 |

| GOSHEN | $3,092.66 |

| GRAFTON | $3,094.36 |

| GRANTHAM | $3,023.42 |

| GREENFIELD | $3,126.80 |

| GREENLAND | $3,153.41 |

| GREENVILLE | $3,173.94 |

| GROVETON | $3,159.78 |

| GUILD | $3,077.33 |

| HAMPSTEAD | $3,735.99 |

| HAMPTON | $3,174.72 |

| HAMPTON FALLS | $3,163.02 |

| HANCOCK | $3,120.67 |

| HANOVER | $3,032.36 |

| HARRISVILLE | $3,064.85 |

| HAVERHILL | $3,136.79 |

| HEBRON | $3,091.74 |

| HENNIKER | $3,139.93 |

| HILL | $3,070.38 |

| HILLSBOROUGH | $3,147.66 |

| HINSDALE | $3,108.29 |

| HOLDERNESS | $3,029.02 |

| HOLLIS | $3,331.53 |

| HOOKSETT | $3,268.15 |

| HUDSON | $3,242.99 |

| INTERVALE | $3,133.95 |

| JACKSON | $3,133.19 |

| JAFFREY | $3,101.63 |

| JEFFERSON | $3,138.79 |

| KEARSARGE | $3,136.79 |

| KEENE | $2,894.88 |

| KINGSTON | $3,689.28 |

| LACONIA | $3,149.75 |

| LANCASTER | $3,149.75 |

| LEBANON | $3,030.03 |

| LEE | $3,129.92 |

| LEMPSTER | $3,102.34 |

| LINCOLN | $3,118.08 |

| LISBON | $3,150.03 |

| LITCHFIELD | $3,214.50 |

| LITTLETON | $3,137.67 |

| LOCHMERE | $3,064.63 |

| LONDONDERRY | $3,324.24 |

| LOUDON | $3,070.22 |

| LYME | $3,087.85 |

| LYME CENTER | $3,097.73 |

| LYNDEBOROUGH | $3,144.30 |

| MADBURY | $3,144.79 |

| MADISON | $3,129.06 |

| MANCHESTER | $3,798.09 |

| MARLBOROUGH | $3,085.99 |

| MARLOW | $3,105.83 |

| MELVIN VILLAGE | $3,138.62 |

| MEREDITH | $3,082.56 |

| MERIDEN | $3,077.25 |

| MERRIMACK | $3,201.58 |

| MILAN | $3,152.90 |

| MILFORD | $3,200.23 |

| MILTON | $3,081.10 |

| MILTON MILLS | $3,140.95 |

| MIRROR LAKE | $3,090.41 |

| MONROE | $3,136.79 |

| MONT VERNON | $3,143.93 |

| MOULTONBOROUGH | $3,127.11 |

| MOUNT WASHINGTON | $3,136.79 |

| NASHUA | $3,411.92 |

| NELSON | $3,091.00 |

| NEW BOSTON | $3,263.40 |

| NEW CASTLE | $3,049.39 |

| NEW DURHAM | $3,097.12 |

| NEW HAMPTON | $3,085.51 |

| NEW IPSWICH | $3,160.05 |

| NEW LONDON | $3,066.31 |

| NEWBURY | $3,120.94 |

| NEWFIELDS | $3,180.82 |

| NEWMARKET | $3,112.71 |

| NEWPORT | $3,125.79 |

| NEWTON | $3,694.35 |

| NEWTON JUNCTION | $3,512.48 |

| NORTH CONWAY | $3,127.97 |

| NORTH HAMPTON | $3,194.47 |

| NORTH HAVERHILL | $3,138.01 |

| NORTH SALEM | $3,314.36 |

| NORTH SANDWICH | $3,130.46 |

| NORTH STRATFORD | $3,164.31 |

| NORTH SUTTON | $3,052.95 |

| NORTH WALPOLE | $3,101.57 |

| NORTH WOODSTOCK | $3,123.89 |

| NORTHWOOD | $3,172.67 |

| NOTTINGHAM | $3,124.15 |

| ORFORD | $3,094.76 |

| OSSIPEE | $3,126.70 |

| PELHAM | $3,611.18 |

| PETERBOROUGH | $3,142.33 |

| PIERMONT | $3,097.73 |

| PIKE | $3,136.79 |

| PITTSBURG | $3,154.79 |

| PITTSFIELD | $3,137.04 |

| PLAINFIELD | $3,070.81 |

| PLAISTOW | $3,653.43 |

| PLYMOUTH | $2,994.72 |

| PORTSMOUTH | $3,046.47 |

| RANDOLPH | $3,156.04 |

| RAYMOND | $3,083.74 |

| RINDGE | $3,107.24 |

| ROCHESTER | $2,982.71 |

| ROLLINSFORD | $3,028.86 |

| RUMNEY | $3,091.88 |

| RYE | $3,161.79 |

| RYE BEACH | $3,164.19 |

| SALEM | $3,678.46 |

| SALISBURY | $3,079.41 |

| SANBORNTON | $3,073.67 |

| SANBORNVILLE | $3,126.15 |

| SANDOWN | $3,269.18 |

| SEABROOK | $3,610.79 |

| SILVER LAKE | $3,129.12 |

| SOMERSWORTH | $2,978.65 |

| SOUTH ACWORTH | $3,091.00 |

| SOUTH NEWBURY | $3,038.38 |

| SOUTH SUTTON | $2,991.56 |

| SOUTH TAMWORTH | $3,138.62 |

| SPOFFORD | $3,098.02 |

| SPRINGFIELD | $3,033.79 |

| STINSON LAKE | $2,977.73 |

| STODDARD | $3,097.91 |

| STRAFFORD | $3,136.05 |

| STRATHAM | $3,173.12 |

| SUGAR HILL | $3,161.99 |

| SULLIVAN | $3,085.58 |

| SUNAPEE | $3,084.02 |

| SUNCOOK | $2,962.53 |

| SWANZEY | $3,037.08 |

| TAMWORTH | $3,130.37 |

| TEMPLE | $3,168.50 |

| THORNTON | $3,118.72 |

| TILTON | $3,083.36 |

| TROY | $3,107.78 |

| TWIN MOUNTAIN | $3,131.61 |

| UNION | $3,111.29 |

| WALPOLE | $3,094.82 |

| WARNER | $3,081.47 |

| WARREN | $3,124.58 |

| WASHINGTON | $3,055.34 |

| WATERVILLE VALLEY | $3,143.86 |

| WEARE | $3,260.44 |

| WENTWORTH | $3,129.14 |

| WEST CHESTERFIELD | $3,082.21 |

| WEST LEBANON | $3,068.10 |

| WEST NOTTINGHAM | $3,013.06 |

| WEST OSSIPEE | $3,138.62 |

| WEST PETERBOROUGH | $3,146.12 |

| WEST STEWARTSTOWN | $3,136.79 |

| WESTMORELAND | $3,087.03 |

| WHITEFIELD | $3,135.82 |

| WILMOT | $3,063.82 |

| WILTON | $3,159.94 |

| WINCHESTER | $3,113.18 |

| WINDHAM | $3,648.72 |

| WINNISQUAM | $3,126.81 |

| WOLFEBORO | $3,094.29 |

| WOLFEBORO FALLS | $3,103.04 |

| WONALANCET | $3,138.62 |

| WOODSVILLE | $3,148.85 |

For the top 10 largest cities, there is a difference. Concord, Rochester, and Keene have three of the lowest premiums in the state. Meanwhile, Machester, Salem, and Nashua have some of the highest.

The reason might be more straightforward than first-assumed: New Hampshire is one of the smallest states in the U.S. with fewer cities compared to other states.

In our data, there are 252 cities only separated by $900. It makes sense that even the big cities wouldn’t be separated by a great deal.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best New Hampshire Car Insurance Companies

Progressive has Flo. Geico has the gecko. Allstate has Mayhem. State Farm has half the (former) Houston Rockets team.

But those are just ads. They are there to make you laugh, creating a good feeling while they talk about comprehensive and collision insurance.

What do you know about them really?

If you’ve felt like you’ve been in the dark about car insurance companies, whether someone else’s or (gasp) even your own, look no further.

This is the section for you.

We’ll cover financial ratings, customer satisfaction rating, the companies with the most complaints, the cheapest company in New Hampshire, and more driving factors.

Ready? Let’s get some snow on our tires.

The Largest Companies Financial Ratings

If you do business on a global scale, companies in other nations want to see how trustworthy you. Not necessarily in the human to human way; in the financial strength way.

For large institutions, like global property and casualty insurance companies, that comes down debt versus repayment; like your credit score, financial institutions have financial ratings.

These can come from three global credit rating agencies: Standard and Poor’s, Moody’s, and AM Best. In our analysis, we’re going to look at the financial strength ratings from AM Best.

New Hampshire A.M. Best Ratings| Company | AM Best Rating |

|---|---|

| Allstate | A+ |

| Geico | A++ |

| Nationwide | A+ |

| Progressive | A+ |

| Safeco | A |

| State Farm | A++ |

| USAA | A++ |

Every company has an A rating or higher. AM Best writes, about the A rating, “Assigned to insurance companies that have, in our opinion, an excellent ability to meet their ongoing financial obligations.”

Every company A+ or higher is labeled as “superior.”

These ratings indicate a company’s debt-to-revenue ratio; a higher rated company has higher revenue and less debt that the companies rated below it.

Overall, strong financial ratings for every company.

Companies with the Best Ratings

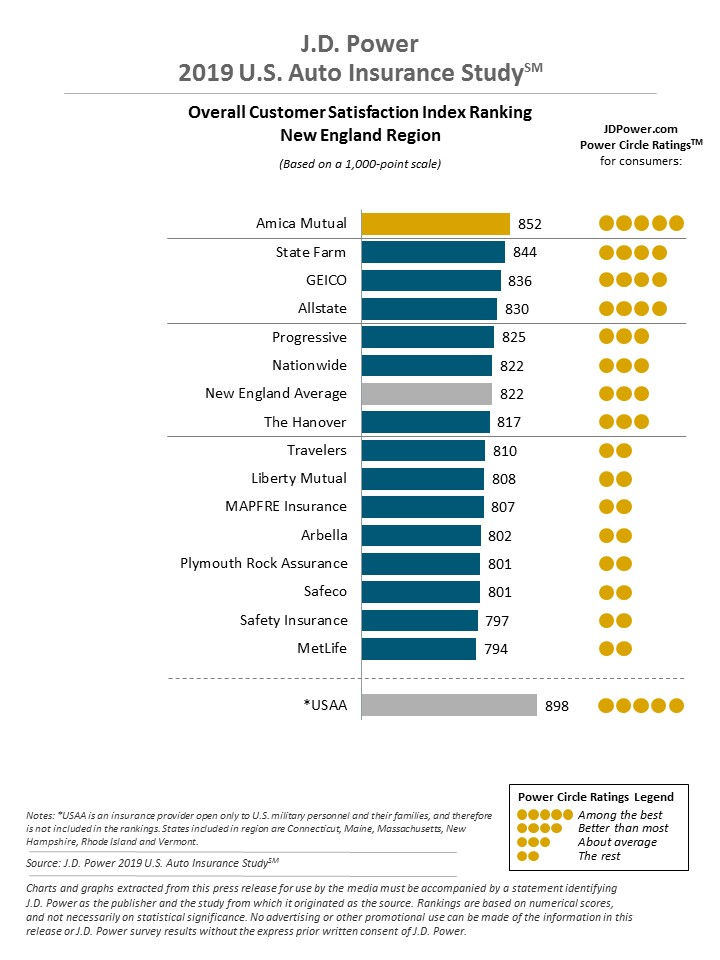

Financial ratings are one side of the coin. The other is customer satisfaction, and for that, we turn to J.D. Power.

J.D. Power is a heavy hitter in the insurance industry (and many other industries as well). Companies cite their J.D. Power awards in commercials; they are a mover and shaker in its fields.

One of its contributions is an annual auto-insurance customer satisfaction study that looks at regions throughout the country and asks consumers: are you satisfied?

In New England, they asked the same question and put together all the results in a graph, which is shown below.

USAA and Amica Mutual (not listed in New Hampshire) are the two companies with the most satisfied customers.

State Farm, Geico, and Allstate all have four stars. Progressive and Nationwide have three stars. Safeco has two.

Companies with Most Complaints in New Hampshire

There are financial ratings and customer satisfaction, then there are complaints. And, fortunately, there is an organization tracking those too. Who?

The National Association of Insurance Commissioners is a regulatory group organized and run by the chief insurance regulators in each state. And, yes, they track all sorts of things.

In this instance, we’ll look at complaint indexes, which are a ratio of the number of complaints against a company versus the premiums they have written.

It can be found when entering each company’s NAIC code on the NAIC’s consumer page.

The numbers in the next table are national numbers and are taken, through the NAIC, from state departments throughout the country.

| Company | Complaint Index | Total Complaints |

|---|---|---|

| Allstate | 1.26 | 226 |

| Geico | 0.92 | 600 |

| Nationwide | 0.43 | 37 |

| Progressive | 0.88 | 84 |

| Safeco | 1.69 | 124 |

| State Farm | 0.57 | 1,397 |

| USAA | 1.15 | 328 |

In the case of the complaint index, lower is better. The companies can be divided into three tiers: high, middle, low.

- High-tier companies (over 1 in the complaint index): Safeco, USAA, Allstate

- Middle-tier companies (around .9): Geico, Progressive

- Low-tier companies (between .6 and .4): State Farm, Nationwide

A good study in contrasts is Safeco and State Farm. Safeco has just 124 complaints but has the worst complaint index. State Farm has around 1,400 complaints but is second-best.

State Farm does more business than Safeco and as such its complaint index is much lower.

Cheapest Companies in New Hampshire

Now, there are financial ratings. And there are the customer satisfaction ratings. There’s even the complaint data.

But what is the golden question in many people’s eyes? It might be this: What is the cheapest insurance company in New Hampshire?

We have the answer, right here.

| Company | Annual Average | Compared to Average (+/-) | Compared to Average (%) |

|---|---|---|---|

| Allstate F&C | $2,737.70 | -$421.29 | -15.39% |

| Geico General | $1,611.67 | -$1,547.32 | -96.01% |

| Nationwide Mutual | $2,487.58 | -$671.41 | -26.99% |

| Progressive Universal | $2,691.13 | -$467.86 | -17.39% |

| Safeco Ins Co of America | $8,476.85 | $5,317.87 | 62.73% |

| State Farm Mutual Auto | $2,186.81 | -$972.18 | -44.46% |

| USAA | $1,921.18 | -$1,237.81 | -64.43% |

You have the cheapest companies, the mid-level companies, and the most expensive company.

- Cheapest companies: Geico, USAA

- Mid-level companies: State Farm, Nationwide, Progressive, Allstate

- Most expensive company (by a wide margin): Safeco

The cheapest companies and mid-level companies are all lower than $2,700 in average premiums. They are all lower than the average for all companies.

This is because Safeco, the most expensive company, is $5,700 above the nearest competitor and $5,300 above the average.

Keep in mind Safeco had the lowest customer satisfaction of the companies featured here in the J.D. Power study. It also had the highest complaint index.

The cheapest company is Geico at $1,600 per annual premium. That is nearly $7,000 below Safeco and $300 below USAA, its nearest competitor.

Commute Rates by Companies

Commute rates and the mileage you drive sometimes affect your annual rate.

The reason is simple: insurance companies believe the more you drive, the more likely you are to file a claim. In New Hampshire, four companies adjust their rates dependent on annual mileage.

| Group | Commute & Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute | 6,000 annual mileage. | $2,700.46 |

| Allstate | 25 miles commute | 12,000 annual mileage. | $2,774.94 |

| Geico | 10 miles commute | 6,000 annual mileage. | $1,598.00 |

| Geico | 25 miles commute | 12,000 annual mileage. | $1,625.33 |

| Liberty Mutual | 10 miles commute | 6,000 annual mileage. | $8,476.86 |

| Liberty Mutual | 25 miles commute | 12,000 annual mileage. | $8,476.86 |

| Nationwide | 10 miles commute | 6,000 annual mileage. | $2,487.58 |

| Nationwide | 25 miles commute | 12,000 annual mileage. | $2,487.58 |

| Progressive | 10 miles commute | 6,000 annual mileage. | $2,691.13 |

| Progressive | 25 miles commute | 12,000 annual mileage. | $2,691.13 |

| State Farm | 10 miles commute | 6,000 annual mileage. | $2,137.31 |

| State Farm | 25 miles commute | 12,000 annual mileage. | $2,236.31 |

| USAA | 10 miles commute | 6,000 annual mileage. | $1,901.80 |

| USAA | 25 miles commute | 12,000 annual mileage. | $1,940.56 |

Those four are Allstate, State Farm, USAA, and Geico. Neither of them moves very much.

- Allstate: $75

- State Farm: $100

- USAA: $40

- Geico: $25

Often, because insurance plans are roughly the same year in and year out, an insurance company might not ask for your annual mileage every year. It may adjust if you have an electronic tracker.

Otherwise, it’s up to you to tell them.

Take a look at these 6 major factors affecting auto insurance rates in New Hampshire.

Coverage Level Rates by Companies

Coverage levels can depend on some factors that may not be easy to determine right off hand.

Your coverage limits affect your coverage level. If you have a $50,000 coverage limit for bodily liability versus a $20,000 limit, your coverage level will be higher and you’ll pay more.

The number of additional coverages affects your coverage level. If you have comprehensive and collision on top of standard bodily liability, your coverage level will be higher. And you’ll pay more.

In the table below, Liberty Mutual is the parent company of Safeco. Their rates for car insurance are close to equal, generally speaking.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $2,817.35 |

| Allstate | Medium | $2,734.45 |

| Allstate | Low | $2,661.29 |

| Geico | High | $1,695.58 |

| Geico | Medium | $1,602.39 |

| Geico | Low | $1,537.03 |

| Liberty Mutual | High | $8,836.20 |

| Liberty Mutual | Medium | $8,450.31 |

| Liberty Mutual | Low | $8,144.06 |

| Nationwide | High | $2,356.75 |

| Nationwide | Medium | $2,453.07 |

| Nationwide | Low | $2,652.92 |

| Progressive | High | $2,797.82 |

| Progressive | Medium | $2,691.20 |

| Progressive | Low | $2,584.38 |

| State Farm | High | $2,282.92 |

| State Farm | Medium | $2,189.03 |

| State Farm | Low | $2,088.49 |

| USAA | High | $1,997.66 |

| USAA | Medium | $1,917.96 |

| USAA | Low | $1,847.91 |

Liberty Mutual has the largest price difference from low to high coverages: $700. Geico has the smallest: $70. Most are around the $150 to $200 margin.

Credit History Rates by Companies

Just like insurance companies have financial ratings, the average consumer has a credit score. This score is a measure of trustworthiness: if we loan money to this person, will they pay it back?

Car insurance companies use your credit score for a different purpose: to determine whether or not you’ll file a claim.

This is a controversial practice.

One lawmaker, Representative Rashida Tlaib from Michigan proposed legislation in March to stop credit bureaus from sending customer information to insurance companies.

Read more: Michigan Car Insurance (The Only Guide You’ll Ever Need)

It’s important to know how credit ratings can affect your premiums more severely than accidents or even DWI offenses. For example, the average premium for an adult single person with a clean record and poor credit is around $2,600, while a person with excellent credit and a DWI i could be as low as $1,700.

Now, onto those credit scores and average annual rates per company.

| Group | Annual Average | Good Credit Annual Average | Fair Credit Annual Average | Bad Credit Annual Average |

|---|---|---|---|---|

| Allstate | $2,352.43 | $2,352.43 | $2,492.26 | $3,368.40 |

| Geico | $1,363.32 | $1,363.32 | $1,564.33 | $5,820.50 |

| Liberty Mutual | $5,820.50 | $5,820.50 | $7,441.23 | $12,168.83 |

| Nationwide | $2,191.67 | $2,191.67 | $2,374.92 | $2,896.14 |

| Progressive | $2,462.05 | $2,462.05 | $2,624.47 | $2,986.88 |

| State Farm | $1,536.16 | $1,536.16 | $1,927.69 | $3,096.59 |

| USAA | $1,443.21 | $1,443.21 | $1,714.14 | $2,606.19 |

The least expensive score is Geico with a “good” score of $1,350. The most expensive is Liberty Mutual with a “poor” score of $12,150.

The biggest difference between a “poor” score and a “good” score is Liberty Mutual at $6,300. The smallest is Progressive at $500.

| Fair | Good | Poor | Total Average |

|---|---|---|---|

| $2,877.01 | $2,452.76 | $4,147.19 | $3,158.99 |

A poor score, on average, is $1,700 more than a good score.

As seen in the next section, the average poor score is a more expensive penalty than, for many companies, if you get a DWI.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving Record Rates by Companies

Many lawmakers believe that a person’s driving record should be the only factor used in determining rates.

Three states—Massachusetts, California, and Hawaii—feel the same way. So what are the penalties for getting an infraction?

Read more: Hawaii Car Insurance (The Only Guide You’ll Ever Need)

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $2,276.40 | $3,095.98 | $2,923.20 | $2,655.21 |

| Geico | $1,437.50 | $1,590.83 | $1,980.83 | $1,437.50 |

| Liberty Mutual | $5,324.37 | $9,624.42 | $9,874.47 | $9,084.16 |

| Nationwide | $1,914.01 | $2,657.49 | $3,249.78 | $2,129.05 |

| Progressive | $2,312.48 | $3,190.12 | $2,550.23 | $2,711.71 |

| State Farm | $2,013.89 | $2,157.23 | $2,562.23 | $2,013.89 |

| USAA | $1,483.03 | $1,996.60 | $2,480.96 | $1,724.12 |

Liberty Mutual, across the board, is the most expensive. A clean record with it is still more expensive than the highest infraction for all other companies.

Still note, however, that its infraction rates are less than its poor credit score rate. Geico and USAA are the lowest priced.

Each company is different when dealing with specific infractions, with some offering accident forgiveness ot no rise in rates for speeding violations.

The following is not based on total rates. It’s based on the change within an overall company’s rates.

- The best company for one speeding ticket: Geico (no change)

- The best company for one accident: USAA (+$500)

- The best company for 1 DUI: Progressive (+$225)

You may have the question: which infractions are more expensive overall, however? We have that answer.

They are all very expensive, with the smallest rise in rates being $700 for a speeding ticket. DUIs are the most expensive with a $1,200 rise in rates.

All are lower than the average rate for a poor credit score.

Largest Car Insurance Companies in New Hampshire

In some states, a particular company will dominate the competition. Is that the case in New Hampshire?

| Group | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $84,945 | 54.95% | 10.04% |

| Amica Mutual Group | $29,976 | 65.49% | 3.54% |

| Auto-Owners Group | $27,987 | 60.58% | 3.31% |

| Geico | $114,977 | 72.49% | 13.59% |

| Liberty Mutual Group | $97,114 | 58.48% | 11.48% |

| Metropolitan Group | $25,318 | 54.20% | 2.99% |

| Progressive Group | $103,823 | 61.53% | 12.28% |

| State Farm Group | $106,434 | 52.06% | 12.58% |

| State Total | $845,748 | 60.47% | 100.00% |

| Travelers Group | $20,099 | 59.55% | 2.38% |

| USAA Group | $44,555 | 72.58% | 5.27% |

At the top, the market is balanced with five companies between 13.5 and 10 percent of the market share.

- Four of those companies are outperforming their national averages: Geico, Progressive, Liberty Mutual, and Allstate.

- One is underperforming its national average: State Farm.

The loss ratios for each company look good, though some like State Farm are near the .5 threshold.

Number of Insurers in New Hampshire

There are 647 foreign insurers in New Hampshire and 50 domestic. What does this mean?

Most people think of foreign and domestic like the boundaries of a country. Anything that is foreign is outside of the country, anything domestic is inside the country.

The same logic applies to insurance companies but even more localized. Domestic insurers are insurers incorporated in the state in which they solely do business. Foreign insurers do business in other states or were incorporated in a different state.

It’s the difference between your mom and pop insurance company and the Allstates and State Farms.

There is no difference legally, however. The only problem with domestic insurers is not being able to take your insurance plan when you move.

With foreign insurers, you have a better shot.

State Laws

If you’re traveling in New Hampshire or a resident, knowing the rules can keep you out of jail or from getting a ticket.

You have probably researched these and found them confusing.

They’re shrouded in legalese, buried in legislative documents, and you might feel like Gandalf poring over papers in Gondor, searching for that mythical explanation of reckless driving laws.

It may make your head hurt.

In this section, we’ll cover four separate categories of laws: car insurance, vehicles, rules of the road, and safety.

By the end, you’ll know about everything from reckless driving laws to high-risk insurance. And those pesky Real ID requirements.

Here starts State Laws. Park your car for a second. We’re having a meal in four courses.

Car Insurance Laws

Car Insurance laws are like the roast beef of state laws. They are delicious, nutritious, and build muscles.

Here you’ll learn about the time limits from filing a lawsuit, the statistics about car insurance fraud, and what insurance you need if you’re labeled a high-risk driver.

All useful information. Let’s dig in.

How State Laws Are Determined

Fortunately, insurance companies can’t just charge anything. There are rules and regulations in place that check the amount they charge, keeping prices reasonable.

In New Hampshire, this method is called file and use and means that insurance companies must file their rates with the insurance department before charging consumers.

This is according to an auto insurance database report from the National Association of Insurance Commissioners.

A company needs prior approval before entering a non-competitive market.

These keep insurance companies from running up rates and may be part of the reason why New Hampshire’s rates are so low.

Windshield Coverage

A crack in your windshield might cost hundreds of dollars in replacement fees. What options does New Hampshire offer?

CarWindshields.info aggregates all the information for windshield replacement within states. It writes about New Hampshire, “Nothing unique to windshields.”

It lists two state resources to detail more.

- Insurers must disclose if they’re using aftermarket products (407-D:4)

- Aftermarket products should be equal in quality to OEMs (407-D:3)

New Hampshire’s laws are nothing particularly different than other states.

High-Risk Insurance

If you are labeled a high-risk driver, you may be asked to purchase a form of financial responsibility. This is an SR-22 in New Hampshire.

There are a few reasons why this might occur. The New Hampshire Department of Safety Division of Motor Vehicles writes about four.

- If you’re convicted of a DWI, you’ll need an SR-22 for three years from the time of the offense

- If you’re certified as a habitual offender, you’ll need an SR-22 for three years from the time of the certification

- If your license is at risk of suspension, you may be required to purchase an SR-22

- If you’re found at fault in an accident and are uninsured, you will be required to get an SR-22 for three years

There are some specific violations where the person will be required to get an SR-22 if convicted:

- Leaving the scene of an accident

- A second conviction of reckless operation

- Conduct after accident

If you are convicted, you’ll need to purchase an SR-22 through your insurance company. This will likely cause a spike in rates.

If you can’t find insurance through the standard marketplace, you can try the New Hampshire Automobile Reinsurance Facility. It is a last-ditch market for high-risk drivers.

Low-Cost Insurance

Unfortunately, New Hampshire does not offer low-cost insurance. Only California, Hawaii, and New Jersey do.

Automobile Insurance Fraud in New Hampshire

Automobile insurance fraud costs the insurance industry $30 billion per year, according to the Insurance Information Institute.

These losses happen on both the consumer side and the employee side.

- Consumer side: padding claims, submitting claims for events that never happened, staging accidents

- Employee side: using deceptive practices to trick customers into buying plans, altering documents to make extra money

New Hampshire has an Insurance Department Fraud Unit to handle cases of insurance fraud, processing about 300 per year.

From 2016-2018, it indicted 25 people on felony insurance fraud charges.

If you suspect fraud, you can submit a complaint through the Unit’s fraud referral form.

Statute of Limitations

Let’s say you’re in an accident in New Hampshire. You’ve injured your arm and the right side of your car is busted up. The police determine that the other person is at fault.

But the person doesn’t have insurance and isn’t paying. What do you do? The quick answer: file a lawsuit.

The problem is simple. You have a set amount of time to file that lawsuit, which governed by the Statute of Limitations.