Mississippi Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Mississippi Statistics Summary | Stats |

|---|---|

| Road Miles | Total In State: 76,777 Vehicle Miles Driven: 39,890 million |

| Vehicles | Registered: 2,040,524 Total Stolen: 4,243 |

| State Population | 2,986,530 |

| Most Popular Vehicle | Ford F-150 |

| Motorists Uninsured | 23.7% State Rank: 2nd |

| Driving Deaths | 2008-2017 Speeding: 1,219 Drunk Driving: 1,667 |

| Average Premiums (Annual) | Liability: $460.50 Collision: $323.22 Comprehensive: $210.33 Combined Premium: $994.05 |

| Cheapest Provider | USAA |

The Magnolia State, more commonly known as Mississippi, is rich in that deep southern culture that continues to draw people in droves. With so many people on the road, you’re going to want to make sure you have the proper insurance coverage.

That’s why we’ve created this comprehensive guide to help assist you in finding the optimal coverage for your needs and to make sure you have the basic requirements needed to legally drive in Mississippi.

Ready to get started now? Use our FREE online tool. You only need is your zip code to get started.

Mississippi Car Insurance Coverage and Rates

One of the biggest topics to talk about when getting insurance coverage is what kind of coverage you’re going to need and what rates you’ll be paying.

In this section, that’s exactly what we’ll be discussing. We’ll cover all the things you’ll want to know for the required coverage in Mississippi, as well as some of the rates you’ll see for the state.

Mississippi Minimum Coverage

Mississippi requires you to have something known as the minimum liability coverage to legally drive, as do most states in the nation. What exactly is minimum liability coverage?

A minimum liability coverage is the minimum amount of insurance coverage (coverage that helps to protect you in the case of an accident) you are allowed to have.

So what can you expect for Mississippi? Mississippi follows a 20/40/10 minimum liability coverage, which we’ve explained further for you down below:

- 20 = $20,000 for the payment of just one person in an accident that you caused

- 40 = $40,000 for the payment of multiple people in an accident that you caused

- 10 = $10,000 for the payment of any property damage in an accident that you caused

This is especially important to have, as Mississippi is considered an “at-fault” state. This means you’re going to be in a “you break it you bought it” kind of situation.

Meaning that if you caused the accident, and you don’t have insurance coverage, you’ll have to pay out of pocket for the costs of that accident!

So while you absolutely must have the minimum coverage, keep in mind that this is just the minimum. It’s always wise to at least consider getting more than just the minimum coverage.

Your future self might thank you for it.

Forms of Financial Responsibility

A form of financial responsibility, also known as proof of insurance, is a way for others to confirm you do have this minimum liability coverage.

https://www.youtube.com/watch?v=Kixa8dg2w0A

You might be required to provide this proof in any of the following situations:

- If you’ve been in an accident

- When registering your vehicle

- Whenever you’ve been pulled over by law enforcement

So what kind of proof of insurance is appropriate in Mississippi? Any of the following are considered acceptable forms of financial responsibility:

- An insurance ID card (can be a physical copy or an electronic copy)

- Certificate of your insurance policy

- Certificate of deposit showing cash or security deposited posted with the State Treasurer

- Proof of your bond

Premiums as a Percentage of Income

There is a factor that can affect your insurance premium known as the per capita disposable income. What exactly does this mean, and how does it affect you?

The per capita disposable income is the amount of money a group of individuals (as in the citizens of Mississippi) has after taxes has been taken out.

So let’s say that you earn $75,000 per year, but after taxes, you have $60,000. This $60,000 is your disposable income. Average out your disposable income with others who live in Mississippi, and there you have it, the per capita disposable income!

In Mississippi, the per capita disposable income is $31,365. After taxes, you will use this disposable income to pay for the rest of your expenses such as rent, groceries, and even your car insurance premiums.

In the table below, we show a three-year trend of the per capita disposable income, the average cost of full coverage insurance, and exactly how much of this disposable income goes to insurance coverage.

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|

| $957.59 | $31,365.00 | 3.05% | $925.13 | $30,580.00 | 3.03% | $902.95 | $30,385.00 | 2.97% |

As you can see, approximately 3 percent of Mississippi citizens’ disposable income is going just to their insurance coverage. Making sure you budget yourself so you can pay for this coverage is vital.

Average Monthly Car Insurance Rates in MS (Liability, Collision, Comprehensive)

According to the National Association of Insurance Commissioners, you can expect the following core coverage costs in Mississippi:

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $460.50 |

| Collision | $323.22 |

| Comprehensive | $210.33 |

| Combined | $994.05 |

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

Additional Liability

In addition to the minimum liability coverage available, there are additional liability coverage types optional for Mississippi drivers, namely Medical Payment (MedPay) coverage and uninsured/underinsured motorist coverage.

What exactly are these two coverage types?

MedPay coverage is for the payment of your medical expenses should you ever be injured in an accident. Bodily Injury Coverage is for the payment of others’ medical expenses if they are injured in an accident you caused.

Uninsured/underinsured motorist coverage is to help protect you should you ever be involved in an accident with a driver who either does not have at least the minimum insurance coverage or who has no insurance coverage at all.

This coverage type, in particular, is crucial in Mississippi. Why?

According to the National Association of Insurance Commissioners (NAIC), Mississippi has an uninsured driver rate of 23.7 percent, meaning it is ranked as the second-most uninsured state in the nation!

https://www.youtube.com/watch?v=LH-6wizPE-g

Now that we’ve covered what these additional liability coverage types are, we’ll discuss their loss ratios in the state of Mississippi.

What is a loss ratio?

A loss ratio is the amount of money insurance companies pay out in claims to their customers as compared to the amount of money they bring in through the insurance premiums you pay.

You want companies with loss ratios that are in just the right place. Not too high, and not too low. If insurance companies have loss ratios that are too low, it means that they aren’t paying out enough in claims to their customers.

If insurance companies have loss ratios that are too high (over 100 percent), it means that they are paying out too much in claims and are actually at risk for going bankrupt.

In Mississippi, the table below shows the loss ratios for these two liability coverage types.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 74.81% | 77.44% | 80.03% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 69.10% | 74.67% | 79.20% |

As you can see, both coverage types are in a pretty good spot. They’re not too high and not too low.

Add-Ons, Endorsements, and Riders

Our biggest priority is making sure you have the car insurance coverage that you need, and for the best price. Did you know that there are affordable add-on coverage options that you can add to your policy? Check out the list below to see what you can add to your policy in Mississippi:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Average Monthly Car Insurance Rates by Age & Gender in MS

It’s often a myth that men tend to pay more for their insurance coverage than women, so we decided to see if this was true in Mississippi.

| Company | Married 35-year Old Female | Married 35-year Old Male | Married 60-year Old Female | Married 60-year Old Male | Single 17-year Old Female | Single 17-year Old Male | Single 25-year Old Female | Single 25-year Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,759.49 | $2,635.21 | $2,463.36 | $2,519.32 | $11,031.99 | $11,772.88 | $3,133.31 | $3,215.18 |

| Geico General | $2,966.41 | $2,806.48 | $2,694.14 | $2,503.52 | $7,389.86 | $6,979.27 | $4,950.27 | $2,400.88 |

| Nationwide P&C | $2,046.11 | $2,102.48 | $1,835.74 | $1,945.49 | $4,088.44 | $5,202.84 | $2,318.23 | $2,510.05 |

| Progressive Gulf Ins | $2,591.63 | $2,419.61 | $2,124.47 | $2,061.68 | $9,375.44 | $10,495.41 | $2,662.75 | $2,769.80 |

| SAFECO Ins Co of IL | $2,629.22 | $2,846.39 | $2,112.59 | $2,370.20 | $9,446.38 | $10,504.45 | $2,794.00 | $2,941.24 |

| State Farm Mutual Auto | $1,877.59 | $1,877.59 | $1,680.17 | $1,680.17 | $5,427.70 | $6,823.62 | $2,091.75 | $2,382.03 |

| Travelers Home & Marine Ins Co | $1,683.09 | $1,713.42 | $1,600.71 | $1,602.55 | $7,522.15 | $11,907.14 | $1,765.06 | $2,047.25 |

| USAA | $1,385.56 | $1,371.97 | $1,293.28 | $1,308.31 | $3,448.85 | $4,091.04 | $1,689.16 | $1,861.86 |

What we found instead was that more commonly, it’s not your gender affecting your insurance coverage, but your age and marital status.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mississippi Car Insurance Companies

In this next section, we’ll talk about the car insurance companies available to you in Mississippi. There are so many out there that it can seem overwhelming, so we’re going to cover the largest companies in the state.

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in MS.

The Largest Companies’ Financial Rating

Did you know that while insurance companies can check your credit history to see what your financial health is like, you can do the same to them? That’s right, you can check to see what state a company’s financial health is like in a really easy way, through an agency known as the A.M. Best Rating.

This rating system assigns a grade to a company based on numerous financial factors. The higher the grade, the better the company’s financial health.

Check out the table below to see what the financial ratings are for the largest companies in Mississippi:

| Company Name | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Alfa Insurance Group | A | $70,841 | 64.72% | 3.77% |

| Allstate Insurance Group | A+ | $155,147 | 50.96% | 8.26% |

| Geico | A++ | $117,890 | 70.29% | 6.28% |

| Liberty Mutual Group | A | $117,425 | 68.86% | 6.25% |

| Nationwide Corp Group | A+ | $108,233 | 60.37% | 5.76% |

| Progressive Group | A+ | $192,012 | 65.31% | 10.22% |

| Shelter Insurance Group | A | $59,844 | 68.58% | 3.19% |

| Southern Farm Bureau Casualty Group | A+ | $223,023 | 69.60% | 11.87% |

| State Farm Group | A++ | $483,064 | 61.62% | 25.72% |

| USAA Group | A++ | $95,802 | 78.03% | 5.10% |

| State Total | $1,878,254 | 64.24% | 100.00% |

Companies with Best Ratings

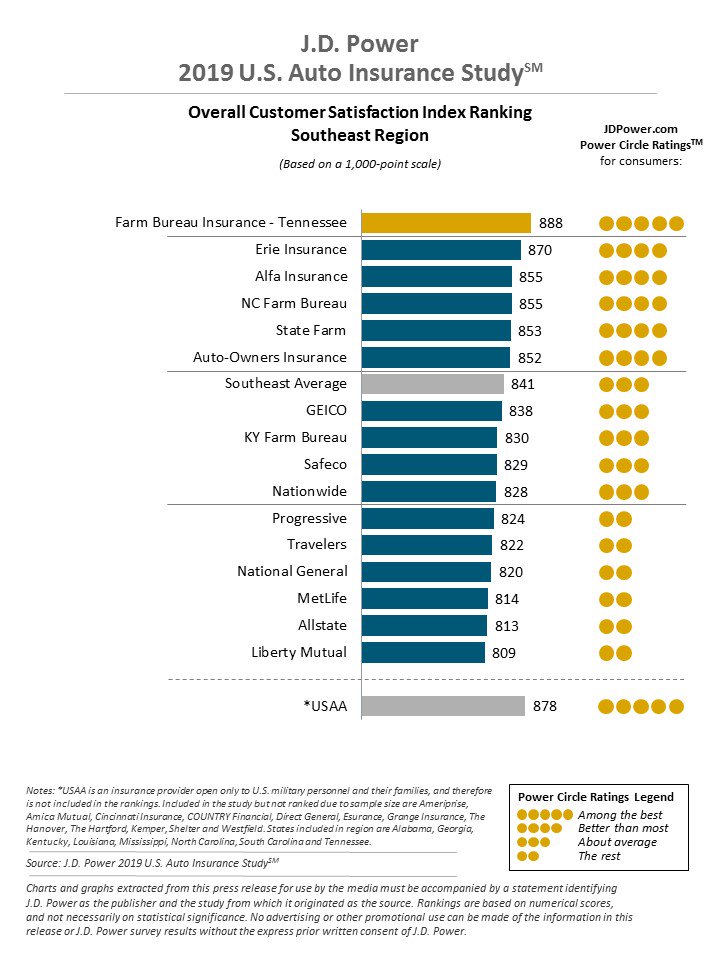

J.D. Power has done a study to discover which companies, in each region in the United States, have the best customer ratings. Mississippi lands in the Southeast region, so the following are the results of the J.D. Power study:

Companies with Most Complaints in Mississippi

Just like you would want to know how satisfied other customers are with a company, you’ll want to know how unsatisfied they are, as well. In the table below, we’ve gathered the complaint indexes for various insurance providers in Mississippi:

| Car Insurance Company | Number of Complaints | Complaint Index |

|---|---|---|

| Safeco | 0 | 0.00 |

| Shelter | 0 | 0.00 |

| Safeway | 0 | 0.00 |

| State Auto | 0 | 0.00 |

| 21st Century | 0 | 0.00 |

| United Automobile | 0 | 0.00 |

| Alfa | 2 | 0.23 |

| Mississippi Farm Bureau | 9 | 0.29 |

| MetLife | 2 | 0.51 |

| Allstate | 11 | 0.53 |

| State Farm | 44 | 0.67 |

| Nationwide | 10 | 0.70 |

| Dairyland | 1 | 0.70 |

| Hartford | 2 | 0.76 |

| AAA | 1 | 0.85 |

| Geico | 13 | 0.90 |

| USAA | 11 | 0.97 |

| GuideOne Insurance | 2 | 1.08 |

| Esurance | 2 | 1.11 |

| Travelers | 3 | 1.22 |

| Progressive | 23 | 1.23 |

| ANPAC | 1 | 1.33 |

| Victoria Insurance | 1 | 1.48 |

| USA Insurance | 3 | 1.83 |

| Inverness Partners | 2 | 2.20 |

| Liberty Mutual | 5 | 2.22 |

| Mendakota Insurance | 2 | 2.36 |

| Farmers | 5 | 2.43 |

| National General | 4 | 5.06 |

| Direct General | 21 | 5.63 |

| ACCC Insurance Company | 21 | 9.79 |

| Unique Insurance | 9 | 17.93 |

Mississippi Car Insurance Rates by Company

| Company | Average | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate P&C | $4,941.34 | $1,276.53 | 25.83% |

| Geico General | $4,086.36 | $421.54 | 10.32% |

| Nationwide P&C | $2,756.17 | -$908.64 | -32.97% |

| Progressive Gulf Ins | $4,312.60 | $647.78 | 15.02% |

| SAFECO Ins Co of IL | $4,455.56 | $790.74 | 17.75% |

| State Farm Mutual Auto | $2,980.08 | -$684.74 | -22.98% |

| Travelers Home & Marine Ins Co | $3,730.17 | $65.35 | 1.75% |

| USAA | $2,056.25 | -$1,608.56 | -78.23% |

Commute Rates by Company

Yes, how far you commute regularly can affect exactly what your insurance rate will be. Typically the further you drive, the more you pay. But this isn’t always the case these days.

| Company | 10 Miles Commute / 6000 Annual Mileage | 25 Miles Commute/ 12000 Annual Mileage |

|---|---|---|

| Liberty Mutual | $13,055.12 | $13,847.08 |

| MS | $3,646.43 | $3,683.20 |

| Nationwide | $2,926.49 | $2,926.49 |

| USAA | $2,824.14 | $2,899.06 |

| State Farm | $2,011.15 | $2,122.82 |

Companies are starting to wise up and charge the same rate regardless of what your commute looks like. You can see this with Nationwide above. Unfortunately, however, a lot of companies still do. So making sure you pay close attention to these types of factors will help you out in the long run.

Coverage Level Rates by Company

Who wants to pay more for less? No one, right? Well, as it turns out, you could actually be paying a higher rate for a lower coverage level.

| Group | High | Medium | Low |

|---|---|---|---|

| Allstate | $5,160.28 | $4,936.29 | $4,727.46 |

| Geico | $4,286.85 | $4,114.68 | $3,857.53 |

| Liberty Mutual | $4,750.94 | $4,435.93 | $4,179.80 |

| Nationwide | $2,914.81 | $2,747.46 | $2,606.25 |

| Progressive | $4,710.11 | $4,368.16 | $3,859.52 |

| State Farm | $3,161.38 | $2,967.50 | $2,811.35 |

| Travelers | $3,897.41 | $3,752.92 | $3,540.18 |

| USAA | $2,200.90 | $2,045.11 | $1,922.75 |

As you can see from the table above, a low coverage plan with Liberty Mutual would cost you $4,179.80 while a high coverage plan with Travelers would only cost $3,897.41. That means you’d be paying $282.39 more for a lower coverage plan.

This is why you should always make sure to compare insurance rates and plans before you sign on the dotted line.

Credit History Rates by Company

Your credit history can affect what your insurance rate will be, as well. The worse your credit history is, the higher your rate will tend to be. Why?

Insurance providers are a business, after all, and while they want to provide the best coverage for their customers, they also want to ensure that at the end of the day that you’ll still reliably pay your premiums.

Making sure you keep on top of your credit history will help to save you hundreds of dollars on your insurance rates.

| Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $5,721.87 | $5,065.11 | $4,037.04 |

| Geico | $6,161.23 | $3,490.89 | $2,606.95 |

| Liberty Mutual | $14,094.18 | $9,029.73 | $7,062.75 |

| Nationwide | $3,397.54 | $2,747.94 | $2,459.66 |

| Progressive | $4,891.94 | $4,170.46 | $3,875.40 |

| State Farm | $3,451.55 | $2,102.98 | $1,581.04 |

| Travelers | $4,233.92 | $3,502.98 | $3,453.60 |

| USAA | $3,914.74 | $2,069.13 | $1,776.60 |

Driving Record Rates by Company

Kind of like with your credit history, the better your driving history is, the better your insurance rates will be. It’s the same reasoning as for your credit history, just with driving. The more reliable of a driver you are, and the less likelihood of you ending up in an accident, the more comfortable insurance providers feel.

| Company | With 1 DUI | With 1 accident | With 1 speeding violation | Clean record |

|---|---|---|---|---|

| Allstate | $5,956.24 | $4,912.99 | $4,726.86 | $4,169.28 |

| Geico | $5,869.23 | $3,856.26 | $4,078.45 | $2,541.48 |

| Liberty Mutual | $5,170.33 | $5,046.99 | $4,442.21 | $3,162.70 |

| Nationwide | $3,574.60 | $2,809.29 | $2,438.23 | $2,202.58 |

| Progressive | $4,267.10 | $4,952.25 | $4,338.27 | $3,692.78 |

| State Farm | $2,949.82 | $3,312.87 | $2,949.82 | $2,707.79 |

| Travelers | $4,688.01 | $3,413.50 | $3,558.80 | $3,260.37 |

| USAA | $2,783.92 | $2,050.45 | $1,785.46 | $1,605.19 |

Number of Insurers

While there are an insurmountable amount of car insurance providers in the United States, there are specifically two kinds you’ll encounter: foreign providers and domestic providers.

What’s the difference between these two?

- Domestic Provider = A provider who is local to the state they provide coverage for, and can only provide coverage for that state

- Foreign Provider = A provider who is located in many different states, and can provide coverage for many different states

In Mississippi, you have the following number of domestic and foreign providers available:

| Number of Licensed Insurers in Mississippi | Number |

|---|---|

| Domestic | 15 |

| Foreign | 907 |

| Total Number of Licensed Insurers | 922 |

Mississippi State Laws

We’ll now move on to the state laws you’ll need to make sure you follow in Mississippi. The last thing that we want is for you to get in trouble for a law you didn’t even know existed!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Laws

We’ll start with car insurance laws in Mississippi. There are several laws regarding insurance in the state you’ll have to abide by to legally drive in the state.

High-Risk Insurance

If you are a high-risk driver, you likely have encountered difficulties in acquiring insurance coverage. A high-risk driver is typically someone with a pretty poor driving record with numerous traffic violations, accidents, and even DUIs.

To legally drive in the state of Mississippi, you’re required to have at least the minimum liability coverage. So what are you to do?

According to Mississippi’s DMV, you have another option known as the Mississippi Automobile Insurance Plan (MSAIP). It’s a program design to assign you to an insurance provider, who will then be required to offer you at least the minimum required liability coverage.

You may qualify for this program as long as you possess both of these two things:

- A valid Mississippi driver’s license

- Current car registration in Mississippi

Once you’ve been accepted into the program, you’ll then be assigned to your insurance provider. The catch to this, however, is that because you are assigned to this provider, they are allowed to charge you whatever rate they deem appropriate to provide you with your coverage.

But if you’ve been continuously declined coverage voluntarily with other insurance providers, this will likely be your last resort.

Low-Cost Insurance

Unfortunately, there is no low-cost insurance plan in Mississippi, but don’t let this discourage you! There are plenty of other ways to save some cash on your insurance policy.

Aside from having a clean driving record and good credit history, you could also apply for car insurance discounts. That’s right, there are hundreds of car insurance discounts out there.

Make sure to check with your insurance company to see if you could apply for some of these common discounts:

- Good driver

- Homeowner

- Anti-Theft/Anti-Lock Systems

- Good Student

- Accident-Free

- Multiple Cars

- Paying in Full

- Company/School (the company you work for/the school you attend sometimes offers discounts)

Windshield Coverage

Having a windshield is kind of important when you’re driving, but a lot of states have very specific requirements for replacing/repairing your windshield.

Luckily for Mississippi citizens, Mississippi is not one such state. There are currently no laws requiring windshield coverage, although a lot of insurance providers offer this coverage as an optional coverage type.

Automobile Insurance Fraud in Mississippi

According to the Insurance Information Institute (III), insurance fraud costs approximately $30 billion in loss each year.

This is precisely why committing insurance fraud is illegal across the United States.

The Insurance Information Institute defines committing insurance fraud as:

- Intentionally faking an accident or making a false claim

- Adding “extra” things onto a legitimate claim

Committing insurance fraud comes with heavy penalties, including hefty fines and even prison time. If you need to report fraud, you can contact Mississippi’s Insurance Department in the following ways:

- Call the Mississippi Insurance Department Consumer Help Line toll free at 800-562-2957

- Call the Insurance Integrity Enforcement Bureau of the Mississippi Attorney General’s Office at 888-528-5780

Statute of Limitations

If you are ever involved in a car accident, you’ll want to know the statute of limitations for submitting any claims from that accident.

The statute of limitations is the legal amount of time you have to bring a claim forward.

The time starts on the day of your accident and goes until the end of that time period for you to submit your claim. The ending date varies depending on which state you live in. If you try to submit a claim past your state’s statute of limitations, it will be immediately thrown out.

How much time do you have in Mississippi?

- Personal Injuries: Three years

- Property Damage: Three years

Make sure to submit any claims you need to submit before time is up.

Vehicle Licensing Laws

Just like with car insurance, there are some laws regarding vehicle licensing you’ll also want to adhere to.

Penalties for Driving Without Insurance

As we’ve stated many times before in this guide, you are required to have at least the minimum liability coverage to legally drive in the state of Mississippi.

What will happen to you if you don’t? Well, you could be facing some of the following penalties if you are caught driving without insurance according to Mississippi’s Insurance Department:

- Fine: $1,000

- Driving Privileges: Suspended for one year or until proof of insurance

This is for each time you are caught without your insurance.

Teen Driver Laws

One of the most exciting times of a teenager’s life is the day they’re able to hop behind the wheel and go out on the open road. But before they can do that, they’re going learn the following rules and regulations for teen drivers:

| Requirements for Getting a License in Mississippi | Time |

|---|---|

| Mandatory Holding Period | 12 months (individuals 17 years and older are exempt) |

| Minimum Supervised Driving Time | None |

| Minimum Age | 16 years old (individuals 17 and older are exempt from the requirement to get an intermediate license) |

There are also some restrictions that younger drivers need to be aware of in Mississippi:

| Restrictions for Restricted Licenses in Mississippi | Time |

|---|---|

| Nighttime Restrictions | 10 p.m.-6 a.m. Sun.-Thur., 11:30 p.m.-6 a.m. Fri.-Sat. |

| Passenger Restrictions (excepting family members) | None |

| Age at which restrictions may be lifted: | |

| Nighttime Restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) |

| Passenger Restrictions | None |

License Renewal Procedures

According to the Insurance Institute for Highway Safety (IIHS), the following license renewal procedures apply to Mississippi citizens:

| Mississippi License Renewal Procedures | General Population | Older Population |

|---|---|---|

| License Renewal Cycle | 4 or 8 years, personal option | 4 or 8 years, personal option |

| Proof of Adequate Vision | No | No |

| Mail or Online Renewal Permitted? | Online, every other renewal | Online, every other renewal |

New Residents

For those of you out there looking to make the Magnolia State your home, there are just a few things you’ll want to make sure you do to get yourself settled.

- Update your driver’s license to a Mississippi driver’s license once you establish residency

- Follow the minimum liability coverage for Mississippi which, as a reminder, is the following:

- 20 = $20,000 for the payment of just one person in an accident that you caused

- 40 = $40,000 for the payment of multiple people in an accident that you caused

- 10 = $10,000 for the payment of any property damage in an accident that you caused

Rules of the Road

Before you get to cruising on the roads of Mississippi, there are a few rules of the road you’ll want to know.

Fault vs. No-Fault

Another topic mentioned earlier in this guide is the fact that Mississippi is considered an “at-fault” state. If you are the one who caused an accident, you (and your insurance provider) are held liable for the costs of that accident.

Ensuring you have at least the minimum liability coverage is vital, as you would be forced to pay out of pocket otherwise.

Keep Right and Move Over Laws

Keep Right and Move Over laws are extremely easy to follow. Keep Right laws in Mississippi state that if you are driving slower than the rest of traffic, you need to keep in the right lane. Move Over laws are just as simple: if you see a vehicle with flashing lights, move over.

These laws protect those trying to keep the roads safe for you, so make sure you abide by them.

Speed Limits

The speed limits in Mississippi, according to the Insurance Institute for Highway Safety (IIHS), are as follows:

- Rural Interstates: 70 mph

- Urban Interstates: 70 mph

- Limited-Access Roads: 70 mph

- All Other Roads: 65 mph

Seat Belt and Car Seat Laws

Mississippi, just like every state, wants to ensure all drivers and passengers on the road are safe. This is why they have several seat belt and car seat laws, to better protect all passengers in the vehicle.

According to both the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS), Mississippi has the following seat belt laws:

| Safety Belt Use | Laws |

|---|---|

| Initial Effective Date | 07/01/94 |

| Primary Enforcement? | Yes; effective 05/27/06 |

| Age/Seats Applicable | 7+ years in all seats |

| 1st Offense - maximum base fine | $25 |

Mississippi also has laws enforcing child seat usage:

| Child Seat Requirements | Laws |

|---|---|

| Must be in child safety seat | 3 years and younger must be in a child restraint; 4 through 6 years and either less than 57 inches or less than 65 pounds must be in a booster seat |

| Adult Belt Permissible | 6 years and younger who either weigh 65 pounds or more or who are 57 inches or taller |

| 1st Offense Maximum Base Fine | $25 |

| Preference for Rear Seat | Law states no preference for rear seat |

Ridesharing

It’s hard in this day and age to have not heard of ridesharing services such as Uber or Lyft. It’s a convenient travel method in a pinch and can be a great income for those individuals wanting to earn some extra cash.

If you are someone looking to work with a ridesharing company, you’ll want to ensure you have ridesharing coverage.

Currently the only insurance provider that offers ridesharing coverage in Mississippi is State Farm.

So if you do not have coverage under State Farm, you may be required to get an additional policy with State Farm to access this coverage type.

Safety Laws

Besides making sure you get a good deal on your insurance coverage, we want to ensure that you are safe while behind the wheel. Mississippi wants the same thing, which is why they have safety laws in place.

DUI Laws

Drinking and driving has become an epidemic across the United States, with the number of DUI-related fatalities increasing every year. This is why Mississippi has formed some pretty serious laws.

| Mississippi DUI Laws | Limits |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | N/A |

| Criminal Status by Offense | 1st-2nd misdemeanors, 3rd+ felonies with 4th automatic felony carrying 2-10 yrs. in prison |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back / Washout Period | 5 years |

If you are caught drinking and driving, you could be facing some serious consequences.

| Number of Offenses | License Revocation | Jail Time | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 90 days +completion of alcohol safety program unless received IID license | No minimum. 48 hours OR attend victim impact panel | $250-$1000 | Complete alcohol safety program within 1 year |

| 2nd Offense | 2nd in 5 years: 1 year unless traded license for IID only llicense | 2nd in 5 years: 5 days - 1 year AND 10 days-1 year community service | 2nd in 5 years: $600-$1500 | – |

| 3rd Offense | 3rd in 5 years: 3 years after release from incarceration and only then on IID license for 3 years | 3rd in 5 years: 1-5 years | 3rd in 5 years: $2000-$5000 | – |

| 4th Offense | Same as 3rd offense | Same as 3rd offense | Same as 3rd offense | – |

Moral of the story? Don’t drink and drive.

Marijuana-Impaired Driving Laws

In the past decade, the United States has seen numerous states legalize the use of marijuana. This calls into question what kind of driving laws should be enacted around this substance.

This isn’t an issue in Mississippi, as marijuana is still fully illegal in the state. Even having it with you could land you in a lot of trouble.

Distracted Driving Laws

Ever since the dawn of the age of technology, the number of distracted drivers on the road has exploded. It only takes a second of your attention being on your screen for you to get into a car accident.

This exact reason is why Mississippi has the following hand-held bans:

| Ban | Details |

|---|---|

| Hand-held ban | No |

| Young driver cell phone ban | No |

| Texting ban | All drivers |

| Enforcement | Primary |

Mississippi Can’t-Miss Facts

Down to the last section! Before you go, make sure you read some of the can’t-miss facts and statistics of driving in Mississippi.

Vehicle Theft in Mississippi

One of the more unfortunate things to happen to a vehicle owner is for your vehicle to be stolen. To better protect yourself, we’ve made a list of the most popular vehicles to be stolen in Mississippi in the table below:

| Rank | Make/Model | Year of Vehicle | Number of Thefts |

|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 1994 | 286 |

| 2 | Ford Pickup (Full Size) | 2006 | 278 |

| 3 | Nissan Altima | 2015 | 128 |

| 4 | Chevrolet Impala | 2006 | 114 |

| 5 | GMC Pickup (Full Size) | 2000 | 103 |

| 6 | Toyota Camry | 2014 | 94 |

| 7 | Honda Accord | 2007 | 91 |

| 8 | Dodge Pickup (Full Size) | 2005 | 85 |

| 9 | Chevrolet Malibu | 2015 | 73 |

| 10 | Chevrolet Tahoe | 2005 | 68 |

In addition, we’ve found an FBI-conducted study about the number of vehicles stolen per city in Mississippi and put it into the following table:

| City | City Population | Motor Vehicle Thefts |

|---|---|---|

| Aberdeen | 5,473 | 5 |

| Amory | 7,167 | 3 |

| Batesville | 7,417 | 15 |

| Biloxi | 44,744 | 131 |

| Byhalia | 1,270 | 1 |

| Byram | 11,795 | 16 |

| Cleveland | 12,174 | 12 |

| Columbia | 6,430 | 0 |

| D'Iberville | 10,123 | 19 |

| Flowood | 8,249 | 6 |

| Fulton | 3,984 | 1 |

| Gautier | 18,532 | 34 |

| Greenville | 33,119 | 87 |

| Greenwood | 16,112 | 16 |

| Gulfport | 70,863 | 125 |

| Hattiesburg | 47,549 | 90 |

| Horn Lake | 26,670 | 25 |

| Iuka | 3,015 | 1 |

| Jackson | 176,039 | 1054 |

| Laurel | 18,917 | 20 |

| Long Beach | 15,467 | 17 |

| Louisville | 6,500 | 0 |

| Madison | 25,044 | 2 |

| McComb | 12,726 | 35 |

| Meridian | 40,748 | 186 |

| Ocean Springs | 17,479 | 27 |

| Olive Branch | 34,827 | 36 |

| Pascagoula | 22,217 | 45 |

| Pass Christian | 5,020 | 7 |

| Petal | 10,902 | 7 |

| Philadelphia | 7,488 | 4 |

| Picayune | 10,840 | 20 |

| Poplarville | 2,816 | 1 |

| Ridgeland | 24,319 | 15 |

| Southaven | 50,801 | 56 |

| Starkville | 24,519 | 11 |

| Vicksburg | 23,318 | 70 |

| West Point | 11,179 | 1 |

| Wiggins | 4,535 | 3 |

Dangers on the Road in Mississippi

The statistics no one wants to know are about road-related fatalities, but we feel it’s important to cover. It’ll give you an idea as to what you should be watching out for while out on the roads in Mississippi.

The statistics below are according to the National Highway Traffic Safety Administration (NHTSA).

Fatal Crashes by Weather Condition and Light Condition

How well you can see the road in front of you, as well as what the weather is like, can affect how you navigate the road.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 273 | 60 | 196 | 16 | 0 | 545 |

| Rain | 30 | 4 | 10 | 1 | 0 | 45 |

| Snow/Sleet | 0 | 1 | 1 | 0 | 0 | 2 |

| Other | 1 | 1 | 12 | 2 | 0 | 16 |

| Unknown | 2 | 0 | 3 | 0 | 1 | 6 |

| TOTAL | 306 | 66 | 222 | 19 | 1 | 614 |

Traffic Fatalities

In the following table, we’ve gone through and displayed all of the traffic fatalities seen in Mississippi.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 6 | 11 | 2 | 3 | 4 |

| Alcorn | 5 | 9 | 10 | 5 | 10 |

| Amite | 4 | 7 | 5 | 6 | 4 |

| Attala | 5 | 2 | 9 | 5 | 3 |

| Benton | 3 | 4 | 1 | 3 | 6 |

| Bolivar | 9 | 5 | 13 | 8 | 4 |

| Calhoun | 1 | 4 | 5 | 6 | 1 |

| Carroll | 2 | 7 | 4 | 3 | 6 |

| Chickasaw | 4 | 4 | 10 | 2 | 3 |

| Choctaw | 3 | 1 | 0 | 0 | 1 |

| Claiborne | 4 | 3 | 5 | 6 | 5 |

| Clarke | 13 | 6 | 5 | 4 | 6 |

| Clay | 1 | 2 | 5 | 3 | 1 |

| Coahoma | 7 | 9 | 8 | 5 | 7 |

| Copiah | 14 | 7 | 19 | 12 | 11 |

| Covington | 9 | 12 | 13 | 11 | 7 |

| Desoto | 17 | 19 | 24 | 24 | 23 |

| Forrest | 8 | 9 | 15 | 10 | 18 |

| Franklin | 3 | 1 | 3 | 3 | 3 |

| George | 10 | 7 | 11 | 9 | 12 |

| Greene | 2 | 6 | 6 | 4 | 2 |

| Grenada | 15 | 6 | 9 | 8 | 6 |

| Hancock | 8 | 8 | 13 | 13 | 5 |

| Harrison | 24 | 23 | 28 | 21 | 34 |

| Hinds | 28 | 31 | 47 | 46 | 45 |

| Holmes | 8 | 10 | 8 | 3 | 7 |

| Humphreys | 1 | 2 | 1 | 3 | 4 |

| Issaquena | 0 | 2 | 0 | 0 | 0 |

| Itawamba | 6 | 7 | 9 | 10 | 8 |

| Jackson | 18 | 28 | 20 | 27 | 23 |

| Jasper | 6 | 3 | 3 | 11 | 6 |

| Jefferson | 2 | 2 | 2 | 2 | 2 |

| Jefferson Davis | 7 | 4 | 8 | 6 | 3 |

| Jones | 11 | 14 | 19 | 17 | 14 |

| Kemper | 2 | 5 | 6 | 8 | 4 |

| Lafayette | 7 | 2 | 11 | 7 | 13 |

| Lamar | 10 | 6 | 5 | 10 | 11 |

| Lauderdale | 15 | 17 | 10 | 24 | 12 |

| Lawrence | 5 | 4 | 2 | 2 | 6 |

| Leake | 6 | 8 | 11 | 5 | 7 |

| Lee | 19 | 20 | 14 | 19 | 23 |

| Leflore | 5 | 3 | 6 | 6 | 4 |

| Lincoln | 11 | 13 | 8 | 13 | 5 |

| Lowndes | 9 | 13 | 7 | 7 | 11 |

| Madison | 6 | 11 | 14 | 17 | 14 |

| Marion | 6 | 12 | 8 | 7 | 5 |

| Marshall | 14 | 14 | 17 | 16 | 17 |

| Monroe | 10 | 5 | 4 | 9 | 6 |

| Montgomery | 3 | 7 | 1 | 4 | 2 |

| Neshoba | 4 | 2 | 8 | 14 | 12 |

| Newton | 8 | 4 | 6 | 6 | 1 |

| Noxubee | 0 | 0 | 0 | 3 | 9 |

| Oktibbeha | 5 | 3 | 7 | 9 | 8 |

| Panola | 15 | 11 | 10 | 12 | 21 |

| Pearl River | 13 | 13 | 17 | 12 | 11 |

| Perry | 2 | 1 | 2 | 4 | 3 |

| Pike | 9 | 11 | 15 | 13 | 20 |

| Pontotoc | 9 | 9 | 9 | 11 | 13 |

| Prentiss | 5 | 6 | 11 | 9 | 6 |

| Quitman | 4 | 1 | 2 | 3 | 3 |

| Rankin | 21 | 18 | 16 | 19 | 22 |

| Scott | 10 | 9 | 8 | 8 | 15 |

| Sharkey | 0 | 0 | 1 | 1 | 3 |

| Simpson | 6 | 8 | 6 | 8 | 8 |

| Smith | 1 | 6 | 0 | 6 | 8 |

| Stone | 4 | 4 | 5 | 3 | 4 |

| Sunflower | 9 | 7 | 6 | 1 | 3 |

| Tallahatchie | 6 | 3 | 2 | 4 | 2 |

| Tate | 7 | 6 | 9 | 13 | 9 |

| Tippah | 4 | 4 | 10 | 8 | 10 |

| Tishomingo | 8 | 5 | 6 | 7 | 11 |

| Tunica | 5 | 7 | 6 | 4 | 4 |

| Union | 8 | 8 | 9 | 5 | 4 |

| Walthall | 6 | 8 | 1 | 3 | 1 |

| Warren | 15 | 6 | 10 | 10 | 12 |

| Washington | 9 | 10 | 8 | 12 | 12 |

| Wayne | 7 | 4 | 4 | 10 | 6 |

| Webster | 6 | 2 | 1 | 3 | 0 |

| Wilkinson | 1 | 4 | 3 | 3 | 1 |

| Winston | 4 | 2 | 3 | 2 | 4 |

| Yalobusha | 4 | 0 | 5 | 4 | 6 |

| Yazoo | 6 | 10 | 7 | 4 | 4 |

Fatalities by Road Type

| Traffic Fatalities by Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 627 | 507 | 506 | 508 | 407 | 519 | 551 | 559 | 533 | 430 |

| Urban | 156 | 193 | 135 | 122 | 175 | 94 | 56 | 118 | 154 | 259 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Total (C-1) | 783 | 700 | 641 | 630 | 582 | 613 | 607 | 677 | 687 | 690 |

As you can see in the table above, rural roads tend to see more road fatalities in Mississippi than urban roads do.

Fatalities by Person Type

Who is driving the vehicle, as well as the type of vehicle involved, can affect what traffic fatalities occur.

| Traffic Fatalities by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 232 | 262 | 257 | 272 | 309 |

| Light Truck - Pickup | 140 | 113 | 161 | 134 | 108 |

| Light Truck - Utility | 94 | 82 | 112 | 110 | 109 |

| Light Truck - Van | 20 | 13 | 14 | 24 | 16 |

| Light Truck - Other | 3 | 5 | 2 | 5 | 2 |

| Large Truck | 17 | 13 | 18 | 13 | 17 |

| Other/Unknown Occupants | 9 | 18 | 7 | 16 | 5 |

| Bus | 0 | 0 | 0 | 0 | 5 |

| Motorcyclists | 39 | 41 | 37 | 50 | 40 |

| Pedestrian | 53 | 53 | 63 | 58 | 71 |

| Bicyclist and Other Cyclist | 6 | 6 | 5 | 5 | 7 |

| Other/Unknown Nonoccupants | 0 | 1 | 1 | 0 | 1 |

| Total Occupants | 515 | 506 | 571 | 574 | 571 |

| Total Nonoccupants | 59 | 60 | 69 | 63 | 79 |

| Total | 613 | 607 | 677 | 687 | 690 |

Fatalities by Crash Type

There are also various types of crashes that can occur, as seen below.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 396 | 366 | 399 | 409 | 375 |

| Involving a Large Truck | 63 | 81 | 72 | 78 | 102 |

| Involving Speeding | 126 | 96 | 96 | 81 | 59 |

| Involving a Rollover | 168 | 151 | 207 | 200 | 174 |

| Involving a Roadway Departure | 382 | 325 | 424 | 432 | 399 |

| Involving an Intersection (or Intersection Related) | 110 | 112 | 104 | 98 | 108 |

| Total Fatalities (All Crashes) | 613 | 607 | 677 | 687 | 690 |

Five-Year Trend For The Top 10 Counties

| Rank | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Hinds County | 28 | 31 | 47 | 46 | 45 |

| 2 | Harrison County | 24 | 23 | 28 | 21 | 34 |

| 3 | Desoto County | 17 | 19 | 24 | 24 | 23 |

| 4 | Jackson County | 18 | 28 | 20 | 27 | 23 |

| 5 | Lee County | 19 | 20 | 14 | 19 | 23 |

| 6 | Rankin County | 21 | 18 | 16 | 19 | 22 |

| 7 | Panola County | 15 | 11 | 10 | 12 | 21 |

| 8 | Pike County | 9 | 11 | 15 | 13 | 20 |

| 9 | Forrest County | 8 | 9 | 15 | 10 | 18 |

| 10 | Marshall County | 14 | 14 | 17 | 16 | 17 |

| Total | 613 | 607 | 677 | 687 | 690 |

Based on the five-year trend above, fatalities, unfortunately, have increased in the above counties.

Fatalities Involving Speeding by County

Speeding is one of the top contenders for avoidable causes of car accidents in the United States, but that doesn’t stop them from occuring.

| County name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 0 | 2 | 1 | 1 | 0 |

| Alcorn | 1 | 0 | 2 | 1 | 0 |

| Amite | 1 | 0 | 0 | 0 | 1 |

| Attala | 1 | 0 | 3 | 0 | 0 |

| Benton | 1 | 0 | 0 | 0 | 1 |

| Bolivar | 2 | 1 | 2 | 2 | 0 |

| Calhoun | 0 | 0 | 0 | 2 | 0 |

| Carroll | 0 | 0 | 0 | 0 | 0 |

| Chickasaw | 0 | 0 | 2 | 1 | 0 |

| Choctaw | 0 | 1 | 0 | 0 | 0 |

| Claiborne | 1 | 1 | 0 | 1 | 0 |

| Clarke | 1 | 2 | 0 | 0 | 0 |

| Clay | 0 | 0 | 1 | 0 | 0 |

| Coahoma | 1 | 0 | 0 | 0 | 0 |

| Copiah | 8 | 1 | 0 | 0 | 0 |

| Covington | 1 | 2 | 3 | 0 | 0 |

| Desoto | 6 | 2 | 4 | 7 | 8 |

| Forrest | 0 | 0 | 1 | 2 | 2 |

| Franklin | 0 | 0 | 0 | 0 | 0 |

| George | 2 | 1 | 0 | 2 | 1 |

| Greene | 0 | 2 | 1 | 1 | 0 |

| Grenada | 2 | 0 | 0 | 0 | 2 |

| Hancock | 2 | 1 | 3 | 0 | 0 |

| Harrison | 8 | 6 | 11 | 3 | 3 |

| Hinds | 4 | 5 | 10 | 8 | 6 |

| Holmes | 0 | 0 | 1 | 0 | 0 |

| Humphreys | 0 | 0 | 0 | 0 | 0 |

| Issaquena | 0 | 2 | 0 | 0 | 0 |

| Itawamba | 0 | 1 | 1 | 0 | 0 |

| Jackson | 5 | 4 | 3 | 5 | 1 |

| Jasper | 0 | 0 | 0 | 2 | 1 |

| Jefferson | 0 | 0 | 0 | 0 | 0 |

| Jefferson Davis | 4 | 1 | 0 | 0 | 0 |

| Jones | 1 | 4 | 4 | 2 | 1 |

| Kemper | 0 | 0 | 2 | 0 | 0 |

| Lafayette | 1 | 0 | 0 | 0 | 0 |

| Lamar | 4 | 3 | 0 | 0 | 0 |

| Lauderdale | 3 | 2 | 3 | 2 | 1 |

| Lawrence | 1 | 1 | 0 | 0 | 0 |

| Leake | 1 | 0 | 3 | 1 | 0 |

| Lee | 5 | 3 | 2 | 0 | 0 |

| Leflore | 0 | 2 | 0 | 0 | 0 |

| Lincoln | 4 | 4 | 1 | 1 | 1 |

| Lowndes | 1 | 4 | 0 | 1 | 0 |

| Madison | 3 | 6 | 4 | 2 | 0 |

| Marion | 0 | 0 | 3 | 0 | 1 |

| Marshall | 2 | 2 | 3 | 2 | 0 |

| Monroe | 3 | 2 | 1 | 3 | 0 |

| Montgomery | 1 | 0 | 0 | 1 | 0 |

| Neshoba | 0 | 0 | 1 | 2 | 1 |

| Newton | 3 | 0 | 1 | 3 | 0 |

| Noxubee | 0 | 0 | 0 | 1 | 1 |

| Oktibbeha | 2 | 0 | 0 | 1 | 0 |

| Panola | 5 | 2 | 0 | 1 | 2 |

| Pearl River | 5 | 3 | 5 | 3 | 1 |

| Perry | 1 | 0 | 0 | 0 | 0 |

| Pike | 0 | 1 | 1 | 3 | 3 |

| Pontotoc | 1 | 0 | 4 | 1 | 1 |

| Prentiss | 0 | 0 | 0 | 1 | 0 |

| Quitman | 1 | 0 | 0 | 1 | 0 |

| Rankin | 4 | 4 | 2 | 2 | 6 |

| Scott | 2 | 2 | 0 | 2 | 1 |

| Sharkey | 0 | 0 | 0 | 0 | 0 |

| Simpson | 1 | 1 | 1 | 2 | 0 |

| Smith | 0 | 1 | 0 | 0 | 1 |

| Stone | 4 | 2 | 0 | 0 | 1 |

| Sunflower | 1 | 0 | 0 | 0 | 0 |

| Tallahatchie | 2 | 0 | 0 | 0 | 0 |

| Tate | 1 | 3 | 0 | 0 | 2 |

| Tippah | 0 | 2 | 1 | 0 | 0 |

| Tishomingo | 0 | 1 | 0 | 0 | 1 |

| Tunica | 1 | 0 | 0 | 0 | 0 |

| Union | 1 | 1 | 0 | 0 | 2 |

| Walthall | 0 | 2 | 1 | 0 | 0 |

| Warren | 2 | 1 | 1 | 0 | 1 |

| Washington | 0 | 1 | 1 | 2 | 5 |

| Wayne | 1 | 0 | 1 | 0 | 0 |

| Webster | 3 | 0 | 1 | 1 | 0 |

| Wilkinson | 0 | 0 | 0 | 0 | 0 |

| Winston | 1 | 1 | 0 | 1 | 0 |

| Yalobusha | 3 | 0 | 0 | 1 | 0 |

| Yazoo | 0 | 0 | 0 | 0 | 0 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 4 | 4 | 1 | 1 | 1 |

| Alcorn | 2 | 2 | 1 | 2 | 2 |

| Amite | 2 | 3 | 1 | 2 | 0 |

| Attala | 1 | 0 | 1 | 0 | 0 |

| Benton | 1 | 1 | 1 | 0 | 2 |

| Bolivar | 4 | 2 | 4 | 1 | 1 |

| Calhoun | 1 | 0 | 2 | 2 | 0 |

| Carroll | 0 | 2 | 1 | 1 | 1 |

| Chickasaw | 1 | 2 | 2 | 0 | 1 |

| Choctaw | 0 | 0 | 0 | 0 | 0 |

| Claiborne | 3 | 2 | 3 | 4 | 2 |

| Clarke | 2 | 0 | 1 | 0 | 1 |

| Clay | 1 | 1 | 2 | 1 | 0 |

| Coahoma | 3 | 1 | 2 | 1 | 1 |

| Copiah | 3 | 2 | 4 | 2 | 3 |

| Covington | 3 | 2 | 2 | 0 | 2 |

| Desoto | 5 | 10 | 6 | 4 | 5 |

| Forrest | 3 | 1 | 5 | 2 | 3 |

| Franklin | 1 | 0 | 1 | 0 | 0 |

| George | 4 | 1 | 6 | 2 | 1 |

| Greene | 1 | 1 | 1 | 0 | 1 |

| Grenada | 5 | 1 | 1 | 1 | 0 |

| Hancock | 4 | 1 | 3 | 2 | 1 |

| Harrison | 12 | 6 | 7 | 3 | 10 |

| Hinds | 7 | 9 | 15 | 11 | 8 |

| Holmes | 5 | 2 | 3 | 0 | 2 |

| Humphreys | 1 | 0 | 1 | 0 | 2 |

| Issaquena | 0 | 0 | 0 | 0 | 0 |

| Itawamba | 2 | 1 | 1 | 1 | 3 |

| Jackson | 5 | 6 | 5 | 8 | 6 |

| Jasper | 1 | 1 | 1 | 2 | 1 |

| Jefferson | 1 | 0 | 0 | 0 | 1 |

| Jefferson Davis | 5 | 0 | 1 | 1 | 0 |

| Jones | 4 | 4 | 3 | 0 | 1 |

| Kemper | 1 | 2 | 1 | 3 | 3 |

| Lafayette | 3 | 1 | 3 | 3 | 4 |

| Lamar | 4 | 2 | 0 | 0 | 4 |

| Newton | 2 | 1 | 1 | 1 | 0 |

| Noxubee | 0 | 0 | 0 | 0 | 0 |

| Oktibbeha | 4 | 0 | 1 | 0 | 1 |

| Panola | 6 | 3 | 2 | 2 | 5 |

| Pearl River | 5 | 2 | 4 | 2 | 2 |

| Perry | 2 | 0 | 0 | 0 | 1 |

| Pike | 2 | 5 | 6 | 3 | 4 |

| Pontotoc | 2 | 5 | 2 | 1 | 1 |

| Prentiss | 2 | 2 | 2 | 6 | 4 |

| Quitman | 2 | 1 | 1 | 2 | 0 |

| Rankin | 5 | 6 | 4 | 2 | 1 |

| Scott | 4 | 1 | 2 | 1 | 1 |

| Sharkey | 0 | 0 | 0 | 0 | 1 |

| Simpson | 2 | 2 | 0 | 2 | 2 |

| Smith | 1 | 1 | 0 | 3 | 2 |

| Stone | 3 | 1 | 2 | 2 | 2 |

| Sunflower | 2 | 1 | 1 | 0 | 1 |

| Tallahatchie | 1 | 1 | 1 | 0 | 0 |

| Tate | 1 | 2 | 3 | 6 | 3 |

| Tippah | 1 | 1 | 2 | 1 | 4 |

| Tishomingo | 2 | 1 | 0 | 1 | 3 |

| Tunica | 3 | 3 | 2 | 1 | 1 |

| Union | 4 | 3 | 0 | 0 | 1 |

| Walthall | 1 | 1 | 1 | 2 | 0 |

| Warren | 6 | 2 | 3 | 4 | 1 |

| Washington | 3 | 3 | 1 | 1 | 7 |

| Wayne | 2 | 0 | 1 | 0 | 1 |

| Webster | 1 | 0 | 1 | 0 | 0 |

| Wilkinson | 0 | 2 | 0 | 1 | 0 |

| Winston | 0 | 1 | 1 | 0 | 1 |

| Yalobusha | 3 | 0 | 0 | 0 | 1 |

| Yazoo | 1 | 3 | 3 | 0 | 1 |

Teen Drinking and Driving

The information above does, unfortunately, include teen drivers.

According to Responsibility, approximately 1.8 deaths per a 100,000 population are caused by teen drinking and driving, which is higher than the national average of 1.2 deaths per a 100,000 population.

This is precisely why there are DUI laws put in place, to make sure numbers like this decline.

EMS Response Time

Should you ever be in an accident and need to get to the hospital, knowing what the EMS response times for the area that you’re in can help you know exactly how much time you’ll have to get to safety:

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Urban | 3.96 min | 7.52 min | 30.84 min | 40.99 min | 144 |

| Rural | 3.69 min | 10.48 min | 33.63 min | 47.05 min | 481 |

Transportation

Finally, we’ll give you some of the facts and statistics of transportation in Mississippi.

Car Ownership

On average, Mississippi citizens own two vehicles per household.

Commute Time

According to Data USA, the national average for commute time is 25.5 minutes. This is good news for Mississippi citizens, as their commute times are, on average, approximately 24.4 minutes.

On average, Mississippi citizens spend less time commuting than others across the nation.

Commuter Transportation

Commuters tend to prefer to drive alone, and this is an accurate statement for Mississippi citizens, as on average they drive alone 85.5 percent of the time.

Top City for Traffic Congestion

So, Mississippi citizens have managed to commute less than the average American citizen, but can the same be said for traffic congestion overall?

According to the INRIX scorecard, TomTom, AND Numbeo, Mississippi can rest easy. None of their cities managed to make it onto these traffic congestion scorecards.

Way to go, Mississippi!

You did it. You went through this comprehensive guide like a champ.

If you’re ready to start comparing insurance today, don’t forget to use our FREE online tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.