Liberty Mutual Car Insurance Guide [Data + Expert Review]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Without the aid of a British gecko or a cheerful checkout lady, Liberty Mutual has had to make due. That said, this car insurance provider hasn’t exactly struggled when placed against its competition.

Liberty Mutual recently celebrated its 100th anniversary, and the success of the company doesn’t look like it’s going to stop anytime soon. Maybe that’s just one of the benefits of utilizing the straight-laced Lady Liberty as your business’s mascot.

That said, just because Liberty Mutual affiliates itself with all things red, white, and blue, that doesn’t mean it’s the perfect insurance provider for you.

Sorting through the complexities of car insurance is difficult. Ideally, you need to gather all the information there is about your potential providers together and compare it. It’s through that comparative process, after all, that you’ll learn which provider has your best interests at heart.

The good news is that you don’t have to do that work on your own. Instead, we’ve done it for you. In this guide to Liberty Mutual’s car insurance, we’ll tell you everything you need to know about the company’s:

- Ratings

- Operating history

- Current marketing standing

- Available discounts

- App and website structure

- And more

Can’t wait to get started? You can use our free online tool to start comparing rates in your area.

Let’s get the wheel turning, though, with an introduction to Liberty Mutual and the deals it can offer you.

| Liberty Mutual Auto Insurance | Details |

|---|---|

| Founded | 1912 |

| Premiums Written | 33,831,726 |

| Loss Ratio | 66.77% |

| Contact Info | Liberty Mutual Insurance 175 Berkeley Street Boston, Massachusetts 02116 Customer Service: 1 (888) 398-8924 Website: https://www.libertymutual.com/ |

| Best For | Automobile, home, and life insurance |

Ratings

All car insurance providers are given different ratings by a variety of assessors, including A.M. Best and J.D. Power. These ratings reflect each company’s financial strength, then places that strength in comparison to the company in question’s peers.

When you look at Liberty Mutual’s ratings, then, you’re getting a better idea not only of how the company stands on its own, but how it compares to your other potential providers.

| Agency | Rating |

|---|---|

| AM Best | A |

| Better Business Bureau (California) | A- |

| Moody's | Baa2 |

| S&P | BBB |

| Complaint Index | 21.78 |

| Consumer Reports | Very Good |

| Market Share | $5,295.55 |

But what do all of these ratings mean?

A.M Best

Liberty Mutual receives an “A” rating for A.M. Best. This rating reflects the company’s excellent financial standing in its industry. How is that standing determined, though? A.M. Best takes the company’s loss ratio into account.

A company’s loss ratio reflects its financial commitment to its drivers. A low loss ratio suggests that an insurance company isn’t paying as many claims as it is financially able to. Comparatively, a high loss ratio suggests that the company in question may not be financially stable — but that they are, at least, paying their claims.

When choosing a car insurance provider, you ideally want to work with a company that has a middling loss ratio.

Liberty Mutual, for example, has a 66.77 percent loss ratio — not outstanding, but certainly not anything that would raise eyebrows, either.

Better Business Bureau

Better Business Bureau assigns its company ratings based on a litany of factors. The most important of these factors include the number of complaints a car insurance company receives over the course of a fiscal year.

However, the rating systems also vary from state to state, making it a little difficult to secure an overall average rating for a provider.

That said, Liberty Mutual’s average Better Business Bureau rating comes in at a solid S-. This means that the company can readily support its consumers, even if there are some areas in which it can still grow.

Moody’s Rating

That said, Liberty Mutual doesn’t maintain its positive ratings all across the board. Moody’s Rating actually ranks the company fairly low in terms of its overall system. The highest rating companies can receive on the Moody scale is Aaa, and Liberty Mutual comes in at Baa2.

This lower rating doesn’t spell the doom of Liberty Mutual, of course. It does suggest, though, that investors that partner with Liberty Mutual may endure marginal credit risk.

S&P

S&P is also slow to award Liberty Mutual praise. On a scale that goes all the way up to AAA, Liberty Mutual receives a BBB.

How does that rating break down? S&P assesses a company’s ability to meet its financial responsibilities. A BBB ranking suggests that while Liberty Mutual does meet those responsibilities, economic conditions may make doing so more difficult in the future.

NAIC Complaint Index

Who doesn’t like exploring a company’s list of complaints? While we don’t have all the dirt here, we can explore Liberty Mutual’s complaint index.

| Company Branch | 2018 Complaint Index |

|---|---|

| Liberty Mutual Fire Insurance Company | 1.67 |

| Liberty Mutual Insurance Company | 21.78 |

| Liberty Mutual Mid Atlantic Insurance Company | 0.0 |

| Liberty Mutual Personal Insurance Company | 0.0 |

Now, because Liberty Mutual is a larger car insurance provider, it dredges up more complaints than a mom and pop shop. However, any company’s complaints can still serve as indicators of that company’s weak points.

According to NAIC, Liberty Mutual’s complaint index is fairly low.

J.D. Power

J.D. Power also offers a perspective on Liberty Mutual’s ability to meet its consumers’ needs. Take a look at that breakdown in the table below:

| Rating Factor | Score (Out of 5 Possible Points) |

|---|---|

| Overall Satisfaction | 2 |

| First Notice of Loss | 3 |

| Estimation Process | 3 |

| Repair Process | 3 |

| Rental Experience | 2 |

| Claims Servicing | 2 |

| Settlement | 3 |

Here, Liberty Mutual’s growth potential is made clear. J.D. Power places the company near the bottom of its list of reliable insurance providers. In terms of customer service, the company receives an especially low grade.

What does this mean for you? Liberty Mutual still serves as an entirely viable, top 10 car insurance provider. However, J.D. Power believes that there are other providers who may be able to meet your needs more readily.

Consumer Reports

And let it be said that one source isn’t enough to go on. Compared to J.D. Power, Consumer Reports awards Liberty Mutual a stunning ranking in terms of customer satisfaction.

| Claim Process | Satisfaction Rating |

|---|---|

| Ease of Reaching an Agent | Very Good |

| Simplicity of the Process | Very Good |

| Promptness of the Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Very Good |

| Freedom to Select | Very Good |

| Being Kept Informed of Claim Status | Very Good |

What’s the takeaway from all of this? Liberty Mutual is a fairly standard car insurance provider, in terms of ratings. While you may face some issues with customer service, opinions vary as to whether or not the company can meet its consumers’ needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual History

Now that you have a better understanding of where Liberty Mutual stands, financially, we can move on and look at the history of the company.

Once you develop a better understanding of the approach a company uses to reach its consumer audience, you’ll be able to determine whether or not that company’s strong suits meet your needs.

Market Share

You need to look at a company’s market share to determine at what rate the company in question can build up its revenue. With more revenue comes greater opportunity for resource building, and what business — let alone consumer — doesn’t want that?

| Year | Market Share |

|---|---|

| 2015 | 4.83 % |

| 2016 | 4.97 % |

| 2017 | 5.01 % |

As you can see, Liberty Mutual’s market share has been slowly growing. Slow growth, however, is better than no growth. It also indicates that Liberty Mutual has been able to convert some of its competitor’s clientele, meaning that its deals are — to a point — more appealing than the competition’s.

Business Model

Unlike its competitors, Liberty Mutual maintains a diverse array of business models. If you want to purchase an insurance policy from the company, you’ll be able to do so by:

- Talking with a local agent

- Completing an online form

- Making a phone call

Why the diversity? Because the agents Liberty Mutual employs are independent. This means that they can sell products for Liberty Mutual as well as for other companies. Effectively, independent agents will provide you with honest feedback about the companies you’re considering and are better at securing you the best deal on your car insurance.

Advertising

We’ve already touched on the ways that Liberty Mutual differentiates its ads from its competitors’. However, recent advertising trends have seen the company introduce a cutesy mascot of their own — a commendable, if stoic, Limu Emu.

https://www.youtube.com/watch?v=5ugLWL3G9iQ

For a long while, though, Liberty Mutual relied on straightforward advertising that invoked the Statue of Liberty alongside its “Only Pay For What You Need” motto.

https://www.youtube.com/watch?v=QRREDL59u_o

Investment in the Community

The Liberty Mutual Foundation, established in 2003, allows Liberty Mutual to provide grants to three communities in need. The causes this provider supports alongside its partner fund, the Safeco Insurance Fund, include:

- Accessibility programs for the disabled

- Enrichment and education programs for underprivileged families

- Homelessness programs

The company has, at this point, donated over $52 million dollars to these causes.

This is not the only way Liberty Mutual gives back to its community, though. The company also bolsters its Liberty Torchbearers Program. Through this program, company employees are encouraged to donate their time and money to local causes. Liberty Mutual, in turn, matches the donations its employees give.

Liberty Mutual employees had volunteered over 2,680,844 hours as of 2017.

Liberty Mutual’s Position for the Future

Liberty Mutual is a company looking to grow. It’s made slow progress in the last few years, as can be seen by its market share growth. If the company improves its loss ratio — and according to its financial ratings, it might — then it will likely retain its spot among the nation’s top ten providers.

States of Operation

Liberty Mutual offers its car insurance policies in all 50 states.

Coverage Offered

Now that you have a better understanding of Liberty Mutual’s history, let’s break down Liberty Mutual’s available coverage options.

For basic coverage, you can choose from the following:

- Bodily Injury Liability — if you’re found to be at-fault in an accident, then bodily injury liability insurance helps you pay for the other injured party’s medical bills.

- Property Damage — if you’re found to be the party responsible for property damage in an accident, then property damage insurance helps you replace the other party’s damaged property.

- Med Pay — medical payment coverage protects you and your passengers in case of injury in an accident. Note that this coverage will help you pay ONLY for initial medical treatment costs, including the cost of an ambulance ride, emergency room coverage, and so on. After these initial medical treatments, you’ll need an alternative form of insurance to help you stay in the medical black.

You’ll note that Liberty Mutual doesn’t explicitly offerfull coverage insurance, but that these plans instead allow you to “Only Pay for What You Need.” If you’re looking for more comprehensive coverage, you can consider Liberty Mutual’s add-ons, which include the following:

- Accident Forgiveness — this coverage ensures that your rates won’t rise after your first accident.

- Better Car Replacement — if you total your car, this coverage helps you replace your old car with a car that’s one model year newer and that has fewer than 15,000 miles on the odometer.

- Comprehensive — if your car is damaged by a force of nature (storms, floods, fires, vandalism, or theft), then comprehensive coverage ensures that you’ll be able to afford your repairs or vehicular replacements.

- Collision — if you run into another object, this coverage will help you attend to replacement or repair costs.

- Lifetime Repair Guarantee — after an accident, Liberty Mutual will cover the cost of your repairs, save for their deductibles. Do note, though, that you’ll have to take your car to a shop that’s been approved by the insurance provider to receive this coverage.

- New Car Replacement — while this type of coverage is comparable to better car replacement, Liberty Mutual will instead help you find an entirely new car (one from the present model year) to replace the car that you totaled.

- Original Parts Replacement — if you need individual parts for your car, this coverage will ensure that you get some of the newest, original manufacturer parts available. If those original manufacturer parts aren’t available, then Liberty Mutual will direct you to parts that are equal in quality.

- Rental Car Coverage — if you need to rent a vehicle while yours is being repaired, Liberty Mutual will help you cover the cost of that rental.

- Towing and Labor — Liberty Mutual will send a representative from a towing and labor company to come and help you if you happen to get in an accident on the side of the road.

- Uninsured Motorist Coverage — if you get into an accident with another driver who is under- or uninsured, then this coverage will ensure that they won’t go bankrupt paying off your medical bills or property damage.

Liberty Mutual’s Discounts

Liberty Mutual operates on the ideal of savings. That is, you should only have to purchase as much car insurance as you need to suit your needs.

The discounts that Liberty Mutual makes available to potential drivers fit in with this mindset. Take a look at the discounts you might qualify for below.

| Discount | % Savings |

|---|---|

| Adaptive Cruise Control | 5% |

| Adaptive Headlights | 5% |

| Anti-Lock Brakes | 5% |

| Anti-Theft | 20% (off of comprehensive policy) |

| Daytime Running Lights | 5% |

| Defensive Driver (usually must be 50-years-old or older) | 10% |

| Driver's Ed | 10% |

| Right Track | up to 30% |

| Electronic Stability Control | 5% |

| Federal Employee | 10% |

| Forward Collision Warning | 5% |

| Full Payment | $5 off on monthly processing fee |

| Further Education | 10% |

| Good Student | 22.5% |

| Green (Eco-Friendly, Hybrid) Vehicle | 10% |

| Membership/Group | 10% |

| Military | 4% |

| Multiple Policies | 20% |

| Multiple Vehicles | 10% |

| New Address | 5% |

| New Graduate | 5% |

| Newly Licensed | 5% |

| Newlyweds | 5% |

| Occupation | 10% |

| Recent Retirees | 4% |

| Students and Alumni | 10% |

| Switching Provider | 10% |

| Vehicle Recovery | 35% |

| VIN Etching | 5% |

That said, Liberty Mutual is missing some discounts that other insurance providers consider essential. These discounts include:

| Discounts Not Offered | |

|---|---|

| Continuous Coverage | New Vehicle |

| Discount Student | Non-Smoker/Non-Drinker |

| Early Signing | Occasional Operator |

| Emergency Deployment | On-Time Payments |

| Engaged Couple | Online Shopper |

| Family Legacy | Paperless Documents |

| Family Plan | Renter |

| Farm Vehicle | Roadside Assistance |

| Fast 5 | Safe Driver |

| Garage/Storing | Seat Belt Use |

| Good Credit | Senior Driver |

| Life Insurance | Stable Residence |

| Loyalty | Utility Vehicle |

| Military Garaging | Volunteer |

| Multiple Drivers |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Availability of Coverage

Let’s get to the most important car insurance factor, though: cost. How much will you have to pay to insure your car through Liberty Mutual?

There is no one number that fits everyone. After all, your car insurance premium will depend on several factors, including where you live, how much you drive, and how old you are.

Let’s take a look at how your rate through Liberty Mutual may vary based on these factors.

Liberty Mutual’s State Rates

While the offer of cheaper insurance shouldn’t drive you to move to a new state, it’s worth noting that Liberty Mutual’s coverage does cost less in some areas of the U.S.

| State | Company | Annual Premium | Average Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|---|

| Alabama | Liberty Mutual | $4,005.48 | $438.52 | 10.95% |

| Alaska | Liberty Mutual | $5,295.55 | $1,874.04 | 35.39% |

| Arizona | Liberty Mutual | NA in State | NA in State | NA in State |

| Arkansas | Liberty Mutual | NA in State | NA in State | NA in State |

| California | Liberty Mutual | $3,034.42 | -$654.51 | -21.57% |

| Colorado | Liberty Mutual | $2,797.74 | -$1,078.65 | -38.55% |

| Connecticut | Liberty Mutual | $7,282.87 | $2,663.95 | 36.58% |

| Delaware | Liberty Mutual | $18,360.02 | $12,373.69 | 67.39% |

| District of Columbia | Liberty Mutual | NA in State | NA in State | NA in State |

| Florida | Liberty Mutual | $5,368.15 | $687.69 | 12.81% |

| Georgia | Liberty Mutual | $10,053.44 | $5,086.61 | 50.60% |

| Hawaii | Liberty Mutual | $3,189.55 | $633.91 | 19.87% |

| Idaho | Liberty Mutual | $2,301.51 | -$677.58 | -29.44% |

| Illinois | Liberty Mutual | $2,277.65 | -$1,027.83 | -45.13% |

| Indiana | Liberty Mutual | $5,781.35 | $2,366.38 | 40.93% |

| Iowa | Liberty Mutual | $4,415.28 | $1,434.00 | 32.48% |

| Kansas | Liberty Mutual | $4,784.42 | $1,504.80 | 31.45% |

| Kentucky | Liberty Mutual | $5,930.97 | $735.57 | 12.40% |

| Louisiana | Liberty Mutual | NA in State | NA in State | NA in State |

| Maine | Liberty Mutual | $4,331.39 | $1,378.12 | 31.82% |

| Maryland | Liberty Mutual | $9,297.55 | $4,714.85 | 50.71% |

| Massachusetts | Liberty Mutual | $4,339.35 | $1,660.50 | 38.27% |

| Michigan | Liberty Mutual | $20,000.04 | $9,501.40 | 47.51% |

| Minnesota | Liberty Mutual | $13,563.61 | $9,160.36 | 67.54% |

| Mississippi | Liberty Mutual | $4,455.94 | $791.37 | 17.76% |

| Missouri | Liberty Mutual | $4,518.67 | $1,189.74 | 26.33% |

| Montana | Liberty Mutual | $1,326.11 | -$1,894.73 | -142.88% |

| Nebraska | Liberty Mutual | $6,241.52 | $2,957.84 | 47.39% |

| Nevada | Liberty Mutual | $6,201.55 | $1,339.85 | 21.61% |

| New Hampshire | Liberty Mutual | $8,444.41 | $5,292.64 | 62.68% |

| New Jersey | Liberty Mutual | $6,766.62 | $1,251.40 | 18.49% |

| New Mexico | Liberty Mutual | NA in State | ||

| New York | Liberty Mutual | $6,540.73 | $2,250.85 | 34.41% |

| North Carolina | Liberty Mutual | $2,182.71 | -$1,210.40 | -55.45% |

| North Dakota | Liberty Mutual | $12,852.83 | $8,686.99 | 67.59% |

| Ohio | Liberty Mutual | $4,429.74 | $1,720.03 | 38.83% |

| Oklahoma | Liberty Mutual | $6,874.62 | $2,732.30 | 39.74% |

| Oregon | Liberty Mutual | $4,334.55 | $866.78 | 20.00% |

| Pennsylvania | Liberty Mutual | $6,055.20 | $2,020.70 | 33.37% |

| Rhode Island | Liberty Mutual | $6,184.12 | $1,180.76 | 19.09% |

| South Carolina | Liberty Mutual | NA in State | ||

| South Dakota | Liberty Mutual | $7,515.99 | $3,533.72 | 47.02% |

| Tennessee | Liberty Mutual | $6,206.69 | $2,545.80 | 41.02% |

| Texas | Liberty Mutual | NA in State | NA in State | NA in State |

| Utah | Liberty Mutual | $4,327.76 | $715.87 | 16.54% |

| Vermont | Liberty Mutual | $3,621.08 | $386.95 | 10.69% |

| Virginia | Liberty Mutual | NA in State | NA in State | NA in State |

| Washington | Liberty Mutual | $3,994.73 | $935.41 | 23.42% |

| West Virginia | Liberty Mutual | $2,924.39 | $329.03 | 11.25% |

| Wisconsin | Liberty Mutual | $6,758.85 | $3,152.79 | 46.65% |

| Wyoming | Liberty Mutual | $1,989.36 | -$1,210.72 | -60.86% |

| Median | Liberty Mutual | $5,295.55 | $1,634.66 | 30.87% |

Average Annual Premium in Comparison

| Company | Average Annual Premium |

|---|---|

| Liberty Mutual | $6,073 |

| Allstate | $4,887 |

| Travelers | $4,434 |

| Farmers | $4,194 |

| Progressive | $4,035 |

| American Family | $3,493 |

| Nationwide | $3,450 |

| State Farm | $3,260 |

| Geico | $3,215 |

| USAA | $2,537 |

Liberty Mutual does have an average annual premium that’s significantly more expensive than that of its insurance providing peers, regardless of where you live.

Average Annual Premium by Demographic

Some car insurance myths claim that men pay more for their coverage than women do. This myth is often refuted with an equivalent myth — if women are assumed to be bad drivers, then their car insurance premiums must be higher than men’s.

| Provider | Single 17-year-old Female | Single 17-year-old Male | Single 25-year-old Female | Single 25-year-old Male | Married 35-year-old Female | Married 35-year-old Male | Married 60-year-old Female | Married 60-year-old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 |

| American Family | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 |

| Farmers | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 |

| Geico | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 | $2,302.89 | $2,312.38 | $2,247.06 | $2,283.45 |

| Liberty Mutual | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 |

| Nationwide | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 |

| Progressive | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 |

| State Farm | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 |

| Travelers | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 |

| USAA | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 |

Fun fact: neither myth is true. Age, in fact, has more influence over a person’s available rates than their gender. Teenagers, especially, will have to spend more on their car insurance than older, married drivers.

Average Annual Premium by Coverage Level

The level of coverage you want to take on will also impact your average annual premium.

| Coverage Level | Average Liberty Mutual Rate |

|---|---|

| Low | $5,805.75 |

| Medium | $6,058.57 |

| High | $6,356.04 |

Average Annual Premium by Driving Record

You will also likely see your rates rise if you have points on your license or a history of accidents.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,987.68 | $6,260.73 | $4,483.51 |

| American Family | $2,693.61 | $3,722.75 | $4,330.24 | $3,025.74 |

| Farmers | $3,460.60 | $4,518.73 | $4,718.75 | $4,079.01 |

| Geico | $2,145.96 | $3,192.77 | $4,875.87 | $2,645.43 |

| Liberty Mutual | $4,774.30 | $6,204.78 | $7,613.48 | $5,701.26 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 | $3,113.68 |

| Progressive | $3,393.09 | $4,777.04 | $3,969.65 | $4,002.28 |

| State Farm | $2,821.18 | $3,396.01 | $3,636.80 | $3,186.01 |

| Travelers | $3,447.69 | $4,289.74 | $5,741.40 | $4,260.80 |

| USAA | $1,933.68 | $2,516.24 | $3,506.03 | $2,193.25 |

Liberty Mutual is not especially kind to drivers with poor driving records. Note that if you have a DUI, Liberty Mutual will charge you significantly more for your coverage than its peers. There are a number of reasons not to drink and drive, but this is certainly one of them.

Average Annual Premium by Credit History

Car insurance providers look toyour credit history to determine whether or not you’ll be able to pay them on a consistent basis.

| Group | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $3,859.66 | $4,581.16 | $6,490.65 |

| American Family | $2,691.74 | $3,169.53 | $4,467.98 |

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

| Geico | $2,434.82 | $2,986.79 | $4,259.50 |

| Liberty Mutual | $4,388.18 | $5,604.24 | $8,802.22 |

| Nationwide | $2,925.94 | $3,254.83 | $4,083.29 |

| Progressive | $3,628.85 | $3,956.31 | $4,737.64 |

| State Farm | $2,174.26 | $2,853.00 | $4,951.20 |

| Travelers | $4,058.97 | $4,344.10 | $5,160.22 |

| USAA | $1,821.20 | $2,219.83 | $3,690.73 |

The range between Liberty Mutual’s average costs for drivers with good credit and poor credit is over $4,000.

Average Annual Premium by Commute

You may also be charged more for your coverage if you have a longer commute to work.

| Group | 10 Miles Commute / 6000 Annual Mileage | 25 Miles Commute / 12000 Annual Mileage |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

In this case, if you drive more than 12,000 per year, you’ll be paying more for coverage through Liberty Mutual.

Average Annual Premium by Make and Model

Last but not least, know that the type of car you’re looking to insure will impact your rates.

| Group | 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | 2015 Toyota RAV4: XLE | 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT |

|---|---|---|---|---|---|

| Allstate | $4,429.74 | $4,753.69 | $4,324.99 | $5,491.12 | $5,380.28 |

| American Family | $3,447.30 | $3,178.82 | $3,326.18 | $3,487.91 | $3,721.32 |

| Farmers | $4,093.50 | $4,405.21 | $3,728.22 | $4,390.19 | $4,779.51 |

| Geico | $3,092.11 | $3,092.58 | $3,090.89 | $3,338.40 | $3,338.87 |

| Liberty Mutual | $5,830.16 | $5,869.32 | $5,825.33 | $5,988.85 | $6,682.63 |

| Nationwide | $3,571.01 | $3,547.84 | $3,517.03 | $3,373.64 | $3,361.93 |

| Progressive | $3,914.05 | $4,429.56 | $3,647.22 | $3,962.58 | $4,528.90 |

| State Farm | $3,204.23 | $3,024.24 | $3,226.02 | $3,497.17 | $3,189.99 |

| Travelers | $4,023.47 | $4,420.37 | $4,383.78 | $4,412.42 | $4,661.22 |

| USAA | $2,551.56 | $2,409.67 | $2,454.58 | $2,855.69 | $2,422.66 |

As you can see, the newer your car is, the more expensive it will be to insure. Liberty Mutual, however, is fairly forgiving. While you will see your rates rise, the jump isn’t nearly as severe as those displayed by other companies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to File a Claim

If you get into an accident, you have until your state’s assigned statute of limitations to submit a claim to your insurance provider. Luckily, Liberty Mutual makes it easy for you to do so. You can file a claim with the company through any of the following means:

- By phone, calling 1-844-825-2467

- By mobile app, available for Android and iPhone

- By online claim form

You’ll also need the following materials on hand while filing your claim:

| Paperwork Needed | Details |

|---|---|

| Driver's License | Required |

| Social Security Number | Required |

| Vehicle Information (VIN number) | Required |

| Bank Documents | Credit score MAY be required |

Website Structure

In the era of the Internet, you need a strong website to draw in drivers. The good news is that Liberty Mutual’s platform is easy to use. The homepage provides you with quick access to information about products, services, quotes, claims, and the company itself.

- Car insurance calculators that will determine your coverage needs

- Resources on coverage, car maintenance, and the auto insurance industry

- “Master This,” a guide to car repair and mechanic shopping

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

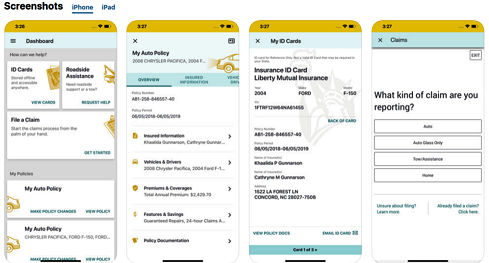

App Structure

Mobility is essential, these days. Liberty Mutual knows this, which is why the provider’s app is available on iPhones, iPads, and all Android devices.

- Pay your related bills

- View your policy and ID cards

- Update your information

- Apply for paperless billing

- Report a claim

- Assess the status of a claim

- Apply to receive text messages about your claim’s status

- Locate approved repair shops

- Take photos after a car accident

Pros and Cons

With all of that information laid out for you, how does Liberty Mutual stand as a car insurance provider?

| Pros | Cons |

|---|---|

| Offers service in U.S. states and globally | Average rates are more expensive than other insurance companies |

| Consumer reports are mostly positive | Loss ratio is a little low |

| Website and app are easy to navigate | Moody's and S&P's ratings could be better |

The long and short of it is this: Liberty Mutual is a company with a lot of room to grow. You’ll be able to take advantage of its many discounts and coverage plans if you choose to work with one of its agents. However, you may not find yourself entirely satisfied, as the provider’s customer satisfaction ratings are a little lower than they could be.

That said, things are on the up and up for this provider. Partnering with them now could lead to good things in your driving future.

FAQ’s

If you have questions about Liberty Mutual and its available insurance, you can find more answers on the provider’s FAQ page. We’ll touch on some of the more pressing questions here.

How do I get an auto quote?

You can receive a quote from Liberty Mutual online. Just do as follows:

- On Liberty Mutual’s home page, select the type of quote you’re interested in

- Enter your zip code into the prompted box

- Liberty Mutual will identify vehicles registered to your name and fill in that information; choose the vehicle you’re looking to insure or add your chosen vehicle manually

- List the names of drivers you want included on your coverage

- Provide Liberty Mutual with a phone number at which you can be reached

- Answer a series of basic questions about your previous insurance policies

- Adjust deductibles and coverage options to your preferred protection level

What is GAP insurance?

GAP insurance is an optional form of car insurance coverage that can help you cover the “gap” between the amount you owe on your car and the amount the car is actually worth, or its actual cash value (ACV).

Should you get in an accident, you’ll be able to use GAP insurance to cover the difference between the amount of money your car is worth now that it’s been damaged and the amount of money you may still owe on an auto loan.

What is an SR-22?

An SR-22 is a certificate of insurance or a form of financial responsibility. This vehicle liability insurance document is only required of drivers who insurance companies like Geico consider to be “high-risk.”

You’ll be considered a high-risk driver if you have an abnormal number of points registered to your driver’s license or if any of the following apply to you:

- You’ve been convicted of a traffic-related offense, like a DUI

- You’ve been in an uninsured car accident and had your license revoked

- You’ve had your license revoked for any other reason

What happens if I’m involved in an accident in another state?

Because Liberty Mutual operates in nearly every state, you should be able to maintain your coverage no matter where you are. However, the nature of individual accidents and state laws may change whether or not you’re determined to be at-fault for an accident or not.

Even so, Liberty Mutual’s liability rates will — in the case of an accident — be modified to match the state minimum liability requirements of the state you got in an accident in. This change will not be a permanent one but will rather only apply to you for as long as a case regarding the accident is ongoing.

Does my deductible still apply even if I’m not at fault?

You may have to pay your deductible even if you’re not at fault depending on what kind of coverage you have. If there’s a chance that Liberty Mutual could recover the amount you paid on your deductible from the person determined to be at-fault in your accident, then the company will do so.

However, if the company does not succeed, you can either choose to try and recover the deductible yourself or pay your deductible as required.

And with that, we’ve come to the end of our guide to Liberty Mutual. If you’re ready to start comparing the car insurance rates available in your area, why not use our FREE online tool?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.