Delaware Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Statistics | Details |

|---|---|

| Miles of Roadway | Total in State: 6,416 Vehicle Miles: 9,931 million |

| Vehicles | Registered: 936,137 Total Thefts: 1,181 |

| Population | 944,107 |

| Most Popular Vehicle | Silverado 1500 |

| Uninsured % / Underinsured % | 11.40% |

| Total Driving Related Deaths | Speeding Fatalities: 33 DUI Fatalities: 32 |

| Full Coverage Average Premiums | Liability: $799.30 Collision: $318.77 Comprehensive: $122.49 Full Coverage: $1,240.57 |

| Cheapest Provider | USAA |

Crammed into a tiny space, Delaware is the second smallest state in America with a landmass of 1,949 square miles and only three counties to drive through. Nonetheless, residents of the First State are well-placed in terms of access to the best around them — beaches, Philly burgers, and the White House.

With a variety of attractions close to home, Delawareans get to drive to different states quite frequently — at times, for work, and more often, for fun. Now that the holiday season is close, you can start planning for your vacation to get the best deals.

Between all the fun and work, you should also think about getting the right auto insurance coverage that protects you from any type of accident while you’re driving in-state or out of state.

We understand that you don’t have the time to conduct in-depth research on the web or otherwise to know what insurance company would work the best for you.

That’s why we are writing this guide to be your one-stop solution for all research related to car insurance.

We will cover what type of coverage is available, how much is the premium rate for different profiles, which companies are the best in Delaware, laws you need to follow to avoid violations, and much more.

If you would like, you can start comparison shopping now by entering your ZIP code in our FREE online tool.

Delaware Car Insurance Coverage and Rates

We will start with the most crucial piece of information which is — the types of coverage you might need and the average rate of insurance in your state.

Though you can get quotes from any insurer by just making a call or going online, you wouldn’t know if those rates are comparable to the state averages. Also, some insurance agents might try to push you just the basic coverage to make a sale, but is that enough for you?

Let’s analyze what is available and what you might need.

Delaware’s Car Culture

Every state has its quirks that are unique and incomprehensible by outsiders. For Delawareans, it’s their love for low-numbered license plates, and they are ready to pay through the roof for those coveted plates.

In 2018, plate number 20 was auctioned for a staggering $410,000 in Delaware. Yes, you read the amount right. For Delawareans, owning a license plate with a few digits is a status symbol, which started a long while ago.

When it comes to car culture, residents of Delaware are practical in their approach and take a car as their mode of transportation mainly.

Minimum Car Insurance Requirements in Delaware

Before delving into the state-mandated minimum coverage requirement, let’s get to know why these laws are in place.

While driving one beautiful day, you’re hit by a motorist without any fault of yours. Now, would it be fair to you if you have to bear all the costs of your medical injury and car damage?

At times, there are errors in judgment by us; however, some motorists engage in reckless driving behavior.

A study pegged the average amount for car accident claim settlement from $14,000 to $28,000 with more severe accidents costing around $31,000.

Every motorist doesn’t have the resources to pay for the damages sustained in accidents. That’s why the state mandates people to buy auto insurance so that you’re covered for expenses from an accident by paying a comparatively smaller fee each month.

Now, we come to the part where the at-fault driver should absorb the responsibility for damages.

Delaware is an at-fault state which means that insurance companies determine fault in an accident to settle claims. Every state requires motorists to mandatorily buy liability coverage to pay for the third-party damages in an accident.

And, therefore, life is comparatively more comfortable as you’re saved from the enormous costs of car accidents.

Delaware mandates motorists to have the following auto coverage on their motor vehicles:

- Bodily injury liability of $25,000 per person and $50,000 per accident

- Property damage liability of $10,000 per accident

- Personal injury protection of $15,000 per person and $30,000 per accident which includes $5,000 in funeral expenses

As we explained earlier, the mandatory liability coverage for bodily injury and property damages would cover the cost of expenses for passengers and pedestrians injured by you.

In Delaware, your basic liability insurance policy covers third-party personal injury expenses to the extent of $25,000 per person with an overall limit of $50,000 for each accident. For property damage, your policy would cover expenses of $10,000 for each accident.

Despite being an at-fault state, Delaware requires all motorists to buy Personal Injury Protection or PIP that covers your medical expenses and lost wages when you’re injured in an accident irrespective of fault.

You can also watch this quick two-minute video to understand liability claims better.

Do note that if you’re asked by a law enforcement officer to produce proof of insurance, you must be able to show your valid insurance identification card. Delaware also allows motorists to show digital copies of their insurance card on their mobile phone or any portable electronic device.

The state minimum coverage helps you to meet the legal requirement for driving a car; however, the policy limits wouldn’t be enough if you’re involved in a major accident.

Premium as a Percentage of Income

Budgeting each month for your regular expenses makes you think at least once about how much are you spending on premiums as a percentage of your income.

If that’s true, you would want to see the average premiums to income ratio in Delaware.

| Particulars | 2012 | 2013 | 2014 |

|---|---|---|---|

| Disposable Income | $38,893 | $38,879 | $40,256 |

| Average Annual Premiums | $1,153.59 | $1,187.18 | $1,215.69 |

| Percentage to Income | 2.97% | 3.05% | 3.02% |

In 2014, Delawareans spent around 3.02 percent of their income on auto insurance premiums which increased slightly from the percentage spent in 2012.

Compared to the premium percentage in District of Columbia, Maryland, and Virginia, the ratio of premiums to income in Delaware is on the higher side. Even in New Jersey, the percentage of premiums to income was 2.76 percent in 2014.

Why are premiums so high in Delaware compared to the average income?

Some of the reasons that make Delaware expensive for car insurance premiums are high population density and the rising number of uninsured motorists in the state.

Another essential factor that might lead to a rise in premiums is the average repair cost in your state.

Delaware ranks 8th for the average cost of car repair in the US, which equals to $387.74 for parts & labor.

Using our in-house calculator, you can also get to know the percentage you’re spending on premiums.

Core Auto Insurance Premiums in Delaware

| Coverage | Average Cost |

|---|---|

| Collision | $318.77 |

| Comprehensive | $122.49 |

| Liability | $799.3 |

| Full Coverage | $1240.57 |

The full coverage average premium in Delaware is $1,240.57, which includes liability, collision, and comprehensive coverage. Including collision and comprehensive coverage in your policy is recommended as you might need these at some point in time.

Now, what exactly is a collision and comprehensive insurance coverage?

You might hit an object while driving, such as poles, mailboxes, another car, or any other valuable object, and you would be required to cover the expenses for repair of that object. If you have collision coverage, your insurer would cover that cost.

Comprehensive coverage helps when your car gets damaged due to situations out of your control, such as fire, vandalism, hurricanes, etc. Events like these are difficult to envision, so adding this option is a good idea.

Additional Liability Coverage in Delaware

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 79.32% | 75.49% | 81.59% |

| Medical Payments | 86.94% | 169.04% | 135.54% |

| Uninsured/Underinsured Motorist Coverage | 71.16% | 85.48% | 85.08% |

Other than the basic coverage mandated by law, motorists can also consider buying Medical Pay and Uninsured/Underinsured Motorist coverage with their policy.

The table illustrates the loss ratio for different coverage options in Delaware. Loss ratio is the percentage of premiums that the insurance companies have settled or paid in claims. If the loss ratio is 80 percent and the premiums earned are $100, then the insurer has spent $80 in claims.

Why is loss ratio important?

Insurance companies tend to profit from premiums by charging a rate higher than what they estimate to settle through claims. For Medical Pay, insurers in Delaware seem to be in financial distress as they are paying out much more in claims than they’re earning through premiums.

PIP is mandatory in Delaware, and it covers your medical expenses, so why should you buy Medical Pay?

You have to assess whether you need Medical Pay as PIP covers both your medical expenses and lost wages. You can either raise the PIP limits or buy Medical Pay, depending on which option is more cost-effective for you.

One salient feature of Medical Pay is that it covers you and your family members from accidents even if you’re in another car or walking somewhere.

Let’s understand more about the inclusions in PIP and Medical Pay from this short video.

https://www.youtube.com/watch?v=Nhjaiz6wzCQ

Add-ons, Endorsements, and Riders in Delaware

You can also consider certain other add-ons and riders that cover specific situations. For instance, if your car is undergoing repair following a covered claim, you might need a rental car for your daily needs. Rental reimbursement covers a rental vehicle or public transportation fare.

Do browse through the available options and assess what you might need.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Usage-Based or Pay-as-you-Drive Insurance in Delaware

Buying auto insurance coverage is mandatory, so you can’t run away from the fixed monthly cost of premiums.

However, insurance companies do offer motorists the option to get discounts through usage-based insurance, also known as pay-as-you-drive insurance.

Using telematics technology, your driving pattern can be tracked, and you’re rewarded at the end of a specified period for safe driving. Usage-based programs were designed to ensure safety on the roads and make the premium rates more fair for good drivers.

Talk to your insurance agent to know if there’s a usage-based program that you can enroll in.

Premium Rates by Demographics in Delaware

| Insurance Provider | Single 17-Year Old Female | Single 17-Year Old Male | Single 25-Year Old Female | Single 25-Year Old Male | Married 35-Year Old Female | Married 35-Year Old Male | Married 60-Year Old Female | Married 60-Year Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $13,198.18 | $15,406.57 | $3,876.03 | $4,113.55 | $3,680.77 | $3,617.49 | $3,230.45 | $3,405.48 |

| Geico Advantage | $6,449.50 | $6,710.85 | $2,798.53 | $2,699.68 | $2,660.39 | $2,952.77 | $2,562.65 | $2,983.93 |

| Liberty Mut Fire Ins Co | $27,326.93 | $41,390.16 | $12,287.48 | $17,022.83 | $12,287.48 | $12,287.48 | $12,138.88 | $12,138.88 |

| Nationwide Mutual | $7,151.92 | $9,060.24 | $3,345.06 | $3,575.26 | $3,017.56 | $2,994.99 | $2,753.71 | $2,742.95 |

| Progressive Direct | $10,102.13 | $11,159.65 | $2,437.17 | $2,371.56 | $1,994.89 | $1,844.62 | $1,754.37 | $1,790.24 |

| State Farm Mutual Auto | $8,048.04 | $10,393.68 | $3,162.14 | $3,294.46 | $2,818.09 | $2,818.09 | $2,600.14 | $2,600.14 |

| Travelers Home & Marine Ins Co | $9,243.54 | $14,106.72 | $1,745.40 | $1,906.92 | $1,634.80 | $1,642.27 | $1,610.37 | $1,568.84 |

| USAA | $4,729.53 | $5,556.07 | $1,615.19 | $1,773.54 | $1,286.77 | $1,265.78 | $1,191.65 | $1,189.30 |

Average premiums help you to get a vague idea of how much you might pay in premiums. In reality, your rates might be significantly different from the state average or someone you know because your personal factors play a huge role in determining rates.

That’s why we have collated premium data by demographics in Delaware.

In the table above, rates are illustrated for males and females in different age groups. USAA is the cheapest provider in the state; however, it’s available only for the members of the U.S. military and their family.

Another important statistics to note here is the premiums charged for single 17-year-old motorists, which is much higher than any other age group. Also, males are charged much more than females.

So, if you’re a teenaged male, you have to find out ways to lower your rates.

Let’s also look at the ranking of these insurance companies by the rates they charge, from most expensive to the cheapest.

| Insurance Provider | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Allstate P&C | Married 35-year old female | $3,680.77 | 25 |

| Allstate P&C | Married 35-year old male | $3,617.49 | 26 |

| Allstate P&C | Married 60-year old female | $3,230.45 | 31 |

| Allstate P&C | Married 60-year old male | $3,405.48 | 28 |

| Allstate P&C | Single 17-year old female | $13,198.18 | 6 |

| Allstate P&C | Single 17-year old male | $15,406.57 | 4 |

| Allstate P&C | Single 25-year old female | $3,876.03 | 24 |

| Allstate P&C | Single 25-year old male | $4,113.55 | 23 |

| Geico Advantage | Married 35-year old female | $2,660.39 | 43 |

| Geico Advantage | Married 35-year old male | $2,952.77 | 36 |

| Geico Advantage | Married 60-year old female | $2,562.65 | 46 |

| Geico Advantage | Married 60-year old male | $2,983.93 | 35 |

| Geico Advantage | Single 17-year old female | $6,449.50 | 20 |

| Geico Advantage | Single 17-year old male | $6,710.85 | 19 |

| Geico Advantage | Single 25-year old female | $2,798.53 | 39 |

| Geico Advantage | Single 25-year old male | $2,699.68 | 42 |

| Liberty Mut Fire Ins Co | Married 35-year old female | $12,287.48 | 7 |

| Liberty Mut Fire Ins Co | Married 35-year old male | $12,287.48 | 7 |

| Liberty Mut Fire Ins Co | Married 60-year old female | $12,138.88 | 10 |

| Liberty Mut Fire Ins Co | Married 60-year old male | $12,138.88 | 10 |

| Liberty Mut Fire Ins Co | Single 17-year old female | $27,326.93 | 2 |

| Liberty Mut Fire Ins Co | Single 17-year old male | $41,390.16 | 1 |

| Liberty Mut Fire Ins Co | Single 25-year old female | $12,287.48 | 7 |

| Liberty Mut Fire Ins Co | Single 25-year old male | $17,022.83 | 3 |

| Nationwide Mutual | Married 35-year old female | $3,017.56 | 33 |

| Nationwide Mutual | Married 35-year old male | $2,994.99 | 34 |

| Nationwide Mutual | Married 60-year old female | $2,753.71 | 40 |

| Nationwide Mutual | Married 60-year old male | $2,742.95 | 41 |

| Nationwide Mutual | Single 17-year old female | $7,151.92 | 18 |

| Nationwide Mutual | Single 17-year old male | $9,060.24 | 16 |

| Nationwide Mutual | Single 25-year old female | $3,345.06 | 29 |

| Nationwide Mutual | Single 25-year old male | $3,575.26 | 27 |

| Progressive Direct | Married 35-year old female | $1,994.89 | 49 |

| Progressive Direct | Married 35-year old male | $1,844.62 | 51 |

| Progressive Direct | Married 60-year old female | $1,754.37 | 54 |

| Progressive Direct | Married 60-year old male | $1,790.24 | 52 |

| Progressive Direct | Single 17-year old female | $10,102.13 | 14 |

| Progressive Direct | Single 17-year old male | $11,159.65 | 12 |

| Progressive Direct | Single 25-year old female | $2,437.17 | 47 |

| Progressive Direct | Single 25-year old male | $2,371.56 | 48 |

| State Farm Mutual Auto | Married 35-year old female | $2,818.09 | 37 |

| State Farm Mutual Auto | Married 35-year old male | $2,818.09 | 37 |

| State Farm Mutual Auto | Married 60-year old female | $2,600.14 | 44 |

| State Farm Mutual Auto | Married 60-year old male | $2,600.14 | 44 |

| State Farm Mutual Auto | Single 17-year old female | $8,048.04 | 17 |

| State Farm Mutual Auto | Single 17-year old male | $10,393.68 | 13 |

| State Farm Mutual Auto | Single 25-year old female | $3,162.14 | 32 |

| State Farm Mutual Auto | Single 25-year old male | $3,294.46 | 30 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $1,634.80 | 57 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $1,642.27 | 56 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $1,610.37 | 59 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $9,243.54 | 15 |

| Travelers Home & Marine Ins Co | Single 17-year old male | $14,106.72 | 5 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $1,745.40 | 55 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $1,906.92 | 50 |

| USAA | Single 17-year old female | $4,729.53 | 22 |

| USAA | Single 17-year old male | $5,556.07 | 21 |

| USAA | Single 25-year old female | $1,615.19 | 58 |

| USAA | Single 25-year old male | $1,773.54 | 53 |

Premium Rates by Zip Code in Delaware

| Zipcode | Average Annual Premiums | Allstate P&C | Geico Advantage | Liberty Mut Fire Ins Co | Nationwide Mutual | Progressive Direct | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 19701 | $6,949.68 | $7,277.45 | $4,024.31 | $21,841.41 | $5,558.03 | $4,399.78 | $5,533.03 | $4,172.74 | $2,790.67 |

| 19702 | $7,071.81 | $7,277.45 | $4,024.31 | $21,841.41 | $5,558.03 | $5,204.62 | $6,015.33 | $3,862.66 | $2,790.67 |

| 19703 | $6,767.07 | $6,736.16 | $4,334.85 | $20,610.11 | $5,336.40 | $4,750.15 | $5,015.02 | $4,505.60 | $2,848.28 |

| 19706 | $7,358.23 | $7,531.58 | $4,594.56 | $22,574.11 | $5,558.03 | $5,162.50 | $6,043.01 | $4,505.60 | $2,896.48 |

| 19707 | $6,339.10 | $7,307.23 | $4,026.75 | $18,084.08 | $4,734.88 | $4,813.21 | $4,838.60 | $4,274.36 | $2,633.66 |

| 19708 | $7,393.19 | $7,277.45 | $4,594.56 | $26,050.32 | $4,734.88 | $4,608.77 | $4,971.52 | $4,274.36 | $2,633.66 |

| 19709 | $6,072.84 | $7,339.89 | $3,368.23 | $18,248.83 | $4,559.54 | $4,428.68 | $4,701.88 | $3,709.07 | $2,226.61 |

| 19710 | $7,199.39 | $7,307.23 | $4,026.75 | $26,050.32 | $4,559.54 | $4,815.06 | $4,971.52 | $3,709.07 | $2,155.61 |

| 19711 | $6,243.07 | $7,309.64 | $4,024.31 | $18,084.08 | $4,734.88 | $4,542.99 | $4,553.09 | $4,088.40 | $2,607.20 |

| 19713 | $6,828.11 | $7,491.14 | $4,024.31 | $21,841.41 | $4,734.88 | $5,100.59 | $4,786.53 | $4,038.80 | $2,607.20 |

| 19716 | $6,296.25 | $7,491.14 | $4,024.31 | $18,084.08 | $4,734.88 | $4,292.53 | $4,971.52 | $4,164.34 | $2,607.20 |

| 19717 | $6,279.80 | $7,309.64 | $4,024.31 | $18,084.08 | $4,734.88 | $4,342.44 | $4,971.52 | $4,164.34 | $2,607.20 |

| 19720 | $7,378.97 | $7,531.58 | $4,594.56 | $22,574.11 | $5,558.03 | $5,209.07 | $6,083.30 | $4,584.67 | $2,896.48 |

| 19730 | $6,354.44 | $7,339.89 | $3,368.23 | $18,248.83 | $5,558.03 | $4,608.77 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19731 | $7,329.63 | $7,339.89 | $3,368.23 | $26,050.32 | $5,558.03 | $4,608.77 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19732 | $7,433.65 | $7,307.23 | $4,026.75 | $26,050.32 | $5,558.03 | $4,815.06 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19733 | $7,549.45 | $7,531.58 | $4,594.56 | $26,050.32 | $5,558.03 | $4,949.30 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19734 | $7,434.79 | $7,109.37 | $3,368.23 | $18,248.83 | $4,559.54 | $4,471.08 | $4,785.00 | $14,780.71 | $2,155.61 |

| 19735 | $6,287.71 | $7,307.23 | $4,026.75 | $18,084.08 | $4,734.88 | $4,815.06 | $4,971.52 | $4,206.58 | $2,155.61 |

| 19736 | $7,863.61 | $7,307.23 | $4,026.75 | $18,084.08 | $4,734.88 | $4,876.62 | $4,971.52 | $16,171.23 | $2,736.58 |

| 19801 | $8,265.76 | $7,592.25 | $5,073.26 | $26,050.32 | $6,076.09 | $5,271.17 | $6,650.09 | $6,423.76 | $2,989.12 |

| 19802 | $8,136.26 | $7,208.58 | $5,073.26 | $26,050.32 | $6,076.09 | $4,753.87 | $6,344.73 | $6,341.42 | $3,241.84 |

| 19803 | $6,372.49 | $7,495.23 | $4,541.61 | $18,084.08 | $4,797.10 | $4,553.22 | $4,672.63 | $3,987.81 | $2,848.28 |

| 19804 | $6,656.56 | $7,524.44 | $4,594.56 | $18,084.08 | $5,572.97 | $5,079.02 | $5,165.81 | $4,242.46 | $2,989.12 |

| 19805 | $7,939.41 | $7,495.23 | $5,073.26 | $26,050.32 | $5,572.97 | $5,271.17 | $5,182.11 | $6,063.95 | $2,806.30 |

| 19806 | $7,806.15 | $7,495.23 | $4,096.13 | $26,050.32 | $4,797.10 | $4,750.71 | $6,384.81 | $6,067.16 | $2,807.76 |

| 19807 | $6,326.10 | $7,307.23 | $4,026.75 | $18,084.08 | $4,797.10 | $4,859.03 | $4,706.43 | $4,206.58 | $2,621.57 |

| 19808 | $6,262.76 | $6,906.82 | $4,026.75 | $18,084.08 | $4,734.88 | $4,570.98 | $4,862.81 | $4,282.11 | $2,633.66 |

| 19809 | $6,824.40 | $6,883.73 | $4,334.85 | $20,610.11 | $5,572.97 | $4,833.40 | $4,796.01 | $4,397.52 | $3,166.59 |

| 19810 | $6,291.90 | $6,883.73 | $4,334.85 | $18,084.08 | $4,734.88 | $4,530.89 | $4,836.82 | $4,179.92 | $2,750.03 |

| 19901 | $5,381.28 | $5,832.22 | $3,476.23 | $16,074.32 | $3,941.48 | $3,922.50 | $4,099.44 | $3,490.80 | $2,213.23 |

| 19902 | $5,356.71 | $6,184.06 | $3,476.23 | $16,074.32 | $3,941.48 | $3,961.72 | $3,931.65 | $3,490.80 | $1,793.40 |

| 19904 | $5,341.88 | $5,816.79 | $3,476.23 | $16,074.32 | $3,941.48 | $3,893.58 | $4,075.94 | $3,345.58 | $2,111.16 |

| 19906 | $5,312.12 | $5,816.79 | $3,476.23 | $16,074.32 | $3,941.48 | $3,878.50 | $3,931.65 | $3,345.58 | $2,032.44 |

| 19930 | $4,953.79 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,579.10 | $3,750.13 | $3,129.09 | $2,160.30 |

| 19931 | $5,351.04 | $5,412.91 | $3,368.23 | $17,098.58 | $3,618.62 | $3,767.81 | $3,931.65 | $3,376.55 | $2,233.99 |

| 19933 | $5,310.53 | $5,412.91 | $3,368.23 | $17,098.58 | $3,618.62 | $3,806.74 | $3,925.01 | $3,226.46 | $2,027.68 |

| 19934 | $5,320.67 | $5,586.31 | $3,476.23 | $16,074.32 | $3,840.72 | $3,922.50 | $4,063.49 | $3,567.87 | $2,033.95 |

| 19938 | $5,648.66 | $7,109.37 | $3,368.23 | $17,351.40 | $3,840.72 | $3,974.06 | $3,954.22 | $3,464.10 | $2,127.16 |

| 19939 | $4,974.65 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,555.71 | $4,016.38 | $3,177.74 | $2,035.63 |

| 19940 | $5,280.34 | $5,072.47 | $3,368.23 | $17,098.58 | $3,618.62 | $3,555.71 | $3,839.96 | $3,455.16 | $2,233.99 |

| 19941 | $5,296.57 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,551.24 | $3,930.90 | $3,324.60 | $2,051.24 |

| 19943 | $5,434.09 | $5,592.47 | $3,368.23 | $17,098.58 | $3,840.72 | $3,970.49 | $4,093.44 | $3,461.26 | $2,047.58 |

| 19944 | $4,964.30 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,588.19 | $3,712.08 | $3,242.07 | $2,160.30 |

| 19945 | $4,966.95 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,555.71 | $3,825.60 | $3,306.95 | $2,035.63 |

| 19946 | $5,438.33 | $5,733.22 | $3,368.23 | $17,098.58 | $3,840.72 | $3,970.31 | $3,980.80 | $3,362.75 | $2,152.01 |

| 19947 | $5,051.49 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,821.10 | $3,842.95 | $3,313.53 | $2,082.21 |

| 19950 | $5,262.52 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,565.87 | $3,866.72 | $3,125.36 | $2,027.68 |

| 19951 | $5,058.86 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,548.04 | $3,931.65 | $3,410.96 | $2,228.05 |

| 19952 | $5,325.34 | $5,429.14 | $3,368.23 | $17,098.58 | $3,840.72 | $3,548.04 | $3,967.94 | $3,343.49 | $2,006.59 |

| 19953 | $5,411.87 | $6,478.64 | $3,368.23 | $16,074.32 | $3,840.72 | $3,974.24 | $3,908.92 | $3,437.11 | $2,212.77 |

| 19954 | $5,367.66 | $5,429.14 | $3,368.23 | $17,098.58 | $3,840.72 | $3,604.09 | $3,924.88 | $3,523.60 | $2,152.01 |

| 19956 | $5,309.29 | $5,072.47 | $3,368.23 | $17,098.58 | $3,618.62 | $3,805.34 | $3,900.52 | $3,376.55 | $2,233.99 |

| 19958 | $4,962.40 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.10 | $3,643.17 | $3,065.55 | $2,068.21 |

| 19960 | $5,300.74 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,575.35 | $3,944.94 | $3,319.81 | $2,051.24 |

| 19961 | $5,351.51 | $6,246.83 | $3,368.23 | $16,074.32 | $3,840.72 | $3,878.50 | $3,931.65 | $3,319.81 | $2,152.01 |

| 19962 | $5,423.18 | $5,586.31 | $3,368.23 | $17,098.58 | $3,840.72 | $3,974.06 | $3,998.38 | $3,362.78 | $2,156.35 |

| 19963 | $5,309.15 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,589.97 | $3,856.77 | $3,359.91 | $2,152.01 |

| 19964 | $5,351.45 | $5,791.83 | $3,368.23 | $16,074.32 | $3,840.72 | $3,962.85 | $3,931.65 | $3,600.03 | $2,241.97 |

| 19966 | $4,971.33 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.10 | $3,870.21 | $3,236.36 | $2,082.21 |

| 19967 | $4,986.08 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,542.67 | $3,931.65 | $3,242.25 | $2,160.30 |

| 19968 | $4,979.39 | $5,429.14 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.32 | $3,739.43 | $3,105.70 | $2,051.24 |

| 19969 | $5,009.19 | $5,429.14 | $3,368.23 | $14,952.41 | $3,618.62 | $3,616.52 | $3,931.65 | $3,105.70 | $2,051.24 |

| 19970 | $4,954.07 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,564.49 | $3,778.49 | $3,242.25 | $2,035.63 |

| 19971 | $4,983.50 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,550.32 | $3,682.00 | $3,215.30 | $2,068.21 |

| 19973 | $5,343.52 | $5,412.91 | $3,368.23 | $17,098.58 | $3,618.62 | $3,819.74 | $3,922.26 | $3,437.43 | $2,070.40 |

| 19975 | $4,956.80 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.10 | $3,744.19 | $3,292.74 | $2,035.63 |

| 19977 | $5,983.51 | $7,109.37 | $3,368.23 | $17,351.40 | $3,941.48 | $3,922.50 | $4,831.43 | $5,188.06 | $2,155.61 |

| 19979 | $5,466.08 | $6,177.89 | $3,368.23 | $17,098.58 | $3,840.72 | $3,962.85 | $3,931.65 | $3,314.76 | $2,033.95 |

| 19980 | $5,279.24 | $5,791.83 | $3,368.23 | $16,074.32 | $3,840.72 | $3,878.50 | $3,931.65 | $3,314.76 | $2,033.95 |

You can also check the premiums for your zip code by searching in the table. Usually, premiums vary by zip code as certain areas with high population density or theft rate are considered riskier by insurance providers.

Premium Rates by City in Delaware

| Zipcode | Average Annual Premiums | Rank | Compared to Average (+/-) | City |

|---|---|---|---|---|

| 19701 | $6,949.68 | 15 | $963.36 | BEAR |

| 19702 | $7,071.81 | 14 | $1,085.49 | NEWARK |

| 19703 | $6,767.07 | 18 | $780.75 | CLAYMONT |

| 19706 | $7,358.23 | 11 | $1,371.91 | DELAWARE CITY |

| 19707 | $6,339.10 | 22 | $352.78 | HOCKESSIN |

| 19708 | $7,393.19 | 9 | $1,406.87 | KIRKWOOD |

| 19709 | $6,072.84 | 30 | $86.52 | MIDDLETOWN |

| 19710 | $7,199.39 | 13 | $1,213.07 | MONTCHANIN |

| 19711 | $6,243.07 | 29 | $256.75 | NEWARK |

| 19713 | $6,828.11 | 16 | $841.79 | NEWARK |

| 19716 | $6,296.25 | 24 | $309.93 | NEWARK |

| 19717 | $6,279.80 | 27 | $293.48 | NEWARK |

| 19720 | $7,378.97 | 10 | $1,392.65 | NEW CASTLE |

| 19730 | $6,354.44 | 21 | $368.12 | ODESSA |

| 19731 | $7,329.63 | 12 | $1,343.31 | PORT PENN |

| 19732 | $7,433.65 | 8 | $1,447.33 | ROCKLAND |

| 19733 | $7,549.45 | 6 | $1,563.13 | SAINT GEORGES |

| 19734 | $7,434.79 | 7 | $1,448.47 | TOWNSEND |

| 19735 | $6,287.71 | 26 | $301.39 | WINTERTHUR |

| 19736 | $7,863.61 | 4 | $1,877.29 | YORKLYN |

| 19801 | $8,265.76 | 1 | $2,279.44 | WILMINGTON |

| 19802 | $8,136.26 | 2 | $2,149.94 | WILMINGTON |

| 19803 | $6,372.50 | 20 | $386.18 | WILMINGTON |

| 19804 | $6,656.56 | 19 | $670.24 | WILMINGTON |

| 19805 | $7,939.41 | 3 | $1,953.09 | WILMINGTON |

| 19806 | $7,806.15 | 5 | $1,819.83 | WILMINGTON |

| 19807 | $6,326.10 | 23 | $339.78 | WILMINGTON |

| 19808 | $6,262.76 | 28 | $276.44 | WILMINGTON |

| 19809 | $6,824.40 | 17 | $838.08 | WILMINGTON |

| 19810 | $6,291.90 | 25 | $305.58 | WILMINGTON |

| 19901 | $5,381.27 | 39 | -$605.05 | DOVER |

| 19902 | $5,356.71 | 41 | -$629.61 | DOVER AFB |

| 19904 | $5,341.88 | 46 | -$644.44 | DOVER |

| 19906 | $5,312.12 | 49 | -$674.20 | DOVER |

| 19930 | $4,953.79 | 71 | -$1,032.53 | BETHANY BEACH |

| 19931 | $5,351.04 | 44 | -$635.28 | BETHEL |

| 19933 | $5,310.53 | 50 | -$675.79 | BRIDGEVILLE |

| 19934 | $5,320.67 | 48 | -$665.65 | CAMDEN WYOMING |

| 19938 | $5,648.66 | 33 | -$337.66 | CLAYTON |

| 19939 | $4,974.65 | 64 | -$1,011.67 | DAGSBORO |

| 19940 | $5,280.34 | 55 | -$705.98 | DELMAR |

| 19941 | $5,296.57 | 54 | -$689.75 | ELLENDALE |

| 19943 | $5,434.10 | 36 | -$552.22 | FELTON |

| 19944 | $4,964.30 | 67 | -$1,022.02 | FENWICK ISLAND |

| 19945 | $4,966.95 | 66 | -$1,019.37 | FRANKFORD |

| 19946 | $5,438.33 | 35 | -$547.99 | FREDERICA |

| 19947 | $5,051.49 | 59 | -$934.83 | GEORGETOWN |

| 19950 | $5,262.53 | 57 | -$723.79 | GREENWOOD |

| 19951 | $5,058.86 | 58 | -$927.46 | HARBESON |

| 19952 | $5,325.34 | 47 | -$660.98 | HARRINGTON |

| 19953 | $5,411.87 | 38 | -$574.45 | HARTLY |

| 19954 | $5,367.66 | 40 | -$618.66 | HOUSTON |

| 19956 | $5,309.29 | 51 | -$677.03 | LAUREL |

| 19958 | $4,962.40 | 68 | -$1,023.92 | LEWES |

| 19960 | $5,300.74 | 53 | -$685.58 | LINCOLN |

| 19961 | $5,351.51 | 42 | -$634.81 | LITTLE CREEK |

| 19962 | $5,423.18 | 37 | -$563.14 | MAGNOLIA |

| 19963 | $5,309.15 | 52 | -$677.17 | MILFORD |

| 19964 | $5,351.45 | 43 | -$634.87 | MARYDEL |

| 19966 | $4,971.33 | 65 | -$1,014.99 | MILLSBORO |

| 19967 | $4,986.07 | 61 | -$1,000.25 | MILLVILLE |

| 19968 | $4,979.39 | 63 | -$1,006.93 | MILTON |

| 19969 | $5,009.19 | 60 | -$977.13 | NASSAU |

| 19970 | $4,954.07 | 70 | -$1,032.25 | OCEAN VIEW |

| 19971 | $4,983.50 | 62 | -$1,002.82 | REHOBOTH BEACH |

| 19973 | $5,343.52 | 45 | -$642.80 | SEAFORD |

| 19975 | $4,956.80 | 69 | -$1,029.52 | SELBYVILLE |

| 19977 | $5,983.51 | 32 | -$2.81 | SMYRNA |

| 19979 | $5,466.08 | 34 | -$520.24 | VIOLA |

| 19980 | $5,279.25 | 56 | -$707.07 | WOODSIDE |

In this table, you can check the rates by your city and compare it with the statewide average premium of $5,986.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Car Insurance Companies in Delaware

Finalizing an insurance provider for your auto insurance requirements is not an easy task; it requires careful analysis and comparison of various factors.

Were you deciding the insurance provider merely based on premium rates until now?

That strategy would have worked if all providers offered the same level of service, which is practically impossible.

And, then there are operational challenges that insurance companies face which might impair their ability to settle your claims in the future. We would provide information about what should matter when you’re finalizing a provider and which companies offer the best rates for different driver profiles.

Financial Ratings of the Leading Insurance Providers in Delaware

| Insurance Company | A.M. Best Rating |

|---|---|

| Allstate Insurance Group | A+ |

| CSAA Insurance Group | A |

| Geico | A++ |

| Hartford Fire & Casualty Group | A+ |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| State Farm Group | A++ |

| Travelers Group | A++ |

| USAA Group | A++ |

Any insurance policy that you buy should protect you until the time you are paying premiums. But, what if your insurance provider doesn’t have the ability to meet its long-term insurance obligations?

Financial meltdowns and bankruptcies happen, and the insurance provider that you choose should have a strong financial backbone to withstand events that might shake the economy.

How would you know if your insurer is financially strong?

By checking the financial ratings from accredited organizations you can confirm the viability of insurance companies. Though there are many credit rating agencies, we would present the ratings from A.M. Best as it focuses on the insurance sector specifically.

A.M. Best is an independent opinion about the financial strength of insurance providers which rates them on a scale of A+ to D. Insurers rated with an A+ or A are well-placed in the market to settle their insurance obligations in the long-term.

When buying insurance, you may choose an insurer below the rating of A but that would involve some degree of risk in the future.

| Insurance Company | A.M. Best Rating |

|---|---|

| Allstate Insurance Group | A+ |

| CSAA Insurance Group | A |

| Geico | A++ |

| Hartford Fire & Casualty Group | A+ |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| State Farm Group | A++ |

| Travelers Group | A++ |

| USAA Group | A++ |

Insurance Companies with Best Customer Ratings in Delaware

How would you know if your financially wealthy insurance provider is prompt with their customer service? Because ratings can’t read beyond the financial well-being of an insurance provider.

And, that’s why you need to look at customer reviews from trusted sources.

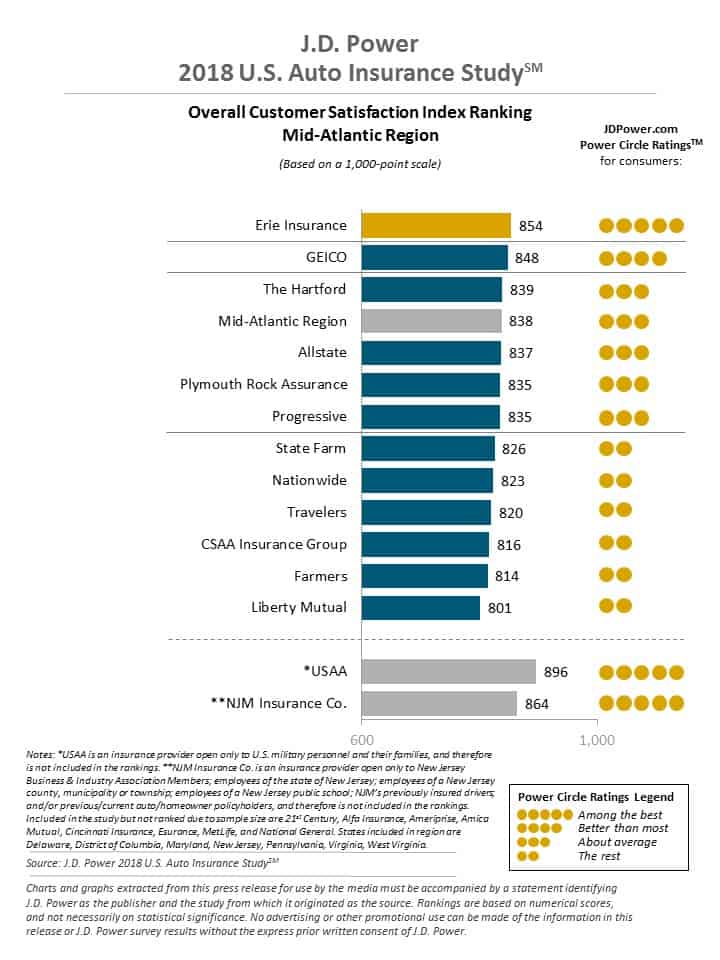

J.D. Power, a global marketing information company, conducts annual surveys to assess customer satisfaction for insurance providers. As per their 2018 U.S. Auto Insurance Study, Erie Insurance earned 854 points on a 1,000 point scale making it the highest-rated company in the Mid-Atlantic region.

Complaint Numbers of Leading Insurers in Delaware

| Insurance Company | Complaint Numbers |

|---|---|

| Allstate Insurance Group | 163 |

| CSAA Insurance Group | 6 |

| Geico | 333 |

| Hartford Fire & Casualty Group | 9 |

| Liberty Mutual Group | 222 |

| Nationwide Corp Group | 25 |

| Progressive Group | 120 |

| State Farm Group | 1482 |

| Travelers Group | 2 |

| USAA Group | 296 |

Customers should also check the complaints data against insurers before making a decision because a high number of complaints means that the people aren’t satisfied.

Car Insurance Rates by Providers in Delaware

| Insurance Company | Annual Average Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate P&C | $6,316.07 | $329.74 | 5.22% |

| Geico Advantage | $3,727.29 | -$2,259.04 | -60.61% |

| Liberty Mut Fire Ins Co | $18,360.01 | $12,373.69 | 67.39% |

| Nationwide Mutual | $4,330.21 | -$1,656.11 | -38.25% |

| Progressive Direct | $4,181.83 | -$1,804.50 | -43.15% |

| State Farm Mutual Auto | $4,466.85 | -$1,519.48 | -34.02% |

| Travelers Home & Marine Ins Co | $4,182.36 | -$1,803.97 | -43.13% |

| USAA | $2,325.98 | -$3,660.34 | -157.37% |

Car Insurance Rates by Annual Commute in Delaware

| Insurance Company | 10 miles commute/6000 annual mileage | 25 miles commute/12000 annual mileage |

|---|---|---|

| Allstate | $6,316.06 | $6,316.06 |

| Geico | $3,668.09 | $3,786.48 |

| Liberty Mutual | $17,851.76 | $18,868.27 |

| Nationwide | $4,330.21 | $4,330.21 |

| Progressive | $4,181.83 | $4,181.83 |

| State Farm | $4,314.22 | $4,619.47 |

| Travelers | $4,182.36 | $4,182.36 |

| USAA | $2,301.33 | $2,350.62 |

Insurance providers also offer discounts if you clock a low mileage annually which means that the probability of accidents is lower. Though it’s not necessary that you would get discounts for low mileage, you can always ask your agent.

Some insurers in Delaware, such as Geico, Liberty Mutual, State Farm, and USAA, offer a slightly better rate for commuters who drive less.

Car Insurance Rates by Coverage Level in Delaware

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $5,776.86 | $6,390.63 | $6,780.70 |

| Geico | $3,346.29 | $3,781.75 | $4,053.82 |

| Liberty Mutual | $17,469.29 | $18,149.05 | $19,461.69 |

| Nationwide | $4,306.39 | $4,257.06 | $4,427.19 |

| Progressive | $3,663.70 | $4,231.00 | $4,650.79 |

| State Farm | $4,166.98 | $4,477.15 | $4,756.42 |

| Travelers | $3,961.39 | $4,310.79 | $4,274.89 |

| USAA | $2,177.57 | $2,322.08 | $2,478.30 |

The coverage level you choose also has an impact on your premium rates. If you buy a lower amount of coverage, your premiums tend to be low, as illustrated in the table above.

Though buying a low coverage helps you to lower your rates, do remember that you might have to bear out-of-pocket expenses in the event of a major accident.

Car Insurance Rates by Credit History in Delaware

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $8,105.13 | $5,748.80 | $5,094.26 |

| Geico | $5,781.10 | $3,205.19 | $2,195.57 |

| Liberty Mutual | $24,846.46 | $16,738.18 | $13,495.40 |

| Nationwide | $5,022.69 | $4,170.85 | $3,797.09 |

| Progressive | $4,674.19 | $4,090.99 | $3,780.31 |

| State Farm | $6,836.26 | $3,767.83 | $2,796.45 |

| Travelers | $4,666.75 | $3,851.51 | $4,028.81 |

| USAA | $3,809.76 | $1,841.00 | $1,327.18 |

If you don’t pay your debts on time (which is reflected on your credit score), insurance companies would penalize you through a higher premium rate. Because the truth is they want to make profits and can’t rely on people delaying their payments.

That’s why they charge higher premiums from those with a poor or fair credit history to make up for any future delays in payment.

In the State of Credit survey 2017, the average vantage score of Delawareans was 672 as compared to the national average of 675.

Vantage score is a credit-rating model, developed jointly by Equifax, Experian, and TransUnion, to assess the credit paying ability of consumers. Anyone with a score of 700 and above has a good to excellent ability to pay-off their debts.

Car Insurance Rates by Driving History in Delaware

| Insurance Company | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $5,339.71 | $6,398.38 | $7,464.16 | $6,062.01 |

| Geico | $2,859.02 | $3,960.12 | $4,842.11 | $3,247.89 |

| Liberty Mutual | $14,685.04 | $16,885.42 | $26,825.11 | $15,044.50 |

| Nationwide | $3,454.89 | $3,454.89 | $6,329.52 | $4,081.55 |

| Progressive | $3,602.97 | $4,773.89 | $4,103.13 | $4,247.32 |

| State Farm | $4,048.67 | $4,885.02 | $4,466.85 | $4,466.85 |

| Travelers | $3,563.54 | $3,573.78 | $5,847.26 | $3,744.85 |

| USAA | $1,916.79 | $1,916.79 | $3,280.40 | $2,189.94 |

Motorists with any history of speeding violations, accidents, or DUI are charged a higher rate than those with clean records. Since the probability of a claim depends on how safe you’re on the road, it’s natural for insurance carriers to quote a higher rate for unsafe drivers.

Specifically, for DUI offenses, motorists are charged a much higher rate by most of the insurers as compared to other violations.

Leading Car Insurance Providers in Delaware

| Insurance Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $50,794 | 57.40% | 5.95% |

| CSAA Insurance Group | $13,997 | 120.36% | 1.64% |

| Geico | $149,130 | 83.24% | 17.46% |

| Hartford Fire & Casualty Group | $22,107 | 65.96% | 2.59% |

| Liberty Mutual Group | $65,887 | 66.90% | 7.71% |

| Nationwide Corp Group | $117,716 | 60.95% | 13.78% |

| Progressive Group | $71,536 | 59.97% | 8.37% |

| State Farm Group | $208,113 | 69.02% | 24.36% |

| Travelers Group | $16,349 | 54.73% | 1.91% |

| USAA Group | $65,690 | 82.08% | 7.69% |

Number of Car Insurance Providers in Delaware

| Type of Insurer | Number |

|---|---|

| Domestic | 101 |

| Foreign | 766 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Laws in Delaware

By now, you’re familiar with the coverage requirements in your state and can understand the basic terminology for a car insurance policy. And, you can also research about which insurance carrier to buy a policy from through the knowledge gained in the last section.

How about a refresher of the state laws now?

Along with an understanding of insurance coverage and carriers, its important to know and abide by the laws in your state so that you’re able to minimize your insurance premiums.

Safe driving is your best bet against high premium rates.

Car Insurance Laws in Delaware

Every state implements unique laws for car insurance and determines the regulations based on the specific requirements in a state.

Let’s look at the car insurance laws in Delaware.

Windshield Coverage Laws in Delaware

Safe driving doesn’t only mean following the traffic rules, it also involves the right upkeep of your vehicle. If you’re driving with a cracked or chipped windshield, there’s a probability that the glass might break.

When it comes to windshield laws, Delaware follows the federal law which states that cracks on windshield shouldn’t block the driver’s vision and one crack shouldn’t intersect another crack.

High-Risk Insurance in Delaware

Since it’s mandatory to carry auto insurance in Delaware, you must buy coverage even if you’re denied by every other insurance company because of your poor driving record or credit history.

Motorists with a poor driving record, questionable credit history, bad insurance record, or those who live in a high-risk area can be deined insurance because carriers wouldn’t want to absorb a high-level of risk for individuals.

How can you get coverage if everyone denies you?

Like every other state, Delaware has an assigned risk plan for high-risk drivers known as the Delaware Automobile Insurance Plan (DAIP). Under this plan, all insurance carriers, authorized to carry out business in Delaware, are required to offer coverage to a pool of high-risk drivers in proportion to their market share.

Are the auto insurance premiums high under the plan?

Though premiums are comparatively higher, you can at least get coverage to meet the legal requirements of your state. In the meantime, you can make efforts to improve your record so that you can get coverage in the voluntary market.

Apart from the state assigned plan, you can also check for insurance carriers who specialize in high-risk insurance and offer a more comprehensive coverage than the DAIP.

Steps to become a low-risk driver:

- Enrolling for a defensive driving course can help in getting better at your driving which is the major reason behind the denial of coverage.

- Driving safely and obeying the traffic rules also ensures that you don’t accumulate more points on your record.

- Avoid mixing driving with drinking at all cost.

- Improving your credit score can also lower the risk of untimely premium payments for carriers.

Automobile Insurance Fraud in Delaware

As per estimates, property and casualty insurance frauds led to losses of around $30 billion each year from 2013 to 2017.

How do you think insurance companies manage these losses?

If the risk of frauds from a particular location is high, insurance carriers increase the premium rates for everyone in that location to make up for any losses in the future.

Doesn’t sound fair, right?

That’s why your state laws recommend everyone to stay away from insurance frauds and immediately report any fraudulent activity.

Let’s understand what all falls under fraud:

- Misrepresentation of facts in your application such as the address to benefit from low-rates in a particular location.

- Filing overstated claims with fake receipts of repair or replacement.

- Staging accidents to benefit from the claim settlement money.

- Failing to disclose prior claims or eligible drivers in your household.

Whether you furnish incorrect information or knowingly conceal information from your insurance company, you can be booked for fraud under the state laws.

Statute of Limitations in Delaware

How long do you think you have to file a lawsuit against the at-fault party after an accident?

The state laws enforce a time-limit for filing lawsuits beyond which you aren’t allowed to sue the other party who was responsible for causing an accident.

In Delaware, you have two years from the day of accident to bring a lawsuit for personal injury and property damage because of an accident.

Vehicle Licensing Laws in Delaware

Your license is a document that allows you to drive legally in your state. Keeping in line with the current procedures, new ID requirements, and renewal deadlines would save you a ticket from law enforcement.

For instance, did you know that to enter certain federal facilities and fly in a commercial airline you would need a Real ID soon?

Real ID is a federal effort in conjunction with the state governments to make the identification documents issued by states’ more reliable and secure.

Your DMV in Delaware offers federally-compliant identification cards and driver’s license to all those who bring in the correct documents for revalidation. Once you submit the documents, your new ID would get a fresh, secure look that would allow you to enter federal buildings and take commercial flights.

Penalties for Driving without Insurance in Delaware

Driving without insurance is a costly idea because of two reasons — if you are involved in an accident without insurance, you would have to pay all the expenses out of pocket; if you’re caught by law enforcement without insurance, you would be fined and your license could be suspended.

The crux of the story is that always buy insurance before you hit the road.

If you’re thinking that how much can the fine be for driving without insurance, you should know that it can range from $1,500 to $3,000 depending on how many times you’re caught. Add to that the license suspension period of six months and it could get really expensive to commute.

How does the DMV check for compliance with insurance laws?

The DMV conducts random inspections on vehicles by sending notices to which you have to respond by showing the appropriate proof of insurance. Failure to do so would lead to the suspension of your car registration.

Teen Driver Laws in Delaware

The AAA Foundation of Traffic safety found that distraction is the major cause of accidents amongst teen drivers after a video analysis of in-vehicle event recorders. Some of the reasons that led to these crashes were — cellphone usage, talking to a co-passenger, checking something inside or outside the vehicle, singing to music, personal grooming, and trying to get to an object.

Here’s an interesting video on teen driver safety which will help your kids be more responsible on the road.

Now that we have established that teens can be reckless on the road, if not advised properly, let’s look at the laws for teen driving in Delaware.

The state of Delaware has designed a Graduated Driver License program for teenagers under 18 that requires them to pass a couple of steps to get an unrestricted license.

Level One: Learner’s Permit

To get a Learner’s Permit, an applicant must be at least 16 years old, and less than 18. Teens are required to show a Delaware Driver Education Certificate (Blue Certificate) as proof of successful completion of the driver education course.

Certain restrictions that teens need to follow under the learner’s permit are listed below:

- Teens aren’t allowed to use any kind of electronic device for texting or talking while driving.

- All passengers under 18 and the permit holder must wear a seat belt or be secured in a safety seat.

- During the first year of driving, the permit holder should drive with an adult supervisor and can be accompanied by only one more passenger. Immediate family members are an exception to the passenger restriction regulation.

- The supervising adult must be above 25 with a class D license which has been held for at least five years.

Since the DMV has designed stages for new drivers, there are different restrictions for the first six months and later.

- During the first six months after the permit, teens must be under supervision completely while driving and the supervising adult must certify the mandatory driving time of 50 hours including 10 hours of nighttime driving.

- After six months, teens can drive without any supervision from 6:00 a.m. to 10:00 p.m. However, to drive between 10:00 p.m. and 6:00 a.m., the teen has to be under supervision, with a few exceptions such as driving to church, work, or school activities.

Do remember there are penalties for any violation during this stage. If you break any rule, your license would be suspended for two months on the first offense and for any subsequent offenses, it would be suspended for four months.

Class D Operator’s License

Teens become eligible for a Class D license once they turn 17. The learner’s permit automatically converts to an unrestricted license on the completion of 12 months of driving without any revocations or suspensions.

The newfound freedom to drive is exhilarating but it comes with its own share of responsibilities. The Delaware DMV has a separate section on their website to make this ride smooth for teens.

License Renewal Procedures in Delaware

Driving licenses are issued for a period of eight years in Delaware, with the exception of immigration length, driving privilege card holders, and hazmat holders.

Residents of Delaware, irrespective of their age, should renew their license within 180 days prior to the date of expiration.

Rules of the Road

Rules for driving were devised to make it safe for everyone and by following these you can save yourselves from accidents or violations. Law abiding motorists also enjoy better premium rates from insurance carriers as they are considered less risky.

Let’s look at some basic rules you need to follow while driving.

Fault vs No-Fault

Delaware follows the fault system for auto insurance wherein the at-fault driver is responsible to settle damages sustained by the other motorists/passengers and pedestrians. That’s why buying a liability insurance coverage is mandatory in Delaware.

States that follow the no-fault system require motorists to buy liability as well as personal injury protection coverage so that in the event of an accident, your personal injury cover kicks-in irrespective of who was at fault.

The major difference between at-fault and no-fault systems is the ability to sue the other party which is restricted to a large extent in no-fault states, unless the accident causes a life-altering injury. Pennsylvania and New Jersey, neighbors of Delaware, follow the no-fault system.

Seat Belt and Car Seat Laws in Delaware

Laws in Delaware require all people on the front seat to use the seat belt at all times while the automobile is in motion.

Child restraints:

For the safety of children, the laws in Delaware require all children below eight who weigh less than 66 lbs to be restrained by a child safety seat.

For proper restrainment, the Delaware driver’s manual recommends the safety standards set by The National Highway Traffic Safety Administration (NHTSA) and the American Academy of Pediatrics (AAP).

- Children up to the age of 1: Infants should always be restrained in a rear-facing seat.

- Children between the age of 1 and 3: Keeping your children in a rear-facing seat is recommended for as long as possible until they outgrow the seat as per the height and weight recommendation of the seat manufacturer.

- Children between the age of 4 and 7: It’s time for your kids to be restrained in a forward facing seat until the time they outgrow this one as well and can be put in a booster seat.

- Children between the age of 8 and 12: Children should be placed in a booster seat until they are big enough to be restrained by a seat belt.

Keep Right and Move Over Laws in Delaware

So, it’s illegal to drive slow on the left lane in Delaware and you’re expected to move to the right lanes if you’re driving slower than the rest of the traffic.

In fact, since 2015, law enforcement officers have issued 47 citations to motorists driving slow on the left lane.

And, if you’re thinking you can get by once in a while, do remember that fines for driving slow on the left lane fall somewhere between $25 and $75 for the first offense which increases to $57.50-$95 for subsequent offenses.

Similarly, when you notice an emergency vehicle on your right with flashing lights, you should move one lane to your left if it’s safe to do so or reduce your speed considerably so that it’s safe for law enforcement officers who are stationed there.

Speed Limits in Delaware

| Type of Road | Speed Limit |

|---|---|

| Divided Highways and Four-lane Roads | 55 mph |

| Rural/State-owned Two-lane Roads | 50 mph |

| Urban Four-lane Roads | 35 mph |

| Urban Two-lane Roads | 25 mph |

| Business and Residential Districts | 25 mph |

| School Zones (During school hours) | 20 mph |

Ridesharing Laws in Delaware

Taking an Uber or Lyft during peak office hours is quite common these days, but what happens if you get injured in an accident during your ride?

Though ridesharing companies aren’t subjected to the same regulations as local taxi providers, legislators across America are making efforts to make the ride safer for commuters.

By passing Senate Bill 262, Delaware established insurance regulations for these ridesharing or transportation network companies to ensure safe transportation. The bill requires Uber or Lyft drivers to carry minimum insurance while they’re logged in the app or taking a ride.

- Logged-in the digital network: The driver should carry liability coverage of $50,000 for personal injury per person and $100,000 per incident. For property damage liability, the driver should buy a minimum coverage of $25,000 per incident.

- Engaged in a ride: Since the probability of an accident or claim amount is high during a ride, the regulations require drivers to carry minimum coverage of $1,000,000 for personal injury and property damage.

Automation on the Road

Who doesn’t want to be at the forefront of new technology? Especially, when that technology can solve the traffic congestion problems and help people commute without the need to drive.

Although driverless vehicles aren’t being tested on the highways in Delaware, Governor Carney initiated an advisory council to start discussions about the future of connected and autonomous vehicles.

Safety Laws in Delaware

Wherever people drive, accidents are bound to happen because of a lack of judgment.

However, getting involved in an accident is one thing, but causing harm while knowingly driving under the influence of alcohol or other substances is a serious offense.

Your insurance provider would charge steep premiums if you have a DUI record. Let’s look at the regulations in Delaware for DUI.

DUI Laws in Delaware

Like every other state, Delaware doesn’t take a DUI offense lightly.

For a conviction, a Blood Alcohol Level (BAC) of 0.08 percent and more or the presence of an illegal substance or drug in your vehicle is enough. The DMV also states that you can be arrested if found with a BAC greater than 0.05 percent.

Delaware also follows the “Implied Consent” law for impairment which means that if you drive in the state, you automatically agree to a chemical test for checking the BAC. Any protests against the law would lead to a license suspension depending on the number of offenses you commit.

Penalties for a DUI

The state also levies penalties and jail time for DUI offenses.

| Number of Offense | Fines | Prison Time |

|---|---|---|

| First Offense | $500-$1,500 | Up to 1 year |

| Second Offense | $750 to $2,500 | 60 days to 18 months |

| Third Offense | Up to $5,000 | 1 to 2 years |

DUI Arrests in Delaware

Let’s look at the number of DUI arrests over a period of five years in Delaware.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent | 1120 | 991 | 966 | 902 | 752 |

| New Castle | 1804 | 1589 | 1728 | 1564 | 1449 |

| Sussex | 1644 | 1546 | 1668 | 1732 | 1828 |

| Total | 4568 | 4126 | 4362 | 4198 | 4029 |

Marijuana-Impaired Driving Laws in Delaware

Delaware has a zero-tolerance law for THC and metabolites for all drivers in the state.

Any motorist who’s caught driving while under the influence of a drug or is found with any trace of a recreational or illicit drug in his blood within four hours of driving is deemed guilty of DUI.

For drugged driving, the penalties are severe.

Distracted Driving Laws in Delaware

Since 2011, Delaware’s hands-free mobile phone law is in place which bans all motorists from using smartphones, laptops, tablets, or other portable devices while driving. Also, drivers aren’t allowed to read or write text messages while they’re driving.

If there’s a violation, motorists can be fined $100 on their first offense and between $200 and $300 for subsequent offenses.

Driving in Delaware

Along with the details about the best car insurance companies, laws in your states, and coverage rates, what else matters when it comes to driving?

Fatality rates, number of commuters, vehicle theft, and traffic congestion are some factors that affect your insurance rates and are usually taken into consideration while calculating premiums.

It’s also good to know about these facts and figures so that you can plan your move between cities or zip codes better.

Car Theft in Delaware

| Rank | Make & Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Honda Civic | 2000 | 53 |

| 2 | Honda Accord | 2004 | 43 |

| 3 | Chevrolet Pickup (Full Size) | 2005 | 36 |

| 4 | Ford Pickup (Full Size) | 1999 | 31 |

| 5 | Chevrolet Impala | 2007 | 28 |

| 6 | Nissan Altima | 2006 | 23 |

| 6 | Honda CR-V | 2001 | 23 |

| 8 | Ford Taurus | 2002 | 22 |

| 9 | Toyota Corolla | 2010 | 21 |

| 10 | Toyota Camry | 2012 | 20 |

Honda is the most popular make for theft in Delaware.

Let’s look at the theft data by cities as well.

| City | Motor vehicle theft |

|---|---|

| Bethany Beach | 0 |

| Blades | 1 |

| Bridgeville | 1 |

| Camden | 2 |

| Cheswold | 0 |

| Clayton | 0 |

| Dagsboro | 0 |

| Delaware City | 3 |

| Delmar | 2 |

| Dewey Beach | 1 |

| Dover | 81 |

| Ellendale | 0 |

| Elsmere | 15 |

| Felton | 0 |

| Fenwick Island | 0 |

| Frankford | 1 |

| Georgetown | 5 |

| Greenwood | 0 |

| Harrington | 7 |

| Laurel | 3 |

| Lewes | 1 |

| Middletown | 6 |

| Milford | 7 |

| Millsboro | 2 |

| Milton | 0 |

| New Castle | 9 |

| Newark | 26 |

| Newport | 2 |

| Ocean View | 0 |

| Rehoboth Beach | 0 |

| Seaford | 1 |

| Selbyville | 4 |

| Smyrna | 9 |

| South Bethany | 0 |

| Wilmington | 500 |

| Wyoming | 0 |

Road Fatalities in Delaware

We will also cover details about fatalities in Delaware, with granular information like county-wise data, speeding crashes, and much more.

Fatal Crashes by Weather Condition in Delaware

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 41 | 15 | 38 | 5 | 0 | 99 |

| Rain | 2 | 2 | 8 | 1 | 0 | 13 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 0 | 0 | 0 | 0 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 43 | 17 | 46 | 6 | 0 | 112 |

Fatalities (All Crashes) by County in Delaware

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent County | 14 | 21 | 27 | 31 | 21 |

| New Castle County | 48 | 59 | 63 | 53 | 59 |

| Sussex County | 36 | 44 | 41 | 35 | 39 |

Fatalities by Road Type in Delaware

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 74 | 68 | 65 | 58 | 57 | 51 | 64 | 62 | 69 | 61 |

| Urban | 47 | 48 | 36 | 41 | 57 | 48 | 60 | 69 | 50 | 56 |

Fatalities by Person Type in Delaware

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 30 | 45 | 50 | 42 | 44 |

| Light Truck - Pickup | 6 | 9 | 5 | 8 | 8 |

| Light Truck - Utility | 10 | 13 | 11 | 14 | 14 |

| Light Truck - Van | 4 | 6 | 3 | 8 | 3 |

| Large Truck | 2 | 4 | 2 | 1 | 0 |

| Bus | 1 | 3 | 0 | 0 | 0 |

| Other/Unknown Occupants | 0 | 0 | 1 | 0 | 1 |

| Light Truck - Other | 0 | 0 | 0 | 1 | 0 |

| Total Motorcyclists | 20 | 15 | 19 | 14 | 10 |

| Pedestrian | 25 | 26 | 36 | 27 | 33 |

| Bicyclist and Other Cyclist | 1 | 3 | 3 | 2 | 5 |

| Other/Unknown Nonoccupants | 0 | 0 | 1 | 2 | 1 |

| Total | 99 | 124 | 131 | 119 | 119 |

Fatalities by Crash Type in Delaware

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 99 | 124 | 131 | 119 | 119 |

| Single Vehicle | 51 | 67 | 71 | 71 | 62 |

| Involving a Large Truck | 10 | 12 | 12 | 9 | 14 |

| Involving Speeding | 37 | 45 | 35 | 39 | 33 |

| Involving a Rollover | 13 | 23 | 16 | 20 | 13 |

| Involving a Roadway Departure | 39 | 63 | 48 | 57 | 47 |

| Involving an Intersection (or Intersection Related) | 25 | 26 | 36 | 37 | 39 |

Fatalities Trend of the Past Five Years by Counties in Delaware (Fatalities Per 100,000 Population)

| Counties | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Sussex County | 17.44 | 20.89 | 19.05 | 15.9 | 17.31 |

| Kent County | 8.28 | 12.23 | 15.58 | 17.74 | 11.88 |

| New Castle County | 8.74 | 10.68 | 11.34 | 9.5 | 10.54 |

| Total | 10.59 | 13.26 | 13.88 | 12.49 | 12.37 |

Fatalities Involving Speeding by County in Delaware

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent County | 8 | 5 | 3 | 14 | 8 |

| New Castle County | 13 | 27 | 18 | 12 | 16 |

| Sussex County | 16 | 13 | 14 | 13 | 9 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County in Delaware

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent County | 8 | 10 | 7 | 7 | 10 |

| New Castle County | 16 | 23 | 19 | 16 | 15 |

| Sussex County | 14 | 18 | 14 | 14 | 7 |

Teen Drinking and Driving in Delaware

There’s no tolerance for DUI because your reckless behavior can cause major harm to someone, especially if you’re a teenager.

In 2016, the alcohol-impaired driving fatality rate per 100,000 people for motorists under 21 was 1.7 as against the national average of 1.2 deaths.

EMS Response Time in Delaware

| Type of Road | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Crashes |

|---|---|---|---|---|---|

| Rural | 4.23 | 7.44 | 34.31 | 43.84 | 57 |

| Urban | 4.42 | 5.72 | 21.53 | 30.50 | 54 |

Transportation in Delaware

Nobody likes to be stuck in traffic for long hours while going to the office. So, what’s causing all the delays on the roads.

Let’s take a look at the transportation data. The data for Car Ownership, Commute Time, and Commuter Transportation was sourced from the Census Bureau via DataUSA.io.

Car Ownership in Delaware

Like most of the country, the majority of households (just over 40 percent) in Delaware owns two cars. Slightly more than 20 percent own three cars followed closely by one-car households.

Commute Time in Delaware

The average commute time for motorists in Delaware is 25.1 minutes, slightly lower than the national average of 25.5 minutes. The next most common commute is 30-34 minutes, followed by commutes of 5-14 minutes. Roughly 2.5 percent of commuters have a drive time of 90 minutes or more.

Commuter Transportation in Delaware

How do you think most people reach their office in Delaware?

Of course, by driving on their own. And that’s how most people in America prefer to reach to work. The next most popular transportation options are carpooling, taking public transportation, and walking. About five percent work from home.

Now you’ve got everything you need to drive safely in Delaware. Have we missed anything in our complete guide?

Make sure to compare multiple quotes on our site below to ensure you’ve got the right coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.