Arkansas Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Arkansas Statistics Summary | |

|---|---|

| Road Miles | Total in State: 102,595 Vehicle Miles Driven (in millions): 34,024 |

| Driving Deaths | Speeding – 116 Drunk Driving – 140 |

| Vehicles | Registered: 2,685,739 Total Stolen: 5,601 |

| Population | 3,013,825 |

| Most Popular Vehicle | Sierra 1500 |

| Average Premiums (Annual) | Liability – $394.13 Collision – $321.80 Comprehensive – $190.41 Combined Premiums – $906.34 |

| Percent of Motorists Uninsured | 16.6% State Rank: 9th |

| Cheapest Provider | USAA |

Home to Bill Clinton and the extensive, rugged Ozarks, Arkansas is the hidden gem of the United States. Few other states have as many national parks as this southern state, and driving through it can reveal hundreds of natural secrets.

Explore limestone caves, steamy marshes, and the bustling cities that define Arkansas for everyone who lives there.

If you’re just moving to Arkansas, or if you want to try and drive more efficiently on the state’s roads, digging through the various car insurance options can be a trial. Well, don’t worry. We want to help you really enjoy the expanse of the state you’re living in.

We’ve created a comprehensive guide to Arkansas’s car insurance providers, driver laws, and daily roadside experience that’ll make it easier for you to drive through the Natural State on a daily basis.

You can even start comparing Arkansas car insurance rates today with our FREE online tool. All you have to do is entered your ZIP code to get started.

If you want to dig deep into car insurance in Arkansas, come with us! We’ll make understanding the state’s laws and legalities a little bit easier.

Arkansas Car Insurance Coverage and Rates

When you’re learning something new, it’s best to start with the basics. Let’s take a look at Arkansas’s minimum coverage, available car insurance plans, and the ways the state’s demographic, age, and location variables can impact your rates.

Arkansas Minimum Coverage

Arkansas, like all of the other states in the United States, requires that its drivers at least have a minimum amount of coverage before they get out onto the road. Take a look at Arkansas’s breakdown below:

| Insurance Required | Minimum Limits: 25/50/25 |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

| Personal Injury Protection (optional) | $5,000 minimum |

It’s important to acknowledge these minimum requirements before Arkansas is an at-fault state.

What does that mean? Well, if you get into an accident in an at-fault state, one driver will be determined to be “at-fault.” That driver will then have to take on the costs of the entire accident. If you don’t have state minimum coverage, then an accident can make your bank account suffer.

When you have liability coverage, you can ensure that everyone involved in a car accident receives the compensation that they’re due.

As we touch on in the chart below, you can break down Arkansas’s minimum liability coverage as follows:

- $25,000 – to cover the injury or death of a single person in a car accident where you’re found to be at-fault

- $50,000 – to cover the injuries or deaths or more than one person in a car accident wherein you’re found to be at-fault

- $25,000 – to cover the recovery or repair of any property that was damaged in an accident wherein you’re found to be at-fault

Keep in mind the fact that these minimum rates take care of other people’s injuries or property damage. You should also note that, in the state of Arkansas, you’re required to have $5,000 minimum of no-fault coverage, or personal injury protection (PIP),

We’ll touch a little more on PIP and MedPay in a little bit, but this kind of coverage will protect you should you be in a wreck.

Forms of Financial Responsibility in Arkansas

Arkansas residents like yourself who happen to get in an accident are required by the state to fill out a Safety Responsibility (SR-1) accident form. In addition to this paperwork, you’ll have to submit proof of insurance to the state within 30 days of your accident.

You won’t have to submit proof of insurance if the property damage that the accident caused exceed $1,000 or if the other person involved has been injured or died.

Because proof of insurance is so important to the legalities of driving in Arkansas, you’ll want to keep some version of it in your glove box whenever you’re driving. That said, the state of Arkansas does not require you to have proof of insurance on you while driving. Rather, it’s better to be safe than sorry.

More importantly, you’ll want to have a copy of an SR-1 on your person or in your glove box in case you get in an accident. It’s better to have this paperwork on you so you can fill it out quickly — without the appropriate compensation, the $1,000 that the state allows can disappear in the blink of an eye.

Premiums as a Percentage of Income in Arkansas

State minimum coverage comes in handy, but more often than not you’ll want to have more to protect you while you’re on the road.

As such, you’ll need to know how much it’ll cost you to maintain car insurance over the course of a year.

As of 2014, the state of Arkansas reported that its residents’ annual per capita disposable income — the amount of money residents had to spend after they paid their taxes — came in at about $33,929.

Divvy that number by 12, and Arkansas residents have roughly $2,827 to spend on utilities, groceries, mortgages, and yes, car insurance every month.

That may seem like a reasonable amount of money to work with, but you need to consider how much the coverage you want costs in Arkansas. In general, residents pay roughly $900 a year for their preferred car insurance coverage — a generous 2.7 percent of a resident’s DPI.

Naturally, then, you’ll want to be careful when choosing the best car insurance coverage for your lifestyle.

Core Coverage

There are a variety of different types of coverage available to you as a resident of Arkansas, as you can see in the table below:

| Coverage Type: | Annual Costs in 2015: |

|---|---|

| Collision | $321.80 |

| Comprehensive | $190.41 |

| Liability | $394.13 |

| Combined | $906.34 |

This data is provided by the National Association of Insurance Commissioners, though it dates back to 2015. It should be noted that the rates listed alongside these types of coverage are going to be much higher as of 2019 and beyond.

These coverage types all extend beyond the minimum coverage that the state of Arkansas requires, and they can go far to protect you if you happen to be declared “at-fault” after an accident.

Additional Liability

You can also shore up your car insurance by seeking out additional liability. You can gauge the reliability of these types of insurance by taking their loss ratios into account.

Loss ratios that are higher than average — say, ranging from 80 percent and above — indicate that a car insurance company is willing to pay out on the claims you may issue. These companies, however, also put themselves at financial risk.

Car insurance companies with lower loss ratios are more financially secure, of course, but they are also less likely to pay out on their claims.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 84% | 78% | 69% |

| Uninsured/Underinsured Motorist | 68% | 69% | 68% |

The types of car insurance listed above — Med Pay and Uninsured or Underinsured Motorist coverage — aren’t required by the state of Arkansas. However, they’ll support you if you happen to get in an accident in Arkansas.

These types of insurance are especially important to consider given that Arkansas ranks 9th in the United States for uninsured or underinsured drivers.

Add-ons, Endorsements, and Riders

There are other ways you can expand on your car insurance coverage. Take a look at some of the most cost-effective extensions below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

You can integrate these types of car insurance into your coverage fairly easily, depending on which coverage provider you opt to work with. Don’t let the research process intimidate you! You’ll find that doing your research helps you save money in the long run.

Males vs. Female Drivers in Arkansas

If you’re worried about the rates you’ll have to pay, know for a fact that there are some statistics that’ll impact how much car insurance companies charge you for your coverage. It’s a car insurance myth that your gender will influence the expense of your rate.

Supposedly, women receive cheaper rates than their male counterparts. If you take a look at the data below, though, you’ll see that’s not quite true.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,908.00 | $2,928.74 | $2,593.49 | $2,774.39 | $10,596.85 | $12,699.62 | $3,211.86 | $3,487.30 |

| Farmers Ins Co | $2,316.82 | $2,306.44 | $2,070.77 | $2,176.91 | $9,693.38 | $10,046.95 | $2,654.22 | $2,797.50 |

| Geico General | $2,536.43 | $2,508.78 | $2,340.15 | $2,274.76 | $6,588.67 | $6,607.80 | $2,492.72 | $2,527.69 |

| Nationwide Mutual | $2,629.04 | $2,679.98 | $2,359.97 | $2,495.08 | $6,363.21 | $8,114.04 | $3,008.14 | $3,244.81 |

| Progressive NorthWestern | $2,820.71 | $2,675.07 | $2,318.03 | $2,422.91 | $11,868.05 | $13,373.52 | $3,372.76 | $3,645.70 |

| Safeco Ins Co of IL | $2,324.12 | $2,488.44 | $2,220.47 | $2,477.39 | $8,280.70 | $9,115.49 | $2,511.18 | $2,626.04 |

| State Farm Mutual Auto | $1,757.39 | $1,757.39 | $1,571.32 | $1,571.32 | $5,051.46 | $6,355.63 | $1,979.45 | $2,268.23 |

| Travelers Home & Marine Ins Co | $2,222.90 | $2,265.25 | $2,194.96 | $2,201.72 | $12,955.34 | $20,822.43 | $2,377.54 | $2,746.50 |

| USAA | $1,336.55 | $1,349.38 | $1,240.31 | $1,248.11 | $4,210.03 | $4,407.45 | $1,721.30 | $1,855.30 |

Age, in fact, contributes to the rate you’ll receive more so than your gender. Younger drivers are charged higher car insurance rates than their older, married counterparts. Of course, though, these rates will change depending on the provider you’re interested in working with.

Arkansas ZIP Codes

The county in which you live in Arkansas also alters the car insurance rates that different providers will offer you. Urban areas, as you might expect, tend to have higher rates than rural ones.

Take a look at the table below and see for yourself the ways that these rates can vary.

| ZIP Code | Highest Average Rate | ZIP Code | Lowest Average Rate |

|---|---|---|---|

| 72202 | $4,957.15 | 72626 | $3,675.93 |

| 72204 | $4,910.68 | 72687 | $3,701.73 |

| 72201 | $4,910.28 | 72634 | $3,706.66 |

| 72209 | $4,824.25 | 72761 | $3,714.85 |

| 72206 | $4,813.84 | 72619 | $3,719.26 |

| 72332 | $4,759.29 | 72941 | $3,727.89 |

| 72205 | $4,748.91 | 72768 | $3,730.83 |

| 72114 | $4,747.38 | 72745 | $3,732.84 |

| 72342 | $4,725.99 | 72653 | $3,733.80 |

| 72390 | $4,698.75 | 72635 | $3,737.78 |

| 72169 | $4,681.81 | 72633 | $3,740.11 |

| 72227 | $4,667.26 | 72719 | $3,740.12 |

| 72355 | $4,660.25 | 72658 | $3,744.24 |

| 71759 | $4,632.65 | 72951 | $3,746.65 |

| 72210 | $4,617.77 | 72642 | $3,750.39 |

| 72369 | $4,603.82 | 72840 | $3,752.32 |

| 71823 | $4,602.56 | 72758 | $3,753.45 |

| 72312 | $4,594.10 | 72712 | $3,756.99 |

| 72322 | $4,591.51 | 72747 | $3,760.25 |

| 72211 | $4,574.12 | 72601 | $3,760.28 |

| 72374 | $4,570.51 | 72661 | $3,760.68 |

| 72366 | $4,559.19 | 72832 | $3,761.40 |

| 72135 | $4,559.09 | 72820 | $3,763.31 |

| 72462 | $4,558.66 | 72644 | $3,764.03 |

| 72383 | $4,554.58 | 72830 | $3,764.38 |

| 72037 | $4,554.52 | 72839 | $3,766.14 |

| 72223 | $4,533.10 | 72943 | $3,766.31 |

| 72212 | $4,518.98 | 72733 | $3,768.92 |

| 72207 | $4,514.46 | 72903 | $3,772.41 |

| 72328 | $4,508.83 | 72735 | $3,773.59 |

| 72360 | $4,494.46 | 72937 | $3,775.02 |

| 71646 | $4,493.87 | 72949 | $3,775.82 |

| 72367 | $4,492.81 | 72734 | $3,777.59 |

| 72333 | $4,478.22 | 72821 | $3,778.37 |

| 71601 | $4,473.72 | 72636 | $3,778.47 |

| 72065 | $4,472.74 | 72801 | $3,779.21 |

| 72103 | $4,467.04 | 72651 | $3,786.15 |

| 72180 | $4,442.86 | 72936 | $3,788.31 |

| 71675 | $4,442.85 | 72682 | $3,788.34 |

| 71635 | $4,441.80 | 72847 | $3,788.68 |

| 72118 | $4,441.33 | 72715 | $3,790.40 |

| 71603 | $4,440.98 | 72722 | $3,792.36 |

| 72389 | $4,440.61 | 72729 | $3,792.99 |

| 71663 | $4,437.39 | 72908 | $3,793.25 |

| 72132 | $4,435.04 | 72732 | $3,793.96 |

| 72113 | $4,433.50 | 72742 | $3,794.09 |

| 71654 | $4,432.27 | 72714 | $3,794.62 |

| 72376 | $4,431.21 | 72615 | $3,794.88 |

| 71667 | $4,425.08 | 72923 | $3,798.08 |

| 72142 | $4,416.88 | 72959 | $3,803.91 |

| 71666 | $4,415.56 | 72769 | $3,804.01 |

| 71676 | $4,412.43 | 72744 | $3,805.26 |

| 72183 | $4,409.46 | 72756 | $3,805.92 |

| 72348 | $4,406.93 | 72855 | $3,805.98 |

| 72311 | $4,402.16 | 72631 | $3,810.69 |

| 72320 | $4,401.91 | 72751 | $3,810.74 |

| 72341 | $4,400.52 | 72749 | $3,811.51 |

| 71678 | $4,397.31 | 72537 | $3,813.14 |

| 71956 | $4,383.58 | 72672 | $3,815.53 |

| 71658 | $4,383.44 | 72675 | $3,815.59 |

| 71630 | $4,382.04 | 72753 | $3,816.07 |

| 71674 | $4,381.23 | 72752 | $3,817.02 |

| 71661 | $4,376.79 | 72916 | $3,817.20 |

| 72164 | $4,376.40 | 72739 | $3,820.14 |

| 71659 | $4,374.66 | 72865 | $3,820.19 |

| 71968 | $4,371.56 | 72685 | $3,820.75 |

| 72133 | $4,371.05 | 72773 | $3,821.96 |

| 72368 | $4,369.60 | 72764 | $3,823.90 |

| 72011 | $4,362.21 | 72736 | $3,825.09 |

| 71964 | $4,362.07 | 72704 | $3,825.45 |

| 71677 | $4,360.04 | 72933 | $3,828.13 |

| 72117 | $4,359.45 | 72774 | $3,828.56 |

| 71640 | $4,358.38 | 72854 | $3,828.88 |

| 71653 | $4,352.05 | 72823 | $3,828.93 |

| 71639 | $4,351.53 | 72762 | $3,829.02 |

| 71913 | $4,347.83 | 72617 | $3,829.04 |

| 71655 | $4,344.26 | 72616 | $3,829.30 |

| 71643 | $4,340.30 | 72666 | $3,829.81 |

| 72122 | $4,338.14 | 72718 | $3,833.38 |

| 71901 | $4,337.65 | 72659 | $3,835.29 |

| 72022 | $4,335.55 | 72930 | $3,835.64 |

| 71602 | $4,333.70 | 72927 | $3,837.27 |

| 72129 | $4,332.53 | 72852 | $3,838.35 |

| 71671 | $4,330.68 | 72737 | $3,838.46 |

| 71642 | $4,330.49 | 72837 | $3,838.64 |

| 72339 | $4,329.53 | 72835 | $3,840.28 |

| 72379 | $4,326.46 | 72624 | $3,840.63 |

| 71929 | $4,324.82 | 72904 | $3,841.68 |

| 72002 | $4,324.68 | 72628 | $3,842.72 |

| 72384 | $4,323.47 | 72863 | $3,842.80 |

| 71949 | $4,319.67 | 72901 | $3,843.14 |

| 72120 | $4,318.37 | 72727 | $3,843.47 |

| 71662 | $4,316.95 | 72717 | $3,844.04 |

| 71652 | $4,311.87 | 72845 | $3,844.41 |

| 72128 | $4,311.68 | 72802 | $3,845.20 |

| 72364 | $4,310.91 | 72858 | $3,847.39 |

| 72550 | $4,308.99 | 72938 | $3,850.23 |

| 72327 | $4,303.32 | 72668 | $3,850.55 |

| 71854 | $4,302.63 | 72544 | $3,855.55 |

| 72087 | $4,300.42 | 72843 | $3,855.82 |

| 71837 | $4,299.13 | 72660 | $3,856.90 |

| 71826 | $4,297.97 | 72856 | $3,858.60 |

| 71748 | $4,295.79 | 72662 | $3,861.27 |

| 72152 | $4,290.97 | 72928 | $3,861.77 |

| 72079 | $4,290.20 | 72932 | $3,862.21 |

| 71644 | $4,289.86 | 72738 | $3,863.57 |

| 71670 | $4,289.53 | 72640 | $3,870.89 |

| 72373 | $4,286.72 | 72703 | $3,874.93 |

| 72340 | $4,285.59 | 72956 | $3,876.27 |

| 72301 | $4,284.61 | 72632 | $3,878.35 |

| 72168 | $4,279.80 | 72721 | $3,879.99 |

| 71660 | $4,276.86 | 72921 | $3,882.75 |

| 71747 | $4,276.65 | 72701 | $3,883.42 |

| 72116 | $4,276.11 | 72940 | $3,884.38 |

| 72015 | $4,275.51 | 72669 | $3,885.12 |

| 71933 | $4,271.32 | 72740 | $3,886.97 |

| 71943 | $4,271.16 | 72842 | $3,889.58 |

| 72353 | $4,270.99 | 72730 | $3,890.25 |

| 71638 | $4,269.21 | 72679 | $3,890.86 |

| 72019 | $4,268.89 | 72846 | $3,893.18 |

| 72377 | $4,266.81 | 72611 | $3,893.59 |

| 72331 | $4,264.95 | 72683 | $3,895.67 |

| 72352 | $4,263.41 | 72686 | $3,896.04 |

| 71909 | $4,262.17 | 72655 | $3,903.55 |

| 72329 | $4,261.40 | 72641 | $3,905.27 |

| 72568 | $4,260.62 | 72650 | $3,905.47 |

| 72105 | $4,260.57 | 72623 | $3,909.73 |

| 72527 | $4,260.33 | 72638 | $3,912.51 |

| 72396 | $4,258.84 | 72776 | $3,918.25 |

| 71631 | $4,258.47 | 72945 | $3,918.96 |

| 72346 | $4,257.42 | 72648 | $3,921.34 |

| 71647 | $4,257.02 | 72934 | $3,925.17 |

| 72046 | $4,256.42 | 72851 | $3,926.14 |

| 72076 | $4,255.86 | 72946 | $3,929.74 |

| 71651 | $4,254.78 | 72947 | $3,931.69 |

| 72472 | $4,254.21 | 72034 | $3,937.61 |

| 71952 | $4,252.86 | 72110 | $3,940.34 |

| 71935 | $4,250.88 | 72958 | $3,943.41 |

| 71845 | $4,247.19 | 72760 | $3,946.03 |

| 72175 | $4,241.28 | 71945 | $3,947.54 |

| 71921 | $4,240.74 | 72032 | $3,951.48 |

| 72150 | $4,240.42 | 71953 | $3,955.98 |

| 72072 | $4,236.09 | 72070 | $3,956.09 |

| 72004 | $4,235.40 | 72952 | $3,956.38 |

| 71765 | $4,235.27 | 72001 | $3,957.08 |

| 72391 | $4,230.92 | 72454 | $3,962.19 |

| 72167 | $4,230.06 | 72080 | $3,964.23 |

| 71861 | $4,229.17 | 72045 | $3,968.01 |

| 72529 | $4,226.68 | 72415 | $3,968.65 |

| 71665 | $4,224.73 | 72834 | $3,969.59 |

| 71750 | $4,224.30 | 72955 | $3,970.21 |

| 71950 | $4,224.18 | 72063 | $3,974.36 |

| 71749 | $4,221.91 | 72944 | $3,975.03 |

| 72566 | $4,221.41 | 71937 | $3,975.95 |

| 72387 | $4,220.12 | 72434 | $3,976.25 |

| 72677 | $4,219.69 | 72125 | $3,980.21 |

| 72084 | $4,218.27 | 72160 | $3,981.55 |

| 72386 | $4,214.88 | 72035 | $3,981.80 |

| 71834 | $4,212.74 | 72141 | $3,982.05 |

| 72099 | $4,212.41 | 72060 | $3,983.23 |

| 71940 | $4,211.90 | 72670 | $3,983.66 |

| 72350 | $4,211.04 | 72460 | $3,985.96 |

| 72556 | $4,210.37 | 72003 | $3,989.59 |

| 71762 | $4,210.09 | 72315 | $3,991.65 |

| 72534 | $4,209.82 | 72948 | $3,992.81 |

| 71959 | $4,208.24 | 72833 | $3,993.79 |

| 71971 | $4,207.15 | 72181 | $3,994.77 |

| 71840 | $4,206.98 | 72170 | $3,996.48 |

| 72069 | $4,205.59 | 72370 | $3,996.61 |

| 71853 | $4,203.87 | 72426 | $3,997.00 |

| 72016 | $4,201.32 | 71973 | $3,998.59 |

| 71770 | $4,199.99 | 72433 | $4,000.00 |

| 72338 | $4,199.15 | 72156 | $4,005.88 |

| 72313 | $4,199.15 | 72088 | $4,002.60 |

| 72513 | $4,198.05 | 72012 | $4,006.27 |

| 71965 | $4,195.59 | 72824 | $4,007.32 |

| 72123 | $4,194.77 | 72438 | $4,008.51 |

| 72561 | $4,194.19 | 72629 | $4,009.96 |

| 72470 | $4,193.83 | 72419 | $4,010.65 |

| 72395 | $4,193.07 | 72017 | $4,011.75 |

| 71831 | $4,192.85 | 72157 | $4,012.83 |

| 72567 | $4,192.76 | 72442 | $4,013.02 |

| 71764 | $4,190.66 | 72149 | $4,013.44 |

| 71724 | $4,190.51 | 72657 | $4,013.94 |

| 72467 | $4,190.43 | 72853 | $4,015.16 |

| 72530 | $4,189.94 | 72068 | $4,016.31 |

| 71860 | $4,189.06 | 72042 | $4,018.57 |

| 72577 | $4,188.23 | 72461 | $4,018.76 |

| 71839 | $4,187.38 | 72445 | $4,019.14 |

| 72432 | $4,186.68 | 72950 | $4,019.82 |

| 71725 | $4,186.21 | 72841 | $4,020.76 |

| 71758 | $4,185.88 | 72153 | $4,021.57 |

| 72501 | $4,185.68 | 72531 | $4,023.62 |

| 71832 | $4,185.68 | 72059 | $4,021.90 |

| 72523 | $4,185.60 | 72476 | $4,024.13 |

| 71842 | $4,185.35 | 72041 | $4,024.90 |

| 71958 | $4,184.60 | 72926 | $4,026.54 |

| 72365 | $4,184.60 | 72121 | $4,024.93 |

| 72569 | $4,184.46 | 72064 | $4,026.55 |

| 72166 | $4,183.96 | 72639 | $4,027.03 |

| 72104 | $4,183.46 | 72578 | $4,027.33 |

| 71753 | $4,182.60 | 72029 | $4,029.70 |

| 72140 | $4,180.87 | 72437 | $4,029.71 |

| 71742 | $4,178.48 | 72458 | $4,030.37 |

| 71730 | $4,178.47 | 72083 | $4,030.58 |

| 72126 | $4,177.89 | 72827 | $4,032.91 |

| 72521 | $4,177.61 | 72027 | $4,033.28 |

| 72057 | $4,176.87 | 71944 | $4,033.79 |

| 71957 | $4,176.62 | 72471 | $4,034.86 |

| 71969 | $4,176.06 | 72473 | $4,037.03 |

| 71923 | $4,174.56 | 72134 | $4,037.85 |

| 72422 | $4,173.80 | 72102 | $4,040.32 |

| 72325 | $4,172.64 | 72838 | $4,044.67 |

| 72321 | $4,171.84 | 72330 | $4,047.96 |

| 72101 | $4,171.31 | 72524 | $4,048.63 |

| 72526 | $4,171.17 | 72130 | $4,049.19 |

| 71961 | $4,171.13 | 72455 | $4,051.89 |

| 72579 | $4,171.11 | 71972 | $4,051.95 |

| 71836 | $4,170.57 | 72082 | $4,053.36 |

| 71833 | $4,169.44 | 72061 | $4,053.82 |

| 72517 | $4,168.43 | 71857 | $4,055.81 |

| 72392 | $4,168.41 | 72058 | $4,057.14 |

| 72394 | $4,168.23 | 72358 | $4,057.43 |

| 72048 | $4,167.60 | 72447 | $4,058.14 |

| 71970 | $4,167.51 | 72410 | $4,058.32 |

| 71922 | $4,167.39 | 72431 | $4,059.56 |

| 72522 | $4,166.31 | 72428 | $4,061.12 |

| 72542 | $4,165.37 | 72075 | $4,061.31 |

| 72540 | $4,165.28 | 72565 | $4,061.66 |

| 71960 | $4,164.49 | 72546 | $4,062.02 |

| 71941 | $4,162.71 | 72519 | $4,062.33 |

| 71820 | $4,160.96 | 72026 | $4,062.53 |

| 72039 | $4,160.26 | 72044 | $4,063.60 |

| 71847 | $4,158.33 | 72013 | $4,064.16 |

| 72179 | $4,158.20 | 72178 | $4,064.71 |

| 72023 | $4,157.53 | 72031 | $4,064.91 |

| 72429 | $4,154.86 | 72107 | $4,065.41 |

| 72335 | $4,153.88 | 72351 | $4,066.53 |

| 71744 | $4,153.21 | 72857 | $4,066.85 |

| 71801 | $4,152.39 | 71722 | $4,067.73 |

| 72137 | $4,151.71 | 72020 | $4,067.74 |

| 72572 | $4,151.60 | 72538 | $4,068.32 |

| 71862 | $4,149.92 | 72520 | $4,069.16 |

| 72475 | $4,149.91 | 72047 | $4,069.46 |

| 72441 | $4,148.51 | 72465 | $4,070.35 |

| 72131 | $4,147.92 | 72413 | $4,070.60 |

| 71825 | $4,147.12 | 72310 | $4,070.80 |

| 71751 | $4,146.62 | 72560 | $4,071.01 |

| 71962 | $4,146.61 | 72414 | $4,073.09 |

| 72584 | $4,146.15 | 72474 | $4,074.34 |

| 72562 | $4,145.67 | 72680 | $4,074.39 |

| 72571 | $4,143.83 | 72112 | $4,074.50 |

| 72165 | $4,142.87 | 72010 | $4,077.27 |

| 72066 | $4,142.02 | 72543 | $4,078.00 |

| 72421 | $4,140.09 | 72006 | $4,078.23 |

| 72424 | $4,139.99 | 72176 | $4,079.23 |

| 72469 | $4,139.72 | 72055 | $4,079.64 |

| 72417 | $4,139.64 | 71721 | $4,082.83 |

| 72074 | $4,139.52 | 72581 | $4,083.46 |

| 71859 | $4,139.39 | 72576 | $4,085.37 |

| 72372 | $4,138.89 | 72040 | $4,086.07 |

| 72324 | $4,138.82 | 72404 | $4,086.26 |

| 72052 | $4,138.36 | 72127 | $4,087.64 |

| 71745 | $4,138.26 | 71858 | $4,088.10 |

| 72425 | $4,138.24 | 72663 | $4,088.11 |

| 72478 | $4,136.39 | 72536 | $4,088.67 |

| 72051 | $4,135.83 | 72073 | $4,088.75 |

| 72347 | $4,134.89 | 72512 | $4,089.98 |

| 72007 | $4,134.10 | 72587 | $4,090.11 |

| 72024 | $4,133.63 | 71772 | $4,091.54 |

| 71999 | $4,132.54 | 72025 | $4,091.83 |

| 71740 | $4,132.35 | 72111 | $4,092.60 |

| 72326 | $4,132.16 | 72440 | $4,093.60 |

| 71838 | $4,131.06 | 72354 | $4,094.01 |

| 72573 | $4,130.20 | 72436 | $4,094.57 |

| 71835 | $4,129.66 | 72143 | $4,095.71 |

| 71822 | $4,128.51 | 71851 | $4,096.05 |

| 72435 | $4,128.07 | 72430 | $4,096.77 |

| 72401 | $4,128.01 | 72555 | $4,097.05 |

| 71841 | $4,127.77 | 71720 | $4,097.81 |

| 71942 | $4,127.16 | 72450 | $4,098.11 |

| 72021 | $4,125.66 | 71743 | $4,098.90 |

| 72136 | $4,125.54 | 72457 | $4,099.55 |

| 72585 | $4,125.45 | 72036 | $4,099.70 |

| 71846 | $4,125.34 | 72038 | $4,099.73 |

| 72139 | $4,125.07 | 72030 | $4,099.78 |

| 71766 | $4,124.99 | 72412 | $4,100.53 |

| 71763 | $4,124.98 | 71852 | $4,101.58 |

| 71866 | $4,124.16 | 72539 | $4,101.73 |

| 71726 | $4,123.73 | 72533 | $4,102.16 |

| 72528 | $4,122.63 | 72449 | $4,102.24 |

| 72860 | $4,122.46 | 71701 | $4,102.55 |

| 72479 | $4,122.16 | 72453 | $4,102.70 |

| 72182 | $4,121.61 | 72086 | $4,103.61 |

| 71932 | $4,121.32 | 72416 | $4,103.63 |

| 72411 | $4,121.24 | 72444 | $4,103.75 |

| 72464 | $4,120.15 | 72173 | $4,103.85 |

| 71920 | $4,118.45 | 72081 | $4,103.88 |

| 72067 | $4,117.82 | 72482 | $4,104.47 |

| 72085 | $4,117.72 | 71998 | $4,105.14 |

| 71828 | $4,117.52 | 72459 | $4,105.16 |

| 71827 | $4,117.06 | 72005 | $4,105.59 |

| 72014 | $4,116.08 | 72828 | $4,107.19 |

| 72515 | $4,115.38 | 71855 | $4,107.57 |

| 71752 | $4,115.33 | 72456 | $4,108.16 |

| 72645 | $4,113.80 | 72583 | $4,108.27 |

| 72564 | $4,113.19 | 72554 | $4,108.73 |

| 71728 | $4,112.91 | 72443 | $4,110.26 |

| 72106 | $4,111.71 | 72466 | $4,110.68 |

| 71865 | $4,111.54 | 71864 | $4,110.98 |

| -- | -- | 72532 | $4,111.44 |

Most Expensive and Least Expensive Carrier Rates by City

In the same vein, the cost of your insurance will vary based on the city you live in. Take a look at the table below and see how rates in Arkansas differ from one city to another.

[table “166Lowest” not found /]Arkansas Car Insurance Companies

One of the great things about looking for car insurance is that there is a plan for everyone. There are dozens of car insurance providers who are able to work with you in order to help you find the exact kind of coverage that you need.

That said, it can be exceptionally difficult to work your way through all of those plans on your own.

That’s why you’ve got us. We’re here to help you dig deeper into Arkansas’s largest car insurance companies and the coverage that they have to offer. Keep on reading to learn more about these companies’ ratings, complaint records, and the coverage they have to offer.

The Largest Companies Financial Rating

Let’s start things out with a general overview. AM Best awards rate Arkansas’s insurance providers by their financial rankings, stacking them up with grades ranging from A to A++. As you might guess, the more pluses an insurance company has, the better the financial rating it has.

| Providers | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| State Farm Group | A | 195 | 66.99% | 25.69% |

| Southern Farm Bureau Casualty Group | A+ | 792 | 69.46% | 12.78% |

| Shelter Insurance Group | A | 424 | 67.43% | 8.60% |

| Allstate Insurance Group | A+ | 053 | 47.21% | 7.24% |

| Progressive Group | A+ | 855 | 58.71% | 7.18% |

| Geico | A++ | 940 | 70.69% | 5.65% |

| USAA Group | NR | 071 | 73.14% | 4.73% |

| Liberty Mutual Group | A | 245 | 61.30% | 4.12% |

| Farmers Insurance Group | NR | 776 | 52.42% | 4.10% |

| Nationwide Corp Group | A+ | 506 | 51.80% | 2.95% |

These rankings are based on companies’ loss ratios, market shares, and direct premium composition, meaning that all elements of the companies’ financial standings have been assessed in determining the rank.

Companies with Best Ratings

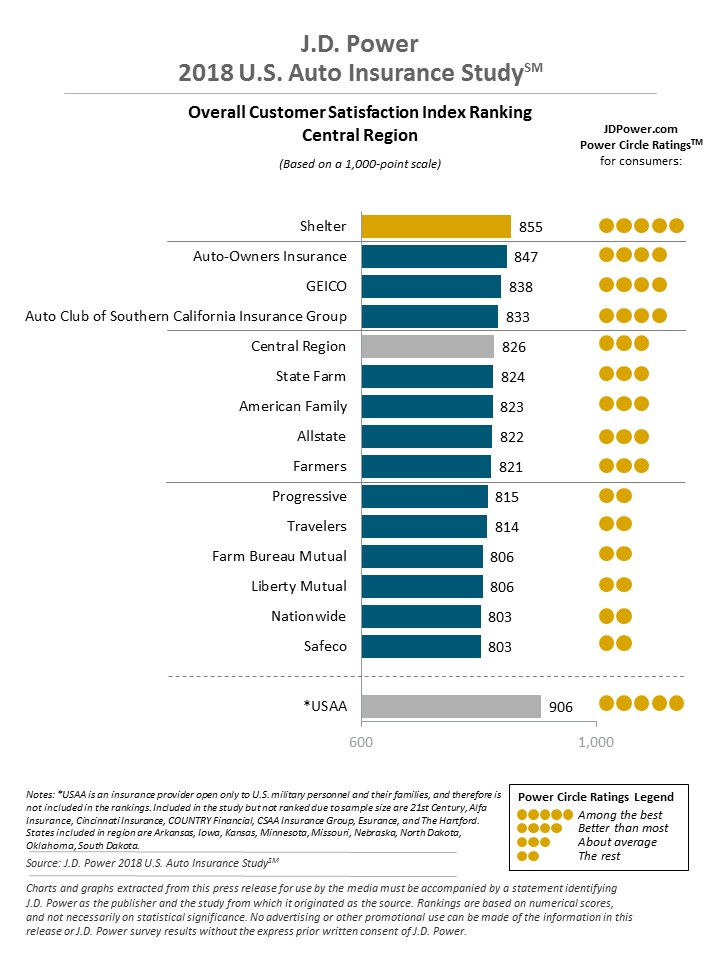

If you want to move away from finances, you can rely on J.D. Power to give you a comprehensive guide to car insurance companies’ customer ratings. Take a look below and see how the companies in Arkansas stack up when compared to one another.

Read more: State Farm Car Insurance Guide [Data + Expert Review]

Companies with Most Complaints in Arkansas

On the flip side of customer satisfaction are customer complaints. Take a look at how Arkansas’s car insurance providers compare to one another when their complaint records are taken into account.

| Company | Direct Written Premiums | Complaint Index |

|---|---|---|

| 21st Century | $8,493,667 | 2.1811 |

| AAA / Automobile Club | $26,115,598 | 0.5675 |

| Alfa | $26,366,435 | 4.0752 |

| Allstate | $109,194,732 | 0.7804 |

| ANPAC | $7,675,988 | 0.4827 |

| Auto-Owners | $10,892,419 | 0.3402 |

| Cincinnati Ins Co | $6,993,252 | 0.5298 |

| Columbia Insurance Group | $11,471,686 | 0 |

| Cornerstone | $6,669,115 | 0 |

| Dairyland | $6,473,624 | 2.8617 |

| Direct General | $11,892,584 | 3.427 |

| Esurance | $5,691,830 | 0 |

| Fairfax / American Underwriters | $10,462,806 | 1.0624 |

| Farmers | $78,015,367 | 1.4722 |

| Geico | $81,792,529 | 1.4949 |

| Hanover | $14,669,056 | 3.0309 |

| Hartford | $24,437,324 | 1.2129 |

| Imperial Fire & Casualty | $6,296,510 | 2.9422 |

| Liberty Mutual | $11,136,725 | 0.6654 |

| MetLife | $14,463,757 | 0.2562 |

| Nationwide | $61,851,329 | 0.4792 |

| Progressive | $93,506,250 | 1.2283 |

| Safeco | $33,813,210 | 0.9862 |

| Shelter | $125,866,966 | 0.5593 |

| Southern Farm Bureau | $206,211,166 | 0.4312 |

| State Auto | $19,414,847 | 1.145 |

| State Farm | $375,631,848 | 0.503 |

| Travelers | $26,897,523 | 0.6887 |

| United Automobile | $5,921,761 | 11.8878 |

| USAA | $67,525,883 | 1.0425 |

While complaint indexes do reflect companies’ ability to interact with their consumers on a daily basis, they don’t dictate whether or not a company will fulfill your claim. There’s still important to consider, though, when considering a provider’s HR capabilities.

Arkansas Car Insurance Rates by Company

We know that you’ll want to learn more about the rates that each of Arkansas’s biggest car insurance providers have to offer. Take a look at the table below and see for yourself how the rates of coverage vary across Arkansas.

| Company | Average | Compared to State Average | Percentage Over/Under State Average |

|---|---|---|---|

| Allstate P&C | $5,150.03 | $1,038.33 | +20.16% |

| Farmers Ins Co | $4,257.88 | $146.18 | +3.43% |

| Geico General | $3,484.63 | -$627.07 | -18.00% |

| Safeco Ins Co of IL | $4,005.48 | -$106.22 | -2.65% |

| Nationwide Mutual | $3,861.78 | -$249.92 | -6.47% |

| Progressive NorthWestern | $5,312.09 | $1,200.39 | +22.60% |

| State Farm Mutual Auto | $2,789.02 | -$1,322.68 | -47.42% |

| Travelers Home & Marine Ins Co | $5,973.33 | $1,861.63 | +31.17% |

| USAA | $2,171.05 | -$1,940.65 | -89.39% |

Average rates, as you can see, can differ significantly in Arkansas. USAA, for example, is nearly $2,000 less expensive than Allstate in terms of company averages.

Commute Rates by Company

Companies will sometimes vary their rates based on the commute you make on a daily basis, too. While not all providers do this, you should still know which ones may charge you more for taking longer to get to work in the morning.

| Group | 10 miles commute/6,000 annual mileage | 25 miles commute/12,000 annual mileage |

|---|---|---|

| Allstate | $5,150.03 | $5,150.03 |

| Farmers | $4,257.87 | $4,257.87 |

| Geico | $3,461.03 | $3,508.22 |

| Liberty Mutual | $4,005.48 | $4,005.48 |

| Nationwide | $3,861.78 | $3,861.78 |

| Progressive | $5,312.09 | $5,312.09 |

| State Farm | $2,721.97 | $2,856.08 |

| Travelers | $5,973.33 | $5,973.33 |

| USAA | $2,109.20 | $2,232.91 |

The longer your commute is, the more likely it is that your car insurance coverage rate will be a little bit higher.

Coverage Level Rates by Company

Similarly, the amount of coverage you purchase will impact your rate. Take a look at the table below to see how different types of coverage vary in cost:

| Company | High Coverage Level | Medium Coverage Level | Low Coverage Level |

|---|---|---|---|

| Allstate | $5,296.98 | $5,146.99 | $5,006.12 |

| Farmers | $4,509.37 | $4,214.22 | $4,050.03 |

| Geico | $3,628.49 | $3,483.6 | $3,341.79 |

| Liberty Mutual | $4,170.01 | $3,977.85 | $3,868.57 |

| Nationwide | $3,915.62 | $3,783.13 | $3,886.6 |

| Progressive | $5,831.14 | $5,221.81 | $4,883.32 |

| State Farm | $2,927.56 | $2,786.42 | $2,653.1 |

| Travelers | $6,245.09 | $5,989.75 | $5,685.15 |

| USAA | $2,268.89 | $2,163.34 | $2,080.93 |

Naturally, the less coverage you have, the less you’ll have to pay. Just remember that you need to maintain the Arkansas minimum liability coverage in order to drive legally on the road.

While purchasing less coverage may sound like a financially-sound decision in the moment, getting in an accident can cost you a lot more if you don’t have enough coverage to take care of the expenses that come along with an accident.

Credit History Rates by Company

Your credit history reflects your ability to pay back expenses that you’ve sought out in other places. Naturally, then, car insurance providers will take your credit history into account when offering you an insurance rate.

Note that Arkansas residents have an average credit score of 657.

| Company | Annual Rate Poor Credit | Annual Rate Fair Credit | Annual Rate Good Credit |

|---|---|---|---|

| Allstate | $6,472.14 | $4,957.59 | $4,020.37 |

| Farmers | $4,845.12 | $4,060.17 | $3,868.33 |

| Geico | $4,174.77 | $3,431.81 | $2,847.29 |

| Liberty Mutual | $5,786.43 | $3,493.43 | $2,736.58 |

| Nationwide | $4,566.24 | $3,673.03 | $3,346.08 |

| Progressive | $6,026.44 | $5,135.36 | $4,774.48 |

| State Farm | $4,040.73 | $2,432.50 | $1,893.84 |

| Travelers | $6,854.36 | $5,719.88 | $5,345.75 |

| USAA | $2,875.86 | $1,963.67 | $1,673.63 |

As you can see, the poorer your credit, the higher your car insurance rate will be.

Driving Record Rates by Company

Your driving history will also have an impact on the rate that your car insurance provider of choice is able to offer you.

| Company | Clean Driving Record | One Speeding Citation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $4,247.65 | $5,074.04 | $5,344.99 | $5,933.45 |

| Farmers | $3,599.68 | $4,315.87 | $4,611.04 | $4,504.91 |

| Geico | $2,361.95 | $2,541.89 | $3,625.74 | $5,408.92 |

| Liberty Mutual | $2,728.95 | $3,668.24 | $4,435.22 | $5,189.50 |

| Nationwide | $3,003.05 | $3,306.76 | $3,881.91 | $5,255.42 |

| Progressive | $4,579.61 | $5,496.11 | $6,359.88 | $4,812.78 |

| State Farm | $2,561.18 | $2,789.02 | $3,016.88 | $2,789.02 |

| Travelers | $5,005.97 | $6,145.34 | $5,171.93 | $7,570.08 |

| USAA | $1,667.81 | $1,850.74 | $2,115.02 | $3,050.64 |

As you might suspect, high-risk drivers who’ve been in a number of accidents or who have received a few tickets in their time on the road will have to pay more for their car insurance than drivers with clean records.

As the table above displays, sometimes high-risk driving can cost you as much as $2,500 more than your clean-record peers. That’s all the more reason to be cautious on the roadways, wouldn’t you agree?

Largest Car Insurance Companies in Arkansas

Now that we’ve touched on all of the finer details that can influence your car insurance rate, what are the car insurance providers that have the biggest presence in Arkansas?

| Company Direct | Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| **State Total** | $1,947,179 | 63.32% | 100.00% |

| Allstate Insurance Group | $141,053 | 47.21% | 7.24% |

| Farmers Insurance Group | $79,776 | 52.42% | 4.10% |

| Geico | $109,940 | 70.69% | 5.65% |

| Liberty Mutual Group | $80,245 | 61.30% | 4.12% |

| Nationwide Corp Group | $57,506 | 51.80% | 2.95% |

| Progressive Group | $139,855 | 58.71% | 7.18% |

| Shelter Insurance Group | $167,424 | 67.43% | 8.60% |

| Southern Farm Bureau Casualty Group | $248,792 | 69.46% | 12.78% |

| State Farm Group | $500,195 | 66.99% | 25.69% |

| USAA Group | $92,071 | 73.14% | 4.73% |

Number of Insurers by Arkansas

You’ll not only be able to choose from the largest car insurance providers in Arkansas, but you’ll have a choice between domestic providers, who are only available within the state, and foreign providers, or providers who operate on a national scale.

| Property & Casualty Insurance | Numbers |

|---|---|

| Domestic | 12 |

| Foreign | 887 |

| Total | 899 |

Arkansas Laws and Legalities

With more car insurance options in mind, you may be curious to know what you can do in order to keep your rates as low as possible. While it’s not exactly the easiest task to learn all of Arkansas’s driving laws and legalities, we’re here to help.

Car Insurance Laws

We’ve collected information about Arkansas’s driving laws and gathered them up here for you to peruse at your leisure. This way you can learn what rules you need to follow while on the road in order to stay out of trouble.

So, let’s get started.

High-Risk Insurance

It’s not always easy to know whether or not you’re a high-risk driver. If you want to know for yourself, you need to take a look back at your driving history.

If you’ve been prone to accidents or traffic violations in the past, then you may also find that car insurance companies are a little less likely to provide you with the coverage you need.

In the state of Arkansas, car insurance providers are not required to cover high-risk drivers.

This means that if you have a complicated driving history, you may find yourself without the car insurance coverage you need to drive legally on the road.

However, if you find that you can’t get coverage through traditional means, you can reach out to the state of Arkansas and apply for Arkansas Automobile Insurance Plan.

No car insurance provider is exempt from the designations of this plan. This means that when you submit your application for the program and find yourself approved, then you’ll be able to receive minimum coverage from the provider of the state’s choosing.

However, do note that you’re not guaranteed approval through AAIP. Still, there’s no harm in applying if you can’t find coverage through other means.

Low-Cost Insurance

Unfortunately, the state of Arkansas does not provide car insurance programs for low-income families. You can only apply for AAIP if you have a history of poor driving; otherwise, you’ll have to explore alternative ways to lower the cost of your car insurance.

As a reminder, you are required to have the following coverage in order to legally drive in Arkansas:

- $25,000 – to cover the injury or death of a single person in a car accident where you’re found to be at-fault

- $50,000 – to cover the injuries or deaths or more than one person in a car accident wherein you’re found to be at-fault

- $25,000 – to cover the recovery or repair of any property that was damaged in an accident wherein you’re found to be at-fault

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Coverage

Let’s say you’re driving through the Ozarks when, BAM! A rock hits your windshield. You can’t legally drive on the road with a fractured windshield, so what can you do in order to replace yours safely?

The state of Arkansas does not require your insurance provider to provide you with windshield coverage.

That said, different providers may be willing to replace your windshield with after-market parts.

Automobile Insurance Fraud in Arkansas

Insurance fraud is a serious offense in every state in the union, not to mention Arkansas. While it’s difficult to commit insurance fraud by accident, that doesn’t mean it’s impossible.

In Arkansas, insurance fraud can take on one of three forms:

- You can fake an accident, make a false claim, or assert false statements regarding an accident that you’ve been in.

- You can pad your valid insurance claim.

- You can help someone else fake the details of an accident that they’ve been in.

Note, though, that it’s pretty difficult to do any of these things unintentionally. You can make a mistake when filing a claim. That said, don’t be tempted to claim beyond your means, or else you’ll face serious consequences.

| Offense | Value in Question | Consequences |

|---|---|---|

| Misdemeanor | >$300 | One year's imprisonment and/or $2,000 fine |

| Class C Felony | Between $19,999 and $301 | Five years imprisonment and/or $10,000 fine |

| Class B Felony | <$20,000 | 10 years imprisonment and/or $25,000 fine |

Statute of Limitations

If you’ve been in a car accident and want to file a claim, you have a limited amount of time in order to bring your claim to court. This period of time is known as your statute of limitations.

In Arkansas, the Arkansas Code Annotated Section 16-56-105 allows drivers found to be at-fault or their victims up to three years to bring their grievances to court.

As such, if you get in an accident, you’ll have three years in order to issue your claim or else you won’t be compensated for any injuries or property damage that you sustained. Note that your three years begins on the day your accident takes place.

Vehicle Licensing Laws

Now, let’s take a look at some of the specific licensing laws in Arkansas.

Penalties for Driving Without Insurance

You can also get in a significant amount of trouble if you’re caught driving on the roads in Arkansas without a license. Take a look at the table below to learn more about the kind of consequences that await you should you try to drive without the necessary registration.

| Occasion | Fines | Additional Consequences | Reinstatement Fee |

|---|---|---|---|

| First Offense | $50 to $250 | Suspended registration; no plates until proof of coverage is provided; court may order a car impoundment | $20 |

| Second Offense | $250 to $500 | Suspended registration; no plates until proof of coverage; court may order car impound | $20 |

Teen Driver Laws

It can be tremendously exciting to get behind the wheel of a car for the first time. Teenagers in Arkansas, though, need to take special care while on the road. That’s why there are specific laws in place designed to keep teenagers safe while driving alongside their more experienced counterparts.

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit: | 14 years | No more than 1 passenger younger than 21 | Between 11 p.m. and 4 a.m. Teens are not required to have any number of hours of supervised driving. |

| Provisional License | Must be 16 years old and have held learner's permit for at least 6 months. | No more than 1 passenger younger than 21 | Nighttime restrictions will be lifted at age 18. |

| Full License | Must be 16 years old and have held provisional license for at least 6 months. | None. | None. |

Older Driver License Renewal Procedures

Drivers on the older end of the spectrum also have to work within different bounds than their younger companions. The license renewal process, specifically, differs for drivers over the age of 70.

| General Population | Older Population | |

|---|---|---|

| License renewal cycle | 8 years | 4 or 8 years for people 70 and older, personal option |

| Mail or online renewal permitted | No | No |

| Proof of adequate vision required at renewal | Every renewal | Every Renewal |

That said, the state of Arkansas makes it easier for older drivers to renew their licenses. While you won’t be able to renew your license via mail or through a website, drivers over 70 can renew their license on a four to eight-year basis.

New Residents

If you’re just moving to Arkansas, you’ll have to make sure that your car and car insurance comply with state requirements.

Upon moving to Arkansas, you need to apply for an Arkansas driver’s license within 30 days.

You’ll have to go to the DMV or an equivalent representation of the Arkansas Department of Finance and Administration in order to retrieve your appropriate license.

However, the new “skip the trip” procedure is looking to move the license renewal process to the Internet. While older drivers still have to renew their licenses in person, younger drivers can rely on the Internet and avoid the DMV’s notorious lines.

Negligent Operator Treatment System

Arkansas is strict when it comes to its at-fault policies. That said, drivers can also share the blame for an accident. This process is known as contributory and comparative negligence.

When Arkansas courts enact these laws, the fault of an accident can be divided between two drivers, which means the expense of property damage and personal injury can be made less severe.

Rules of the Road

With all of that in mind, what do the rules of the road in Arkansas look like, and how will they impact your driving on a daily basis?

Fault vs. No-Fault

As we’ve already touched on, Arkansas is an at-fault state. This means that of the drivers that get caught up in an accident, one will be assigned the blame. That driver will then be responsible for taking care of the cost of that accident.

Keep Right and Move Over Laws

Like many other states in the union, you’re required to stay in the right-hand lane of an interstate if you’re driving more slowly than the posted speed limit.

Arkansas specifically, though, has some variations on this rule, including the following. You can move out of the right-hand lane when:

- One car passes another in the same direction

- The right half of the road is closed due to construction

- The road is divided into three or more lanes

- A sign indicates roadway direction changes

- The right half of the road is unsafe to drive on

- A vehicle exist the road on the left-hand side of the road

Comparatively, move over laws require all drivers on the road to move over for emergency vehicles, drivers who represent the Arkansas State Highway and Transport Department, or vehicles with their hazard lights on.

Speed Limits

The speed limits posted in Arkansas dictate the speed you need to go in order to legally drive on the road.

| Road Type | Posted Speed Limits |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 75 mph |

| Limited Access Roads | 75 mph |

| Other | 65 mph |

Note that these limits are the MAXIMUM speed you can go while driving in these listed areas of Arkansas.

Seat belt and Car Seat Laws

Minors who ride in the car with you who are between the ages of 0-5 have specific seating laws that apply to them. These laws are designed to keep children as safe as possible in a moving vehicle.

| Child Age | Seat Requirements | Exceptions | Consequences |

|---|---|---|---|

| 5 or younger | A child safety seat - but the child can be kept either in the front or back seats | A child over 60 pounds does not have to be restrained by a child safety seat | $100 fine if caught |

| 6-14 | No seating requirements |

Ridesharing

With the rise of ridesharing services like Lyft and Uber, car insurance providers and states have had to issue new legislation in order to keep drivers who want to make careers in this industry safe and legal on the road.

At this point in time, Arkansas’s only laws regarding ridesharing dictate that ridesharing drivers must have the state’s minimum liability coverage.

DUI Laws

You should never get behind the wheel of a car if you think that you’re buzzed or intoxicated. If you do, though, know that the state of Arkansas has strict laws in place that will significantly impact your driving record, should you be pulled over or get into an accident.

| DUI Laws | Data and Consequences |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | N/A |

| Criminal Status by Offense | 4th+ within 5 years is a felony. (otherwise unclassified) |

| Formal Name for Offense | Driving While Intoxicated (DWI) |

| Look Back Period/Washout Period | 5 years |

| 1st Offense-ALS or Revocation | 6 months |

| 1st Offense Imprisonment | 24 hours - 1 year, or community service |

| 1st Offense-Fine | $150-$1000 |

| 1st Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time |

| 2nd Offense-DL Revocation | 2nd offense in 5 years - 2 year revocation |

| 2nd Offense-Imprisonment | 7 days-1 year |

| 2nd Offense-Fine | $400-$3000 |

| 2nd Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time. |

| 3rd Offense-DL Revocation | 3rd offense in 5 years - 30 month revocation |

| 3rd Offense-Imprisonment | 90 days to 1 year |

| 3rd Offense-Fine | $900-$5000 |

| 3rd Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time |

| 4th Offense-DL Revocation | 4 years |

| 4th Offense-Imprisonment | 1-6 years |

| 4th Offense-Fine | $900-$5000 |

| 4th Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time |

| Mandatory Interlock | No |

While there aren’t any marijuana-related laws referenced in Arkansas, impaired driving, as you can see, have serious and life-long consequences that you’ll have to deal with on a financial, emotional, and legislative level.

Distracted Driving Laws

Similarly, Arkansas’s laws regarding distracted driving have severe consequences in place. These laws are designed to keep drivers on the road aware of their surroundings and to prevent driving fatalities.

Let’s break this down:

The state of Arkansas does not allow drivers who are 18 years old are younger to have a cellphone on them while they’re driving a vehicle.

After a driver turns 18, they’ll be able to have a cellphone in the car with them. However, no other handheld devices are permitted in the vehicle.

Drivers of any age who are caught texting while driving will be fined or cited if they’re seen doing so while driving or while stopped at an intersection.

Driving in Arkansas

With the details of Arkansas’s driving laws and legalities out of the way, we can move on to the daily life of a driver in the Natural State. What kind of risks should you keep in mind while moving from one place to another?

Take a look at the research we’ve gathered and see for yourself.

Vehicle Theft in Arkansas

You might expect sports cars to top the list of cars that get stolen most frequently in Arkansas. That’s not the case, though. In fact, pickup trucks are the trucks that thieves in Arkansas prefer to take.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2004 | 402 |

| Ford Pickup (Full Size) | 2008 | 252 |

| GMC Pickup (Full Size) | 1997 | 174 |

| Dodge Pickup (Full Size) | 1999 | 127 |

| Honda Accord | 1997 | 122 |

| Nissan Altima | 2015 | 89 |

| Toyota Camry | 2013 | 82 |

| Chevrolet Impala | 2012 | 76 |

| Chevrolet Malibu | 2006 | 72 |

| Chevrolet Tahoe | 2003 | 68 |

If you’ve got a pickup truck, then, you’ll want to keep an eye on it whenever you leave it parked on the side of the road.

In 2016 alone, nearly 4,900 cars were stolen from registered drivers in Arkansas.

So long as you take safety measures to protect your car, you can lower the likelihood that an opportunistic thief will seek out your car.

| City | Population | Motor vehicle theft |

|---|---|---|

| Arkadelphia | 10,829 | 10 |

| Ash Flat | 1,069 | 1 |

| Ashdown | 4,616 | 2 |

| Atkins | 3,036 | 7 |

| Bald Knob | 2,931 | 9 |

| Barling | 4,733 | 7 |

| Bay | 1,825 | 0 |

| Bearden | 930 | 3 |

| Beebe | 7,744 | 21 |

| Bella Vista | 27,606 | 5 |

| Benton | 32,548 | 81 |

| Bentonville | 39,132 | 12 |

| Berryville | 5,417 | 8 |

| Blytheville | 15,220 | 51 |

| Booneville | 3,922 | 5 |

| Bradford | 768 | 0 |

| Brinkley | 3,024 | 3 |

| Brookland | 1,863 | 5 |

| Bryant | 19,366 | 33 |

| Bull Shoals | 1,975 | 1 |

| Cabot | 24,695 | 44 |

| Caddo Valley | 622 | 1 |

| Camden | 11,726 | 10 |

| Cammack Village | 760 | 0 |

| Caraway | 1,279 | 0 |

| Carlisle | 2,210 | 2 |

| Cave City | 1,881 | 5 |

| Cave Springs | 2,060 | 0 |

| Centerton | 10,377 | 1 |

| Charleston | 2,532 | 0 |

| Cherokee Village | 4,613 | 2 |

| Clarendon | 1,576 | 1 |

| Clarksville | 9,319 | 5 |

| Clinton | 2,561 | 8 |

| Conway | 64,060 | 108 |

| Corning | 3,254 | 2 |

| Cotter | 954 | 0 |

| Crossett | 5,383 | 7 |

| Danville | 2,370 | 1 |

| Dardanelle | 4,672 | 10 |

| De Queen | 6,636 | 13 |

| De Witt | 3,259 | 4 |

| Decatur | 1,766 | 0 |

| Dermott | 2,775 | 0 |

| Des Arc | 1,657 | 1 |

| Diaz | 1,274 | 2 |

| Dover | 1,393 | 1 |

| Dumas | 4,481 | 5 |

| Earle | 2,342 | 2 |

| El Dorado | 18,375 | 53 |

| England | 2,806 | 4 |

| Eudora | 2,169 | 5 |

| Fairfield Bay | 2,295 | 2 |

| Farmington | 6,230 | 2 |

| Fayetteville | 77,900 | 160 |

| Flippin | 1,343 | 0 |

| Fordyce | 4,218 | 5 |

| Forrest City | 15,184 | 27 |

| Fort Smith | 87,821 | 199 |

| Gassville | 2,048 | 2 |

| Gentry | 3,341 | 0 |

| Glenwood | 2,218 | 1 |

| Gosnell | 3,455 | 2 |

| Gravette | 2,409 | 3 |

| Green Forest | 2,768 | 3 |

| Greenbrier | 5,082 | 1 |

| Greenland | 1,312 | 1 |

| Greenwood | 9,223 | 1 |

| Greers Ferry | 881 | 3 |

| Gurdon | 2,184 | 0 |

| Hamburg | 2,828 | 0 |

| Hampton | 1,306 | 0 |

| Hardy | 763 | 3 |

| Harrisburg | 2,317 | 0 |

| Harrison | 13,234 | 22 |

| Heber Springs | 7,146 | 14 |

| Helena-West Helena | 11,591 | 13 |

| Highfill | 620 | 0 |

| Highland | 1,031 | 0 |

| Hope | 10,020 | 18 |

| Hot Springs | 35,551 | 166 |

| Hoxie | 2,690 | 3 |

| Jacksonville | 28,739 | 69 |

| Jonesboro | 71,114 | 86 |

| Kensett | 1,682 | 4 |

| Lake City | 2,199 | 2 |

| Lake Village | 2,482 | 3 |

| Lakeview | 727 | 0 |

| Lamar | 1,678 | 1 |

| Leachville | 1,941 | 2 |

| Lepanto | 1,861 | 2 |

| Lincoln | 2,345 | 1 |

| Little Rock | 197,399 | 1,080 |

| Lonoke | 4,244 | 2 |

| Lowell | 7,832 | 9 |

| Magnolia | 11,682 | 8 |

| Malvern | 10,981 | 2 |

| Marianna | 4,035 | 4 |

| Marion | 12,258 | 17 |

| Marmaduke | 1,147 | 2 |

| Marvell | 1,112 | 1 |

| Maumelle | 17,686 | 13 |

| Mayflower | 2,336 | 8 |

| McCrory | 1,673 | 0 |

| McGehee | 4,024 | 2 |

| McRae | 691 | 0 |

| Mena | 5,721 | 6 |

| Mineral Springs | 1,200 | 0 |

| Monette | 1,502 | 0 |

| Monticello | 9,830 | 21 |

| Morrilton | 6,789 | 6 |

| Mountain Home | 12,246 | 14 |

| Mountain View | 2,838 | 2 |

| Mulberry | 1,634 | 0 |

| Murfreesboro | 1,635 | 0 |

| Nashville | 4,607 | 2 |

| Newport | 7,658 | 13 |

| North Little Rock | 65,398 | 275 |

| Ola | 1,257 | 0 |

| Osceola | 7,494 | 13 |

| Ozark | 3,653 | 5 |

| Pangburn | 607 | 1 |

| Paragould | 27,294 | 136 |

| Paris | 3,457 | 12 |

| Pea Ridge | 5,006 | 1 |

| Perryville | 1,448 | 0 |

| Piggott | 3,751 | 1 |

| Plummerville | 822 | 0 |

| Pottsville | 3,064 | 3 |

| Prairie Grove | 4,737 | 1 |

| Quitman | 752 | 0 |

| Redfield | 1,428 | 0 |

| Rison | 1,329 | 2 |

| Rogers | 59,787 | 31 |

| Russellville | 28,760 | 91 |

| Salem | 1,650 | 0 |

| Sheridan | 4,834 | 4 |

| Sherwood | 29,900 | 66 |

| Siloam Springs | 15,873 | 13 |

| Springdale | 73,939 | 122 |

| Stamps | 1,635 | 2 |

| Star City | 2,206 | 0 |

| Stuttgart | 9,263 | 19 |

| Swifton | 773 | 1 |

| Texarkana | 30,074 | 58 |

| Trumann | 7,163 | 12 |

| Van Buren | 23,063 | 27 |

| Vilonia | 4,202 | 3 |

| Waldron | 3,516 | 4 |

| Walnut Ridge | 4,714 | 1 |

| Ward | 4,454 | 5 |

| Warren | 5,947 | 2 |

| White Hall | 5,381 | 6 |

| Wynne | 8,323 | 6 |

Risky and Harmful Behavior While Driving

It’s not theft that you have to worry about the most in Arkansas, though. Risky driving causes the vast majority of accidents and fatalities in the Natural State. When you go out on the road, you’ll want to drive cautiously in order to protect yourself, your vehicle, and any passengers you may have in your car.

Let’s explore some of the statistics reported as of 2017 in order to learn a little bit more about the risks on the road in Arkansas.

Traffic Fatalities

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 493 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 351 |

| Motorcyclist Fatalities | 65 |

| Drivers Involved in Fatal Crashes | 687 |

| Pedestrian Fatalities | 42 |

| Bicyclist and other Cyclist Fatalities | 3 |

As you can see, the vast majority of fatalities in Arkansas — 72 percent — involved passenger vehicle occupant fatalities. Pedestrians and non-passengers were able to avoid the majority of fatalities throughout the state.

The divide of fatalities throughout the state reveal the different dangers of distracted driving, though, and encourage all drivers on the road to take a little more care when behind the wheel.

Fatalities by Weather

The weather can easily influence the dangers of driving on roads throughout Arkansas, especially during tornado season.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 219 | 28 | 141 | 12 | 1 | 401 |

| Rain | 19 | 2 | 17 | 2 | 0 | 40 |

| Snow/Sleet | 2 | 0 | 1 | 0 | 0 | 3 |

| Other | 2 | 0 | 10 | 1 | 0 | 13 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 242 | 30 | 169 | 15 | 1 | 457 |

If it happens to be early in the morning, late at night, or if the weather is looking particularly harsh, make sure you drive with a closer eye on the road than you normally would in order to stay safe.

Fatalities by Person Type

Person type also impacts the likelihood of a vehicular fatality. Person type here describes how a person relates to the cars in question — who’s a passenger, who’s a pedestrian, and so on.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 166 | 156 | 181 | 184 | 164 |

| Light Truck - Pickup | 86 | 101 | 90 | 109 | 97 |

| Light Truck - Utility | 82 | 74 | 91 | 82 | 72 |

| Light Truck - Van | 18 | 17 | 27 | 22 | 14 |

| Large Truck | 16 | 9 | 18 | 11 | 27 |

| Other/Unknown Occupants | 13 | 8 | 10 | 14 | 4 |

| Total Occupants | 381 | 365 | 423 | 425 | 382 |

| Bus | 0 | 0 | 6 | 0 | 0 |

| Light Truck - Other | 0 | 0 | 0 | 3 | 4 |

| Total Motorcyclists | 63 | 61 | 80 | 82 | 65 |

| Pedestrian | 46 | 37 | 44 | 49 | 42 |

| Bicyclist and Other Cyclist | 4 | 7 | 3 | 3 | 3 |

| Other/Unknown Nonoccupants | 4 | 0 | 0 | 2 | 1 |

| Total Nonoccupants | 54 | 44 | 47 | 54 | 46 |

| Total | 498 | 470 | 550 | 561 | 493 |

We’ve touched on data like this before, but as you can see, occupants in enclosed vehicles are more likely to fall victim to a car accident than motorists and non-occupants combined.

Fatalities by Crash Type

The types of crashes also vary throughout Arkansas.

| Crash Type | Number |

|---|---|

| Single Vehicle | 275 |

| Involving a Large Truck | 84 |

| Involving Speeding | 116 |

| Involving a Rollover | 155 |

| Involving a Roadway Departure | 331 |

| Involving an Intersection (or Intersection Related) | 52 |

Single vehicles are most likely to be involved in accidents across the state than multiple vehicles. However, these cars will most often find trouble at intersections or while departing from a highway.

This shift in attention can jolt a person out of what is otherwise known as “highway hypnosis.” The sudden change can put a driver in danger if they’re in a high traffic area, like an intersection or a highway exit ramp.

https://youtu.be/2FgQZyq7lF8

Drivers’ tendency to fall into this meditative state and the accidents that result because of it should be all the more reason for you to pay attention in areas like those listed above.

Five-Year Trend For The Top 10 Counties

We’ve also already noted how living in particular areas in Arkansas can influence your car insurance rates. As it turns out, location-location-location also impacts fatality likelihood.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Benton County | 18 | 13 | 25 | 30 | 14 |

| Craighead County | 14 | 12 | 17 | 18 | 17 |

| Faulkner County | 14 | 14 | 14 | 15 | 16 |

| Garland County | 21 | 18 | 26 | 31 | 13 |

| Hot Spring County | 13 | 17 | 17 | 15 | 13 |

| Jefferson County | 10 | 16 | 9 | 11 | 15 |

| Miller County | 9 | 6 | 11 | 10 | 18 |

| Pulaski County | 59 | 40 | 53 | 43 | 51 |

| Sebastian County | 10 | 5 | 6 | 15 | 12 |

| Top Ten Counties | 205 | 184 | 221 | 236 | 190 |

| Washington County | 16 | 19 | 22 | 34 | 21 |

| All Other Counties | 293 | 286 | 329 | 325 | 303 |

| All Counties | 498 | 470 | 550 | 561 | 493 |

As you can see in the table above, Pulaski County is both home to the greatest population of people in Arkansas and the most traffic fatalities in the state. As you might expect, urban areas that house a great number of people are more likely to see a greater number of fatalities due to statistics alone.

That said, if you live in Pulaski County, try to be extra careful when driving on the road every day.

Fatalities Involving Speeding by County

While you can’t control the population of the city you live in, you can control whether or not you choose to speed through Arkansas. Speeding results in a fair number of the fatalities Arkansas sees on a yearly basis, as you can see in the table below.

| County Name | Fatalities, 2013 | Fatalities, 2014 | Fatalities, 2015 | Fatalities, 2016 | Fatalities, 2017 | Fatalities Per 100K, 2013 | Fatalities Per 100K, 2014 | Fatalities Per 100K, 2015 | Fatalities Per 100K, 2016 | Fatalities Per 100K, 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Arkansas County | 1 | 1 | 1 | 1 | 0 | 5.33 | 5.41 | 5.45 | 5.49 | 0 |

| Ashley County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 4.88 | 0 |

| Baxter County | 1 | 0 | 1 | 2 | 2 | 2.44 | 0 | 2.43 | 4.86 | 4.84 |

| Benton County | 6 | 4 | 4 | 3 | 3 | 2.51 | 1.64 | 1.59 | 1.16 | 1.13 |

| Boone County | 0 | 1 | 3 | 2 | 3 | 0 | 2.7 | 8.09 | 5.38 | 8.03 |

| Bradley County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 9.11 | 0 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Carroll County | 1 | 0 | 4 | 1 | 3 | 3.6 | 0 | 14.41 | 3.61 | 10.74 |

| Chicot County | 0 | 0 | 3 | 2 | 1 | 0 | 0 | 27.38 | 18.33 | 9.4 |

| Clark County | 2 | 2 | 0 | 2 | 2 | 8.86 | 8.87 | 0 | 8.87 | 8.97 |

| Clay County | 0 | 1 | 0 | 3 | 0 | 0 | 6.54 | 0 | 19.92 | 0 |

| Cleburne County | 1 | 0 | 3 | 1 | 3 | 3.9 | 0 | 11.83 | 3.97 | 11.98 |

| Cleveland County | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 24.21 | 12.19 |

| Columbia County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 4.15 | 0 | 4.23 |

| Conway County | 1 | 1 | 1 | 1 | 1 | 4.75 | 4.77 | 4.78 | 4.79 | 4.78 |

| Craighead County | 2 | 2 | 0 | 1 | 3 | 1.97 | 1.95 | 0 | 0.95 | 2.8 |

| Crawford County | 0 | 1 | 1 | 5 | 2 | 0 | 1.62 | 1.62 | 8.03 | 3.17 |

| Crittenden County | 1 | 1 | 1 | 3 | 0 | 2.01 | 2.02 | 2.04 | 6.08 | 0 |

| Cross County | 0 | 1 | 1 | 0 | 2 | 0 | 5.82 | 5.8 | 0 | 11.86 |

| Dallas County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 13.28 | 0 | 13.53 |

| Desha County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Drew County | 1 | 1 | 0 | 0 | 2 | 5.36 | 5.37 | 0 | 0 | 10.78 |

| Faulkner County | 1 | 1 | 3 | 1 | 4 | 0.84 | 0.83 | 2.48 | 0.82 | 3.23 |

| Franklin County | 0 | 2 | 1 | 5 | 2 | 0 | 11.23 | 5.64 | 28.29 | 11.18 |

| Fulton County | 1 | 0 | 0 | 3 | 1 | 8.22 | 0 | 0 | 24.92 | 8.3 |

| Garland County | 3 | 3 | 5 | 13 | 3 | 3.07 | 3.07 | 5.12 | 13.23 | 3.04 |

| Grant County | 0 | 1 | 1 | 1 | 3 | 0 | 5.53 | 5.55 | 5.53 | 16.52 |

| Greene County | 0 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 6.66 |

| Hempstead County | 0 | 1 | 3 | 1 | 2 | 0 | 4.47 | 13.57 | 4.54 | 9.15 |

| Hot Spring County | 1 | 1 | 2 | 4 | 3 | 2.98 | 2.99 | 5.97 | 11.96 | 8.94 |

| Howard County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 7.48 | 0 | 14.84 |

| Independence County | 0 | 0 | 2 | 4 | 2 | 0 | 0 | 5.4 | 10.78 | 5.33 |

| Izard County | 1 | 0 | 0 | 0 | 2 | 7.46 | 0 | 0 | 0 | 14.61 |

| Jackson County | 0 | 0 | 2 | 1 | 1 | 0 | 0 | 11.51 | 5.78 | 5.84 |

| Jefferson County | 1 | 1 | 0 | 0 | 3 | 1.37 | 1.38 | 0 | 0 | 4.34 |

| Johnson County | 1 | 0 | 0 | 2 | 0 | 3.86 | 0 | 0 | 7.63 | 0 |

| Lafayette County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Lawrence County | 2 | 1 | 0 | 2 | 2 | 11.73 | 5.89 | 0 | 12.02 | 12.1 |

| Lee County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Lincoln County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 14.41 | 0 | 0 |

| Little River County | 2 | 1 | 1 | 0 | 1 | 15.7 | 7.99 | 8.05 | 0 | 8.09 |

| Logan County | 3 | 0 | 2 | 1 | 0 | 13.63 | 0 | 9.21 | 4.61 | 0 |

| Lonoke County | 4 | 1 | 0 | 1 | 2 | 5.66 | 1.4 | 0 | 1.39 | 2.74 |

| Madison County | 1 | 1 | 1 | 1 | 0 | 6.38 | 6.36 | 6.37 | 6.21 | 0 |

| Marion County | 0 | 1 | 2 | 0 | 0 | 0 | 6.09 | 12.34 | 0 | 0 |

| Miller County | 0 | 0 | 1 | 1 | 6 | 0 | 0 | 2.28 | 2.28 | 13.64 |

| Mississippi County | 1 | 0 | 0 | 0 | 0 | 2.24 | 0 | 0 | 0 | 0 |

| Monroe County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Montgomery County | 0 | 2 | 0 | 0 | 0 | 0 | 21.85 | 0 | 0 | 0 |

| Nevada County | 1 | 1 | 0 | 0 | 1 | 11.4 | 11.56 | 0 | 0 | 12.01 |

| Newton County | 1 | 0 | 0 | 1 | 0 | 12.42 | 0 | 0 | 12.71 | 0 |

| Ouachita County | 0 | 0 | 0 | 1 | 4 | 0 | 0 | 0 | 4.16 | 16.76 |

| Perry County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 9.73 | 0 |

| Phillips County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pike County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Poinsett County | 1 | 0 | 0 | 0 | 0 | 4.14 | 0 | 0 | 0 | 0 |

| Polk County | 2 | 0 | 1 | 1 | 0 | 9.83 | 0 | 4.95 | 4.96 | 0 |

| Pope County | 1 | 1 | 0 | 3 | 3 | 1.6 | 1.59 | 0 | 4.7 | 4.7 |

| Prairie County | 0 | 1 | 0 | 0 | 2 | 0 | 11.98 | 0 | 0 | 24.25 |

| Pulaski County | 14 | 4 | 12 | 7 | 7 | 3.58 | 1.02 | 3.05 | 1.78 | 1.78 |

| Randolph County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 5.74 | 0 | 5.7 |

| Saline County | 7 | 2 | 5 | 3 | 3 | 6.18 | 1.74 | 4.3 | 2.55 | 2.51 |

| Scott County | 0 | 1 | 0 | 0 | 1 | 0 | 9.38 | 0 | 0 | 9.57 |

| Searcy County | 2 | 0 | 0 | 1 | 0 | 25.06 | 0 | 0 | 12.55 | 0 |

| Sebastian County | 1 | 0 | 1 | 4 | 2 | 0.79 | 0 | 0.79 | 3.14 | 1.56 |

| Sevier County | 0 | 1 | 1 | 2 | 0 | 0 | 5.75 | 5.8 | 11.8 | 0 |

| Sharp County | 0 | 0 | 1 | 0 | 4 | 0 | 0 | 5.95 | 0 | 23 |

| St. Francis County | 0 | 0 | 2 | 0 | 2 | 0 | 0 | 7.51 | 0 | 7.71 |

| Stone County | 1 | 0 | 0 | 1 | 1 | 8.05 | 0 | 0 | 8 | 7.98 |

| Union County | 0 | 1 | 3 | 2 | 3 | 0 | 2.49 | 7.49 | 5.02 | 7.6 |

| Van Buren County | 1 | 0 | 0 | 0 | 2 | 5.89 | 0 | 0 | 0 | 12.12 |

| Washington County | 1 | 5 | 4 | 10 | 6 | 0.46 | 2.28 | 1.79 | 4.39 | 2.59 |

| White County | 1 | 1 | 6 | 6 | 2 | 1.27 | 1.28 | 7.61 | 7.61 | 2.53 |

| Woodruff County | 0 | 3 | 0 | 0 | 0 | 0 | 43.66 | 0 | 0 | 0 |

| Yell County | 0 | 2 | 1 | 3 | 0 | 0 | 9.2 | 4.66 | 13.96 | 0 |

Read more: Mississippi Car Insurance (The Only Guide You’ll Ever Need)

Fatalities in Crashes Involving an Alcohol-Impaired Driver

Likewise, it is never — never — a good idea to drink and drive. You can control whether or not you get behind the wheel of a car while intoxicated. If you hand off your keys to a sober friend or call a ridesharing service, you’ll be contributing to the lessening of alcohol-related fatalities throughout the state of Arkansas.

| County Name | Fatalities, 2013 | Fatalities, 2014 | Fatalities, 2015 | Fatalities, 2016 | Fatalities, 2017 | Fatalities Per 100k, 2013 | Fatalities Per 100k, 2014 | Fatalities Per 100k, 2015 | Fatalities Per 100k, 2016 | Fatalities Per 100k, 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Arkansas County | 0 | 2 | 0 | 2 | 1 | 0 | 10.82 | 0 | 10.98 | 5.57 |

| Ashley County | 0 | 0 | 3 | 0 | 2 | 0 | 0 | 14.4 | 0 | 9.86 |

| Baxter County | 1 | 1 | 2 | 0 | 1 | 2.44 | 2.45 | 4.86 | 0 | 2.42 |

| Benton County | 2 | 2 | 12 | 4 | 5 | 0.84 | 0.82 | 4.78 | 1.55 | 1.88 |

| Boone County | 2 | 1 | 2 | 1 | 2 | 5.36 | 2.7 | 5.39 | 2.69 | 5.35 |

| Bradley County | 1 | 0 | 0 | 0 | 0 | 8.99 | 0 | 0 | 0 | 0 |

| Calhoun County | 0 | 1 | 0 | 0 | 0 | 0 | 19.35 | 0 | 0 | 0 |

| Carroll County | 0 | 2 | 5 | 4 | 4 | 0 | 7.22 | 18.02 | 14.43 | 14.31 |

| Chicot County | 0 | 0 | 0 | 2 | 2 | 0 | 0 | 0 | 18.33 | 18.8 |

| Clark County | 0 | 3 | 0 | 1 | 1 | 0 | 13.3 | 0 | 4.43 | 4.49 |

| Clay County | 0 | 1 | 2 | 0 | 1 | 0 | 6.54 | 13.16 | 0 | 6.7 |

| Cleburne County | 1 | 1 | 1 | 1 | 2 | 3.9 | 3.91 | 3.94 | 3.97 | 7.98 |

| Cleveland County | 1 | 0 | 0 | 1 | 1 | 11.74 | 0 | 0 | 12.11 | 12.19 |

| Columbia County | 3 | 1 | 1 | 0 | 3 | 12.37 | 4.16 | 4.15 | 0 | 12.7 |

| Conway County | 3 | 2 | 1 | 1 | 0 | 14.24 | 9.53 | 4.78 | 4.79 | 0 |

| Craighead County | 4 | 4 | 4 | 6 | 6 | 3.94 | 3.9 | 3.84 | 5.67 | 5.6 |

| Crawford County | 1 | 5 | 1 | 3 | 4 | 1.62 | 8.09 | 1.62 | 4.82 | 6.35 |

| Crittenden County | 2 | 6 | 1 | 3 | 1 | 4.02 | 12.11 | 2.04 | 6.08 | 2.05 |

| Cross County | 1 | 1 | 0 | 0 | 2 | 5.71 | 5.82 | 0 | 0 | 11.86 |

| Dallas County | 1 | 0 | 2 | 0 | 0 | 12.68 | 0 | 26.56 | 0 | 0 |

| Desha County | 1 | 0 | 1 | 2 | 1 | 8.01 | 0 | 8.31 | 16.78 | 8.5 |

| Drew County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 5.37 | 0 | 10.78 |

| Faulkner County | 3 | 2 | 6 | 1 | 4 | 2.52 | 1.66 | 4.95 | 0.82 | 3.23 |

| Franklin County | 0 | 3 | 1 | 1 | 1 | 0 | 16.84 | 5.64 | 5.66 | 5.59 |

| Fulton County | 1 | 1 | 1 | 0 | 1 | 8.22 | 8.28 | 8.25 | 0 | 8.3 |

| Garland County | 10 | 9 | 9 | 9 | 1 | 10.24 | 9.21 | 9.21 | 9.16 | 1.01 |

| Grant County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 5.55 | 0 | 11.01 |

| Greene County | 1 | 2 | 2 | 1 | 0 | 2.32 | 4.57 | 4.51 | 2.24 | 0 |

| Hempstead County | 4 | 3 | 1 | 2 | 2 | 17.83 | 13.42 | 4.52 | 9.08 | 9.15 |

| Hot Spring County | 3 | 4 | 7 | 3 | 1 | 8.95 | 11.98 | 20.91 | 8.97 | 2.98 |

| Howard County | 0 | 1 | 3 | 1 | 0 | 0 | 7.4 | 22.43 | 7.44 | 0 |

| Independence County | 2 | 4 | 2 | 4 | 2 | 5.43 | 10.8 | 5.4 | 10.78 | 5.33 |

| Izard County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 14.61 |

| Jackson County | 1 | 0 | 2 | 4 | 2 | 5.64 | 0 | 11.51 | 23.11 | 11.67 |

| Jefferson County | 3 | 7 | 7 | 2 | 2 | 4.1 | 9.67 | 9.75 | 2.84 | 2.89 |

| Johnson County | 1 | 1 | 0 | 0 | 1 | 3.86 | 3.85 | 0 | 0 | 3.77 |

| Lafayette County | 0 | 1 | 0 | 1 | 0 | 0 | 13.96 | 0 | 14.43 | 0 |

| Lawrence County | 1 | 3 | 0 | 1 | 1 | 5.87 | 17.68 | 0 | 6.01 | 6.05 |

| Lee County | 0 | 0 | 4 | 0 | 2 | 0 | 0 | 41.33 | 0 | 21.8 |

| Lincoln County | 0 | 2 | 1 | 0 | 1 | 0 | 14.25 | 7.21 | 0 | 7.33 |

| Little River County | 2 | 0 | 0 | 2 | 1 | 15.7 | 0 | 0 | 16.09 | 8.09 |

| Logan County | 3 | 0 | 2 | 1 | 2 | 13.63 | 0 | 9.21 | 4.61 | 9.21 |

| Lonoke County | 4 | 2 | 5 | 4 | 2 | 5.66 | 2.81 | 7.02 | 5.57 | 2.74 |

| Madison County | 2 | 3 | 2 | 1 | 1 | 12.76 | 19.08 | 12.74 | 6.21 | 6.12 |

| Marion County | 2 | 0 | 1 | 0 | 0 | 12.16 | 0 | 6.17 | 0 | 0 |

| Miller County | 1 | 0 | 4 | 1 | 5 | 2.3 | 0 | 9.11 | 2.28 | 11.37 |

| Mississippi County | 4 | 2 | 1 | 2 | 3 | 8.95 | 4.52 | 2.29 | 4.66 | 7.12 |

| Monroe County | 1 | 0 | 1 | 4 | 2 | 13 | 0 | 13.42 | 55.29 | 28.23 |

| Montgomery County | 0 | 2 | 1 | 1 | 2 | 0 | 21.85 | 11.08 | 11.17 | 22.42 |

| Nevada County | 1 | 0 | 0 | 1 | 0 | 11.4 | 0 | 0 | 11.94 | 0 |

| Newton County | 0 | 1 | 0 | 0 | 0 | 0 | 12.69 | 0 | 0 | 0 |

| Ouachita County | 1 | 0 | 1 | 0 | 3 | 4.01 | 0 | 4.11 | 0 | 12.57 |

| Perry County | 1 | 0 | 1 | 1 | 2 | 9.68 | 0 | 9.71 | 9.73 | 19.33 |

| Phillips County | 1 | 3 | 1 | 0 | 1 | 4.89 | 15.03 | 5.11 | 0 | 5.38 |

| Pike County | 1 | 1 | 0 | 0 | 0 | 9 | 9.11 | 0 | 0 | 0 |

| Poinsett County | 1 | 0 | 4 | 1 | 2 | 4.14 | 0 | 16.66 | 4.17 | 8.28 |

| Polk County | 2 | 1 | 3 | 0 | 1 | 9.83 | 4.94 | 14.85 | 0 | 4.97 |

| Pope County | 1 | 1 | 1 | 1 | 4 | 1.6 | 1.59 | 1.57 | 1.57 | 6.27 |

| Prairie County | 1 | 1 | 0 | 1 | 4 | 11.94 | 11.98 | 0 | 12.09 | 48.5 |

| Pulaski County | 21 | 14 | 16 | 14 | 13 | 5.37 | 3.57 | 4.07 | 3.56 | 3.3 |

| Randolph County | 0 | 1 | 2 | 2 | 1 | 0 | 5.69 | 11.48 | 11.49 | 5.7 |

| Saline County | 6 | 5 | 5 | 3 | 1 | 5.3 | 4.36 | 4.3 | 2.55 | 0.84 |

| Scott County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 9.48 | 9.65 | 0 |

| Searcy County | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 25.55 | 0 | 12.6 |

| Sebastian County | 3 | 3 | 1 | 5 | 4 | 2.36 | 2.37 | 0.79 | 3.92 | 3.12 |

| Sevier County | 0 | 1 | 1 | 2 | 1 | 0 | 5.75 | 5.8 | 11.8 | 5.84 |

| Sharp County | 2 | 0 | 2 | 2 | 2 | 11.74 | 0 | 11.89 | 11.67 | 11.5 |

| St. Francis County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 3.75 | 0 | 0 |

| Stone County | 0 | 0 | 2 | 1 | 1 | 0 | 0 | 16.16 | 8 | 7.98 |

| Union County | 0 | 1 | 4 | 2 | 1 | 0 | 2.49 | 9.98 | 5.02 | 2.53 |

| Van Buren County | 1 | 2 | 0 | 0 | 1 | 5.89 | 11.84 | 0 | 0 | 6.06 |

| Washington County | 3 | 11 | 5 | 8 | 7 | 1.39 | 5.01 | 2.23 | 3.51 | 3.02 |

| White County | 2 | 4 | 4 | 8 | 2 | 2.55 | 5.1 | 5.07 | 10.15 | 2.53 |

| Woodruff County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Yell County | 0 | 1 | 0 | 3 | 5 | 0 | 4.6 | 0 | 13.96 | 23.23 |

Teen Drinking and Driving

Unfortunately, it’s not just adults who sometimes choose to drink and drive. Teenage drunk driving is more common in Arkansas than it should be.

| Details | Numbers |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.2 |

| Higher/Lower Than National Average (1.2) | equal |

| DUI Arrest (Under 18 years old) | 44 |

| DUI Arrests (Under 18 years old) Total Per Million People | 62.41 |

You should note that it’s more common for teenagers in rural areas to drink and drive than it is for teenagers in urban areas.

That said, the fatality rate of teenage drunk drivers in Arkansas matches the national average at 1.2 percent.

EMS Response Time

If you happen to get in an accident in Arkansas, you’ll have to rely on the speediness of local EMS response teams.

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |