Allstate Car Insurance Guide [Data + Expert Review]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Feb 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

The Sugar Bowl. Mayhem. And a motto that some say is the most recognizable in the United States.

Welcome to our review about Allstate Car Insurance.

It is an insurance company that has been around since 1931, one that has seen incredible success and a small amount of controversy, one that brings the funny to our minds while hitting our pocketbooks hard.

You’re in good hands.

We’re going to find out if that motto’s true or not.

We, here at Insurantly.com, know that making the correct decision about car insurance is important. The right car insurance aligns with your needs, saves you money, provides good coverages, and helps when needed.

We also know that there’s a lack of information out there about car insurance companies. And you might ask, with the information that is out there, can you trust it?

That’s what we’re here for. In this expert review, we’ll cover Allstate from all angles. We’ll tackle the financial and customer satisfaction ratings, dive into its company culture, provide rates and discounts, review its apps and website.

And, yes, we’ll touch on its controversies.

By the end, you should have all the information you need to know about whether to choose Allstate for your next car insurance. Ready?

We’re pulling out of the bay onto the first stretch.

Ready to compare rates? Try our free online tool.

| Company Overview | Details |

|---|---|

| Year Founded | 1931 |

| Current Executives | CEO: Tom Wilson |

| Number of Employees | 45,700 |

| Total Revenue Total Assets | $39.8 billion $112.2 billion |

| HQ Address | 2775 Sanders Rd Northbrook, IL 60062 |

| Phone Number | 1-877-810-2920 |

| Company Website | https://www.allstate.com/ |

| Premiums Written | Private Passenger Auto: 22,663,214 Total Lines: 33,251,176 |

| Loss Ratio | Private Passenger Auto: .56 Total Lines: .59 |

| Best For | Financial Strength Spanish-speakers Diversity and Inclusion |

Allstate’s Rating Agency

We know that finding correct information is invaluable and how difficult it can be. And it makes a huge difference.

In this section, we cover Allstate’s financial strength ratings and customer satisfaction ratings. This section answers a couple of very important questions.

- Is Allstate going to be functioning well financially long-term?

- What do its customers, perhaps the best people to judge Allstate, think of it?

Let’s start down the first stretch.

A.M. Best

A.M. Best is one of the leading credit rating agencies in the world. Its ratings serve as a barometer for other countries around the world. They help answer the questions, “Is Allstate a financially sound company?”

It gives Allstate an A+, which is the second-highest rating. According to A.M. Best’s Financial Strength Rating Guide, this rating means Allstate has a superior ability to meet its insurance obligations.

This can include paying out liability claims, reimbursing customers for totaled cars in GAP coverage claims, and even providing roadside assistance as part of a plan.

Better Business Bureau

The Better Business Bureau (BBB) is a group that rates businesses, small and large. It uses a 10-factor scale, with just a few factors shown here.

- Complaint issues that are known to BBB

- Transparent business practices

- Any negative government action

- Any advertising issues

BBB gives Allstate an A+, which is the highest possible ranking. However, what do the consumers who review Allstate on BBB think?

On Allstate’s BBB page, consumers give it 1.1 stars out of five, from 249 reviews. Not altogether positive.

Moody’s Rating

Moody’s is one of the Big Three Credit Rating Agencies and rates companies based on credit risk and global long-term outlook.

Moody’s gives Allstate an Aa3 rating, meaning that Allstate’s obligations are “judged to be of the highest quality, subject to the lowest level of credit risk” according to Moody’s rating scale.

S&P Rating

Standard and Poor’s (S&P) is another of the Big Three Rating Agencies and, like Moody’s, evaluates and rates companies according to credit risk and global long-term outlook.

S&P gives Allstate an AA- rating, which is just two from the top. It is considered to have a very strong ability to meet its financial and insurance obligations. It differs from top-level companies by just a little bit.

NAIC Complaint Index

The National Alliance of Insurance Commissioners (NAIC) is a collection of the top public insurance officials in the country. It compiles complete complaint data from all the state departments in the country.

The data is then put into a calculation. This calculation weighs the number of complaints versus the total premiums written. What comes out is a complaint index.

Allstate had 226 complaints to the state departments in 2018. This account for a 1.26 complaint index. How does this stack up against other companies?

| Company | Complaint Index | Total Complaints |

|---|---|---|

| American Family | 0.69 | 99 |

| Farmers | 0.95 | 73 |

| Geico | 0.92 | 600 |

| Liberty Mutual | 0.94 | 146 |

| Nationwide | 0.43 | 37 |

| Progressive | 0.88 | 84 |

| State Farm | 0.57 | 1,397 |

| Travelers | 0.20 | 31 |

| USAA | 1.15 | 328 |

Lower is better. And Allstate’s is the highest.

JD Power

J.D Power is a heavy hitter in the insurance industry. You may have seen its awards being bandied on television commercials.

It does a large insurance study every year evaluating customer satisfaction for each company’s claims process. There are six factors, including how customers feel about the rental experience and repair process.

Allstate scored a three out of five for overall customer satisfaction, good for 12th.

- Ahead of: American Family, Progressive, Liberty Mutual

- Behind: USAA, Farmers, Travelers

- In a near tie with: State Farm, Nationwide, Geico

Read more: American Family Car Insurance Guide [Data + Expert Review]

Customers rated Allstate three out of five stars for each category across the board.

| Factors in Claim Process | Rating (out of 5) |

|---|---|

| Claims Servicing | 3 |

| Estimation Process | 3 |

| First Notice of Loss | 3 |

| Rental Experience | 3 |

| Repair Process | 3 |

| Settlement | 3 |

| Overall Satisfaction | 3 |

With its claims process, Allstate was, well, average.

Consumer Affairs

Consumer Affairs is a website where consumers can post reviews about companies, good and bad, and also give ratings. Out of 1,448 reviews, consumers rated Allstate 3.7 out of five stars.

Some pros Consumer Affairs mentioned include Allstate’s excellent financial strength and the fact that it’s a leading car insurer. One con mentioned is that customers occasionally received premium increases.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate History

It started in 1930. Allstate had been a business at that point, a subsidiary of Sears, Roebuck, and Co., selling tires through Sears’ famed and widespread merchandise catalogs.

In 1930, insurance broker Carl Odell proposed to Robert Wood, the Chairman General of Sears, the idea of selling car insurance through direct mail.

Wood liked the idea, passed it on to the board of directors.

It succeeded, and in 1931 the Allstate Insurance Company was born.

It grew and grew rapidly. Today, it is in the top five of total property and casualty companies. It’s the same with private passenger auto.

It has a long history, being one of the first companies involved in landmark safety legislation and working to reduce teen car crashes. It also raises awareness about domestic violence and economic abuse.

For the latter, it received the Flame of Life award from the National Safety Council.

That is, in part, its story. Its story and its history.

We understand that you, as a customer, might look at more than rates or discounts when researching your next car insurance company. Company culture, activities in the community, what its employees think of it all matter.

We are in the day and age where the bottom line might not be the only factor in choosing a company.

For you, we have this section. We cover Allstate’s market share, its online presence, its community service, and its employees. We even touch on its commercials.

Let’s take a ride through Allstate. We’re heading into stretch two.

Allstate Market Share

Allstate has been ranked in the top four for private passenger auto companies for some time.

In the early 2010s, however, it started to stagnate and lose ground to two smaller companies. They were online policy retailers who focused on the internet to sign customers up for insurance.

Those were Geico and Progressive. Allstate tried to combat this by purchasing Esurance.com in 2011.

Did its efforts succeed and how does it match up against its top competitors in the private passenger auto market?

Let’s take a look at the former first. These numbers come from the market share reports produced by the National Alliance of Insurance Commissioners.

| Allstate Market Share | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Private Passenger Auto | 10.03% | 9.70% | 9.26% | 9.19% |

| All Lines | 5.07% | 5.00% | 4.88% | 4.88% |

The answer is, no, its efforts have not helped or helped enough to keep it from falling. Allstate’s market share in private passenger auto dropped .8 percent from 2015 to 2018. The fall in total lines was smaller, around .2 percent.

It still ranks in the top four of insurance companies in the private passenger market. But whereas it was third in 2015, an up-and-comer overtook it.

While State Farm and Allstate have been falling steadily, Geico and Progressive have been rising. However, as we’ll see in the next section, losing market share doesn’t mean Allstate necessarily isn’t growing.

Allstate’s Position for the Future

Allstate has been losing market share. But it has been growing.

From 2015 to 2018, it increased its premiums written in the private passenger auto market by about 13 percent. The rise in premiums was from 20 million to about 22.6 million. It also grew in total lines, about 10.2 percent.

This, combined with its excellent financial ratings, means Allstate’s position for the future is strong.

If there’s a concern, it has to do with its loss ratios, which are a ratio between claims filled and premiums written.

Its loss ratios are a little lower than typical for some other companies, which indicates it may not be filling claims as much as the other companies. And given some of its controversies, this could be an issue.

Aside from this, it is in a strong position for the future.

Allstate’s Online Presence

Allstate has a large online presence, complete with social media profiles and a one-stop-shop website where you can file claims, get quotes, and contact customer service. For social media, it is active on the big four.

It is also active on SnapChat, sending out ads during March Madness during 2016.

Allstate’s Commercials

In the past several years, Allstate has used two spokespersons to convey its messages. The first, starting in 2003, is Dennis Haysbert, best known perhaps for his role in 24 as a senator-turned president of the U.S.

He appeared in hundreds of commercials from 2003 to 2016.

The one that took over for Haysbert, starting in 2010 was Dean Winters. He’s most known for his roles in Law and Order: SVU and 30 Rock.

Within Allstate commercials, he plays the character Mayhem, who goes through or causes ridiculous insurance claim situations.

Drivewise:

https://www.youtube.com/watch?v=7i_Y5lewEKY

Allstate in the Community

Allstate concentrates its efforts in the community in four areas.

- Safe driving: such as creating Reality Rides, a virtual simulator that teaches safe driving practices

- Giving back locally: such as spotlighting employees that do well in the community

- Ending domestic violence: such as with the Allstate Foundation Purple Purse

- Disaster relief: such as having a catastrophe team and a fleet of vehicles to help anywhere around the country

Within disaster relief, Allstate also helps rebuild communities.

Allstate’s Employees

To see what Allstate’s employees thought about Allstate, we took a look at three different websites that provided surveys of what employees really thought. They are Indeed, Payscale, and Glassdoor.

Employees on Indeed gave Allstate a 3.8 rating out of five stars, coming from nearly 7,000 reviews. Employee responses for the factors in the survey were all above average.

| User Prompt | Rating |

|---|---|

| Rating | 3.8 |

| Work-Life Balance | 3.7 |

| Pay & Benefits | 3.5 |

| Job Security & Advancement | 3.3 |

| Management | 3.4 |

| Culture | 3.6 |

Work-life balance and culture were the highest at 3.7 and 3.6 respectively.

Employees that responded on Payscale were a little less positive about Allstate, with over three-fourths of employees saying their jobs at Allstate were highly stressful.

| Category | Details |

|---|---|

| Job Satisfaction | 3.4 |

| Highly Stressful | 77% |

Employees that responded on Glassdoor were in line with those that responded on Payscale. This, in terms of job satisfaction.

| User Prompt | Details |

|---|---|

| Rating | 3.4 |

| Recommend to a Friend | 58% |

| Approve of CEO | 71% |

Just over half would recommend the company to a friend and 29 percent don’t approve of the CEO. This is not necessarily unusual among the top insurance companies.

Overall, Allstate has gained numerous awards from different outlets. A consistent theme with the awards is diversity, with Allstate being rated as military-friendly, supportive of multicultural women, and good for Hispanics.

Allstate backs this last part up with an unusual feature on its YouTube, with a designated Spanish section. Diversity for Allstate is the real deal.

https://www.youtube.com/watch?v=IAOFVxYKwiE

Cheap Car Insurance Rates

We know that rates are one of the most important factors when choosing a new car insurance company.

You don’t want to spend a mortgage payment on car insurance and every dollar saved goes to that vacation, new pair of shoes, or home repair project.

But rates can be tough to find. You might spend an hour going through different sites, getting quotes, and comparing quotes only to find them conflicting and confusing. That’s what we’re here for.

For this section, we’ve partnered with a company called Quadrant that has the inside track on the private passenger auto insurance industry.

It has data on rates for the top 10 companies, in their available states, and for context. We’re going to use that data to show how Allstate compares to other companies, for average rates and for situations.

Let’s head into stretch three.

Allstate Availability and Rates by State

Rates by state vary widely for most companies. In some cases, even an expensive company can be well-beneath the average in certain states. Search for your state in the search bar.

| State | Average by State | Allstate Annual Premium | Higher/Lower | % |

|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | -$276.21 | -8.07% |

| Alabama | $3,566.96 | $3,311.52 | -$255.44 | -7.16% |

| Arkansas | $4,124.98 | $5,150.03 | $1,025.05 | 24.85% |

| Arizona | $3,770.97 | $4,904.10 | $1,133.13 | 30.05% |

| California | $3,688.93 | $4,532.96 | $844.03 | 22.88% |

| Colorado | $3,876.39 | $5,537.17 | $1,660.78 | 42.84% |

| Connecticut | $4,618.92 | $5,831.60 | $1,212.68 | 26.25% |

| District of Columbia | $4,439.24 | $6,468.92 | $2,029.68 | 45.72% |

| Delaware | $5,986.32 | $6,316.06 | $329.74 | 5.51% |

| Florida | $4,680.46 | $7,440.46 | $2,760.00 | 58.97% |

| Georgia | $4,966.83 | $4,210.70 | -$756.13 | -15.22% |

| Hawaii | $2,555.64 | $2,173.49 | -$382.15 | -14.95% |

| Iowa | $2,981.28 | $2,965.86 | -$15.42 | -0.52% |

| Idaho | $2,979.09 | $4,088.76 | $1,109.67 | 37.25% |

| Illinois | $3,305.48 | $5,204.41 | $1,898.93 | 57.45% |

| Indiana | $3,414.97 | $3,978.81 | $563.84 | 16.51% |

| Kansas | $3,279.62 | $4,010.23 | $730.61 | 22.28% |

| Kentucky | $5,195.40 | $7,143.92 | $1,948.52 | 37.50% |

| Louisiana | $5,711.34 | $5,998.79 | $287.45 | 5.03% |

| Maine | $2,953.28 | $3,675.59 | $722.31 | 24.46% |

| Maryland | $4,582.70 | $5,233.17 | $650.47 | 14.19% |

| Massachusetts | $2,678.85 | $2,708.53 | $29.68 | 1.11% |

| Michigan | $10,498.64 | $22,902.59 | $12,403.95 | 118.15% |

| Minnesota | $4,403.25 | $4,532.01 | $128.76 | 2.92% |

| Missouri | $3,328.93 | $4,096.15 | $767.22 | 23.05% |

| Mississippi | $3,664.57 | $4,942.11 | $1,277.54 | 34.86% |

| Montana | $3,220.84 | $4,672.10 | $1,451.26 | 45.06% |

| North Carolina | $3,393.11 | $7,190.43 | $3,797.32 | 111.91% |

| North Dakota | $4,165.84 | $4,669.31 | $503.47 | 12.09% |

| Nebraska | $3,283.68 | $3,198.83 | -$84.85 | -2.58% |

| New Hampshire | $3,151.77 | $2,725.01 | -$426.77 | -13.54% |

| New Jersey | $5,515.21 | $5,713.58 | $198.36 | 3.60% |

| New Mexico | $3,463.64 | $4,200.65 | $737.01 | 21.28% |

| Nevada | $4,861.70 | $5,371.62 | $509.92 | 10.49% |

| New York | $4,289.88 | $4,740.97 | $451.08 | 10.51% |

| Ohio | $2,709.71 | $3,197.22 | $487.51 | 17.99% |

| Oklahoma | $4,142.33 | $3,718.62 | -$423.70 | -10.23% |

| Oregon | $3,467.77 | $4,765.95 | $1,298.18 | 37.44% |

| Pennsylvania | $4,034.50 | $3,984.12 | -$50.38 | -1.25% |

| Rhode Island | $5,003.36 | $4,959.45 | -$43.91 | -0.88% |

| South Carolina | $3,781.14 | $3,903.43 | $122.29 | 3.23% |

| South Dakota | $3,982.27 | $4,723.72 | $741.45 | 18.62% |

| Tennessee | $3,660.89 | $4,828.85 | $1,167.96 | 31.90% |

| Texas | $4,043.28 | $5,485.44 | $1,442.16 | 35.67% |

| Utah | $3,611.89 | $3,566.42 | -$45.47 | -1.26% |

| Virginia | $2,357.87 | $3,386.80 | $1,028.93 | 43.64% |

| Vermont | $3,234.13 | $3,190.38 | -$43.75 | -1.35% |

| Washington | $3,059.32 | $3,540.52 | $481.20 | 15.73% |

| West Virginia | $2,595.36 | $3,820.68 | $1,225.32 | 47.21% |

| Wisconsin | $3,606.06 | $4,854.41 | $1,248.35 | 34.62% |

| Wyoming | $3,200.08 | $4,373.93 | $1,173.85 | 36.68% |

| Median | $3,660.89 | $4,532.96 | $872.07 | 23.82% |

Read more:

- 60 Day Waiting Period on New Texas Auto Insurance Policies

- Florida Car Insurance (The Only Guide You’ll Ever Need)

- Connecticut Car Insurance (The Only Guide You’ll Ever Need)

- Delaware Car Insurance (The Only Guide You’ll Ever Need)

This rate difference per state is the same with Allstate.

- Where it’s cheaper: Oklahoma, Georgia, Nebraska

- Where’s it’s more expensive: Michigan, North Carolina, Florida

In general, it’s more expensive than the general average.

Comparing the Top 10 Companies by Market Share

Allstate is available in all 50 states. In some states, it compares favorably against some companies. In other states, it doesn’t. Search for yours in the search bar.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | - | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | - | $2,879.96 | $5,295.55 | - | $3,062.85 | $2,228.12 | - | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | - | $5,000.08 | $2,264.71 | - | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | - | $4,257.87 | $3,484.63 | - | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | - | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | - | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | - | - | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | - | - | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | - | - | $3,692.81 | - | $4,848.98 | $4,970.26 | $4,074.05 | - | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | - | - | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | - | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | - | - | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | - | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | - | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | - | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | - | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | - | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | - | - | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | - | - | $6,154.60 | - | - | $7,471.10 | $4,579.12 | - | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | - | $2,770.15 | $2,823.05 | $4,331.39 | - | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | - | - | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | - | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | - | - | $1,510.17 | $4,339.35 | - | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | - | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | - | $2,066.99 | - | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | - | - | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | - | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | - | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | - | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | - | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | - | - | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | - | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | - | $7,617.00 | $2,754.94 | $6,766.62 | - | $3,972.72 | $7,527.16 | $4,254.49 | - |

| New Mexico | $3,463.64 | $4,200.65 | - | $4,315.53 | $4,458.30 | - | $3,514.38 | $3,119.18 | $2,340.66 | - | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | - | - | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | - | - | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | - |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | - | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | - | $4,142.40 | $3,437.34 | $6,874.62 | - | $4,832.35 | $2,816.80 | - | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | - | - | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | - | - | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | - | $4,691.85 | $3,178.01 | - | $3,625.49 | $4,573.08 | $3,071.34 | - | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | - | - |

| Tennessee | $3,660.89 | $4,828.85 | - | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | - | $3,263.28 | - | $3,867.55 | $4,664.69 | $2,879.94 | - | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | - | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | - | - | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | - | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | - | - | $2,061.53 | - | $2,073.00 | $2,498.58 | $2,268.95 | - | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | - | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | - | - | $2,120.80 | $2,924.39 | - | - | $2,126.32 | - | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | - | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | - | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | - | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

Allstate’s median rate for all states is $4,532.95. This makes it the second-most-expensive company compared to the rest of the top 10 private passenger auto insurance companies.

| Company | Median Annual Premium | Allstate (+/-) | Allstate (%) |

|---|---|---|---|

| American Family | $3,698.77 | $834.19 | 18.40% |

| Farmers | $3,907.99 | $624.97 | 13.79% |

| Geico | $3,073.66 | $1,459.30 | 32.19% |

| Liberty Mutual | $5,295.55 | -$762.60 | -16.82% |

| Nationwide | $3,187.20 | $1,345.76 | 29.69% |

| Progressive | $3,935.36 | $597.60 | 13.18% |

| State Farm | $2,731.48 | $1,801.48 | 39.74% |

| Travelers | $3,729.32 | $803.64 | 17.73% |

| USAA | $2,489.49 | $2,043.46 | 45.08% |

The only one that is more expensive is Liberty Mutual, about 17 percent higher than Allstate. When it comes to its nearest competitors, Allstate is much more expensive.

- Progressive: Allstate is more expensive by 13 percent

- Geico: Allstate is more expensive by 32 percent

- State Farm: Allstate is more expensive by 40 percent

It’s likely one reason why Progressive and Geico are gaining market share while Allstate is falling behind.

Average Allstate Male vs Female Car Insurance Rates

Using demographics to set car insurance rates is on its way out.

Seven states (as of this writing) have outlawed the use of gender or all demographic factors to set rates. They are California, Hawaii, North Carolina, Montana, Massachusetts, Pennsylvania, and Michigan.

But if you don’t live in those states, your gender or demographic factors can affect your rates. Why?

It all comes down to the likelihood, calculated by the insurance company, of you filing a claim. For instance, insurance companies believe that males are more dangerous drivers than females and more likely to file a claim.

Younger drivers get penalized because they are more inexperienced and risk-prone. Being married signals responsibility and less likelihood to file a claim.

How do Allstate’s rates vary according to these factors?

| Demographic | Average Premium |

|---|---|

| Married 35-year old female | $3,156.09 |

| Married 35-year old male | $3,123.01 |

| Married 60-year old female | $2,913.37 |

| Married 60-year old male | $2,990.64 |

| Single 17-year old female | $9,282.19 |

| Single 17-year old male | $10,642.53 |

| Single 25-year old female | $3,424.87 |

| Single 25-year old male | $3,570.93 |

There’s a $7,750 difference between the rates of a 17-year-old single male and a 60-year-old married female.

The rate gap between the sexes gets smaller as both sexes age. A $1,400 difference at age 17 becomes $73 at age 60. The only age where females pay more than males is at age 35. The difference is just $33.

Average Allstate Rates by Make and Model

Insuring a new car might lead to higher rates. The reasons are straightforward.

- A newer car is worth more, which means that a claim being filed would cost the insurance company more money

- A newer car might have fancy technological features which would cost more to repair

While this isn’t an exact science as some new cars might get discounts for safety features, this holds true for many companies. This is whether the vehicle is a car, mid-sized SUV, or a truck.

| Make/Model | Average Premium |

|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $4,429.74 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,753.69 |

| 2015 Toyota RAV4: XLE | $4,324.99 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $5,491.12 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $5,380.28 |

| 2018 Toyota RAV4: XLE | $4,947.90 |

Each newer model costs several hundred more to insure, with the F-150 costing the most at nearly $1,000 more.

Average Allstate Commute Rates

Rates can vary according to commute rates and annual mileage as well. If you drive more, you are more likely to get into an accident or have another reason to file a claim. That’s the logic, anyway.

| Commute and Annual Mileage | Average Premium |

|---|---|

| 10 miles commute | 6,000 annual mileage. | $4,841.71 |

| 25 miles commute | 12,000 annual mileage. | $4,934.20 |

Allstate’s rates are $100 higher for someone with a 25-mile commute or 12,000 annual mileage versus someone with a 10-mile commute or 6,000 annual mileage.

Average Allstate Coverage Level Rates

Coverage levels can vary for a couple of reasons.

- First, the number of coverages you have. Simple liability is a lower coverage level than if you add comprehensive and collision.

- Second, the limits of the coverage. A $30,000 bodily liability policy is less coverage than a $50,000 bodily liability policy.

In both cases, a higher coverage level equals a higher rate. For some companies, the difference between a high coverage level and a low coverage level is thousands of dollars. For others, it’s much lower.

How is it with Allstate?

| High | Low | Medium |

|---|---|---|

| $5,139.02 | $4,628.03 | $4,896.81 |

There’s a difference of $500 between high and low-level coverages. How does this stack up against Allstate’s competitors?

| Company | High | Low | Medium |

|---|---|---|---|

| State Farm | $3,454.80 | $3,055.40 | $3,269.80 |

| Geico | $3,429.14 | $3,001.91 | $3,213.97 |

| Progressive | $4,350.96 | $3,737.13 | $4,018.46 |

All three companies have lower coverage level rates overall, with Geico and State Farm both having smaller differences between high and low coverage level rates.

Progressive is different, with a $600 difference between a high and low coverage level.

Average Allstate Credit History Rates

Your credit history can drastically influence your car insurance rate. The difference between poor credit history and good credit history is often thousands of dollars. It can even lead to prices higher than a DUI. The reason?

Insurance companies believe that credit histories are indicative of whether someone will file a claim. The arbitrary nature of this was covered in a Consumer Reports study.

It found that insurance companies don’t use the FICO score as part of their model.

They “cherry-pick” dozens of factors in a person’s credit history to put into their own models to determine the likelihood of filing a claim.

What is the rate difference between a poor credit score and a good credit score with Allstate?

| Fair Credit | Good Credit | Poor Credit |

|---|---|---|

| $4,581.16 | $3,859.66 | $6,490.65 |

It’s about $2,600. Do its competitors have this big of a difference?

| Company | Fair Credit | Good Credit | Poor Credit |

|---|---|---|---|

| State Farm | $2,853.00 | $2,174.26 | $4,951.20 |

| Geico | $2,986.79 | $2,434.82 | $4,259.50 |

| Progressive | $3,956.31 | $3,628.85 | $4,737.64 |

Yes, but just one. It’s State Farm with a difference of $2,800. Geico and Progressive have much smaller differences than those two.

Average Allstate Driving Record Rates

Your driving record also influences your rates. A single infraction can cost you hundreds, sometimes thousands of dollars. Is this the case for Allstate?

| Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Ticket |

|---|---|---|---|

| $3,819.90 | $4,987.68 | $6,260.73 | $4,483.51 |

The rate differences are not small for Allstate. A single speeding ticket jumps rates by $600, a single accident by around $1,170, and a DUI by around $2,400. Those are expensive.

But how do they compare to the rates from Allstate’s competitors?

Honestly, not particularly bad.

- State Farm is the only company that across the board penalizes less than Allstate.

- Geico’s rate jumps are about in-line with Allstate, with a little less when it comes to a ticket and a little more when it comes to a DUI.

- Progressive’s 1 Speeding Ticket jump is about even with Allstate’s. It’s 1 Accident jump is higher and 1 DUI is much lower.

Although Allstate’s overall rates are higher, it’s penalization of infractions is roughly about norm compared to the rest, except for State Farm.

Coverages Offered

We know that finding the right company means finding the right coverages. The right coverages can help you recover from lost wages, repair your car if it gets damaged, or even pay for your medical bills.

Allstate offers a good amount of coverages and a good amount of discounts. We’ll cover them here.

And we’ll take a look at something that influences your rates, simply based on where you are.

Time to give it a little gas. We’re entering stretch four.

Types of Coverages Offered

The 12 coverages here are divided into personal auto coverages, vehicle coverages, and special auto coverages. There are six in the first category and three in each of the final two categories.

Personal auto coverages are those that apply to you personally. They are more about you than your vehicle. Each protects you in its own way, and all are used in light of an accident.

Some of these are required coverages in a state and some are not. Check with your state department for insurance requirements or check out one of our many state guides like Georgia, New Hampshire, Florida, Illinois, and Louisiana.

| Personal Auto Coverage | Purpose | You Need It: |

|---|---|---|

| Bodily Injury Liability | Will pay for the other drivers' medical bills/loss of income in an accident you caused | When the 25-year-old rock star you hit has broken his strumming hand |

| Property Damage Liability | Will pay for the damage to the property in an accident you caused | When the policeman insists you pay for hitting his vehicle |

| Personal Injury Protection | Pays for your medical bills/loss of income after an accident | When someone T-bones you and you get a strained neck |

| Uninsured Motorist | Helps you when you are in an accident with a driver who's uninsured | Because drivers in American have no chill |

| Underinsured Motorist | Helps you when you are in an accident with a driver who's underinsured | Because some drivers in America have more chill than others |

| Medical Payments | Helps pay for you and your passengers' medical costs after an accident | When the hospital comes a-callin |

Vehicle coverages are more about your vehicle. They protect against unusual situations, such as when hail rains down on your car or your vehicle is totaled with time still left on your financing.

| Vehicle Coverages | Purpose | You might need it: |

|---|---|---|

| Collision | Pays for damages to your car in a collision with an object or vehicle | When an 80-year-old woman strikes your car from the rear |

| Comprehensive | Pays for damages to your car for situations not involved in a collision (theft, vandalism, etc.) | When a 16-year-old kid spray-paints your car |

| Gap Coverage | Covers the gap between the actual value of your car and what you owe, if your car is totaled | When your car is totaled and the manufacturer still wants money |

Special auto coverages are more like add-ons. They’re not essential, but can be helpful if you’re in a situation where you need them.

| Special Auto Coverages | Purpose | You might need it: |

|---|---|---|

| Sound System Insurance | Covers the cost of replacing stolen or damaged AV equipment | When your wiring shorts out your radio |

| Emergency Roadside Assistance | Will pay for when you need a tow, jump start, or more | When it's pouring rain and you're stranded on the side of the road |

| Rental Car Expense | Gives you access to a rental car if your car is in the shop for a claim | When you need to get to work but your car has major damage from an accident |

Sound system insurance is a little atypical when it comes to car insurance companies. If you’re worried about your sound system or plan on installing extra sound equipment, this insurance might be helpful.

Factors That Affect Your Rate

The one factor we haven’t talked about that affects your rates is simple geography. Your state, city, and zip code all affect your rates, sometimes by the thousands of dollars.

The difference between the lower-costing states and the higher-costing is in the hundreds.

- On the low end: New Hampshire with $818.75

- On the high end: Michigan with $1,364

Rates for cities within the same state can vary by the thousands, as shown in the cheapest and most expensive cities in Michigan.

- Cheapest: Saint Louis at $7,916.29

- Most expensive: Detroit at $26,966.81

And rates can vary even further according to zip code, as evidenced by rates in Manchester, New Hampshire.

- Cheapest: 03109 at $3,720.88

- Most expensive: 03104 (Manchester) at $3,845.88

These rate changes can happen for several reasons.

A state may have a certain legal system that costs insurance companies more. A city might have different driving challenges than driving in the country. And within zip codes, there are issues of vehicle theft and bad driving behaviors.

Where you live can save you money or cost you money.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting the Best Rate with the Allstate

Allstate offers 29 discounts (a few are bundled under advanced safety features). They are organized here into personal discounts, vehicle, driving, policy, and extra. Discount percentages are included if available.

Personal discounts are almost like demographic discounts, items you’d list on a government form (except one).

| Personal Auto Discounts | Details | Percent Saved |

|---|---|---|

| Good Student | Upper 20% of class | 20 |

| Military | May apply only to active personnel | - |

| Occupation | Employable may not count | - |

| Senior Driver | Also referred to as "Mature Driver" | 10 |

Vehicles are often about claims and laws. To reduce the likelihood of a claim, a person can buy a vehicle with advanced safety features or buy an anti-theft device. Green cars are incentivized, in some cases by law.

| Vehicle Discounts | Details | Percent Saved |

|---|---|---|

| Advanced Safety Features | Examples: Anti-lock brakes, electronic stability control | 2-30 |

| Anti-Theft | Certain anti-theft technologies required | 10 |

| Farm Vehicle | Applies to vehicles used on farms | 10 |

| Green Vehicle | It's all about reducing emissions | 10 |

| Newer Vehicle | They are less prone to break | 30 |

| Utility Vehicle | Certain restrictions may apply | 15 |

| Vehicle Recovery | Some examples are OnStar and LoJack | 10 |

The safer a driver you are, and the more education you get to become one, the more you’ll have discounts available. Generally speaking.

| Driving Discounts | Details | Percent Saved |

|---|---|---|

| Claim Free | If you haven't had to file a claim | 35 |

| Defensive Driver | Usually must be 50+ | 10 |

| Driver's Ed | Usually must be under 21 | 10 |

| Low Mileage | For those who drive under the norm | - |

| Safe Driver | Typically no wrecks or violations | 45 |

Policy discounts are often for adding your family to your plan or by bundling different plans with auto.

| Policy Discounts | Details | Percent Saved (if available) |

|---|---|---|

| Multiple Policies | Also called a "bundle discount" | 10 |

Extra discounts are often for procedures like bill payments, paying your policy in full, or paying on time.

| Extra Discounts | Details | Percent Saved (if available) |

|---|---|---|

| Continuous Coverage | When you haven't had a lapse in coverage | - |

| Early Signing | Usually seven days before current policy expires | 10 |

| Full Payment | When you pay your policy in full | 10 |

| On Time Payment | When you pay your bills on time | - |

| Paperless Documents | Also referred to as an "e-policy" | 10 |

| Paperless/Auto Billing | Some examples are AutoPay and e-Bill | 5 |

Allstate doesn’t have anything particularly spectacular about its discounts. It has nine less than the companies with the most discounts, Liberty Mutual and Met Life. They both have 38.

Allstate’s Drivewise Program

Like other car insurance companies, Allstate has a program where you can get a reduced rate on your car insurance based on how you drive. This program is called Drivewise and it works like this.

When you sign up for Drivewise, the company will send you a device that you attach to your glove compartment. It tracks your speed, how hard you brake, how often you use technological devices, and more.

It will log all of these, along with circumstantial factors like what time of day you’re driving, and put together a points system. You can also complete safe driving challenges to earn more points.

These points go to reducing your premium.

Drivewise is a little unusual in that people not with Allstate can sign up. These people can get cash-back rewards every six months, depending on the safeness of their driving. (For more information, read our “Auto Insurance Companies That Give Rewards for No Accidents“).

Reading reviews online, there is some criticism typically associated with these kinds of apps.

These include using time of day to reduce points, having hard-braking incidents when there really is no other option but to hard brake, and more.

Some even call the Allstate Drivewise Program a sham. However, for some it may work out.

https://www.youtube.com/watch?v=W1zpEsgzYIU

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

We know that canceling your policy can be difficult. There is figuring the right time, going through all the hoops the company will throw at you, then switching to another company.

If you don’t do the process right, you’ll possibly be subjected to fees or have your license plate and tags taken away.

That’s why we’ve put together this section, to take away the uncertainty that goes into canceling your policy. Some of these sections will apply strictly to Allstate. Others are more general, a kind of how-to.

Let’s start down stretch five.

Cancellation Fee

The general consensus is no, but this may vary according to state laws. Talk to your agent to be sure.

Is there a refund?

Yes, Allstate does pro-rated refunds, meaning that if you cancel two months into a six-month policy, you should receive four months worth of payment back.

How to Cancel (Step-by-Step Guide)

Canceling your policy, as said before, is difficult. That’s why we’re here to help. This section will walk you through four steps needed before canceling a policy. If you don’t follow them, you’re subject to fees and legal trouble.

And no one wants that.

Decide What Time Is Right for You

Find a time that is right for you. There are three particular situations in which you might decide to cancel your policy. Two or somewhat unique. You won’t see them typically. The third might be relatable.

- You’re moving out of state. If you’re moving out of state, you might think about changing car insurance providers. It’s the perfect time. Your car insurance company might not even provide coverage in that state. You’re set.

- You’re planning to put your car away for a while. If you’re planning to put your car into storage, it might be tempting to cancel your car insurance. After all, you won’t be using it. But you might want to consider suspending your insurance instead. This is because of the legal hassle of giving up your tags and plates.

- You want to move to a better company. This is a common one. We can all become frustrated with our insurance companies, from dropped claims to bad customer service to a high price. You want to switch.

Cancel Old Policy

According to Allstate’s support page, the first thing you need to do to cancel your policy is to speak to your agent. And there are a few reasons why. In particular, they’ll help you during or with the following three steps.

- Speak to an agent. An agent can walk you through the process of canceling your plan. They may ask questions about why you’re canceling, which you can choose to answer or not. But they are your first point of contact.

- Write out the letter of cancellation. The agent may have you draft a written letter of cancellation. This serves two purposes. The first is that a written cancellation letter is more official than a verbal request. Also, it helps government agencies.

- Have your agent mail it, or mail it yourself or fax it. You can have the agent send in the cancellation document for you or mail it or fax it in yourself. Then, you just have to wait for the cancellation date before you’re free.

Avoid These Two Mistakes

When canceling your policy, you want to avoid these two mistakes. Making them will cost you money and potential issues with your DMV and state department.

Don’t cancel your policy without having a new one in place. Your soon-to-be-former insurance company must report your cancellation date to the DMV and state department.

If you don’t have another policy before or on that date, you could be subject to fees and have your license plate and tags taken away.

Make sure you have coverage before or on the cancellation date. Even a missed day is a problem. If necessary talk to your former agent at your and your new agent.

Make sure this is worked out.

Don’t just stop paying for the policy and assume that the policy will be canceled automatically. There are horror stories of people who didn’t follow procedures that kept receiving bills for months.

Companies can also charge you for the grace period, which is the period after the last payment while the policy is still working.

Follow the procedures in this guide. Make sure you submit a written cancellation later and have new coverage before the old coverage expires. Avoid fees and dealing with the government.

Contact Necessary Parties

After you cancel or switch insurance, you’ll need to contact all the necessary parties. That means if you’re moving, contact the local DMV. If you have a lien-holder on the car, you’ll need to contact them.

When can I cancel?

Anytime.

How to Make a Claim

When you’re in an accident or have an incident where you need to file a claim, the last thing you want to deal with is a long and difficult claims process.

That’s why we have you covered. This section goes over the steps needed when filing a claim, from the beginning of the incident to the end process. We’ll even talk about how many claims Allstate fills, as shown by its loss ratio.

And, of course, that big question, Why was my claim denied and what do I do if it was?

Process of Making a Claim

An accident or an incident where you might need to file a claim might be a stressful experience. Once the initial shock is over, you may worry about how to deal with claims representatives.

Making a claim can be confusing, difficult, and a bit shrouded in mystery.

We’re here to clarify things.

Get Information After the Incident

The first step after the incident, whether it’s an accident or another event, is to gather information. You’ll want to talk to any witnesses that may have seen the accident and get their contact information.

You’ll want to talk to the officer and get a police report. Talk as little as possible with the other driver if it’s an accident and never admit fault.

Take as many pictures as possible of the damage. You’ll want all this information for when you make the claim.

Contact Allstate by Phone or Online

There are four ways you can file a claim with Allstate.

- Use your online account to file a claim

- Use the Allstate Mobile app to file a claim

- Call 1-800-ALLSTATE (1-800-255-7828) to talk with a customer service representative

- Talk to your agent to help file your claim

If you have a minor accident, you can use the Allstate Mobile app to submit QuickFoto claim. This method is promoted as quicker than the others.

All of these have their pros and cons. It’s just a matter about which method or mode you prefer.

Give All the Details About the Accident

Whether you’re filing through the online methods, with your agent, or with a customer service representative, you’ll want to give as much information as possible about the incident.

This means submit all the pictures, submit all the witness statements or provide their contact information, and tell your side of how the incident happened.

If you’ve been in an accident, you’ll want to give the other driver’s contact information and policy information. Then, it’s just a matter of waiting.

Premiums Written

How likely is your claim to be filled? It all starts with premiums written.

The more premiums a company writes, the more claims they likely receive. This may lead to fewer claims being approved, just because of the general load that these companies face. These numbers are from the NAIC.

| Year | 2015 | 2016 | 2017 | 2018 | Percent Change |

|---|---|---|---|---|---|

| Private Passenger Auto | 20,036,973 | 20,813,858 | 21,430,405 | 22,663,214 | 13.11% |

| All Lines | 30,180,756 | 30,875,771 | 31,501,664 | 33,251,176 | 10.17% |

Allstate has seen a 13 percent growth in premiums written for private passenger auto from 2015 to 2018. It has seen a 10 percent growth in premiums written for total lines.

Altogether, Allstate wrote 33 million premiums in 2018, 22.6 million of which were auto insurance premiums.

Loss Ratio

These premiums are used in conjunction with claims filed to create a statistic called the loss ratio. The loss ratio shows how many claims are approved compared to the number of premiums.

.5 to 1 is the general okay range. Anything under .5 and the company might not be paying out on claims. .6 to .8 is the sweet spot.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Private Passenger Auto | 0.65 | 0.65 | 0.60 | 0.56 |

| All Lines | 0.59 | 0.62 | 0.61 | 0.59 |

In general, for both private passenger auto and total lines, the loss ratios vary little, staying within the .56 to .69 range. They are in the sweet spot generally, or close to it. But the numbers are a little low.

Also, Allstate has had some controversies surrounding its claims filing practices. These include issues in two issues where fires destroyed properties.

The court case titles are Hillery v Allstate Indemnity Company and Smith v. Allstate Insurance Company. Allstate is also the subject of a book titled From Good Hands to Boxing Gloves: The Dark Side of Insurance.

It is a book that accuses Allstate of low-balling customers’ claims with positive talk, then “hitting them with boxing gloves” if they refused the payment.

So there is a fair bit of controversy.

Why was my claim denied?

Your claim might have been denied for a few reasons, aside from the controversies.

- Your coverage limits have been reached. If your coverage limit goes to $50,000 and you have damages worth $50,001, you’re responsible for that $1.

- You might have been reported breaking the law. If you were texting at the time of the incident, speeding, or generally breaking the law, your claim might be denied.

- You don’t have the correct coverage. If your car was struck by lightning, you need comprehensive. If your car hit a pothole, you need collision. You need the right kind of insurance for certain damages.

Not having it may lead to your claim being denied. What can you do if it is?

There are a few steps. You can:

- Request an appeal from your car insurance company

- File a complaint with the state department

- Hire a lawyer and pursue legal action.

How to Get a Quote Online

Getting a quote should be easy, right? After all, insurance companies want your business. If you’ve never gone through Allstate’s claims process, you might be wondering what to expect. In this section, we cover it all.

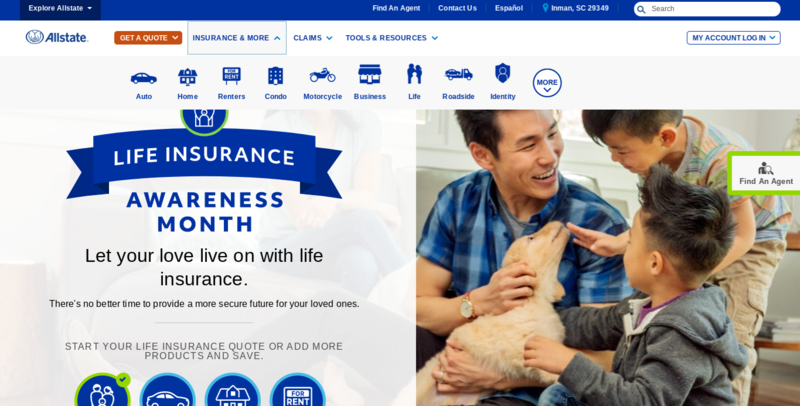

Go to the Allstate Homepage at www.allstate.com

The home page pulls up like this.

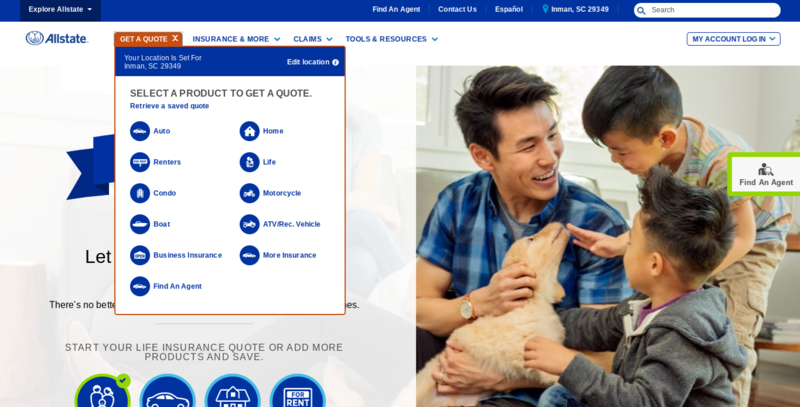

Click the Get a Quote Box

The quote box is the brown-orange box in the upper left. Click on it and it pulls down this menu.

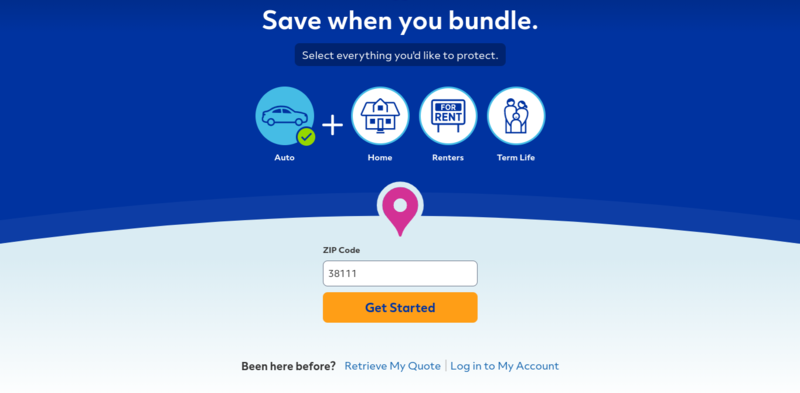

Choose Any Bundling Options and Enter Your Zip Code

After you click on auto, you’ll be taken to this page. Enter your zip code and select any bundling options you want.

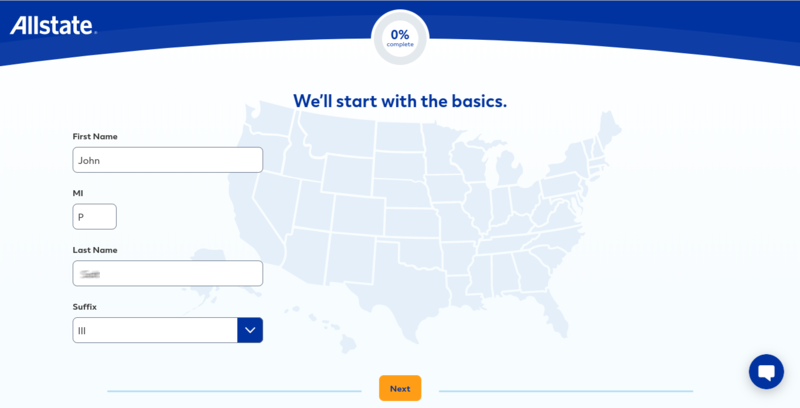

Enter in Personal Information

Enter in your basic name information.

Then enter your date of birth.

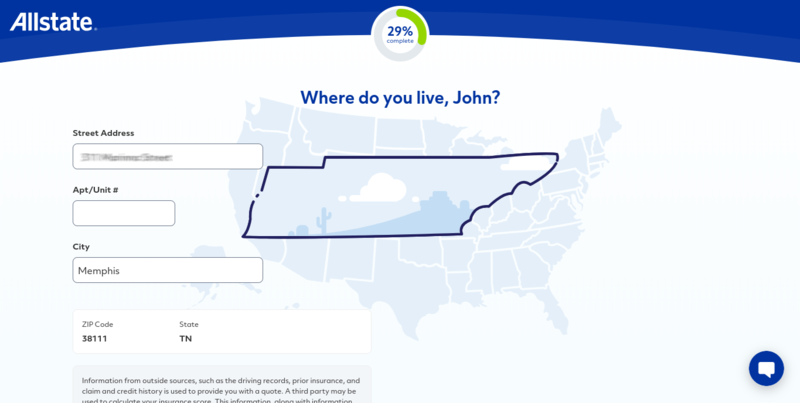

Next, add your address.

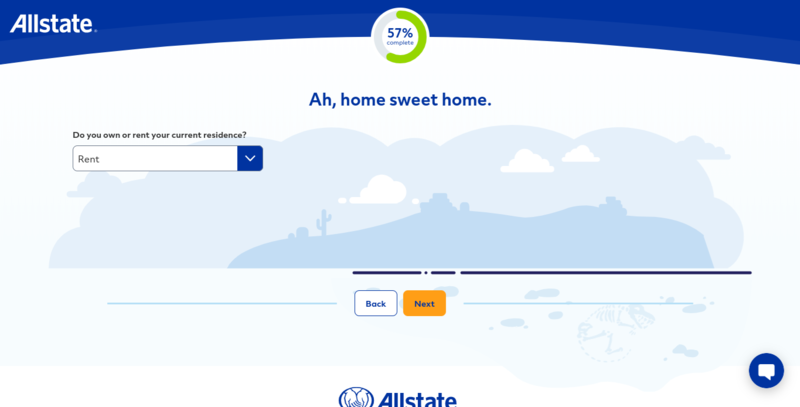

Then select whether you rent or own your residence.

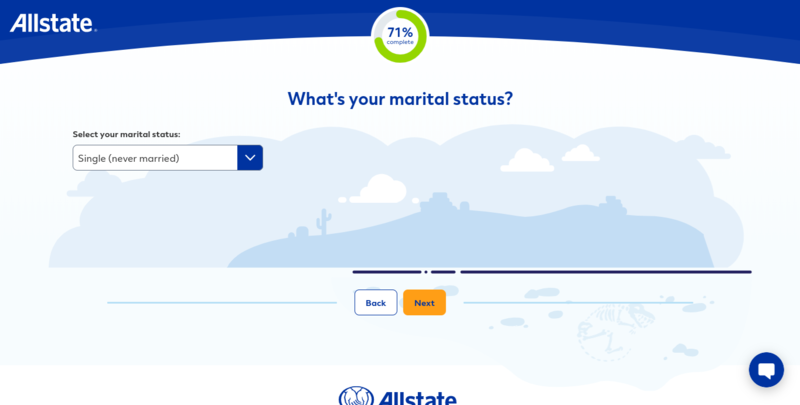

Select your marital status.

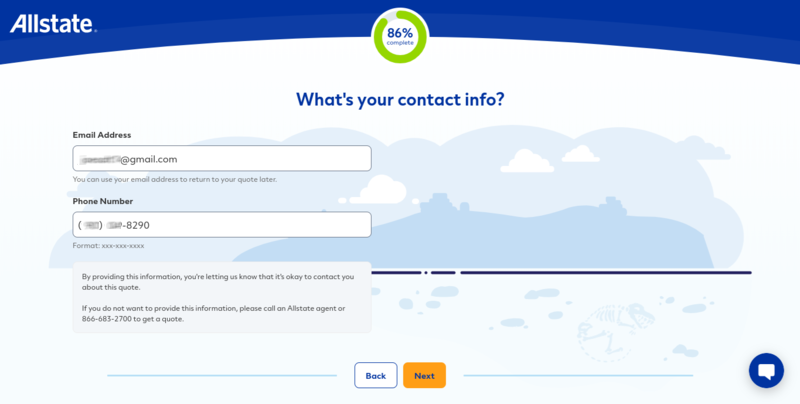

Enter in your contact information.

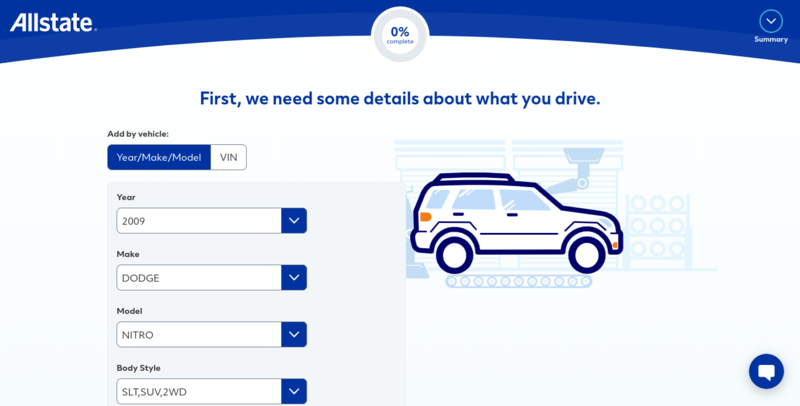

Enter in Vehicle Information

Next, enter in your vehicle information.

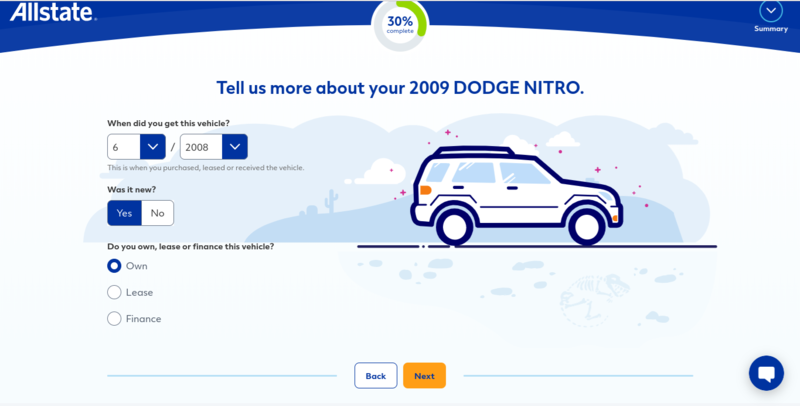

Add additional details.

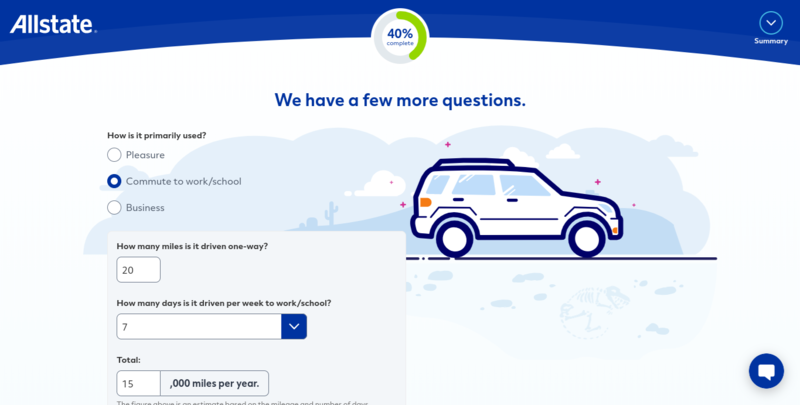

Choose whether it’s used for pleasure, commute, or business. Add the average mileage.

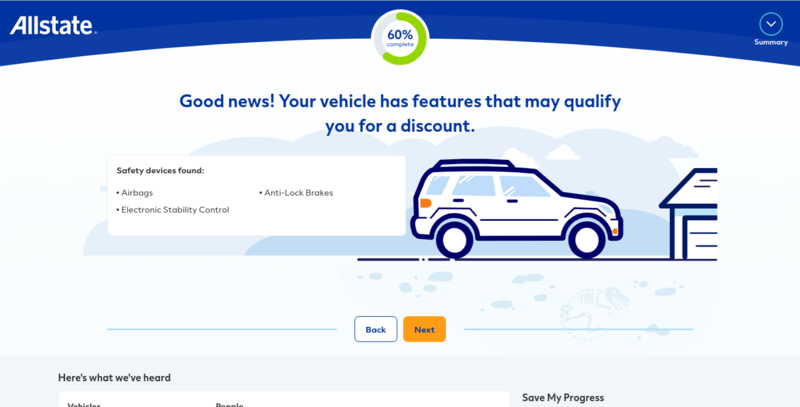

View Vehicle Discounts

Allstate will generate automatic discounts based on your car.

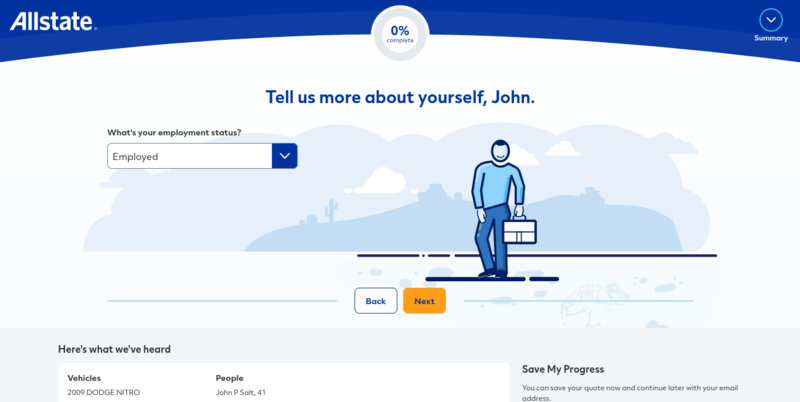

Enter in Occupational Status and First License Date

Enter in your occupational status.

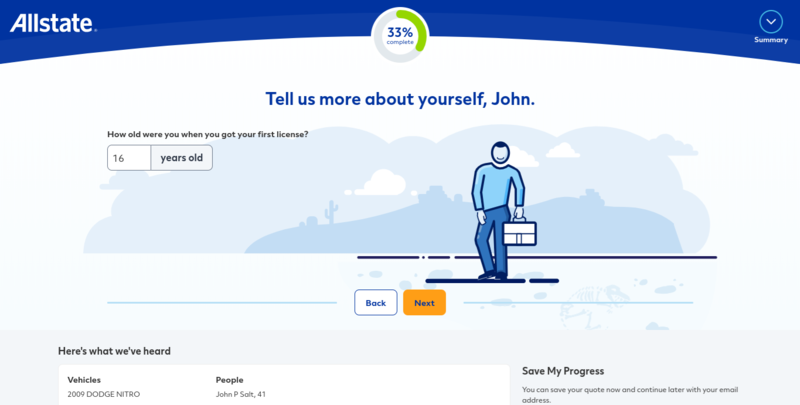

Next comes your first license date.

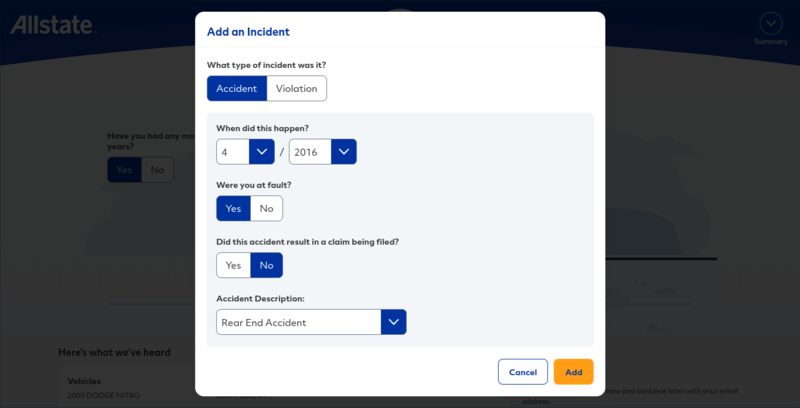

Add Any Incidents and Prior Insurance

Add any accidents or violations.

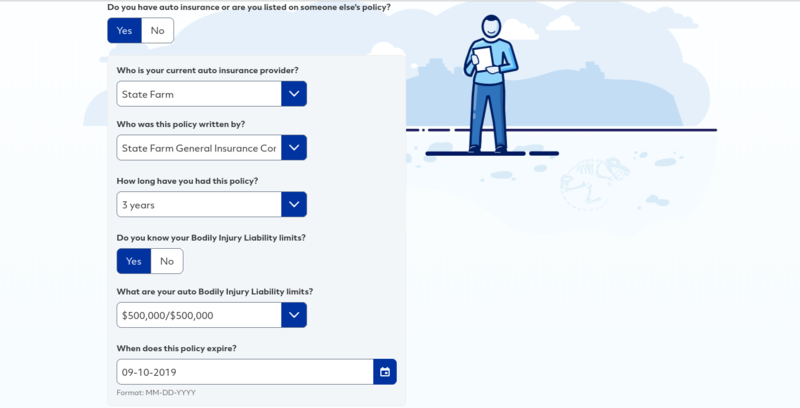

Next, put in information about your former or current insurance company.

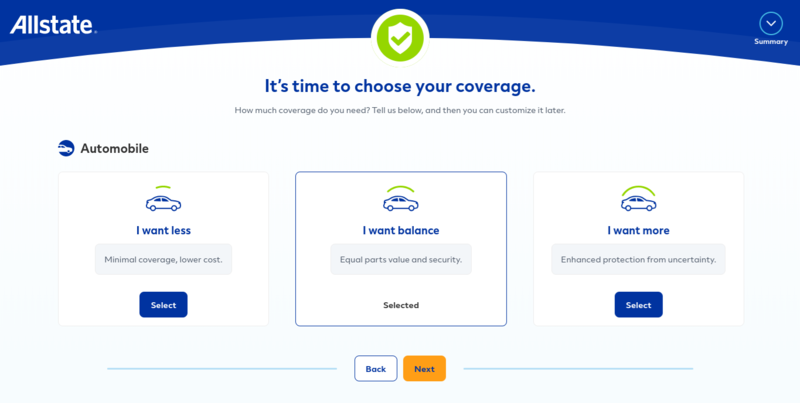

Choose Your Coverage Level

Choose your coverage level.

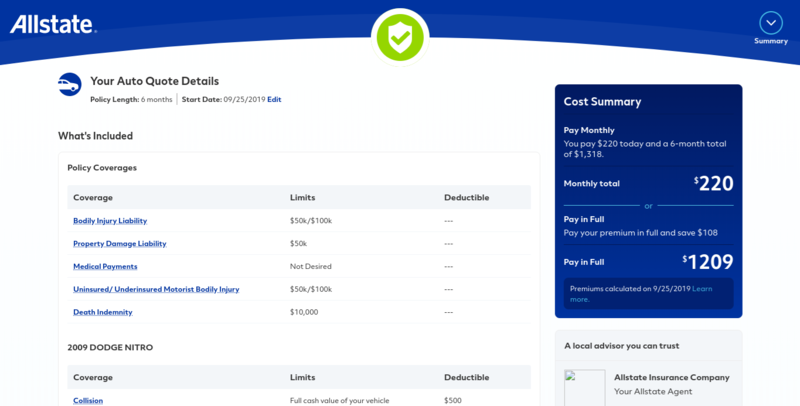

View Your Quote

Then view your quote. This is the top page.

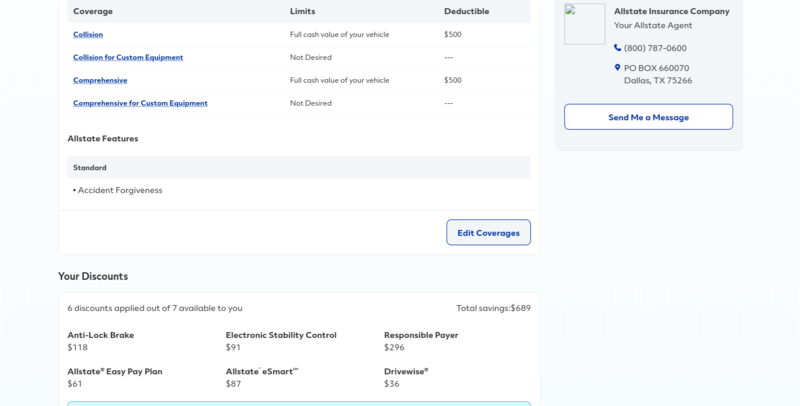

This the page when it’s pulled down. It shows an additional policy than what we covered, which is accident forgiveness. In general, with these discounts, your deductible goes down every year you’re accident-free.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website and App

A company’s website or app is often the first point of contact we have with the company when we’re looking to file a claim, manage our account, or even talking to customer service.

To that end, we’re taking a look at Allstate’s website and mobile apps to show you how they work, what their navigations are like, and how well you can manage your account with them.

Website

After you reach the homepage and want to reach the auto insurance page, you’ll click on Insurance and More, which is next to the Get a Quote box. From there, it’ll pull down a variety of options.

When you click the Auto button, it’ll pull you to this page.

Scroll down to see more options, including research coverage and policies, auto discounts, and claims information. Like other car insurance sites, getting quote boxes fills the screen.

How easy can you find answers?

You can find answers quickly with the search bar. It pulls up articles and pages from all across the site.

Allstate also as a Tools and Resources area, which acts a little bit like a promotional area but also has some good information about factors like collision insurance or how to save money with discounts.

Is the design a plus or minus?

The design is good, better than some other car insurance sites. It’s easy to navigate, with menus that feel intuitive. Many of the menus are drop-down, which saves time navigating from page to page.

Getting a quote, filing a claim, and finding an agent are all prominent on the site, having their own buttons or sections on the homepage.

Allstate also does something a little unusual with its website, which is have a Spanish version of it. A click on the button at the top reveals a site not as populated as the English version but still with plenty of options.

It shows one of Allstate’s target markets but is also inclusive.

Allstate Mobile

Allstate Mobile is Allstate’s main app. From it, you can manage your account, file claims, even link to contact customer service.

Here is how Allstate Mobile looks in iOS:

Users give it 4.8 stars out of 5 from 290,000-plus ratings.

A recent reviewer, however, was not happy about the Drivewise program: “Silly me! I have to open the app and go through the reactivation process EVERY SINGLE TIME I get in my car in order to log my trips and qualify for a very small refund. If I close out of the app”

Here’s how Allstate Mobile looks on Google Play:

Android users give it 4.2 out of 5 stars from nearly 40,000 reviews.

This reviewer was also frustrated with Drivewise: “Worked great until the latest update. It doesn’t record my trips even though it says it is logging a trip. It doesn’t stay running in the background as it did before and I have all settings set up for Allstate to always run.”

How easily can you manage your account using just the app?

According to the description on the iOS page, the app has these features:

- Drivewise

- Insurance ID cards

- View auto coverage

- QuickFoto Claim

- My Agent

- Gas Finder

The gas finder is a little unusual. This part of the app helps you to find gas stations near you and compare gas prices.

Is the design a plus or minus?

The design looks pretty clean in the pictures and videos. Most complaints about the app come from the Drivewise feature, which uses GPS and Wifi to correctly log trips. Sometimes it works, sometimes it doesn’t.

Allstate Mileswise

Mileswise is Allstate’s usage-based insurance. This means that Allstate bills a person based on how much they drive, plus a small daily fee. Customers deposit money into an account, which is then withdrawn from.

Reviewers give it 3.4 stars out of 5 from 10 ratings. It’s clearly not as popular as the standard mobile app.

One reviewer wrote, “I am now waiting for a call back from tech support. This app is not user-friendly!”

Here’s how the Mileswise app looks in Google Play:

Reviewers give it 2.9 stars out of 5 from 35 reviews.

One reviewer writes, “The app still won’t allow me to long in, so I’m forced to use the web browser to check my ‘Milewise‘. However, the Allstate app is working perfectly fine. What is the prob? ”

Does the app have functionality issues?

The app appears to have some functionality issues, with some reviewers reporting not being able to log in and others just saying they can’t get it to work.

There seems to be an issue with the physical tracking device. If you don’t have it, you have to use the website instead of the app.

Is the design a plus or minus?

From the images on the company’s website and the two app pages, the device looks fairly smooth. It seems easy to navigate, with large clickable buttons, and manageable screens.

Some people report that the maps are beautifully drawn and that the app works well. There doesn’t seem to be anything negative said about the design or the navigation. It’s solely the technical aspects.

Pros and Cons

| Pros | Cons |

|---|---|

| Strong financial ratings | Less than strong customer satisfaction ratings |

| Available in all 50 states | Rates are higher than average |

| Has a driving discount app | There are functionality issues |

| Easy to file a claim | Low loss ratios mean fewer might be approved compared to other companies |

The Bottom Line

Allstate is a big company. It has strong financial ratings, a growing number of premiums written, and a history that stretches back to the 1930s.

Someone signing up with them can safely say Allstate will be around for a while, which may be comforting.

However, and there’s always a however.

Allstate is losing market share to some of its top competitors. Geico and Progressive have gained market share over the past few years, while Allstate has lost.

Allstate has some of the highest prices in the business, with premiums that are only superseded by Liberty Mutual as the most expensive. While its getting more customers, it’s not getting them fast enough.

There has also been some bad press. Customers have complained about claims not being filled and a book was written about its negative practices towards customers.

This, unfortunately, could be interpreted in its loss ratios. Compared to some other competitors, it is at the low end of the scale, meaning that Allstate may be denying more claims than its competitors.

Overall, it’s a big company with strong financial ratings and a history that stretches back to the 1930s.

But it’s losing ground to others and is expensive. Those two things may give someone pause.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Car Insurance FAQs

There are always unusual, interesting, or functional questions about Allstate that can’t be gotten to in the body of an article. Here are seven.

Who owns Allstate Insurance?

Allstate started as a subsidiary of Sears. It was spun off in 1993 and immediately went public, becoming the largest IPO at that date. Because it is a publicly-traded company, anyone who holds shares in Allstate is a part-owner. The largest shareholders of Allstate stock are various investment firms.

Will Allstate tow my car?

Allstate has a special auto covered called emergency roadside assistance. This means that Allstate will provide emergency services if you’re stranded somewhere, including services like getting a tow or getting a jump-start. There are three options available, including a pay per use.

Where is Allstate Arena?

Allstate Arena is a multipurpose arena outside of Chicago that has hosted hockey teams, basketball teams, professional wrestling, and arena football. Its address is 6920 Mannheim Rd, Rosemont, IL 60018. It also hosts concerts, including a famous Creed concert where the lead singer fell asleep on stage.

When was Allstate founded?

Allstate was founded in 1931 as part of Sears, Roebuck, and Co. The idea came from an insurance broker who told the Chairman of Sears an idea of selling car insurance through its product catalogs. Allstate was born that year and existed as part of Sears for 62 years before becoming independent.

Who is the Allstate Mayhem Guy?

Dean Winter, of 30 Rock fame, has been the Allstate Mayhem Guy since 2011. Aside from 30 Rock, Winters has had roles in Oz, Law and Order SVU, Rescue Me, and Brooklyn Nine-Nine. He was recently added to the cast of Starz’s American Gods.

What are Allstate Rewards?

Allstate Rewards is a program where those who sign up can earn points for safe driving. An example is having a certain number of days without speeding can result in hundreds of points. These points can be spent on travel, magazines, auctions, and merchandise, just to name four.

Are Allstate agents independent?

As an agent at Allstate, you won’t just be independent. You’ll be the founder and owner of your own business. You’ll carry the Allstate name, find customers, build a clientele, build equity and more. Of course, Allstate wants to see you have $100,000 to get started. But hey.

https://www.youtube.com/watch?v=BMArckG0ek0

There you go! Now you should have all the information you need to make an informed decision about Allstate as your next company. Clear eyes, full hearts. Happy driving.

Ready to compare rates? Try our FREE online tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.