Indiana Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Indiana Statistics Summary | |

|---|---|

| Road Miles 2015 | Total in State: 96,571 Vehicle Miles Driven: 78,819 |

| Vehicles 2015 | Registered: 5,821,744 Total Stolen: 13,519 |

| State Population | 6,691,878 |

| Percentage of Motorists Uninsured | 16.7% State Rank: 8th |

| Most Popular Vehicle | Silverado 1500 |

| Driving Deaths | Speeding (2008-2017) Total: 208 Drunk Driving (2008-2017) Total: 914 |

| Cheapest Provider | USAA |

| Average Premiums 2018 (Annual) | Liability: $382.68 Collision: $250.29 Comprehensive: $122.06 Combined Premiums: $755.03 |

Nobody quite knows what a Hoosier is, but everybody knows that Indiana is the Hoosier State. Home to two Big Ten schools and a whole lot of corn, Indiana sits at the heart of the Midwest, with Indianapolis serving as the Crossroads of America.

Think of it this way: if all roads once led to Rome, most of them now lead to Indianapolis. A lot of roads means a lot of cars come crossing through the state. With a lot of cars comes the need for a hefty amount of insurance.

That said, shopping for insurance isn’t exactly easy. There are hundreds of providers in operation in Indiana, and all of them offer to fill your needs in different ways. If you want to compare the details of each, you’re going to have to set aside a significant amount of time to do so.

The good news is that you don’t have to do that research on your own. We know what it’s like to try and find the best kind of insurance for your lifestyle. That’s why we’re here to help.

In this guide, you’ll be able to compare Indiana’s largest car insurance providers by rates, availability by city and ZIP code, discounts, and more. Not only that, but you’ll learn a little more about the rules of the road in Indiana and how you can keep your rates low by driving with care.

If you’re one of the 6.63 million Indiana residents, or if you want to move to the Hoosier state, you can use this guide to protect yourself and your vehicle from the dangers of the road.

Want to start comparing rates right away? You can use our FREE online tool to find the most affordable car insurance in your area. Just enter your ZIP code to get started.

Indiana Car Insurance Coverage & Rates

Driving through Indiana is always interesting. Whether you’re passing around Indianapolis on I-465 or taking back roads past farmhouses and cornfields, you’re bound to come across a good view. Fun fact about Indiana: if you drive in the right direction, you may just come across Santa Claus, Indiana, home to Santa’s post office and helpful elves.

To drive safely to Santa Claus or any other Indiana destination, though, you need to have the right insurance. Here, we’ll touch on the state’s minimum required liability coverage, different forms of financial responsibility, and basic rate variables that may change how much you have to pay for your insurance.

Ready to get started? Then let’s go.

Indiana Minimum Coverage

Each state has its own minimum required liability coverage. Indiana’s breakdown is as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $25,000 uninsured motorist coverage per person

- $50,000 uninsured motorist coverage per accident

- $25,000 liability coverage

- $50,000 underinsured motorist coverage

All this coverage is designed to keep you and any passengers in your vehicle safe and financially secure in case you get into an accident of any kind, be that accident fatal or otherwise. You must have this coverage to drive legally in Indiana.

Why?

Because Indiana is an at-fault state.

Say you get into a car accident as an Indiana resident. Legal representatives will have to decide whether the accident was your fault or if it was the fault of the other party. If you’re determined to be at fault, you’re deemed responsible not only for your expenses post-accident, but also for the financial expenses of the other party.

That’s why such comprehensive minimum required liability coverage comes in handy. It protects you from any expenses you might incur if you’re determined to be at fault after an accident.

Forms of Financial Responsibility

If you get pulled over or into an accident in Indiana, law enforcement representatives will ask you to show them a form of financial responsibility, otherwise known as proof of insurance. Indiana counts the following documents as valid proof of insurance:

- An insurance card, either as a physical copy or an electronic copy

- An SR-22, should you have been in an accident in the past

Note that SR-22 insurance operates as a temporary form of insurance that all first-time offenders must have on hand when they get behind the wheel of a car.

Premiums as a Percentage of Income

The cost of your insurance will come out of your per capita disposable income. That per capita disposable income consists of the amount of money you have available after you’ve paid your taxes for the year.

In Indiana, residents made $28,323 per year as of 2014. That represents the amount of money they had to spend on things like groceries, rent, utilities, and car insurance.

The average annual cost of car insurance in Indiana represents 2 percent of a resident’s annual income. That comes to $566.46 a year for the state’s average coverage.

Average Monthly Car Insurance Rates in IN (Liability, Collision, Comprehensive)

Not all coverage is equal, though. You’ll be able to secure different kinds of coverage for different rates, as you can see in the table below:

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $382.68 |

| Collision | $250.29 |

| Comprehensive | $122.06 |

| Combined | $755.03 |

Note that the above data comes from the NAIC’s 2015 report. Rates as of 2019 and beyond will be more expensive than those listed here.

Additional Liability

Indiana currently ranks at eighth in the nation of uninsured drivers. That means that 16.7 percent of Indiana residents get behind the wheel of a vehicle without being properly insured.

In light of this information, you may be interested in investing in uninsured/underinsured motorist coverage that exceeds the state’s minimum requirements. You may also want to invest in MedPay coverage. The loss ratios for both forms of liability coverage are listed below:

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Pay (MedPay) | 79.55% | 82.86% | 85.48% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 60.33% | 64.13% | 73.42% |

Loss ratios reflect the ability of applicable companies to fulfill claims issued by drivers.

A loss ratio over 100 percent suggests a company will pay out on claims, but it may also not be as financially stable as it could be. Comparably, a loss ratio below 60 percent suggests that while a company may be financially stable, it won’t be as willing to pay out on driver claims.

With that in mind, you can debate whether taking on additional liability coverage is worth the expense. With the percentage of uninsured drivers on the road in Indiana so high, loss ratios between 60-90 percent are pretty good to work with.

Add-Ons, Endorsements, & Riders

You can explore additional, optional coverage by considering some of the add-ons below. Click on the available links to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates by Age & Gender in IN

The myths surrounding men and women drivers differ. Some sources say women have to pay more for their car insurance, whereas others suggest men’s reckless driving will cost them more in the long run.

Take a look at rate differentiation in Indiana:

| Company | Married 35-year old Female | Married 35-year old Male | Married 60-year old Female | Married 60-year old Male | Single 17-year old Female | Single 17-year old Male | Single 25-year old Female | Single 25-year old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,461.65 | $2,522.04 | $2,161.34 | $2,364.89 | $7,566.53 | $9,542.11 | $2,500.79 | $2,718.57 |

| American Family Mutual | $2,305.56 | $2,305.56 | $2,072.87 | $2,072.87 | $6,342.08 | $9,188.19 | $2,305.56 | $2,839.57 |

| First Liberty Ins Corp | $3,951.85 | $3,951.85 | $3,632.20 | $3,632.20 | $8,652.09 | $13,064.06 | $3,951.85 | $5,418.04 |

| Geico Cas | $1,543.08 | $1,533.98 | $1,441.76 | $1,492.21 | $4,534.08 | $4,216.98 | $1,765.37 | $1,558.45 |

| Illinois Farmers Ins 2.0 | $1,558.68 | $1,538.30 | $1,333.35 | $1,497.61 | $8,369.82 | $8,927.88 | $2,053.19 | $2,219.06 |

| Nationwide Mutual | $1,670.50 | $1,708.99 | $1,463.84 | $1,564.29 | $4,865.35 | $6,323.43 | $1,959.23 | $2,144.10 |

| Progressive Paloverde | $1,659.70 | $1,570.98 | $1,503.23 | $1,513.35 | $9,753.71 | $10,976.02 | $2,081.70 | $2,125.43 |

| State Farm Mutual Auto | $1,480.20 | $1,480.20 | $1,318.52 | $1,318.52 | $4,476.08 | $5,736.50 | $1,637.30 | $1,821.69 |

| Travco Ins Co | $1,225.25 | $1,246.82 | $1,148.12 | $1,147.95 | $7,586.22 | $11,997.40 | $1,295.87 | $1,500.67 |

| USAA | $1,039.00 | $1,023.39 | $966.69 | $974.02 | $2,894.49 | $3,235.29 | $1,404.62 | $1,503.00 |

As you can see, age has more of an impact on your rates than gender does. The older you get, the more likely it is you’ll see your rate level out, regardless of your gender. By the time drivers hit middle age, as you can see above, the premiums they’ll see should be balanced. In some cases, women even have to pay more than their male companions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Indiana Car Insurance Companies

Now that you know a little more about Indiana’s insurance requirements, let’s consider the different car insurance providers who could help you meet those needs.

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in IN.

The Largest Companies’ Financial Ratings

A.M. Best outlines individual insurance companies’ financial ratings, as you can see below:

| Company Group Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $287,390 | 51.71% | 7.61% |

| American Family Insurance Group | $171,186 | 61.90% | 4.54% |

| Auto-Owners Group | $91,976 | 66.46% | 2.44% |

| Erie Insurance Group | $143,261 | 72.18% | 3.80% |

| Geico | $233,428 | 67.85% | 6.18% |

| Indiana Farm Bureau Group | $277,065 | 68.18% | 7.34% |

| Liberty Mutual Group | $185,530 | 63.31% | 4.92% |

| Progressive Group | $428,466 | 58.96% | 11.35% |

| State Farm Group | $907,710 | 60.03% | 24.05% |

| USAA Group | $98,402 | 72.82% | 2.61% |

| State Total | $3,774,286 | 61.91% | 100.00% |

Who are the largest auto insurance companies in Indiana?

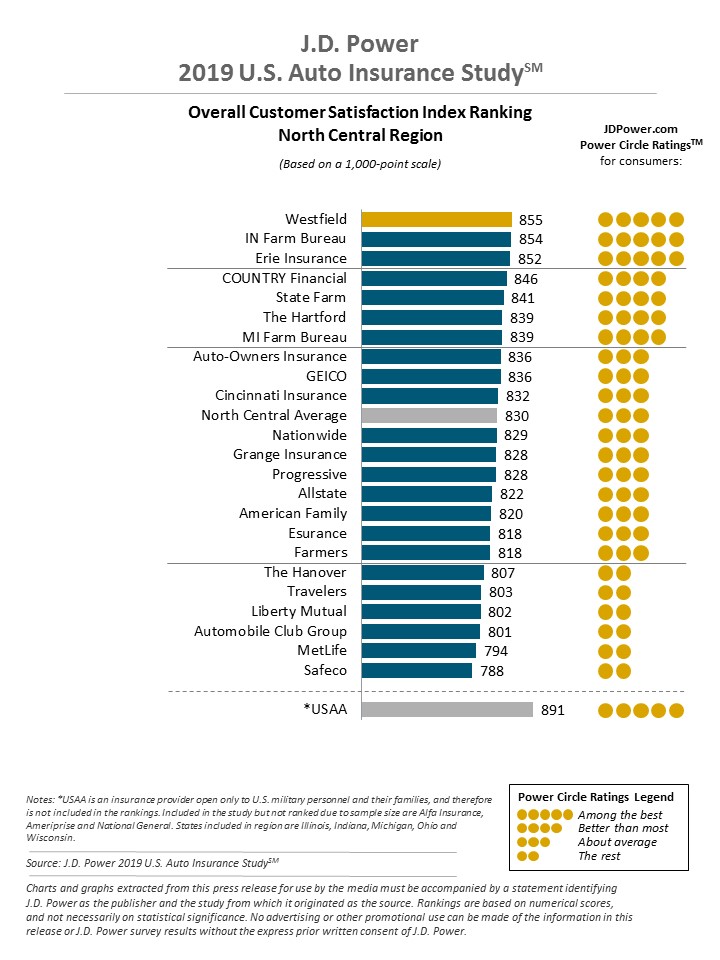

Companies with the Best Ratings

Customer experience and satisfaction also contribute to a company’s state-wide reputation:

Companies with the Most Complaints in Indiana

Complaints are among the most informative forms of data when it comes to insurance. While you can’t always take them at face value, you should keep them in mind when choosing a company to work with.

| Rank | Company | Complaint Index |

|---|---|---|

| 1 | Erie | 0.11 |

| 2 | Indiana Farm Bureau | 0.17 |

| 3 | Farmers | 0.34 |

| 4 | Wolverine Mutual | 0.37 |

| 5 | Hastings Mutual | 0.43 |

| 6 | Kemper Specialty | 0.47 |

| 7 | Cincinnati Insurance | 0.58 |

| 8 | State Auto | 0.66 |

| 9 | Pekin Insurance | 0.67 |

| 10 | State Farm | 0.69 |

| 11 | American Family | 0.82 |

| 12 | Indiana Farmers Mutual | 0.83 |

| 13 | Cal Casualty | 0.92 |

| 14 | Western Reserve | 1.05 |

| 15 | Allstate | 1.22 |

| 16 | Victoria | 1.27 |

| 17 | Grange Mutual | 1.29 |

| 18 | General Casualty | 1.31 |

| 19 | The General | 1.33 |

| 20 | Liberty Mutual | 1.62 |

| 21 | Hanover | 1.73 |

| 22 | Sentry | 2.98 |

| 23 | Safe Auto | 4.03 |

| 24 | Titan | 5.23 |

| 25 | The Hartford | 8.19 |

| 26 | InsureMax | 9.57 |

| 27 | American Freedom | 14.98 |

Indiana Car Insurances Rates by Company

We know that your budget is one of the biggest factors you have to consider when choosing a car insurance provider. That’s why we’ve gathered a list of the most affordable providers in Indiana for you to peruse.

| Company | Average | Compared to State Average | |

|---|---|---|---|

| Allstate P&C | $3,979.74 | $661.62 | 16.62% |

| American Family Mutual | $3,679.03 | $360.91 | 9.81% |

| First Liberty Ins Corp | $5,781.77 | $2,463.65 | 42.61% |

| Geico Cas | $2,260.74 | -$1,057.38 | -46.77% |

| Illinois Farmers Ins 2.0 | $3,437.24 | $119.11 | 3.47% |

| Nationwide Mutual | $2,712.47 | -$605.66 | -22.33% |

| Progressive Paloverde | $3,898.01 | $579.89 | 14.88% |

| State Farm Mutual Auto | $2,408.63 | -$909.49 | -37.76% |

| Travco Ins Co | $3,393.54 | $75.42 | 2.22% |

| USAA | $1,630.06 | -$1,688.06 | -103.56% |

Commute Rates by Company

As you can see in the table below, the distance of your morning commute is going to impact your car insurance rate:

| Group | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $3,979.74 |

| Allstate | 25 miles commute. 12000 annual mileage. | $3,979.74 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,634.66 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,723.40 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,437.24 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,437.24 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,220.59 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,300.89 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $5,628.11 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $5,935.42 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,712.47 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,712.47 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,898.01 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,898.01 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,340.29 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,476.96 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,393.54 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,393.54 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,608.43 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,651.69 |

Six major factors affect auto insurance rates in IN. Which car insurance factors will affect your rates the most? Find out below:

Coverage Levels by Company

Your chosen level of coverage is going to impact the amount you’re expected to pay:

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,185.52 |

| Allstate | Medium | $3,964.38 |

| Allstate | Low | $3,789.32 |

| American Family | High | $3,591.92 |

| American Family | Medium | $3,800.78 |

| American Family | Low | $3,644.40 |

| Farmers | High | $3,565.78 |

| Farmers | Medium | $3,430.50 |

| Farmers | Low | $3,315.42 |

| Geico | High | $2,407.42 |

| Geico | Medium | $2,254.59 |

| Geico | Low | $2,120.21 |

| Liberty Mutual | High | $5,985.03 |

| Liberty Mutual | Medium | $5,766.94 |

| Liberty Mutual | Low | $5,593.34 |

| Nationwide | High | $2,691.75 |

| Nationwide | Medium | $2,690.85 |

| Nationwide | Low | $2,754.80 |

| Progressive | High | $4,174.68 |

| Progressive | Medium | $3,837.21 |

| Progressive | Low | $3,682.14 |

| State Farm | High | $2,522.50 |

| State Farm | Medium | $2,407.80 |

| State Farm | Low | $2,295.59 |

| Travelers | High | $3,428.83 |

| Travelers | Medium | $3,425.20 |

| Travelers | Low | $3,326.58 |

| USAA | High | $1,692.31 |

| USAA | Medium | $1,626.02 |

| USAA | Low | $1,571.85 |

Credit History Rates by Company

Your credit history reflects your ability to pay back the money you owe to different organizations. Naturally, car insurance providers are going to take your credit history into account when offering you a rate.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Good | $3,334.15 |

| Allstate | Fair | $3,670.06 |

| Allstate | Poor | $4,935.01 |

| American Family | Good | $2,736.23 |

| American Family | Fair | $3,268.20 |

| American Family | Poor | $5,032.66 |

| Farmers | Good | $3,030.19 |

| Farmers | Fair | $3,270.65 |

| Farmers | Poor | $4,010.86 |

| Geico | Good | $1,801.53 |

| Geico | Fair | $2,260.74 |

| Geico | Poor | $2,719.94 |

| Liberty Mutual | Good | $4,635.00 |

| Liberty Mutual | Fair | $5,011.70 |

| Liberty Mutual | Poor | $7,698.61 |

| Nationwide | Good | $2,439.73 |

| Nationwide | Fair | $2,608.92 |

| Nationwide | Poor | $3,088.75 |

| Progressive | Good | $3,588.61 |

| Progressive | Fair | $3,806.34 |

| Progressive | Poor | $4,299.10 |

| State Farm | Good | $1,623.32 |

| State Farm | Fair | $2,093.59 |

| State Farm | Poor | $3,508.97 |

| Travelers | Good | $3,199.76 |

| Travelers | Fair | $3,202.05 |

| Travelers | Poor | $3,778.81 |

| USAA | Good | $1,243.51 |

| USAA | Fair | $1,450.78 |

| USAA | Poor | $2,195.89 |

Driving Record Rates by Company

Your driving history reflects both your knowledge of the rules of the road and your ability to work within them.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | Clean record | $3,175.58 |

| Allstate | With 1 accident | $4,665.22 |

| Allstate | With 1 DUI | $4,301.12 |

| Allstate | With 1 speeding violation | $3,777.03 |

| American Family | Clean record | $2,536.03 |

| American Family | With 1 accident | $4,041.92 |

| American Family | With 1 DUI | $5,117.20 |

| American Family | With 1 speeding violation | $3,020.98 |

| Farmers | Clean record | $3,075.51 |

| Farmers | With 1 accident | $3,585.45 |

| Farmers | With 1 DUI | $3,692.93 |

| Farmers | With 1 speeding violation | $3,395.05 |

| Geico | Clean record | $1,483.91 |

| Geico | With 1 accident | $2,335.58 |

| Geico | With 1 DUI | $3,162.96 |

| Geico | With 1 speeding violation | $2,060.50 |

| Liberty Mutual | Clean record | $4,509.08 |

| Liberty Mutual | With 1 accident | $5,317.03 |

| Liberty Mutual | With 1 DUI | $8,331.91 |

| Liberty Mutual | With 1 speeding violation | $4,969.05 |

| Nationwide | Clean record | $2,332.31 |

| Nationwide | With 1 accident | $3,007.11 |

| Nationwide | With 1 DUI | $2,883.35 |

| Nationwide | With 1 speeding violation | $2,627.10 |

| Progressive | Clean record | $2,920.42 |

| Progressive | With 1 accident | $5,121.94 |

| Progressive | With 1 DUI | $3,485.71 |

| Progressive | With 1 speeding violation | $4,063.99 |

| State Farm | Clean record | $2,352.06 |

| State Farm | With 1 accident | $2,578.33 |

| State Farm | With 1 DUI | $2,352.06 |

| State Farm | With 1 speeding violation | $2,352.06 |

| Travelers | Clean record | $2,882.59 |

| Travelers | With 1 accident | $3,562.38 |

| Travelers | With 1 DUI | $4,036.63 |

| Travelers | With 1 speeding violation | $3,092.54 |

| USAA | Clean record | $1,231.12 |

| USAA | With 1 accident | $1,752.37 |

| USAA | With 1 DUI | $2,010.62 |

| USAA | With 1 speeding violation | $1,526.13 |

High-risk drivers are frequently charged more for their coverage than low-risk drivers.

Number of Insurers in Indiana

Domestic and foreign insurers are titles that don’t use their titular terms in the traditional sense. Domestic providers are providers who are present only in a specific state. Foreign insurers, comparatively, are providers who make their policies available just about everywhere.

You can see Indiana’s breakdown of its domestic and foreign insurers here:

| Domestic | 64 |

|---|---|

| Foreign | 958 |

| Total | 1022 |

Indiana State Laws

With some finances out of the way, we can touch on the laws that change the way insurers have to interact with Indiana drivers.

That said, not all of us speak legalese. Breaking down Indiana’s laws takes a bit of time. It’s especially important to consider these legalities, though, because you may find that they differ from the other states’.

The good news is that you don’t have to tackle that research on your own. We’re here to guide you through the legal mumbo jumbo that keeps Indiana operating. So, whether you’re dealing with your first ticket or worried about the consequences of driving without insurance, don’t fret. We’ll walk you through the legalities to ensure you stay on the right side of the law.

Car Insurance Laws

Every state takes different factors into account when determining the laws drivers have to abide by. Liability insurance, for example, varies in each state due to this process, but so do speed limits, drunk driving consequences, and seating requirements.

High-Risk Insurance

If you have a spotty driving history, you may have to seek out high-risk insurance. High-risk insurance, or an SR-22, is a type of insurance that high-risk drivers are required to add to their existing coverage after a conviction or similar punishment.

You may be required to get an SR-22 if you’ve received any of the following:

- DUI conviction

- Reprimand for driving without insurance

- Reprimand for driving with a suspended license

- Reprimand for leaving the scene of an accident

Low-Cost Insurance

Indiana does not offer car insurance programs for low-income families that would ease the pressure of paying for car insurance. However, drivers can seek out discounts to make the cost of insurance more bearable.

Be sure to ask your provider of choice if you or your family are eligible for any of the following:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking — some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around to find the best coverage for you that is equally cost-effective.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Fraud in Indiana

The insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a Class 5 Felony.

Windshield Coverage

Several states require drivers to have windshield coverage provided by their insurance company. This kind of coverage keeps drivers from taking to the road with a cracked or broken windshield.

Indiana does not require insurance providers to offer windshield coverage, nor does it require drivers to obtain windshield coverage.

That doesn’t mean you shouldn’t consider including windshield coverage in the coverage you take on. Windshield coverage keeps you from having to dig into your bank account to pay for part replacement.

In Indiana, vehicles that are less than five years old can choose between OEM, aftermarket, or used parts when looking to replace a damaged windshield.

Statute of Limitations

You have a limited amount of time to file a claim after an accident takes place. The statute of limitations for different types of damage claims break down as follows:

- Personal Injury Claims: Two Years

- Property Damage Claims: Two Years

“No Pay, No Play” in Indiana

Indiana is, unfortunately, a haven for drivers trying to take to the roads without car insurance. Because Indiana is an at-fault state, they’ve had an easier time getting away with doing so. Drivers without insurance only need to successfully argue that they’re not responsible for any of the accidents they get into, and they’ll not have to pay for any of their damages.

In response to this, Indiana instituted new statutes designed to limit the amount of money insured drivers have to pay upon getting into accidents with uninsured drivers. If the uninsured driver has a history of not paying for their accidents and not seeking out car insurance, they won’t be able to collect “non-economic” damages from the at-fault driver. These damages include:

- Emotional/Physical Pain and Suffering

- Physical Impairment

- Loss of Enjoyment/Companionship/Services

- Other Non-Pecuniary Loss

Vehicle Licensing Laws

Driving without insurance seems tempting to those looking to save a quick buck. However, getting caught without insurance or proper vehicular registration can cost you more than a bit of money. Indiana has instated the following penalties to punish drivers who take to the road without the state’s minimum required insurance coverage:

- First Offense: License and registration suspension for between 90 days and one year

- Second Offense: License and registration suspension for up to one year or more

Teen Driver Laws

Most teenagers are eager to get behind the wheel of a car. In Indiana, teens as young as 15 years old can apply for a learner’s permit and start familiarizing themselves with Indiana’s roadways. To get their full license, teenage drivers will need to meet the following requirements:

| Teen Requirements for Getting a License in Indiana | Time |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours, 10 of which must be at night |

| Minimum Age | 16 years old (3 months with drivers education ; 9 months without) |

Teenagers must also abide by night driving and passenger restrictions until they age past 18. Those restrictions break down as follows:

- No driving between the hours of 10 p.m.-5 a.m. during the first six months a driver has their license.

- After the first six months, no driving between the hours of 11 p.m.-5 a.m. Sunday-Friday or 1 a.m.-5 a.m. Saturday-Sunday until the driver in question receives their full license.

- During and after the first six months, no passengers may ride in a teen driver’s vehicle except for family members.

License Renewal Procedures

Indiana residents need to renew their licenses on a six-year cycle. The good news is the state has migrated its renewal process. Nowadays, so long as you’re not a teenager or older driver, you can renew your license online.

That said, you’ll need to submit proof of adequate vision every 10 years, meaning that you’ll need to make every other renewal in-person.

Older Driver License Renewal Procedures

The renewal process is a little more difficult for older drivers. Drivers between the ages of 75-84 need to renew their licenses on a three-year cycle. Anyone driving past the age of 85 needs to renew their license on a two-year cycle.

Drivers in both these age groups also need to submit a vision test with every license renewal. These drivers are also unable to submit their renewals online or through the mail and must come to the DMV in person.

New Residents

If you’ve just moved to Indiana, you’ll need to make sure you comply with the state’s insurance, license, and registration requirements. This means either raising or lowering your insurance coverage to meet Indiana’s minimum liability insurance policy.

As a reminder, Indiana’s minimum required liability coverage breaks down as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $25,000 uninsured motorist coverage per person

- $50,000 uninsured motorist coverage per accident

- $25,000 property damage liability coverage

- $50,000 underinsured motorist coverage

Negligent Drivers

Indiana law defines a negligent driver as someone who, while driving recklessly, places themselves, other people, and property at risk. Indiana is quick to charge negligent drivers, as can be seen in the list of consequences below.

Negligent drivers face the following:

- $1,000 or more fine

- A year-long license suspension

- 180 days of jail time

Indiana Rules of the Road

Those are the legalities you’ll come across in Indiana. What are the rules of the road, though, and how will you need to interact with other drivers while moving from Point A to Point B?

Fault vs. No-Fault

As mentioned, Indiana is an at-fault state. This means that, at the time of an accident, one driver will be determined as the “at-fault” party — the party who was responsible for the accident. That party will then have to take on the financial responsibilities of both the injured party and their own vehicle, as any costs arise in relation to the accident.

Keep Right & Move Over

If you are driving more slowly than the posted speed limit, or if you are not looking to pass a car in front of you, Indiana law dictates you must remain in the right-hand lane of the applicable interstate.

You must also move over for vehicles that have their lights flashing, regardless of whether they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Speed Limits

It’s tempting, when you’re looking out at an empty road flanked by cornfields, to lean a little heavily on the acceleration. However, doing so can readily net you a speeding ticket.

Indiana’s speed limits in rural and urban areas break down as follows:

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph (65 mph for trucks) |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 60 mph |

| Other Roads | 55 mph |

Note, too, that these are the maximum speeds you’re legally allowed to go on applicable roads. If you want to avoid an unnecessary fine, leave the Speed Racer fantasies for video games. The real world has real consequences that you’ll have to face if you aren’t careful.

Seat Belt & Car Seat Safety

Indiana legislators have crafted laws designed to keep children and adults safer in cars. This means strict seat belt and car seat laws. You can find more information about these laws in the tables below:

| Seat Belts Details | Laws |

|---|---|

| Effective Since | July 1, 1987 |

| Primary Enforcement | Yes; effective since July 1, 1998 |

| Age/Seats Applicable | 16+ years old in all seats |

| 1st Offense Maximum Fine | $25 |

Note that “primary enforcement,” as detailed above, means that police officers can stop you for not wearing a seat belt and they need no other reason to pull you over to the size of the road.

| Car Seat Requirements | Age/Fine |

|---|---|

| Child Safety Seat | 7 years old or younger |

| Adult Belt Permissable | 8 through 15 years old |

| Maximum fine for first time offense | $25 |

At this point, Indiana does not have laws in place that dictate whether a person can ride in the cargo area of a pickup truck.

Ridesharing

Ridesharing has seen a distinct uptick over the past few years. Uber and Lyft now serve as viable career opportunities for drivers willing to share their time and vehicles. Before you start working for one of these employers, though, you need to make sure that your car insurance covers ridesharing.

Currently, the following Indiana insurers have ridesharing insurance on their rosters:

- Allstate

- Erie

- Farmers

- Geico

- Safeco

- State Farm

- USAA

Automation on the Road

Self-driving vehicles are still being tested around the United States, but they’ve yet to take to the roads. Right now, “automation” refers primarily to platooning technology, or technologies designed to keep groups of vehicles together while traveling on the road. Trucks and buses typically use these sorts of technologies to stay within a reasonable distance of one another.

These sorts of automated technologies also include cruise control or vehicle detection.

At this point, Indiana does not have any laws in place that limit the use of these sorts of technologies.

Safety Laws

Accidents can’t always be avoided. There are certain behaviors, however, that make a person more inclined to an accident. Drinking and driving or driving while distracted both put a person at greater risk for an accident. Let’s dive into some of the statistics regarding both of these behaviors and their in-state consequences.

DUI Laws

Indiana saw 220 alcohol-related fatalities in 2017 alone. That number serves as a testament to the need for strict DUI laws throughout the states. You can see outlines of DUI laws and consequences in the tables below:

| Indiana DUI Details | Laws |

|---|---|

| Offense Name | Operating While Intoxicated (OWI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st class C misdemeanor, 1st High BAC class A misdemeanor; subsequent convictions within 5 years class D felony |

| Look Back Period | 5 years |

| Indiana DUI - 1st Offense | Penalties |

|---|---|

| License Revoked Period | 30 days - 2 years OR probation with rehabilitation course |

| Jail Time | no minimum but up to 1 year |

| Fine | $500 - $5,000 |

| Other | may be required to: attend victim impact panel, submit to urine testing and other terms of probation |

| Indiana DUI - 2nd Offense | Penalty |

|---|---|

| License Revoked Period | 180 days - 2 years |

| Jail Time | 5 days - 3 years AND/OR community service |

| Fine | no minimum, but up to $10,000 |

| Other | same as 1st offense |

| Indiana DUI - 3rd Offense | Penalty |

|---|---|

| License Revoked Period | 1-10 years |

| Jail Time | 10 days-3 years AND/OR community service |

| Fines | no minimum, but up to $10,000 |

| Other | same as 1st Offense |

Indiana refers to drinking and driving as Operating While Intoxicated. You will face significant fines and potential jail time should you be caught behind the wheel while intoxicated. Even after you’ve faced those consequences, you’ll be expected to pay higher insurance premiums to better protect yourself.

Leave the drinking for your time at home, or make sure you have a designated driver on tap to get you back to where you need to be safely. If you don’t, you’ll suffer severe consequences.

Distracted Driving Laws

Almost everyone has a cellphone on them today. Thus, the temptation to check your phone while driving has increased. (For more information, read our “Ohio Has Strict Driving Safety Laws: A Breakdown and Explanation“).

Indiana has responded to this trend with reasonably strict texting bans, as you can see below:

| Hand-held ban | Young driver cell phone ban | Texting ban | Enforcement |

|---|---|---|---|

| No | Drivers younger than 21 | All Drivers | Primary (officers can pull a driver over JUST for texting) |

Text messages aren’t worth your life while you’re on the road. You need to wait until you’ve come to a complete stop to check your phone.

Driving in Indiana

Vehicle Theft in Indiana

There are certain types of vehicles more likely to be stolen in Indiana than others, as you can see in the table below:

| Rank | Make/Model | Year of Vehicle | Number of Thefts |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2005 | 659 |

| 2 | Chevrolet Pickup (Full Size) | 1994 | 619 |

| 3 | Chevrolet Impala | 2004 | 423 |

| 4 | Dodge Pickup (Full Size) | 2001 | 263 |

| 5 | Chevrolet Malibu | 2005 | 238 |

| 6 | GMC Pickup (Full Size) | 1995 | 192 |

| 7 | Honda Accord | 1994 | 186 |

| 7 | Chevrolet Pickup (Small Size) | 1998 | 186 |

| 9 | Pontiac Grand Prix | 2004 | 183 |

| 10 | Ford Taurus | 2003 | 182 |

That said, different cities have higher risks of vehicular theft than others, as detailed here:

| Indiana Vehicle Thefts by City | City Population | Motor Vehicle Theft |

|---|---|---|

| Albion | 2,344 | 0 |

| Alexandria | 5,060 | 7 |

| Anderson | 55,367 | 230 |

| Angola | 8,587 | 4 |

| Auburn | 12,802 | 12 |

| Aurora | 3,721 | 4 |

| Batesville | 6,489 | 4 |

| Bedford | 13,400 | 32 |

| Beech Grove | 14,384 | 64 |

| Berne | 3,964 | 3 |

| Bloomington | 82,415 | 148 |

| Boonville | 6,197 | 9 |

| Bremen | 4,597 | 4 |

| Brownsburg | 22,908 | 26 |

| Carmel | 84,880 | 43 |

| Cedar Lake | 11,688 | 12 |

| Chesterfield | 2,508 | 3 |

| Clarksville | 21,865 | 47 |

| Clinton | 4,810 | 5 |

| Columbia City | 8,850 | 7 |

| Columbus | 45,874 | 129 |

| Crawfordsville | 16,055 | 21 |

| Cumberland | 5,218 | 8 |

| Danville | 9,151 | 7 |

| Decatur | 9,345 | 10 |

| Delphi | 2,887 | 2 |

| Dyer | 16,369 | 13 |

| East Chicago | 29,397 | 225 |

| Edinburgh | 4,509 | 3 |

| Ellettsville | 6,584 | 1 |

| Elwood | 8,492 | 19 |

| Evansville | 120,284 | 492 |

| Fairmount | 2,906 | 1 |

| Fishers | 83,358 | 29 |

| Fort Wayne | 254,820 | 386 |

| Franklin | 24,034 | 9 |

| Garrett | 6,291 | 16 |

| Gary | 78,819 | 732 |

| Goshen | 32,195 | 70 |

| Greenfield | 21,175 | 17 |

| Greensburg | 11,675 | 2 |

| Greenwood | 53,208 | 88 |

| Griffith | 16,671 | 54 |

| Hagerstown | 1,764 | 3 |

| Hammond | 79,329 | 406 |

| Hartford City | 6,053 | 4 |

| Highland | 23,372 | 54 |

| Hobart | 28,631 | 85 |

| Huntington | 17,271 | 9 |

| Indianapolis | 850,220 | 5,005 |

| Jasper | 15,195 | 6 |

| Jeffersonville | 45,846 | 139 |

| Knox | 3,657 | 0 |

| Kokomo | 56,878 | 114 |

| Lafayette | 68,173 | 232 |

| Lake Station | 12,335 | 61 |

| La Porte | 22,112 | 29 |

| Lawrenceburg | 5,012 | 0 |

| Ligonier | 4,385 | 3 |

| Linton | 5,359 | 1 |

| Long Beach | 1,173 | 3 |

| Lowell | 1,173 | 3 |

| Marion | 29,549 | 75 |

| Martinsville | 11,823 | 36 |

| Merrillville | 35,756 | 112 |

| Mishawaka | 47,967 | 140 |

| Mooresville | 9,490 | 30 |

| Mount Vernon | 6,586 | 19 |

| Muncie | 70,059 | 154 |

| Nappanee | 6,694 | 5 |

| New Albany | 36,490 | 134 |

| New Haven | 15,575 | 27 |

| New Whiteland | 5,668 | 3 |

| North Judson | 1,759 | 1 |

| North Liberty | 1,890 | 0 |

| North Manchester | 5,987 | 0 |

| North Vernon | 6,640 | 16 |

| Peru | 11,219 | 5 |

| Plainfield | 29,644 | 53 |

| Plymouth | 10,034 | 9 |

| Portage | 36,862 | 45 |

| Porter | 4,883 | 6 |

| Portland | 6,278 | 18 |

| Rensselaer | 5,905 | 2 |

| Rushville | 6,204 | 8 |

| Schererville | 28,054 | 32 |

| Scottsburg | 6,614 | 7 |

| Sellersburg | 6,150 | 15 |

| Seymour | 18,655 | 100 |

| Shelbyville | 19,159 | 28 |

| South Bend | 100,711 | 326 |

| South Whitley | 1,728 | 1 |

| Speedway | 11,967 | 46 |

| Tell City | 7,228 | 7 |

| Terre Haute | 61,215 | 281 |

| Tipton | 4,983 | 5 |

| Valparaiso | 32,090 | 23 |

| Walkerton | 2,284 | 5 |

| Warsaw | 13,897 | 16 |

| Washington | 11,813 | 40 |

| Waterloo | 2,240 | 4 |

| Westfield | 32,698 | 12 |

| West Lafayette | 30,687 | 16 |

| Whitestown | 3,778 | 5 |

| Whiting | 4,918 | 20 |

| Winchester | 4,866 | 6 |

| Winona Lake | 4,934 | 0 |

| Zionsville | 24,433 | 3 |

Road Fatalities in Indiana

There are other roadway concerns you’ll need to keep an eye out for beyond theft. As you’re driving through Indiana, make sure you watch out for the other drivers on the road to better avoid becoming a statistic.

Here’s what you need to know to drive safely on Indiana’s interstates.

Most Fatal Highway in Indiana

U.S. 41 in Indiana sees the most fatalities of all Indiana’s highways over a year. There is an average of 11.1 fatalities on this rural roadway, suggesting that rural locations in Indiana are more prone to fatal accidents than urban ones.

Traffic Fatalities by Weather Condition & Light Condition

Different weather and light conditions can impact the way that drivers can operate on the road. Take a look at how both factors cause fatalities in Indiana:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 412 | 110 | 203 | 26 | 1 | 752 |

| Rain | 23 | 8 | 23 | 3 | 0 | 57 |

| Snow/Sleet | 10 | 1 | 5 | 0 | 0 | 16 |

| Other | 5 | 0 | 6 | 0 | 0 | 11 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 450 | 119 | 237 | 29 | 1 | 836 |

Fatalities by County

We can’t control the weather or the nature of the highway we’re driving on. There are some fatalities, however, that we have a little more control over. Take a look at the following data to learn more about Indiana’s different fatalities and how often each occurs in the state.

Traffic Fatalities by Road Type

Location also impacts the likelihood of a car accident, as you can see in the table below:

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 530 | 418 | 474 | 477 | 524 | 535 | 472 | 521 | 543 | 555 |

| Urban | 290 | 275 | 280 | 274 | 257 | 249 | 273 | 296 | 285 | 357 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 |

| Total | 820 | 693 | 754 | 751 | 781 | 784 | 745 | 817 | 829 | 914 |

Fatalities by Person Type

Person type is also likely to impact fatality statistics. “Person type” here refers to a person’s relationship to a vehicle as opposed to any other demographic statistics.

| Indiana Traffic Fatalities by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 321 | 258 | 326 | 331 | 355 |

| Light Pickup Truck Occupants | 95 | 101 | 88 | 118 | 90 |

| Light Utility Truck Occupants | 84 | 92 | 115 | 98 | 124 |

| Large Truck Occupants | 16 | 15 | 16 | 14 | 17 |

| Other/Unknown Occupants | 9 | 11 | 9 | 18 | 14 |

| Van Occupants | 45 | 42 | 41 | 34 | 44 |

| Bus Occupants | 4 | 1 | 0 | 0 | 1 |

| Motorcyclists | 115 | 124 | 108 | 101 | 149 |

| Pedestrians | 76 | 78 | 96 | 87 | 101 |

| Bicyclists and Other Cyclists | 14 | 12 | 12 | 19 | 13 |

| Other/Unknown Non-occupants | 5 | 8 | 5 | 7 | 6 |

| State Total | 784 | 745 | 817 | 829 | 914 |

As you can see, passengers are the people most frequently involved in fatalities. Motorists are also high up on the list of potential fatality victims.

Fatalities by Crash Type

There are also specific crash types that most frequently result in fatalities:

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 431 | 397 | 443 | 436 | 455 |

| Involving a Large Truck | 117 | 128 | 118 | 108 | 138 |

| Involving Speeding | 218 | 204 | 233 | 213 | 208 |

| Involving a Rollover | 162 | 166 | 181 | 176 | 173 |

| Involving a Roadway Departure | 447 | 406 | 435 | 454 | 471 |

| Involving an Intersection (or Intersection Related) | 192 | 189 | 217 | 221 | 261 |

| Total Fatalities (All Crashes) | 784 | 745 | 817 | 829 | 914 |

Five-Year Trend for the Top 10 Counties

The table below relays the top 10 counties in Indiana that happen to see the most accidents over a year.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Marion | 80 | 83 | 97 | 104 | 102 |

| Lake | 47 | 48 | 59 | 50 | 51 |

| Allen | 31 | 31 | 30 | 36 | 43 |

| Porter | 16 | 13 | 22 | 19 | 28 |

| La Porte | 18 | 21 | 10 | 19 | 27 |

| St. Joseph | 20 | 23 | 12 | 22 | 27 |

| Elkhart | 21 | 20 | 33 | 16 | 26 |

| Tippecanoe | 24 | 6 | 19 | 7 | 23 |

| Vanderburgh | 21 | 20 | 15 | 16 | 21 |

| Gibson | 4 | 6 | 14 | 10 | 19 |

Fatalities Involving Speeding

We’ve already touched briefly on the dangers of speeding anywhere in the nation. Even so, Indiana sees its fair share of speeders on the interstates. Speeding often results in fatalities, as detailed in the table below:

| County Name | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adams | 0 | 1 | 3 | 0 | 1 | 0.00 | 2.88 | 8.58 | 0.00 | 2.82 |

| Allen | 8 | 10 | 8 | 7 | 15 | 2.20 | 2.74 | 2.18 | 1.89 | 4.02 |

| Bartholomew | 0 | 3 | 5 | 3 | 1 | 0.00 | 3.73 | 6.15 | 3.66 | 1.22 |

| Benton | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Blackford | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Boone | 0 | 2 | 3 | 1 | 2 | 0.00 | 3.25 | 4.76 | 1.56 | 3.04 |

| Brown | 3 | 0 | 1 | 0 | 1 | 19.93 | 0.00 | 6.67 | 0.00 | 6.65 |

| Carroll | 3 | 3 | 1 | 1 | 0 | 14.91 | 15.03 | 5.03 | 5.01 | 0.00 |

| Cass | 1 | 2 | 1 | 3 | 1 | 2.59 | 5.20 | 2.62 | 7.89 | 2.63 |

| Clark | 4 | 1 | 6 | 3 | 4 | 3.55 | 0.88 | 5.22 | 2.59 | 3.42 |

| Clay | 6 | 0 | 0 | 2 | 3 | 22.51 | 0.00 | 0.00 | 7.63 | 11.45 |

| Clinton | 2 | 0 | 4 | 2 | 4 | 6.10 | 0.00 | 12.34 | 6.20 | 12.38 |

| Crawford | 2 | 1 | 1 | 0 | 0 | 18.83 | 9.37 | 9.47 | 0.00 | 0.00 |

| Daviess | 3 | 1 | 1 | 1 | 1 | 9.29 | 3.06 | 3.05 | 3.03 | 3.02 |

| De Kalb | 2 | 4 | 3 | 1 | 2 | 4.73 | 9.44 | 7.07 | 2.35 | 4.67 |

| Dearborn | 2 | 0 | 2 | 2 | 1 | 4.02 | 0.00 | 4.04 | 4.04 | 2.01 |

| Decatur | 2 | 1 | 0 | 1 | 0 | 7.63 | 3.78 | 0.00 | 3.75 | 0.00 |

| Delaware | 7 | 3 | 3 | 3 | 2 | 5.99 | 2.58 | 2.59 | 2.60 | 1.74 |

| Dubois | 4 | 4 | 1 | 0 | 1 | 9.46 | 9.46 | 2.36 | 0.00 | 2.35 |

| Elkhart | 9 | 8 | 12 | 3 | 9 | 4.49 | 3.97 | 5.90 | 1.47 | 4.39 |

| Fayette | 0 | 2 | 2 | 1 | 0 | 0.00 | 8.53 | 8.55 | 4.30 | 0.00 |

| Floyd | 3 | 2 | 3 | 3 | 2 | 3.95 | 2.63 | 3.92 | 3.91 | 2.60 |

| Fountain | 1 | 0 | 0 | 1 | 0 | 5.92 | 0.00 | 0.00 | 6.07 | 0.00 |

| Franklin | 3 | 1 | 0 | 2 | 0 | 13.07 | 4.36 | 0.00 | 8.80 | 0.00 |

| Fulton | 0 | 0 | 2 | 1 | 0 | 0.00 | 0.00 | 9.84 | 4.97 | 0.00 |

| Gibson | 0 | 2 | 6 | 3 | 4 | 0.00 | 5.93 | 17.85 | 8.93 | 11.91 |

| Grant | 3 | 3 | 2 | 2 | 1 | 4.35 | 4.39 | 2.96 | 2.99 | 1.50 |

| Greene | 1 | 1 | 1 | 1 | 3 | 3.06 | 3.06 | 3.09 | 3.10 | 9.32 |

| Hamilton | 1 | 2 | 5 | 3 | 2 | 0.34 | 0.66 | 1.62 | 0.95 | 0.62 |

| Hancock | 2 | 1 | 1 | 1 | 2 | 2.82 | 1.39 | 1.38 | 1.36 | 2.67 |

| Harrison | 3 | 1 | 5 | 3 | 2 | 7.69 | 2.55 | 12.65 | 7.56 | 5.01 |

| Hendricks | 3 | 2 | 1 | 7 | 0 | 1.96 | 1.28 | 0.63 | 4.37 | 0.00 |

| Henry | 2 | 1 | 3 | 3 | 2 | 4.09 | 2.05 | 6.16 | 6.20 | 4.13 |

| Howard | 3 | 1 | 3 | 2 | 0 | 3.63 | 1.21 | 3.64 | 2.43 | 0.00 |

| Huntington | 1 | 0 | 3 | 1 | 3 | 2.72 | 0.00 | 8.22 | 2.75 | 8.26 |

| Jackson | 0 | 2 | 4 | 1 | 4 | 0.00 | 4.57 | 9.11 | 2.28 | 9.11 |

| Jasper | 4 | 3 | 2 | 3 | 1 | 11.97 | 8.95 | 5.97 | 8.98 | 2.99 |

| Jay | 0 | 0 | 1 | 0 | 0 | 0.00 | 0.00 | 4.73 | 0.00 | 0.00 |

| Jefferson | 1 | 3 | 1 | 1 | 4 | 3.09 | 9.26 | 3.09 | 3.10 | 12.47 |

| Jennings | 0 | 0 | 0 | 3 | 4 | 0.00 | 0.00 | 0.00 | 10.86 | 14.48 |

| Johnson | 1 | 1 | 2 | 1 | 1 | 0.69 | 0.68 | 1.34 | 0.66 | 0.65 |

| Knox | 2 | 0 | 3 | 0 | 2 | 5.26 | 0.00 | 7.95 | 0.00 | 5.33 |

| Kosciusko | 0 | 1 | 0 | 2 | 1 | 0.00 | 1.27 | 0.00 | 2.53 | 1.26 |

| La Porte | 5 | 7 | 3 | 9 | 5 | 4.49 | 6.27 | 2.71 | 8.17 | 4.54 |

| Lagrange | 4 | 3 | 2 | 4 | 4 | 10.50 | 7.80 | 5.18 | 10.22 | 10.18 |

| Lake | 24 | 21 | 25 | 9 | 15 | 4.88 | 4.28 | 5.12 | 1.85 | 3.09 |

| Lawrence | 0 | 2 | 1 | 0 | 1 | 0.00 | 4.38 | 2.19 | 0.00 | 2.19 |

| Madison | 1 | 4 | 1 | 1 | 5 | 0.77 | 3.08 | 0.77 | 0.77 | 3.86 |

| Marion | 23 | 20 | 30 | 31 | 18 | 2.47 | 2.14 | 3.19 | 3.28 | 1.89 |

| Marshall | 1 | 2 | 0 | 2 | 0 | 2.13 | 4.26 | 0.00 | 4.29 | 0.00 |

| Martin | 1 | 0 | 1 | 0 | 0 | 9.78 | 0.00 | 9.79 | 0.00 | 0.00 |

| Miami | 5 | 0 | 1 | 3 | 0 | 13.82 | 0.00 | 2.78 | 8.32 | 0.00 |

| Monroe | 0 | 2 | 1 | 9 | 1 | 0.00 | 1.39 | 0.69 | 6.18 | 0.68 |

| Montgomery | 3 | 2 | 1 | 1 | 1 | 7.87 | 5.24 | 2.61 | 2.61 | 2.60 |

| Morgan | 3 | 2 | 4 | 3 | 2 | 4.33 | 2.88 | 5.75 | 4.31 | 2.87 |

| Newton | 0 | 0 | 1 | 0 | 4 | 0.00 | 0.00 | 7.15 | 0.00 | 28.31 |

| Noble | 3 | 3 | 1 | 0 | 0 | 6.35 | 6.33 | 2.10 | 0.00 | 0.00 |

| Ohio | 1 | 0 | 0 | 1 | 1 | 16.68 | 0.00 | 0.00 | 16.98 | 17.16 |

| Orange | 2 | 0 | 0 | 1 | 0 | 10.09 | 0.00 | 0.00 | 5.13 | 0.00 |

| Owen | 1 | 1 | 2 | 2 | 0 | 4.72 | 4.76 | 9.60 | 9.56 | 0.00 |

| Parke | 0 | 1 | 0 | 1 | 1 | 0.00 | 5.80 | 0.00 | 5.90 | 5.92 |

| Perry | 1 | 2 | 2 | 1 | 0 | 5.15 | 10.35 | 10.36 | 5.26 | 0.00 |

| Pike | 0 | 0 | 1 | 1 | 1 | 0.00 | 0.00 | 8.03 | 8.05 | 8.09 |

| Porter | 5 | 2 | 6 | 5 | 3 | 3.00 | 1.20 | 3.58 | 2.99 | 1.78 |

| Posey | 3 | 0 | 1 | 0 | 0 | 11.74 | 0.00 | 3.90 | 0.00 | 0.00 |

| Pulaski | 1 | 0 | 0 | 2 | 0 | 7.73 | 0.00 | 0.00 | 15.86 | 0.00 |

| Putnam | 0 | 3 | 3 | 1 | 4 | 0.00 | 7.96 | 8.00 | 2.68 | 10.61 |

| Randolph | 0 | 0 | 0 | 0 | 1 | 0.00 | 0.00 | 0.00 | 0.00 | 4.01 |

| Ripley | 3 | 4 | 0 | 4 | 1 | 10.61 | 14.12 | 0.00 | 14.08 | 3.52 |

| Rush | 0 | 0 | 0 | 3 | 0 | 0.00 | 0.00 | 0.00 | 18.04 | 0.00 |

| Scott | 1 | 2 | 0 | 7 | 0 | 4.21 | 8.46 | 0.00 | 29.53 | 0.00 |

| Shelby | 3 | 1 | 3 | 1 | 1 | 6.76 | 2.25 | 6.76 | 2.26 | 2.25 |

| Spencer | 0 | 0 | 0 | 0 | 1 | 0.00 | 0.00 | 0.00 | 0.00 | 4.90 |

| St. Joseph | 7 | 6 | 2 | 6 | 13 | 2.62 | 2.24 | 0.75 | 2.23 | 4.81 |

| Starke | 1 | 1 | 0 | 1 | 1 | 4.32 | 4.36 | 0.00 | 4.35 | 4.37 |

| Steuben | 0 | 3 | 1 | 2 | 2 | 0.00 | 8.69 | 2.90 | 5.82 | 5.80 |

| Sullivan | 3 | 0 | 1 | 1 | 2 | 14.19 | 0.00 | 4.79 | 4.82 | 9.64 |

| Switzerland | 0 | 1 | 0 | 0 | 0 | 0.00 | 9.48 | 0.00 | 0.00 | 0.00 |

| Tippecanoe | 6 | 3 | 9 | 0 | 8 | 3.31 | 1.63 | 4.84 | 0.00 | 4.20 |

| Tipton | 0 | 8 | 1 | 2 | 2 | 0.00 | 51.98 | 6.56 | 13.20 | 13.22 |

| Union | 0 | 1 | 2 | 0 | 1 | 0.00 | 13.80 | 27.78 | 0.00 | 13.89 |

| Vanderburgh | 3 | 5 | 3 | 3 | 6 | 1.65 | 2.75 | 1.65 | 1.65 | 3.30 |

| Vermillion | 2 | 1 | 5 | 1 | 3 | 12.62 | 6.39 | 32.06 | 6.41 | 19.35 |

| Vigo | 3 | 4 | 1 | 5 | 1 | 2.77 | 3.71 | 0.93 | 4.64 | 0.93 |

| Wabash | 1 | 2 | 3 | 4 | 0 | 3.10 | 6.23 | 9.41 | 12.68 | 0.00 |

| Warren | 0 | 0 | 0 | 0 | 1 | 0.00 | 0.00 | 0.00 | 0.00 | 12.19 |

| Warrick | 0 | 1 | 0 | 0 | 3 | 0.00 | 1.64 | 0.00 | 0.00 | 4.80 |

| Washington | 2 | 4 | 2 | 1 | 4 | 7.20 | 14.34 | 7.20 | 3.60 | 14.37 |

| Wayne | 2 | 1 | 2 | 4 | 2 | 2.95 | 1.48 | 2.99 | 6.01 | 3.02 |

| Wells | 1 | 2 | 1 | 1 | 0 | 3.61 | 7.19 | 3.59 | 3.59 | 0.00 |

| White | 0 | 0 | 5 | 1 | 2 | 0.00 | 0.00 | 20.59 | 4.15 | 8.27 |

| Whitley | 1 | 4 | 0 | 1 | 1 | 3.00 | 11.96 | 0.00 | 2.99 | 2.96 |

Read more: Delaware Car Insurance (The Only Guide You’ll Ever Need)

Fatalities Involving an Alcohol-Impaired Driver

Indiana also sees more than its fair share of alcohol-related accidents, including accidents involving teenage drivers who are intoxicated when they get behind the wheel. The table below details the number of individuals involved in alcohol-related fatalities over a year:

| Indiana Drunk Driving Deaths by County | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fatalities | Fatalities per 100,000 Population | |||||||||

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Adams | 0 | 2 | 1 | 0 | 0 | 0.00 | 5.75 | 2.86 | 0.00 | 0.00 |

| Allen | 8 | 10 | 9 | 10 | 14 | 2.20 | 2.74 | 2.45 | 2.70 | 3.75 |

| Bartholomew | 1 | 2 | 4 | 1 | 2 | 1.26 | 2.49 | 4.92 | 1.22 | 2.44 |

| Benton | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Blackford | 0 | 0 | 0 | 1 | 1 | 0.00 | 0.00 | 0.00 | 8.28 | 8.35 |

| Boone | 1 | 0 | 3 | 1 | 1 | 1.66 | 0.00 | 4.76 | 1.56 | 1.52 |

| Brown | 2 | 2 | 0 | 0 | 1 | 13.29 | 13.38 | 0.00 | 0.00 | 6.65 |

| Carroll | 2 | 1 | 1 | 0 | 0 | 9.94 | 5.01 | 5.03 | 0.00 | 0.00 |

| Cass | 0 | 2 | 2 | 3 | 2 | 0.00 | 5.20 | 5.24 | 7.89 | 5.26 |

| Clark | 4 | 3 | 1 | 3 | 1 | 3.55 | 2.63 | 0.87 | 2.59 | 0.85 |

| Clay | 3 | 1 | 1 | 1 | 1 | 11.25 | 3.78 | 3.79 | 3.82 | 3.82 |

| Clinton | 1 | 0 | 3 | 2 | 2 | 3.05 | 0.00 | 9.26 | 6.20 | 6.19 |

| Crawford | 2 | 1 | 0 | 0 | 1 | 18.83 | 9.37 | 0.00 | 0.00 | 9.46 |

| Daviess | 1 | 1 | 0 | 2 | 3 | 3.10 | 3.06 | 0.00 | 6.06 | 9.06 |

| De Kalb | 1 | 2 | 0 | 1 | 1 | 2.36 | 4.72 | 0.00 | 2.35 | 2.33 |

| Dearborn | 2 | 1 | 2 | 1 | 1 | 4.02 | 2.02 | 4.04 | 2.02 | 2.01 |

| Decatur | 0 | 0 | 0 | 3 | 0 | 0.00 | 0.00 | 0.00 | 11.26 | 0.00 |

| Delaware | 1 | 3 | 2 | 1 | 2 | 0.86 | 2.58 | 1.73 | 0.87 | 1.74 |

| Dubois | 3 | 2 | 1 | 0 | 4 | 7.10 | 4.73 | 2.36 | 0.00 | 9.40 |

| Elkhart | 3 | 4 | 7 | 2 | 6 | 1.50 | 1.98 | 3.44 | 0.98 | 2.93 |

| Fayette | 0 | 0 | 1 | 1 | 2 | 0.00 | 0.00 | 4.28 | 4.30 | 8.62 |

| Floyd | 3 | 1 | 2 | 3 | 6 | 3.95 | 1.31 | 2.61 | 3.91 | 7.79 |

| Fountain | 1 | 0 | 0 | 1 | 0 | 5.92 | 0.00 | 0.00 | 6.07 | 0.00 |

| Franklin | 3 | 0 | 0 | 1 | 1 | 13.07 | 0.00 | 0.00 | 4.40 | 4.42 |

| Fulton | 1 | 0 | 0 | 0 | 1 | 4.89 | 0.00 | 0.00 | 0.00 | 4.99 |

| Gibson | 0 | 0 | 2 | 2 | 3 | 0.00 | 0.00 | 5.95 | 5.96 | 8.93 |

| Grant | 1 | 2 | 0 | 7 | 1 | 1.45 | 2.93 | 0.00 | 10.48 | 1.50 |

| Greene | 2 | 2 | 1 | 4 | 2 | 6.11 | 6.13 | 3.09 | 12.41 | 6.22 |

| Hamilton | 6 | 2 | 3 | 4 | 3 | 2.02 | 0.66 | 0.97 | 1.26 | 0.93 |

| Hancock | 2 | 1 | 2 | 2 | 6 | 2.82 | 1.39 | 2.76 | 2.71 | 8.00 |

| Harrison | 3 | 2 | 2 | 5 | 2 | 7.69 | 5.11 | 5.06 | 12.60 | 5.01 |

| Hendricks | 5 | 3 | 2 | 3 | 1 | 3.26 | 1.93 | 1.27 | 1.87 | 0.61 |

| Henry | 0 | 0 | 2 | 1 | 1 | 0.00 | 0.00 | 4.11 | 2.07 | 2.06 |

| Howard | 2 | 2 | 4 | 6 | 6 | 2.42 | 2.42 | 4.86 | 7.29 | 7.28 |

| Huntington | 0 | 0 | 2 | 1 | 2 | 0.00 | 0.00 | 5.48 | 2.75 | 5.50 |

| Jackson | 3 | 0 | 0 | 0 | 1 | 6.90 | 0.00 | 0.00 | 0.00 | 2.28 |

| Jasper | 5 | 3 | 0 | 1 | 1 | 14.96 | 8.95 | 0.00 | 2.99 | 2.99 |

| Jay | 1 | 3 | 1 | 1 | 0 | 4.70 | 14.19 | 4.73 | 4.75 | 0.00 |

| Jefferson | 1 | 2 | 0 | 1 | 1 | 3.09 | 6.17 | 0.00 | 3.10 | 3.12 |

| Jennings | 2 | 0 | 0 | 2 | 1 | 7.09 | 0.00 | 0.00 | 7.24 | 3.62 |

| Johnson | 4 | 1 | 0 | 1 | 2 | 2.75 | 0.68 | 0.00 | 0.66 | 1.30 |

| Knox | 2 | 1 | 1 | 1 | 6 | 5.26 | 2.63 | 2.65 | 2.66 | 16.00 |

| Kosciusko | 0 | 0 | 2 | 6 | 2 | 0.00 | 0.00 | 2.54 | 7.60 | 2.53 |

| La Porte | 6 | 5 | 1 | 5 | 7 | 5.39 | 4.48 | 0.90 | 4.54 | 6.36 |

| Lagrange | 0 | 1 | 0 | 1 | 0 | 0.00 | 2.60 | 0.00 | 2.56 | 0.00 |

| Lake | 16 | 16 | 14 | 9 | 20 | 3.25 | 3.26 | 2.87 | 1.85 | 4.12 |

| Lawrence | 3 | 1 | 0 | 2 | 2 | 6.54 | 2.19 | 0.00 | 4.39 | 4.38 |

| Madison | 1 | 2 | 1 | 2 | 6 | 0.77 | 1.54 | 0.77 | 1.55 | 4.63 |

| Marion | 27 | 14 | 21 | 33 | 26 | 2.90 | 1.50 | 2.23 | 3.50 | 2.74 |

| Marshall | 1 | 2 | 1 | 3 | 0 | 2.13 | 4.26 | 2.14 | 6.43 | 0.00 |

| Martin | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Miami | 0 | 1 | 1 | 1 | 0 | 0.00 | 2.77 | 2.78 | 2.77 | 0.00 |

| Monroe | 2 | 0 | 1 | 5 | 1 | 1.41 | 0.00 | 0.69 | 3.43 | 0.68 |

| Montgomery | 0 | 1 | 2 | 0 | 1 | 0.00 | 2.62 | 5.22 | 0.00 | 2.60 |

| Morgan | 2 | 0 | 5 | 5 | 1 | 2.88 | 0.00 | 7.19 | 7.19 | 1.43 |

| Newton | 0 | 2 | 1 | 0 | 4 | 0.00 | 14.19 | 7.15 | 0.00 | 28.31 |

| Noble | 2 | 2 | 0 | 1 | 1 | 4.23 | 4.22 | 0.00 | 2.11 | 2.11 |

| Ohio | 0 | 0 | 0 | 0 | 1 | 0.00 | 0.00 | 0.00 | 0.00 | 17.16 |

| Orange | 3 | 0 | 0 | 1 | 0 | 15.13 | 0.00 | 0.00 | 5.13 | 0.00 |

| Owen | 2 | 1 | 2 | 1 | 0 | 9.45 | 4.76 | 9.60 | 4.78 | 0.00 |

| Parke | 2 | 0 | 1 | 2 | 2 | 11.60 | 0.00 | 5.89 | 11.79 | 11.84 |

| Perry | 0 | 1 | 2 | 0 | 0 | 0.00 | 5.17 | 10.36 | 0.00 | 0.00 |

| Pike | 1 | 0 | 1 | 1 | 0 | 7.96 | 0.00 | 8.03 | 8.05 | 0.00 |

| Porter | 6 | 5 | 6 | 5 | 3 | 3.60 | 2.99 | 3.58 | 2.99 | 1.78 |

| Posey | 2 | 1 | 2 | 0 | 1 | 7.83 | 3.91 | 7.81 | 0.00 | 3.91 |

| Pulaski | 0 | 0 | 0 | 2 | 1 | 0.00 | 0.00 | 0.00 | 15.86 | 7.98 |

| Putnam | 1 | 1 | 4 | 0 | 3 | 2.66 | 2.65 | 10.67 | 0.00 | 7.96 |

| Randolph | 0 | 1 | 2 | 1 | 1 | 0.00 | 3.95 | 7.96 | 3.99 | 4.01 |

| Ripley | 0 | 4 | 0 | 5 | 3 | 0.00 | 14.12 | 0.00 | 17.60 | 10.55 |

| Rush | 0 | 0 | 1 | 1 | 0 | 0.00 | 0.00 | 5.98 | 6.01 | 0.00 |

| Scott | 2 | 2 | 0 | 2 | 1 | 8.42 | 8.46 | 0.00 | 8.44 | 4.19 |

| Shelby | 2 | 0 | 0 | 2 | 1 | 4.51 | 0.00 | 0.00 | 4.52 | 2.25 |

| Spencer | 1 | 0 | 0 | 1 | 2 | 4.82 | 0.00 | 0.00 | 4.88 | 9.81 |

| St. Joseph | 7 | 6 | 3 | 5 | 7 | 2.62 | 2.24 | 1.12 | 1.85 | 2.59 |

| Starke | 1 | 0 | 2 | 2 | 1 | 4.32 | 0.00 | 8.75 | 8.70 | 4.37 |

| Steuben | 0 | 4 | 2 | 2 | 0 | 0.00 | 11.59 | 5.79 | 5.82 | 0.00 |

| Sullivan | 2 | 1 | 2 | 1 | 2 | 9.46 | 4.76 | 9.58 | 4.82 | 9.64 |

| Switzerland | 0 | 0 | 1 | 1 | 0 | 0.00 | 0.00 | 9.42 | 9.39 | 0.00 |

| Tippecanoe | 4 | 2 | 3 | 1 | 4 | 2.21 | 1.09 | 1.61 | 0.53 | 2.10 |

| Tipton | 0 | 1 | 1 | 2 | 2 | 0.00 | 6.50 | 6.56 | 13.20 | 13.22 |

| Union | 1 | 0 | 0 | 0 | 0 | 13.69 | 0.00 | 0.00 | 0.00 | 0.00 |

| Vanderburgh | 7 | 4 | 3 | 5 | 5 | 3.85 | 2.20 | 1.65 | 2.75 | 2.75 |

| Vermillion | 2 | 1 | 3 | 0 | 0 | 12.62 | 6.39 | 19.24 | 0.00 | 0.00 |

| Vigo | 7 | 1 | 3 | 4 | 4 | 6.47 | 0.93 | 2.79 | 3.72 | 3.72 |

| Wabash | 0 | 1 | 3 | 4 | 0 | 0.00 | 3.11 | 9.41 | 12.68 | 0.00 |

| Warren | 0 | 1 | 0 | 1 | 1 | 0.00 | 12.00 | 0.00 | 12.23 | 12.19 |

| Warrick | 1 | 1 | 0 | 4 | 2 | 1.64 | 1.64 | 0.00 | 6.45 | 3.20 |

| Washington | 1 | 2 | 0 | 2 | 5 | 3.60 | 7.17 | 0.00 | 7.21 | 17.97 |

| Wayne | 0 | 0 | 1 | 3 | 2 | 0.00 | 0.00 | 1.49 | 4.51 | 3.02 |

| Wells | 1 | 2 | 4 | 1 | 0 | 3.61 | 7.19 | 14.37 | 3.59 | 0.00 |

| White | 0 | 2 | 3 | 1 | 0 | 0.00 | 8.19 | 12.36 | 4.15 | 0.00 |

| Whitley | 1 | 3 | 0 | 1 | 2 | 3.00 | 8.97 | 0.00 | 2.99 | 5.92 |

EMS Response Time

Emergency Medical Services are among the first personnel to respond to an accident. If you happen to get into an accident, you’ll want a rough estimate of how long it’ll take EMS to arrive at the scene.

Unfortunately, Indiana doesn’t report its EMS response times in rural or urban areas.

EMS services arrive within eight minutes in urban areas, according to the national average. In rural areas, they’ll typically arrive within 14 minutes.

The best thing to do is make a phone call to emergency services as soon as you can after an accident. Whether you’re making the call yourself or having someone else do it for you, that call can make a real difference.

Transportation

What does driving daily look like in Indiana? Here, you’ll learn more about the state’s traffic patterns, car ownership, and more.

Car Ownership

As is the case across most of the nation, Indiana residents tend to own two cars, on average. Drivers who own a single car are just as common as those who own three cars, as well.

Commute Time

You wouldn’t think commutes would be all that long in a state like Indiana. While the state does come in under the national average — 25.3 minutes — you’re still likely to spend an average of 22.7 minutes on the road every morning and evening.

Commuter Transportation

It’s also rare for Indiana residents to carpool with one another. The vast majority of drivers in Indiana drive themselves to and from work on their own.

Traffic Congestion in Indiana

Indiana’s largest city is also home to the state’s most traffic congestion. Indianapolis ranks at 177 on the INRIX scorecard for global traffic. This means that you’ll need to leave yourself plenty of time to make it around I-465 in the mornings and evenings!

| URBAN AREA | 2018 IMPACT RANK (2017) | HOURS LOST IN CONGESTION | YEAR OVER YEAR CHANGE | COST OF CONGESTION (PER DRIVER) | INNER CITY TRAVEL TIME (MINUTES) | INNER CITY LAST MILE SPEED (MPH) |

|---|---|---|---|---|---|---|

| Indianapolis, IN | 177 (162) | 59 (184) | 2% | $826 | 5 | 13 |

And with that, we come to the end of our comprehensive guide to Indiana’s car insurance providers. Do you feel ready to start insurance shopping? So long as you work with a provider who can meet your needs, you’ll be a-okay in the Hoosier State.

Want to start comparing car insurance rates ASAP? You can use our FREE online tool to get started. Just

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.