American Family Car Insurance Guide [Data + Expert Review]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Feb 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

We, here at Insurantly.com, know that choosing your car insurance company is important. The right company can save you money, provide better customer service, and have the coverages you need, for you and your family.

This guide covers American Family Insurance (American Family). It has been around since the 1920s and ranks in the top 10 of auto insurance providers. You may know them from its commercials with J.J. Watt and the slogan inspire dreams.

But how much do you know about it exactly?

Researching car insurance companies is a bit like buying a car. Everyone says a lot of things, but how much of it is true?

We understand this and have got you covered.

In this guide, you’ll learn all you need to know about American Family. We’ll cover its financial ratings, its company culture, its rates, it cancellation process, even how to get a quote from them.

Start your engines. We’re pulling out of the bay into stretch one.

Ready to compare rates? Try our FREE online tool.

| Company Overview | Details |

|---|---|

| Year Founded | 1927 |

| Current Executives | CEO: Jack Salzwedel President: Bill Westrate |

| Number of Employees | 2,400 independent agents 11,000 total employees |

| Total Revenue Total Assets | $10.3 billion $27.5 billion |

| HQ Address | 6000 American Parkway Madison, WI 53783 |

| Phone Number | 1-800-MYAMFAM 1-800-692-6326 |

| Company Website | www.amfam.com |

| Premiums Written | 4,687,909 |

| Loss Ratio | 0.69 |

| Best For | Online Options Reasonable Rates Community-focused |

American Family’s Rating Agency

We’ll start with rating agencies. These are heavy hitters in the field of weighing and measuring a company. Some give financial ratings like A.M. Best. Some give customer satisfaction ratings like J.D. Power.

All give a clearer picture of American Family, from its financial stability to what its customers think of it.

A.M. Best

A.M. Best looks at five factors in its methodology for Financial Strength Ratings.

- Balance sheet strength

- Operating performance

- Business profile

- Enterprise risk management

- Specific nature and details of a security

American Family receives an A. This means it has an excellent ability to meet its ongoing insurance obligations. These insurance obligations filter down to consumers.

An example is the filling of claims, which are the primary expense related to consumers for an auto insurance company.

An A is one step from the top, which is an A+. Numerous car insurance companies have an A+ or higher, including Geico and State Farm.

Better Business Bureau

The Better Business Bureau (BBB) rates companies through seven factors.

- Complaint history

- Type of business

- Time in business

- Transparent business practices

- Failure to honor commitments to BBB

- Licensing and government actions

- Advertising issues

These factors are all weighted differently with complaints and the type of business being two large ones. American Family receives an A score, which is one step from the highest (also an A+).

However, its consumers leave a less pleasant impression about American Family. They have rated it 1.2 out of 5, for 108 reviews. Not exactly sterling numbers.

Fitch Ratings

Fitch Ratings is one of three nationally recognized statistical rating organizations. For its insurer financial strength rating, it looks at how well a company can meet its insurance obligations. The insurance obligations are all about you, as a customer.

Particularly whether the company can fulfill your claim.

American Family receives an A+ from Fitch Ratings, which is the fifth-highest category. Fitch Ratings writes in its press release,

“Fitch’s affirmation of American Family’s ratings and Outlook revision to Stable reflects the company’s very strong capitalization and business profile, strong underwriting, and sufficient reserve position.”

The company, according to Fitch, is moving in the right direction. But the fact that it had a negative outlook at all might be disconcerting.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) puts together complaints taken from state departments all around the country. Then, it creates a complaint index for each company.

This index is a ratio of the number of complaints compared to the number of premiums.

American Family had 99 complaints in 2018 for a complaint index of .69. This index is lower than the indexes of six of the nine other major car insurance companies.

| Company | Complaint Index | Total Complaints |

|---|---|---|

| Allstate | 1.26 | 226 |

| Farmers | 0.95 | 73 |

| Geico | 0.92 | 600 |

| Liberty Mutual | 0.94 | 146 |

| Nationwide | 0.43 | 37 |

| Progressive | 0.88 | 84 |

| State Farm | 0.57 | 1,397 |

| Travelers | 0.20 | 31 |

| USAA | 1.15 | 328 |

The only three that are better are Travelers, Nationwide, and State Farm.

JD Power

J.D. Power conducts a car insurance study every year to determine their customer satisfaction ratings. The one part we’ll look at closer is the auto claims satisfaction portion.

American Family receives three out of five for customer satisfaction, which is ranked 16th of all major and mid-major insurance companies. J.D. Power breaks down the claims process into six parts, all with their own rankings.

| Factors in Claim Process | Rating (out of 5) |

|---|---|

| Claims Servicing | 3 |

| Estimation Process | 3 |

| First Notice of Loss | 3 |

| Overall Satisfaction | 3 |

| Rental Experience | 2 |

| Repair Process | 3 |

| Settlement | 3 |

American Family receives average scores across the board. The one part it doesn’t is for rental experience, for which they receive a less-than-average score.

Consumer Reports

On its site, the readers of Consumer Reports review car insurance companies on their claims processes. The scoring is between 86 and 96, with American Family receiving an 89. This is good for 15th.

The claims process is broken down into eight parts with an emphasis on customer service and the effectiveness of the process.

| American Family Customer Service | Consumer Report Score |

|---|---|

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Very Good |

| Promptness of the Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Excellent |

| Timely Payment | Excellent |

| Freedom to Select a Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

American Family is ranked very good overall.

Consumer Affairs

Consumer Affairs is a site where consumers can leave reviews about companies, credit cards, mortgages, and much more.

Those consumers left 33 reviews for American Family Insurance (auto) in the past year, for a 1.4 rating out of 5. Not exactly thrilling numbers.

However, like with BBB, consumers might seek out Consumer Affairs because they are frustrated and want to leave a negative review. Oftentimes, these sites are not sought out by the happiest customers.

Take the rating with a grain of salt.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family History

In 1927, a man named Herman Wittwer was traveling through Wisconsin. He was an insurance salesperson and he saw a group of customers that were being under- and poorly served in the market.

These were farmers, and soon Wittwer rolled out the Farmers Mutual Insurance Company (not related to today’s Farmers Insurance) and started the process of approaching his target demographic.

His results, 90 years later, speak for themselves.

Today, Farmers Mutual Insurance Company is American Family Insurance, a top-10 company in private passenger auto insurance and top-15 in total property and casualty lines.

It has grown quite a bit in 90 years and competes against the heavy giants, the Farmers and Travelers of the world.

We understand that sometimes signing up with a car insurance company isn’t all about rates. It’s not always about the best discount or how easy it is to cancel a policy.

We like to do business with companies we’re familiar with, that align with our values as well as our pocketbooks.

That’s what this section is here for.

We’ll take a look at the public (and private) faces of the organization, from its commercials to what employees think of it. We’ll also take a look at market share, to see how it compares to other top 10 companies.

Rounding bend one and heading into stretch two.

American Family Market Share

Market share is a bit like an apple pie. Some people cut themselves big slices. Maybe they hustled to the pie quicker or were smart and placed themselves near where the pie would be served.

When the next pie comes, there’s more competition. The sizes of the slices change.

American Family is the 10th largest private passenger auto insurer and the 15th largest property and casualty insurer. Its market shares are small compared to the top tier, but it has been growing.

These market share numbers come from the National Association of Insurance Commissioners (NAIC).

| American Family Market Share | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Private Passenger Auto | 1.85% | 1.87% | 1.89% | 1.90% |

| All Lines | 1.22% | 1.27% | 1.30% | 1.31% |

Overall, it grew .05 percent in private passenger auto market share between 2015 and 2018. That number was .09 percent within total property and casualty market share.

Although its growth has been small, it beats some other top insurance companies, whose market share has gone down. This includes Nationwide and Farmers.

However, what does this growth look like compared to the top three growers in the private passenger auto market?

Geico, Progressive, and USAA are all growing at a faster rate than American Family. This is especially true of Progressive, which, year after year, has gained more market share. And at a faster clip, to boot.

Still, American Family grows. And with the least amount of premiums written out of all top 10 insurers, it is unsurprising that its growth compared to the rest might be slower.

American Family’s Position for the Future

The verdict on American Family is out currently, but there are some positive signs.

- It has consistently gained market share since 2015. Its gains are small, but that makes sense given its small size.

- It wrote 27 percent more premiums in 2018 in the private passenger auto line compared to 2015, which is significant growth.

- It wrote 23 percent more premiums in 2018 in property and casualty lines compared to 2015, which is also significant growth.

- Its financial ratings are solid, with A.M. Best giving them an A rating and Fitch Ratings giving it an A+.

It also has a solid online presence, with mobile apps available for both regular consumers and those in its driving program.

There are two concerns with American Family.

- The first concern with American Family is its previous Fitch Ratings. Although the current one is an A+, Fitch Ratings labeled American Family’s economic outlook negative in the previous ratings. Its economic outlook is stable now, but having that label is never positive.

- The second concern has to do with reach. American Family auto insurance is only available in 19 states. This can be good, in that consumers in the other states might be looking for a change.

But it can be difficult to crack into these markets. Other companies have set up infrastructure, have agents, and have poured advertising dollars into the states. It could be a challenge for American Family to expand.

So, it’s a mixed bag. While its current situation is improving, it was not good just a little while ago and it might be difficult to improve further.

American Family’s Online Presence

American Family has a full online presence, comparable to other car insurance companies. It is active on four social media platforms, has a website, and offers a mobile app.

- Twitter (@amfam)

- Facebook (@amfam)

- Instagram (@amfam)

- YouTube

- Website: www.amfam.com

- Mobile App: MyAmFam (iOS | Android)

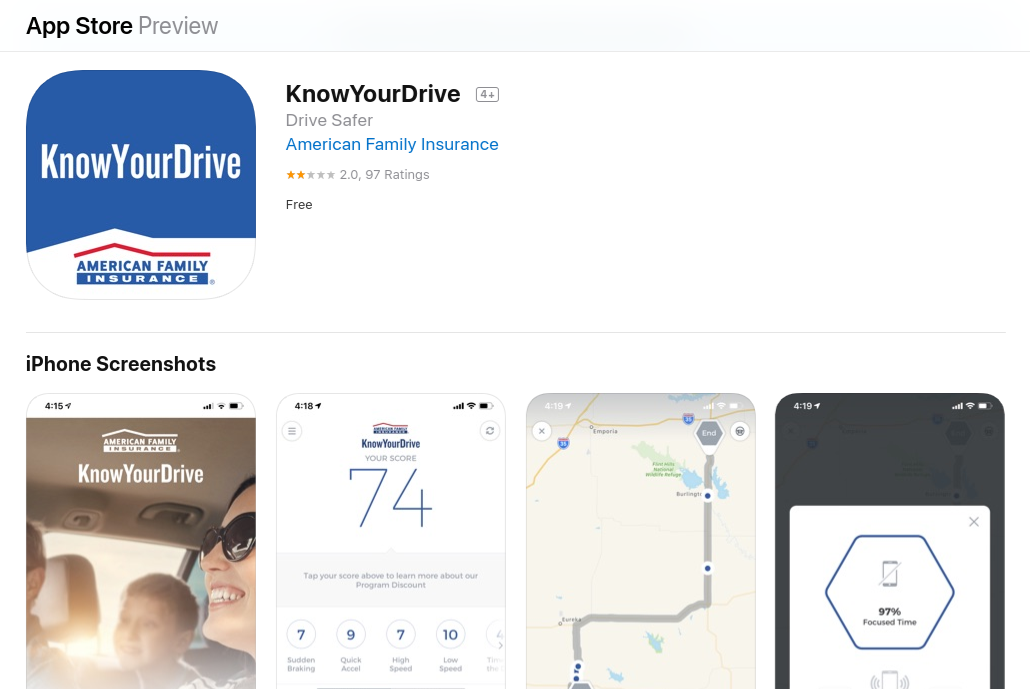

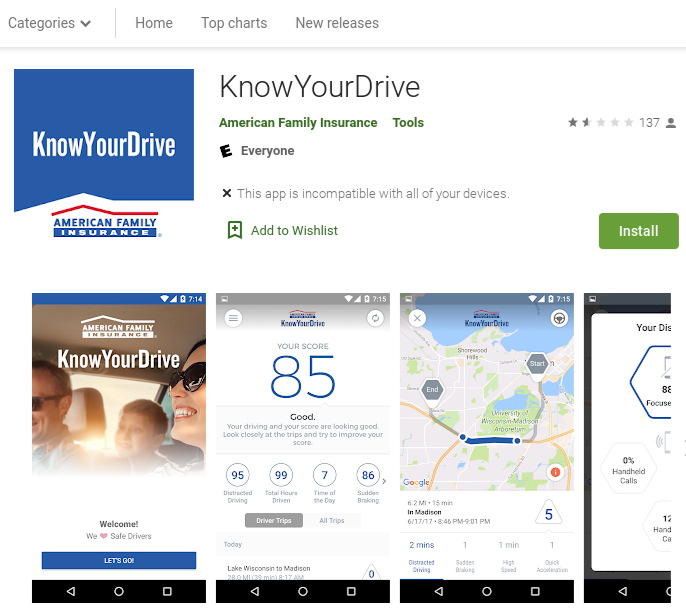

We are going to devote full sections to review the website and the app. We’ll be reviewing the KnowYourDrive app as well. It’s an app that encourages safe driving behavior and can lead a 20 percent discount on premiums.

American Family’s Commercials

Most car insurance bring the funny. That makes it a little more palatable to hear someone talk about collision auto insurance.

However, American Family goes in another direction. Billed as America’s insurance company, American Family doubles down on showing people help the community and providing ways to reach the American dream.

This Win:

https://youtu.be/aIF6NZLPAp0

American Family in the Community

American Family’s focus, in its newsletters and website, is on dreams. Dreams of children, dreams of adults, dreams of families. It passionately supports those dreams through two avenues.

- Corporate responsibility: empowering communities, sustainable practices, and promoting well-being among employees

- DreamBank: an open, empowering place where people can talk about their dreams and support each other while pursuing them

To empower communities, American Family created the American Family Insurance Dreams Foundation. In 2018, this Foundation evolved from giving to investing, creating partnerships with nonprofits, and issuing grants.

One area it pursues is education, offering scholarship support to over 200 students. Employees are encouraged to give back as well.

American Family’s Employees

A good barometer on an organization is how the employees feel about it. Here, we’ll cover employee responses from Indeed, Payscale, and Glassdoor.

American Family appears friendly to the LGBTQ community. It was given the award Most LGBT-friendly company by Out Magazine in 2015.

It received this award because it had offered discounts to members of the LGBT community.

It was also featured in the 2017 and 2018 Best Places to Work for LGBT Equality listings from the Human Rights Campaign Foundation.

Indeed reviews are overall positive, with employees giving American Family an overall score of 3.7.

| User Prompt | Rating out of 5 |

|---|---|

| Overall | 3.7 |

| Work-Life Balance | 3.7 |

| Pay & Benefits | 3.5 |

| Job Security & Advancement | 3.2 |

| Management | 3.3 |

| Culture | 3.5 |

There are 403 five-star reviews and 93 one-star reviews. FairyGodBoss, in association with Indeed, ranks American Family 4.7 out of 5. This metric is based on equality between men and women in the workplace.

Payscale affirms Indeed’s reviewers’ overall ratings.

| Category | Details |

|---|---|

| Job Satisfaction | 3.6 out of 5 |

| Highly Stressful | 72% |

Reviewers report that working for American Family is highly stressful, though it’s roughly on par with other insurance companies. A survey noted that 79.4 percent of respondents were in their early to mid-career.

Fewer employees late in their careers or entry-level submitted responses.

Reviews on Glassdoor were less positive than the other sites.

| User Prompt | Details |

|---|---|

| Rating | 3.3 out of 5 |

| Recommend to a Friend | 54% |

| Approve of CEO | 70% |

Reviewers gave the CEO high marks, however.

Cheap Car Insurance Rates

The first part of searching for a car insurance company might start with the question, “What will my rates be like?” And we understand.

Finding a good rate is an inherent process of choosing a car insurance company, no different than shopping for a product like a new mobile device.

It’s not just about a company’s community service or its financial stability. It’s about what the company can do for you, and oftentimes that means a focus on how much you’ll pay.

In this section, we’ve got you covered:

- Rates by state

- Rates compared to other companies

- Rates by commute

- Rates by driving history

And a few others. After this section, you’ll know all you need to know about the rates of American Family. We’re heading into stretch three.

American Family Availability and Rates by State

American Family is available in 19 states. Overall, in those 19 states, it’s average rates are above the median for other companies by about $40.

American Family Average Rates by State| State | Average by State | American Family Annual Premium | Higher/Lower | % |

|---|---|---|---|---|

| Alaska | $3,421.51 | $4,153.07 | $731.55 | 21.38% |

| Colorado | $3,876.39 | $3,733.02 | -$143.37 | -3.70% |

| Idaho | $2,979.09 | $3,728.79 | $749.70 | 25.17% |

| Illinois | $3,305.48 | $3,815.31 | $509.82 | 15.42% |

| Indiana | $3,414.97 | $3,679.68 | $264.71 | 7.75% |

| Iowa | $2,981.28 | $3,021.81 | $40.53 | 1.36% |

| Kansas | $3,279.62 | $2,146.40 | -$1,133.22 | -34.55% |

| Median | $3,660.89 | $3,698.77 | $37.88 | 1.03% |

| Minnesota | $4,403.25 | $3,521.29 | -$881.97 | -20.03% |

| Missouri | $3,328.93 | $3,286.90 | -$42.03 | -1.26% |

| Nebraska | $3,283.68 | $2,215.13 | -$1,068.55 | -32.54% |

| Nevada | $4,861.70 | $5,441.18 | $579.48 | 11.92% |

| North Dakota | $4,165.84 | $3,812.40 | -$353.44 | -8.48% |

| Ohio | $2,709.71 | $1,515.17 | -$1,194.54 | -44.08% |

| Oregon | $3,467.77 | $3,527.28 | $59.51 | 1.72% |

| South Dakota | $3,982.27 | $4,047.47 | $65.20 | 1.64% |

| Texas | $4,043.28 | $4,848.72 | $805.44 | 19.92% |

| Utah | $3,611.89 | $3,698.77 | $86.88 | 2.41% |

| Washington | $3,059.32 | $3,713.02 | $653.70 | 21.37% |

| Wisconsin | $3,606.06 | $1,513.27 | -$2,092.80 | -58.04% |

It is a steal in some states and much more expensive in other states. The differences against the median are often 20 percent or more.

- A steal: Wisconsin, Ohio, Nebraska

- Much more expensive: Idaho, Alaska, Washington

These percent differences can lead to hundreds (or thousands) in savings or extra expenses compared to the norm.

Comparing the Top 10 Companies by Market Share

Like its numbers suggest, American Family is near the median when it comes to car insurance prices. This, of course, varies by state.

With this table, you use the scroll bar at the bottom to see the rates for all top 10 companies. The rates for the companies are included for just the states within which American Family operates.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | - | $2,879.96 | $5,295.55 | - | $3,062.85 | $2,228.12 | - | $2,454.21 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | - | $3,338.87 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | - | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | - | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | - | $2,066.99 | - | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | - | $2,525.78 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | - | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | - | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | - | - |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | - | $3,263.28 | - | $3,867.55 | $4,664.69 | $2,879.94 | - | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | - | $2,491.10 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | - | $2,262.16 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | - | $2,975.74 |

How does American Family compare overall to other companies?

| Company | Median Average | Higher/Lower (+/-) | Higher/Lower (%) |

|---|---|---|---|

| Allstate | $4,532.96 | -$834.19 | -18.40% |

| Farmers | $3,907.99 | -$209.22 | -5.35% |

| Geico | $3,073.66 | $625.11 | 20.34% |

| Liberty Mutual | $5,295.55 | -$1,596.78 | -30.15% |

| Nationwide | $3,187.20 | $511.57 | 16.05% |

| Progressive | $3,935.36 | -$236.59 | -6.01% |

| State Farm | $2,731.48 | $967.29 | 35.41% |

| Travelers | $3,729.32 | -$30.55 | -0.82% |

| USAA | $2,489.49 | $1,209.28 | 48.58% |

There are some companies more expensive than American Family and some that are cheaper.

- More expensive: Liberty Mutual, Allstate, Progressive, Farmers, Travelers

- Cheaper: USAA, State Farm, Geico, Nationwide

American Family is squarely, almost completely, in the middle.

Average American Family Male vs Female Car Insurance Rates

Rates vary according to demographic factors in many states. Insurance companies believe that certain factors like gender, age, and marital status make someone more or less likely to file a claim.

When it comes to gender that may be right, as the Insurance Institute for Highway Safety notes that men are more dangerous drivers.

As far as age, most people know that younger drivers are more likely to file a claim, if due to nothing more than inexperience.

Marital status and the others? How does American Family change its rates?

| Demographic | Average Premium |

|---|---|

| Married 35-year old female | $2,202.70 |

| Married 35-year old male | $2,224.31 |

| Married 60-year old female | $1,992.92 |

| Married 60-year old male | $2,014.38 |

| Single 17-year old female | $5,996.50 |

| Single 17-year old male | $8,130.50 |

| Single 25-year old female | $2,288.65 |

| Single 25-year old male | $2,694.72 |

There is a $6,000 difference between the rates for a 17-year-old male and a 60-year-old female. Within the age brackets, the largest change is within 17-year-olds. There is a difference of $2,000 between males and females.

Once someone reaches 25, the average rates are $2,700 or less.

Average American Family Rates by Make and Model

Rates vary according to the car you drive as well. Newer cars generally cost more to insure as they are worth more. This means insurance companies will pay more if they are damaged.

This is true for trucks, sedans, and cars.

| Make/Model | Average Premium |

|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,447.30 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $3,178.82 |

| 2015 Toyota RAV4: XLE | $3,326.18 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,487.91 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $3,721.32 |

| 2018 Toyota RAV4: XLE | $3,496.99 |

The Honda Civic Sedan has the rate difference of about $550. The Ford F-150 has the lowest at about $40.

Average American Family Commute Rates

Rates sometimes vary by commute rate or annual mileage as well. Insurance companies believe that the more you drive, the more likely you are to file a claim. Do rates change with American Family?

| Commute and Annual Mileage | Average Premium |

|---|---|

| 10 miles commute | 6,000 annual mileage. | $3,401.30 |

| 25 miles commute | 12,000 annual mileage. | $3,484.88 |

Yes, but only by $83. Not a large price to pay for 6,000 extra miles.

Average American Family Coverage Level Rates

Rates vary according to coverage level as well, but what does that mean?

In many cases, a coverage level can refer to the number of coverages you have. You could have the minimum liability coverage or be someone who has uninsured motorist and Med Pay as well.

The second part that influences coverage level is your actual coverage limits. These limits vary from the bare minimum (often $20,000 for liability insurance) to over a million (with PUP).

Often, companies have a several hundred dollar difference between a low coverage level plan and a high coverage level. Is this true for American Family?

| High | Low | Medium |

|---|---|---|

| $3,416.40 | $3,368.49 | $3,544.37 |

With American Family, the difference is just a little less than $200. For this section and the next two, we’ll be comparing American Family’s rates to its nearest competitors. They are Farmers, Nationwide, and Travelers.

| Company | High | Medium | Low |

|---|---|---|---|

| Farmers | $4,494.13 | $4,166.22 | $3,922.47 |

| Nationwide | $3,505.37 | $3,449.80 | $3,394.83 |

| Travelers | $4,619.07 | $4,462.02 | $4,223.63 |

Farmers and Travelers have larger differences in costs between low coverage plans and high coverage plans at $500 and $400 respectively. Nationwide’s difference is smaller than American Family’s, at just $100.

Average American Family Credit History Rates

Rates vary according to credit history as well. If you have a good credit history, you can save thousands compared to someone with a poor credit history.

Why is this? Insurance companies believe that credit histories indicate how likely a person is to file a claim.

Insurance companies don’t use the traditional FICO score, however. They “cherry-pick” credit histories for dozens of factors and add them to their own models. This, according to Consumers Reports.

The difference between a poor score and a good one is sometimes several thousand dollars. Is this the case for American Family?

| Fair Credit | Good Credit | Poor Credit |

|---|---|---|

| $3,169.53 | $2,691.74 | $4,467.98 |

American Family’s rates for a poor credit score are around $1,700 higher than for a good credit score. How does this compare to its competitors?

| Company | Fair Credit | Good Credit | Poor Credit |

|---|---|---|---|

| Farmers | $3,899.41 | $3,677.12 | $4,864.14 |

| Nationwide | $3,254.83 | $2,925.94 | $4,083.29 |

| Travelers | $4,344.10 | $4,058.97 | $5,160.22 |

American Family has the largest rate difference compared to all three of its closest competitors. However, that may be slightly misleading.

American Family has the lowest overall rate for a good credit score, over $200 less than its nearest competitor, Nationwide. That score is $1,000 less than Farmers and $1,400 less than Travelers.

American Family penalizes those with high credit scores more than the other three companies in comparison to good scores. However, its rates for high credit scores are still lower than Farmers and Travelers.

Average American Family Driving Record Rates

Driving record can be the number one factor in determining rates. A single infraction can shoot up rates, similar to having a good versus poor credit score.

American Family’s rates for driving record infractions are in a $1,600 range, with a clean record at $2,700 and a DUI at $4,300.

A single DUI shoots up rates by $1,600, an accident by about $1,000, and a speeding ticket by about $300. Are these significant differences compared to its competitors?

| Company | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Ticket |

|---|---|---|---|---|

| Farmers | $3,460.60 | $4,518.73 | $4,718.75 | $4,079.01 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 | $3,113.68 |

| Travelers | $3,447.69 | $4,289.74 | $5,741.40 | $4,260.80 |

In all categories, American Family is the lowest, except for 1 Accident. In this case, it is $300 above Nationwide. Averaging all the competitors’ rates shows how low American Family is in comparison.

- Compared to average 1 Accident: -$650

- Compared to average 1 DUI: -$1,400

- Compared to average: 1 Speeding Ticket: -$800

At least compared to its nearest competitors, American Family isn’t bad.

Coverages Offered

Coverages are important. We know that they can be a make or break when choosing car insurance companies. They protect us after an at-fault accident, when an uninsured motorist hits us, or when we have medical bills.

It is the shield that keeps you or your family from financial losses.

It is also often a make or break when it comes to insurance companies. If a company doesn’t offer coverages you need, you might go elsewhere, even if that company has great financial ratings or company culture.

We understand. This section is for you.

Here, we take a look at all the coverages American Family offers, some additional factors that will affect your rates, and total discounts. By the end, you should have a clear picture of what American Family can do for you.

Let’s head into stretch four.

Types of Coverages Offered

American Family offers 12 coverages, each for a particular purpose. They are divided here into personal auto coverages, vehicle coverages, and special auto coverages. Let’s start with the largest category: personal auto coverages.

| Personal Auto Coverage | Purpose | You Might Need It: |

|---|---|---|

| Bodily Injury Liability | Will pay for the other drivers' medical bills/loss of income in an accident you caused | When the 25-year-old rock star you hit has broken his strumming hand |

| Property Damage Liability | Will pay for the damage to the property in an accident you caused | When the policeman insists you pay for hitting his vehicle |

| Personal Injury Protection | Pays for your medical bills/loss of income after an accident | When someone T-bones you and you get a strained neck |

| Uninsured Motorist | Helps you when you are in an accident with a driver who's uninsured | Because drivers in American have no chill |

| Underinsured Motorist | Helps you when you are in an accident with a driver who's underinsured | Because some drivers in America have more chill than others |

| Medical Payments | Helps pay for you and your passengers' medical costs after an accident | When those hospital bills start a-calling |

Each covers you in a particular situation, and each comes with a certain price tag.

| Vehicle Coverages | Purpose | You might need it: |

|---|---|---|

| Collision | Pays for damages to your car in a collision with an object or vehicle | When an 80-year-old woman strikes your car from the rear |

| Comprehensive | Pays for damages to your car for situations not involved in a collision (theft, vandalism, etc.) | When a 16-year-old kid spray-paints your car |

| Gap Coverage | Covers the gap between the actual value of your car and what you owe, if your car is totaled | When your car is totaled and the manufacturer still wants money |

These are considered optional coverages. Whereas the state you live in might require you to have more than one of the personal auto coverages, add these is up to you.

Often, doing this will raise your premium hundreds of dollars. This is especially true for adding collision and comprehensive on top of liability (both property damage and bodily).

These statistics and the ones in the following section come from our partner Quadrant, which has the inside track in the insurance industry. Nationwide, the full coverage cost was $1,009.38 in 2015.

- Liability: $538.73

- Collision: $322.61

- Comprehensive: $148.04

The cost for you will vary according to your situation, your state, all the factors we listed in the rates section, and the company you choose.

However, this is a ballpark figure that will give you an idea when you start the quote process.

| Special Auto Coverages | Purpose | You might need it: |

|---|---|---|

| Accidental Death & Dismemberment | Pays damages for extreme circumstances | You or a family member has been in a catastrophic accident |

| Emergency Roadside Assistance | Will pay for when you need a tow, jump start, or more | When it's pouring rain and you're stranded on the side of the road |

| Rental Car Expense | Gives you access to a rental car if your car is in the shop for a claim | When you need to get to work but your car has major damage from an accident |

These coverages help in particular situations. There’s little more aggravating than having your car break down on the side of the road with no ability to fix it. Ditto for having to put it into the shop without getting a rental.

The accidental death and dismemberment coverage takes effect when you’re in an accident and either die or sustain catastrophic injuries.

Factors That Affect Your Rate

There’s one factor we haven’t covered when it comes to your car insurance rates. That is where you live.

Car insurance rates can vary according to state, city, or zip code. For all states, the average core coverage costs can vary by the hundreds.

- On the low end: New Hampshire with $818.75

- On the high end: Michigan with $1,364

Rates for cities even within states can vary even further, by thousands of dollars. This is evidenced by the cheapest and most expensive average rates per city in Michigan.

- Cheapest: Saint Louis at $7,916.29

- Most expensive: Detroit at $26,966.81

And even further when it comes to zip codes, as evidenced by rates in Manchester, New Hampshire.

- Cheapest: 03109 at $3,720.88

- Most expensive: 03104 (Manchester) at $3,845.88

These rate changes can happen for various reasons. These include the amount of crime in a zip code, the challenges of driving in a populous city, or the accident-related laws in certain states.

Either way, it can cost a bundle. Which is why we understand finding the right policy at the right price is important for you.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting the Best Rate with the American Family

In tune with getting the best rate, we’ve compiled a list of all the discounts American Family offers. There are many different types of discounts. We’ve grouped them by personal auto, car, driving, policy, and extra.

There isn’t much information about how much they’ll save you, except for two: defensive driver and passive restraint.

| Personal Auto Discounts | Details |

|---|---|

| Distant Student | Usually must be 100 miles away |

| Federal Employee | Security times two |

| Good Student | Upper 20% of class |

| Homeowner | Need to be a homeowner |

| Loyalty | Must be a customer of American Family |

| Military | May apply only to active personnel |

| Occupation | Employable may not count |

| Senior Driver | Also referred to as "Mature Driver" |

| Students & Alumni | For certain schools only |

| Young Volunteer | Under 25 and at least 40 hours of volunteer work per year |

These are the discounts that apply to you personally. They can be considered as demographic discounts.

| Car Discounts | Details |

|---|---|

| Advanced Safety Features | Examples: Anti-lock brakes adaptive headlight, electronic stability control |

| Anti-Theft | Certain anti-theft technologies required |

| Farm Vehicle | Applies to vehicles used on farms |

| Garaging/Storing | It's about garaging and storing cars |

| Green Vehicle | It's all about reducing emissions |

| Newer Vehicle | They are less prone to break |

| Utility Vehicle | Certain restrictions may apply |

| Vehicle Recovery | Some examples are OnStar and LoJack |

| VIN Etching | VIN # etched to windshield |

These have do deal with your car, such as preventing theft or having safety features that keep you safe in an accident. Passive restraint is an advanced safety feature that cars up to a 30 percent discount.

| Driving Discounts | Details |

|---|---|

| Claim Free | If you haven't had to file a claim |

| Defensive Driver | Usually must be 50+ |

| Driver's Ed | Usually must be under 21 |

| Low Mileage | For those who drive under the norm |

| Safe Driver | Typically no wrecks or violations |

Read more: Auto Insurance Companies That Are Good for Low-Use Vehicles

These all have to do with your driving record and continued driver education. Defensive driver carries a discount of up to 10 percent.

| Policy Discounts | Details |

|---|---|

| Family Legacy | From generation to generation |

| Family Plan | When you ensure the whole family |

| Multiple Policies | Also called a "bundle discount" |

| Multiple Vehicles | A discount for insuring more than 1 vehicle |

These are policy discounts that reward you for adding more policies to your plan. One is also a legacy, which means if you’d get a discount if your family has been with the company from generation to generation.

| Extra Discounts | Details |

|---|---|

| Continuous Coverage | When you haven't had a lapse in coverage |

| Early Signing | Usually seven days before current policy expires |

| Full Payment | When you pay your policy in full |

| Paperless Documents | Also referred to as an "e-policy" |

| Paperless/Auto Billing | Some examples are AutoPay and e-Bill |

| Switching Providers | When you switch from another company |

These are all extra coverages, which sometimes apply to procedural issues. They can include going paperless to reduce waste (and cost), paying your policy in full, and switching providers.

American Family’s Programs

One discount that American Family offers is through its KnowYourDrive program. It, like the programs from its competitors, relies on an app to analyze your driving behavior. It gives suggestions, tips, and a score

The idea is that the better score you get, the more your rates will go down, up to a point.

The maximum amount you can save is 20 percent.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

We know that a huge hurdle when dealing with your insurance company can be canceling your policy. There are horror stories of individuals who thought they had canceled receiving bills months later.

And there’s the complication in the process as companies often don’t make their cancellation policies available for the public.

This can make it a stressful experience. We understand.

Fortunately, American Family gives a tidbit as to how to cancel. This is by contacting your agent or calling its customer service center.

The customer service representative can submit a cancellation form to your agent on your behalf.

But what about the particulars, the cancellation fee and refund? And there’s the process itself, the procedures and the mistakes. We’ve got you covered.

Cancellation Fee

American Family doesn’t make that information available.

Is there a refund?

It should be pro-rated, as is typical with car insurance companies. This means that if you’re 23 days into a 180-day plan, you should receive 157 days worth of payment back.

How to Cancel (Step-by-Step Guide)

Sometimes, the process of canceling a policy can be vague. And there can be serious problems, especially with the government and with car insurance company fees. How do you cancel and do it without a problem?

Let’s take the process step by step.

Decide What Time Is Right for You

There are certain times you might consider canceling an auto insurance policy.

- When you’re planning on putting a car into storage. You could be thinking about reducing your carbon footprint, using more public transportation, or maybe you just don’t need that extra car in your driveway.

- When you’re planning to move. When you leave your state and head to a new one, you might think it’s the perfect time to cancel your policy. Many companies aren’t available in some state anyway.

- When you’re tired with your current company. Maybe they have bad customer service, don’t fulfill claims, or maybe you just don’t like your rates. You might at this point think of canceling your policy.

Cancel Old Policy

You need to follow the procedures of your company to cancel your policy. With American Family, you have two options.

Contact your agent. Your agent is the person who will help you cancel your policy.

Contact customer service at 1-800-MYAMFAM (1-800-692-6326). The customer service representative can submit a cancelation request form to your agent on your behalf.

Avoid These Two Mistakes

You’ll want to avoid these two mistakes.

- Don’t cancel a policy before having a new one. If you cancel with American Family, it is required by law to notify the DMV that your coverage has been canceled. If the DMV doesn’t have evidence of a new policy, it will request your license plate and tags from you.

- Don’t just stop paying your policy and hope it gets canceled. If you don’t follow the procedures of the company and give them a firm cancellation date, they might charge you for the grace period. This is the period after you’ve made the last payment but before your policy gets canceled.

There are also horror stories of people who have stopped paying but still get billed months down the road, which can become a legal battle. This can cause thousands of dollars in loss.

Contact Necessary Parties

After all of this, you’ll want to contact all the necessary parties. This includes the state DMV where you’re moving or the lien-holder who has loaned the car to you. Anyone who might have a legal or financial stake in the situation.

When can I cancel?

Anytime.

How to Make a Claim

Getting in an accident, having your car stolen, or watching as hail destroys your car is stressful. Submitting a claim shouldn’t be. But it sometimes is.

Dealing with the information process, the customer service representative, the payout, the claims adjuster can all be wearing. Is this the case with American Family?

Process of Making a Claim

The process for filing a claim can be broken down into four parts. Let’s take it step by step.

Get Information After the Incident

After an incident, such as an accident or vehicle theft, you’ll want to gather information. Always call the police and have them write a report. If it’s an accident, don’t admit fault. Make sure to get the other parties’ information.

Make sure to take pictures if you can and get witness reports.

Contact American Family by Phone or Online

After that, you have four options for filing a claim with American Family.

- Contact your agent. They can help you through the claims process.

- Contact customer service at 1-800-MYAMFAM (1-800-692-6326). They can walk you through the claims process.

- Use your online account with American Family (AmFam.com) to file your claim. This will allow you to submit pictures of the incident.

- Use American Family’s mobile app MyAmFam to file your claim. The whole process can happen on your mobile phone.

More about the website and the mobile app will be reviewed in later sections.

Give All the Details About the Accident

You’ll want to give as much information as possible about the incident as you can. Witness reports can help, as well as the police report.

Of course, give information about the other driver, including their insurance company. Submit any pictures you have and anything else you have to make a case about why you should receive a payout.

Now, it comes down to the waiting game. And the question, “Will my claim be approved?”

Premiums Written

One way to determine if your claim will be approved is to look at how many premiums a company has written. With American Family, it’s not a ton, but it’s not a small amount either.

| Year | 2015 | 2016 | 2017 | 2018 | Percent Change |

|---|---|---|---|---|---|

| Private Passenger Auto | 3,694,271 | 4,005,549 | 4,381,962 | 4,687,909 | 26.9% |

| All Lines | 7,242,621 | 7,808,873 | 8,363,930 | 8,939,812 | 23.40% |

Although it is a small amount compared to the State Farms and Geicos, it is still significant and, more importantly, is growing.

From 2015 to 2018, American Family’s premiums written grew by 27 percent for private passenger auto and 23 percent for all lines. Those are positive signs for prospective consumers of American Family.

But can it affect the likelihood of your claim being approved?

Loss Ratio

In a tangential sense, perhaps. The more consumers American Family has, the more claims it likely receives. This could affect its approval ratio.

To get a firm grasp of that, we’ll take a look at a statistic called the loss ratio. This comes from the 2015 to 2018 market shares reports from the National Association of Insurance Commissioners.

This is a statistic that weighs the numbers of that are approved versus the premiums written. If that number is over 1, the company is losing money. If it’s below .5, the company may not be paying out on claims.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Private Passenger Auto | 0.61 | 0.65 | 0.70 | 0.69 |

| All Lines | 0.55 | 0.59 | 0.69 | 0.67 |

For private passenger auto, American Family’s loss ratios are in the good range. For total lines, the loss ratios in 2015 and 2016 were a little low. However, they corrected in 2017 and 2018.

Why was my claim denied?

If your claim is denied, it might be for a few reasons.

Your coverage limits are exhausted. If the damage to your vehicle is $50,001 and your coverage limit is for $50,000, you’ll be responsible for the $1.

You might have been engaging in reckless behavior. If your claim shows you were speeding, using your cell phone, or contributed to the accident, your claim might be denied.

You might not have the coverage necessary. Your car may be hit with hail but you don’t have comprehensive. Or an uninsured motorist might hit you but you don’t have uninsured motorist coverage.

Knowing your coverages is key. If you feel like your claim has been unjustly denied, you can always file an appeal or hire a lawyer.

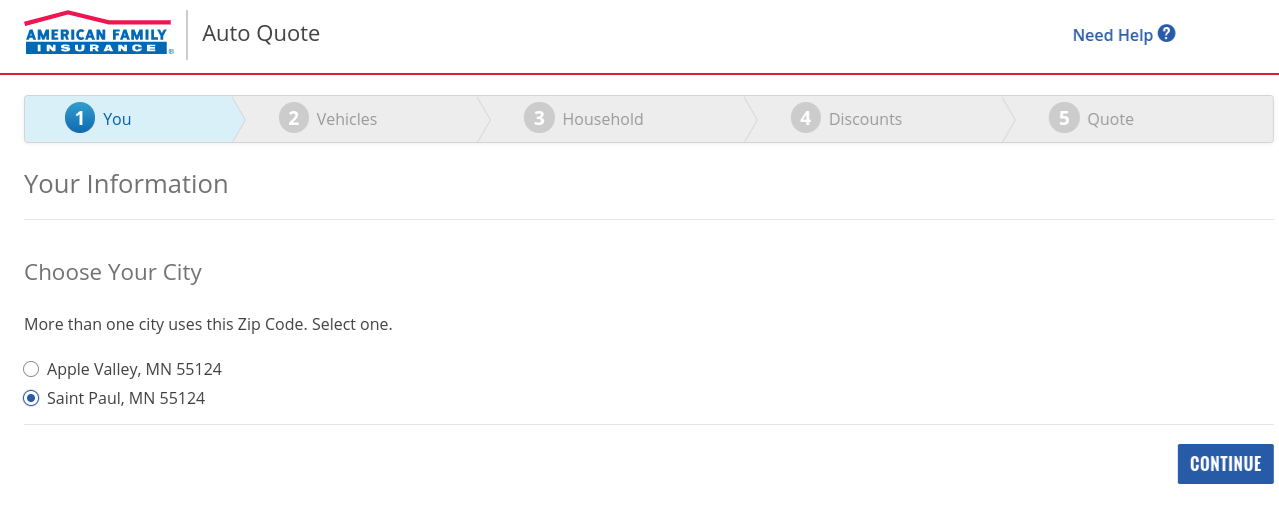

How to Get a Quote Online

Getting a quote should be the easiest process. After all, the company wants your business, right?

An easy way to get a quote from American Family is to go to its website AmFam.com. There, you’ll go through several steps leading you to the page where you know if American Family is right for you.

Enter in Your Zip Code into the Box

First, you’ll go to its homepage and enter your zip code into the box below.

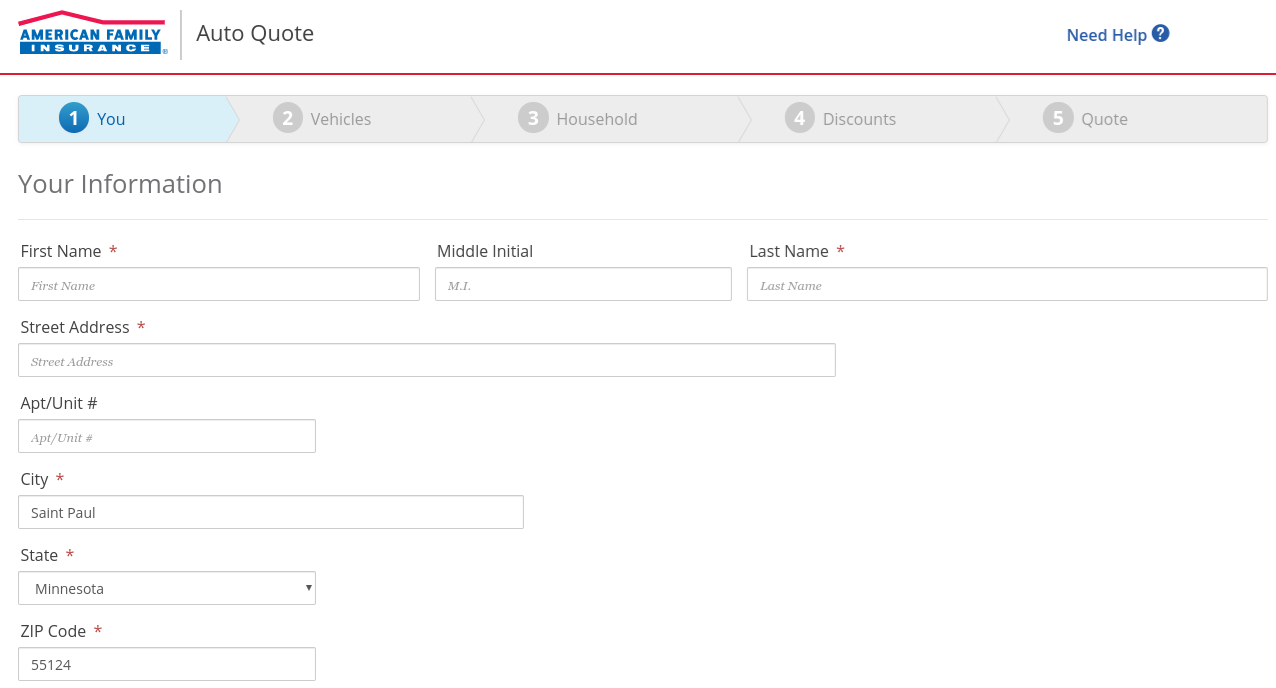

Choose Your City

It’ll take you to a city page. Choose your city and click continue.

Next, you’ll enter your name and street address into the boxes below.

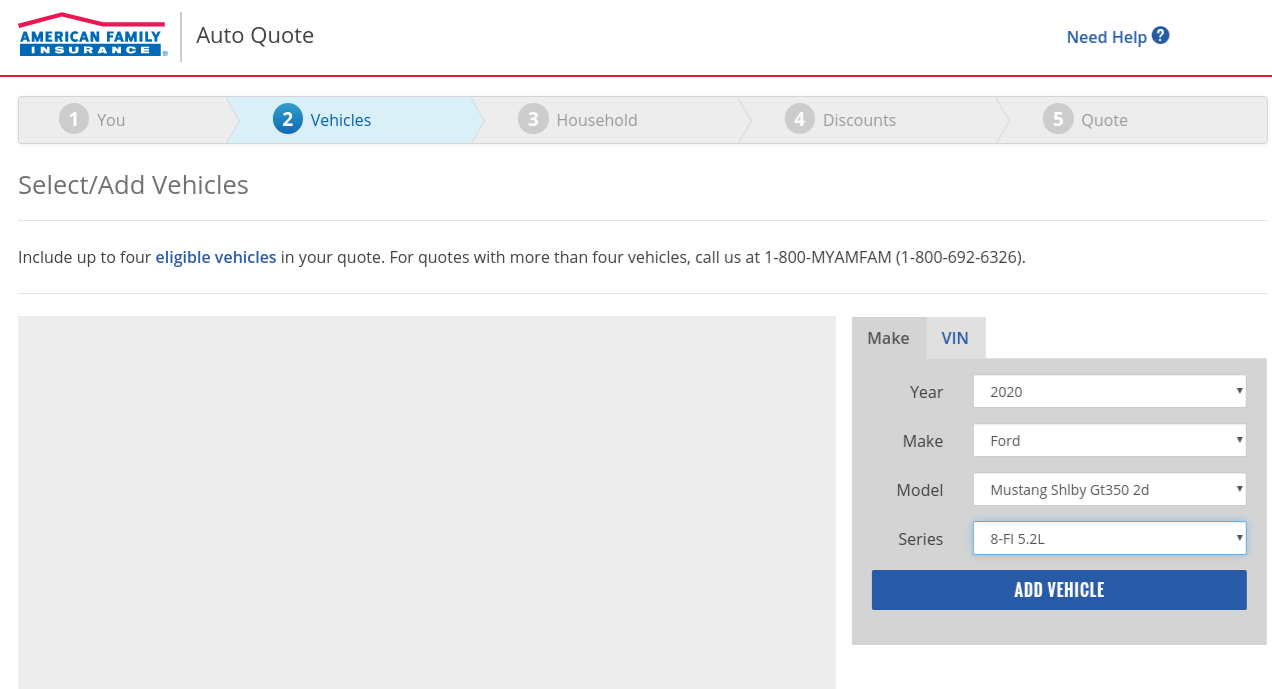

Enter in Your Vehicle Information

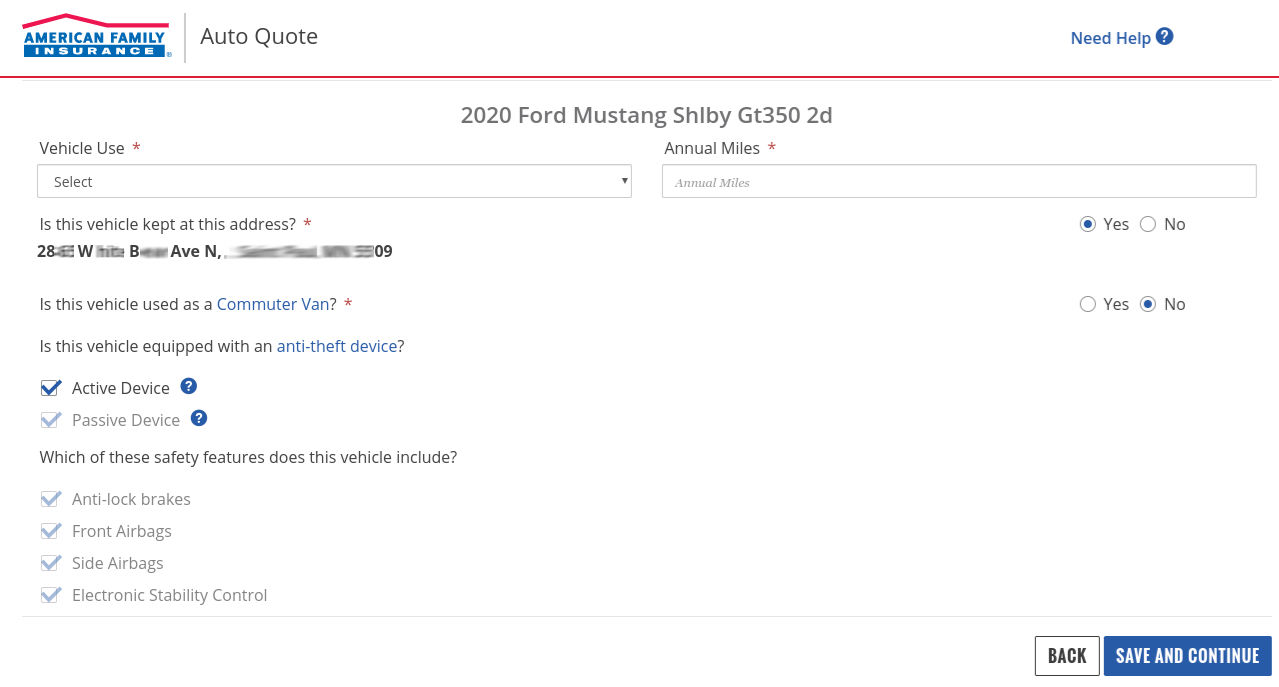

After, it’ll ask you for vehicle information.

It’ll automatically load safety features from the vehicle. You’ll put in your annual mileage as well.

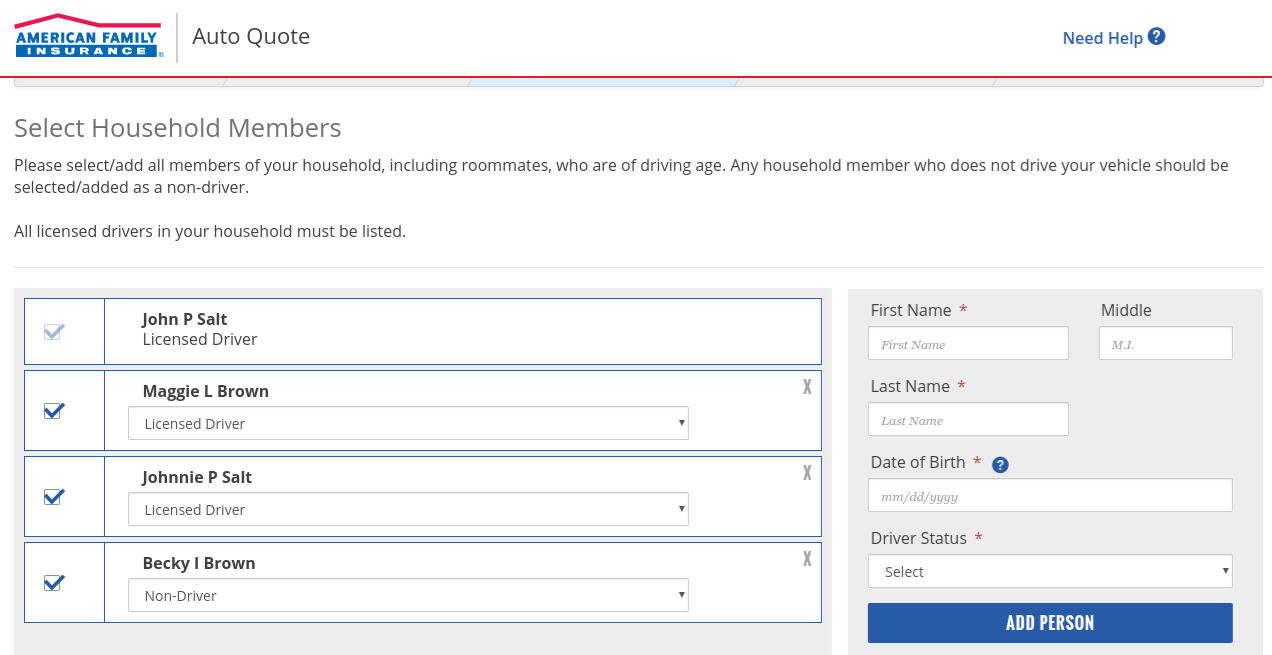

Next, you’ll add all your household members, even if they aren’t drivers.

Add Household Members Demographics

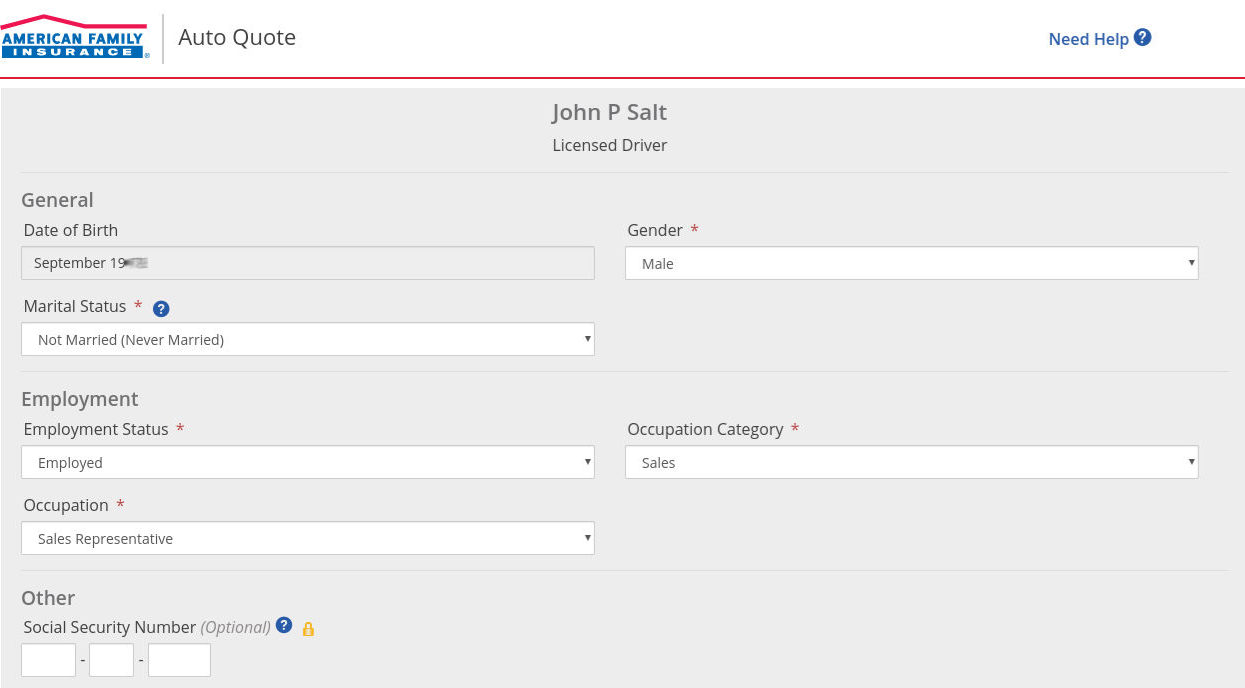

For each household member, you’ll add details, including marital status and occupation.

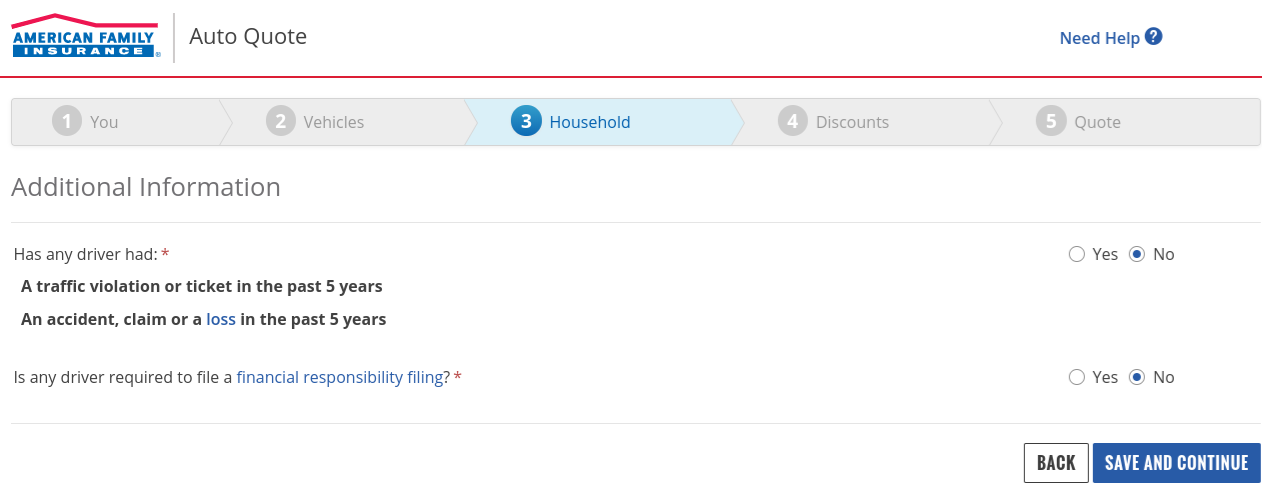

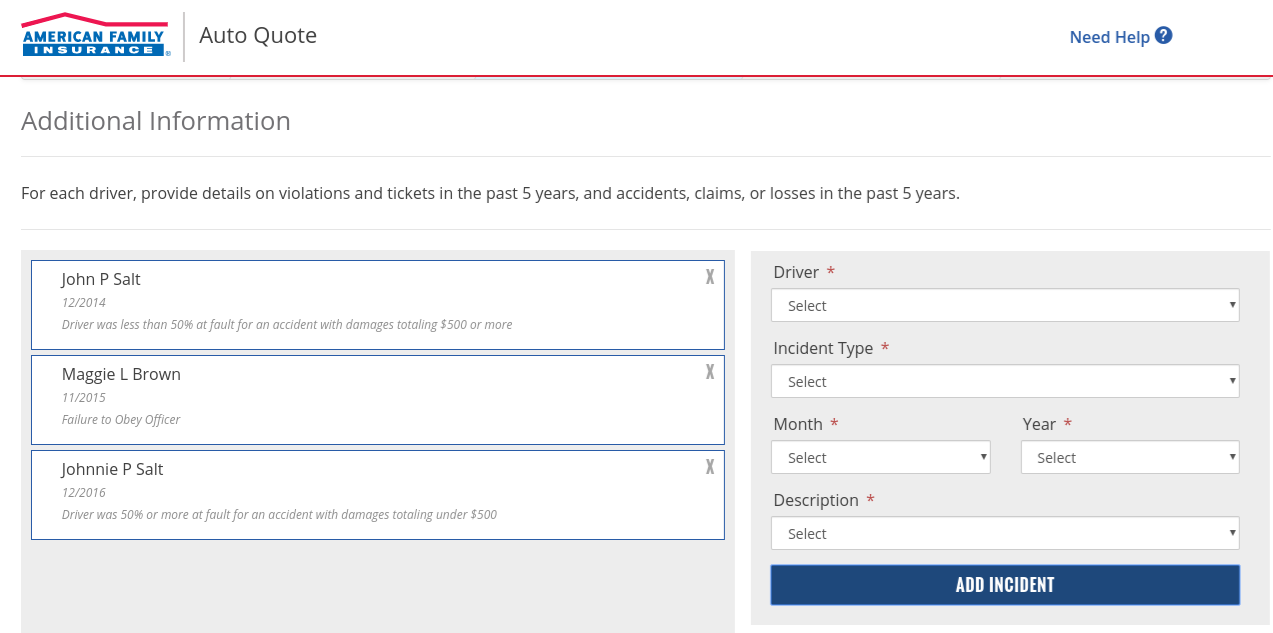

Add Information About Accidents and Traffic Violations

Then you’ll go through the accidents and violations section.

Next, you’ll give details about the incident, when it happened, and who the driver was.

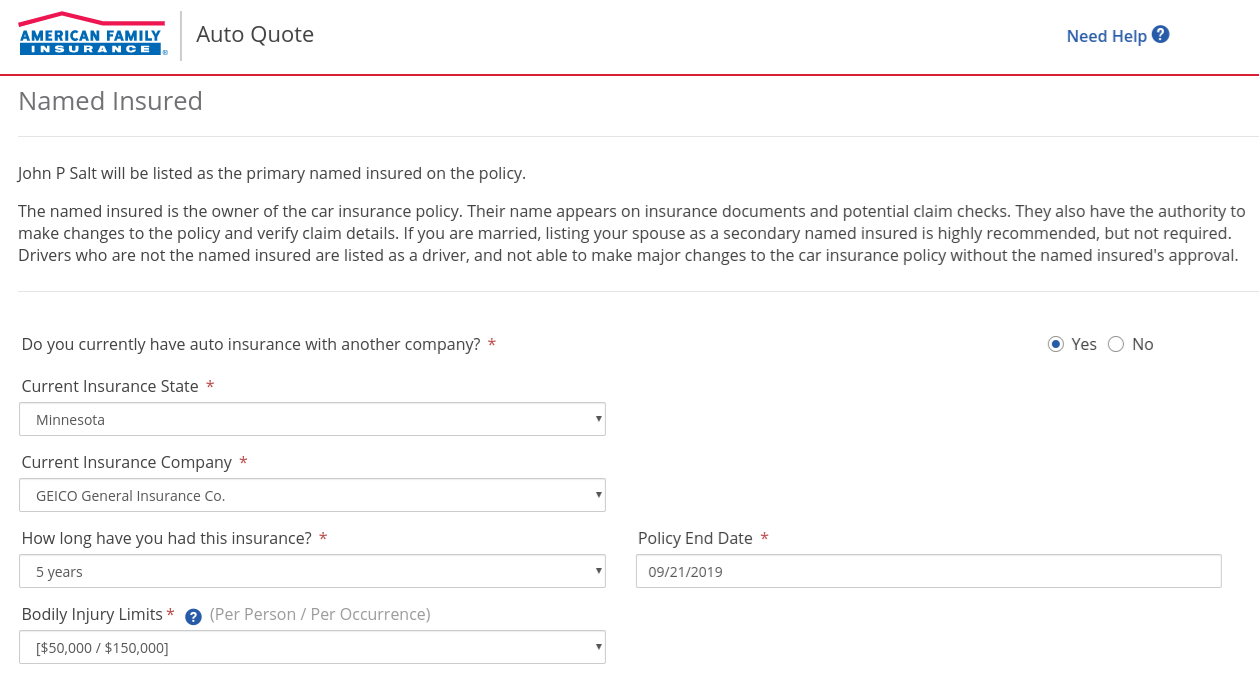

Select Prior Insurance Company

Next, it’ll ask you if you’re a current customer of another car insurance company. If you are, it’ll ask your specific questions about your policy.

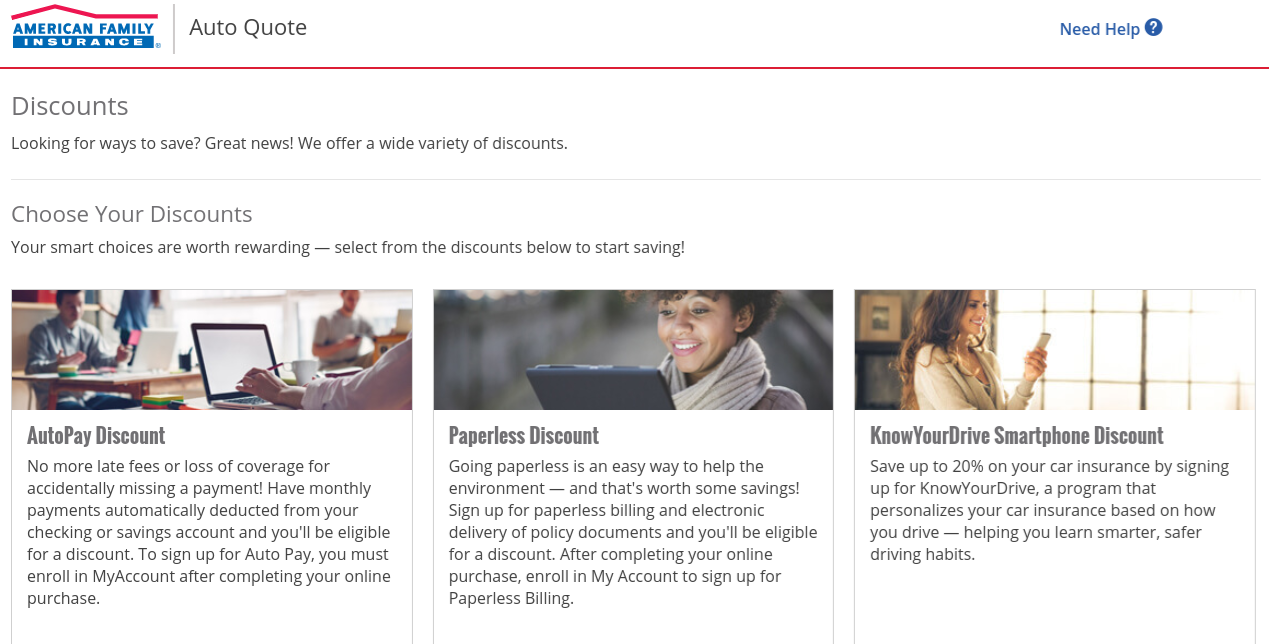

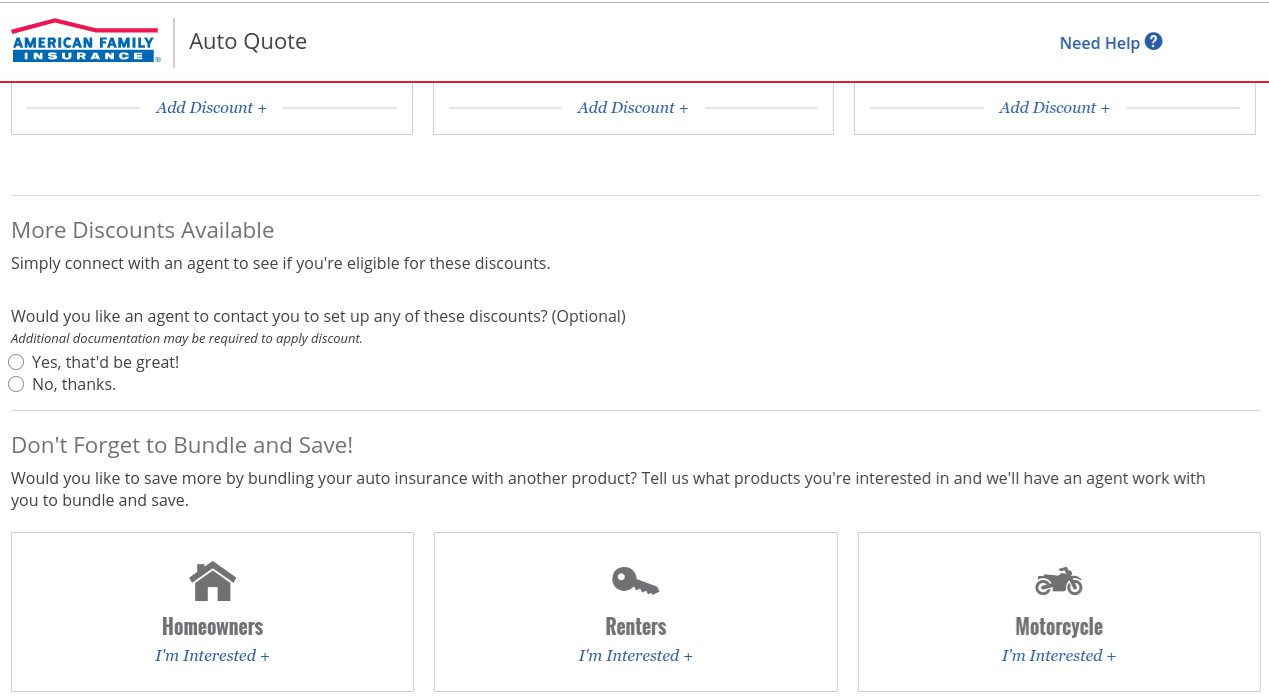

Choose Discounts

Next, you’ll go to the discounts page.

You’ll have the options of bundling insurance as well, by adding homeowners, renters, and others.

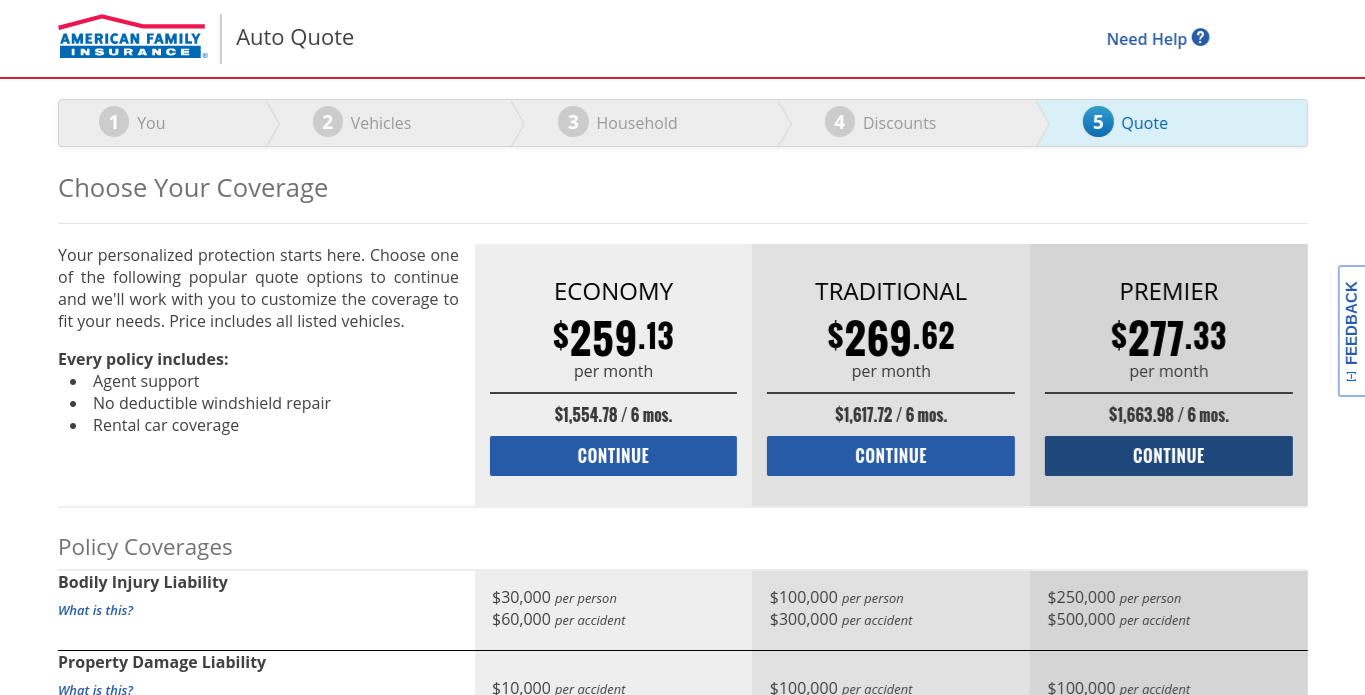

Review Your Quote

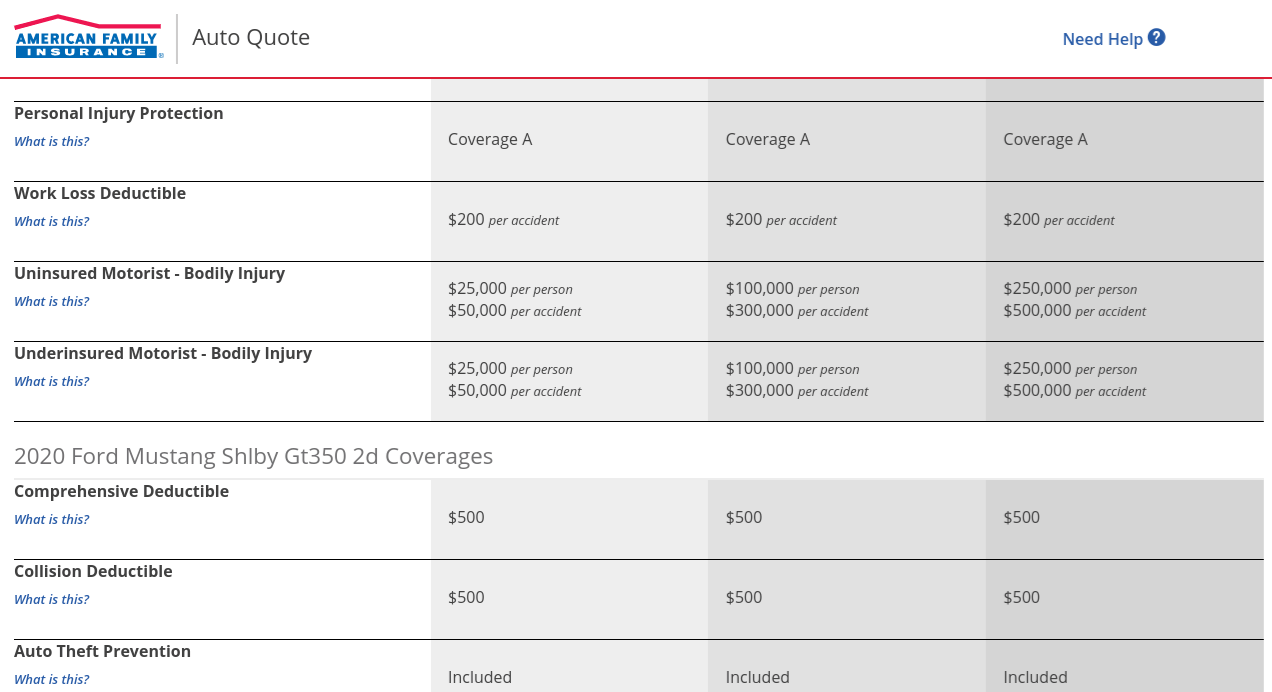

Next, you’ll reach the quote page. It has details about coverage levels, policy coverages, and deductibles.

It’ll include coverages other than liability like the ones we talked about earlier. These include personal injury protection and uninsured motorist.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website and App

A company’s website is generally the first-stop shop when it comes to consumers interacting with the company. American Family’s website holds information on everything from car insurance to farm and ranch insurance.

It also allows current customers to file claims and access their accounts.

How is the website set up and is it easy to navigate? That’s what this section aims to answer.

Website

To go to the website, type AmFam.com into your browser. It’ll take you to the homepage we saw earlier in the get a quote section.

To reach the car insurance page, place your cursor over the insurance button. It’ll pull down a menu with the different types of insurance coverages. You can click on car insurance from there.

From there, you’ll be taken to this page. The top gives you the option of starting a quote by typing in your zip code and pressing the blue button.

A scroll down will reveal six different options or selling points. Here, you can click on a link to make a claim, build a policy, or access the MyAmFam app.

On the left side are options like coverages, discounts, deductibles, and the KnowYourDrive program.

How easy can you find answers?

To find answers to any questions not included in the topics, you can use the search button (magnifying glass) at the upper right to pull up this page.

From there, type in your search query and it’ll go through the site looking for any matching criteria.

Is the design a plus or minus?

The design of the site is an overall positive. It is easy to navigate, with quick buttons for accessing your account, reaching customer service, and getting a quote. Finding information about insurance is easy.

American Family also has a resources section on its site where it writes small posts about insurance topics. These can range from car insurance to homeowners insurance, even insurance 101.

Its app is available on the front page, which is helpful. Its KnowYourDrive program can be accessed easily on the car insurance page. Its mobile site is well-designed and laid-out as well.

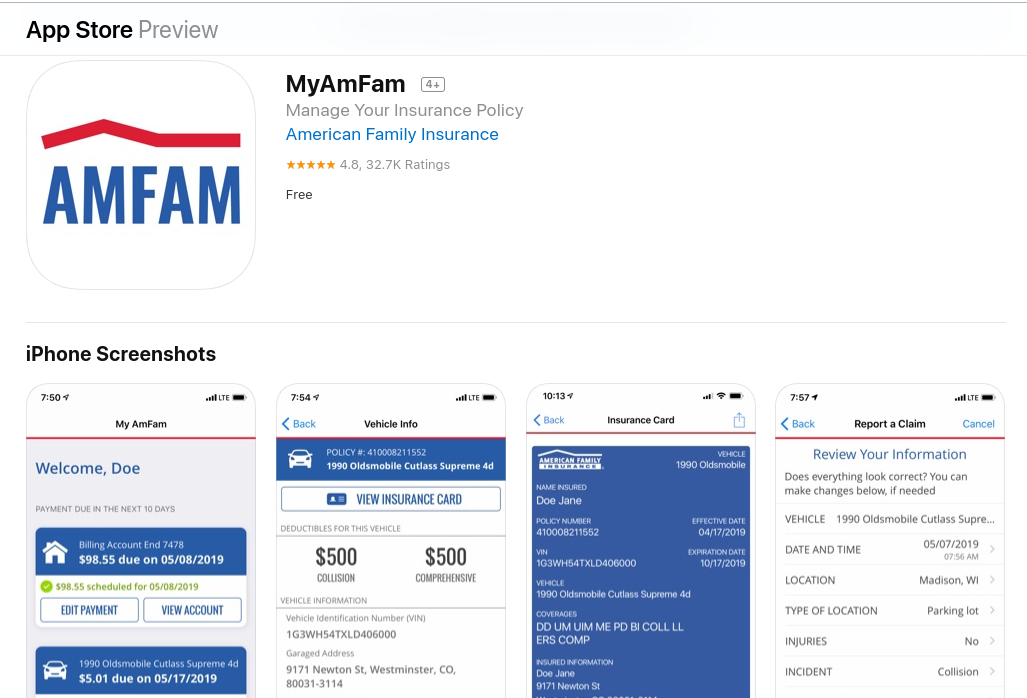

MyAmFam

We know that having an easy way to manage your account is an important point when considering a new car insurance company.

Mobile devices are used the most when accessing the Internet and working with a mobile site can be tiresome.

That’s why we’ve put together this section. We want to give you all the tools needed to choose or not choose American Family as your next insurance provider.

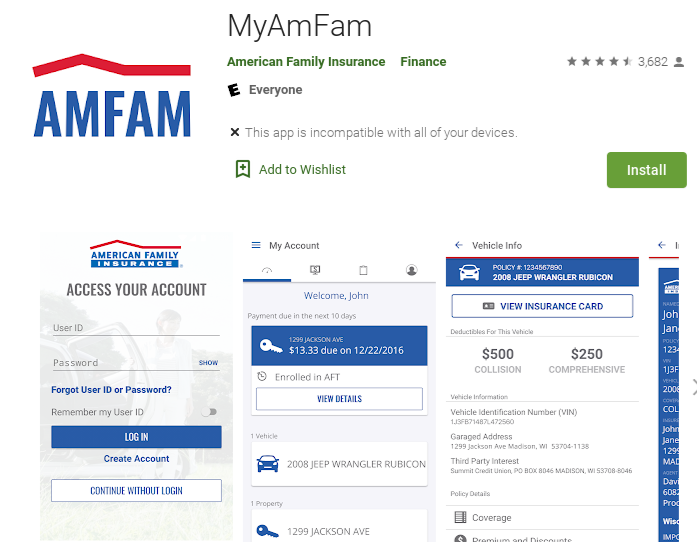

The MyAmFam app is American Family’s main insurance app, with capabilities to manage your account. It’s available in iOS and Android and each is fairly popular, with thousands of reviews.

iOS (32,700 reviews, 4.8 overall rating):

Customers had mostly good things to say about the app.

LitlOne (5-star review) writes, “I love that I can look over my auto coverages by line & cost in the documents! (Please add that to the coverages section of the app) That allowed me to see how little I was paying for my Comp deductible every 6 months.”

Candi983 (5-star review) writes, “She was able to get my policy switched over to new vehicle in about 5 minutes with no hassle and to my surprise, all the vehicle information was transferred to virtual insurance card on my AMFAM app immediately…”

Google Play (3,682 reviews, 4.5 overall rating):

Recent customers had a mix of positive and negative comments.

Shelby Dodgins (1-star review) writes, “This app is worthless. I tried to set up an account and it had me verify everything and told me my information was incorrect when asking for the security questions.”

Janelle Flanagan (4-star review) writes, “POI access could be a bit more handy, like on the menu or homepage. This is the only reason why I gave a 4, otherwise everything else is great.”

How easily can you manage your account using just the app?

According to the description of the app in the Google Play store, there are over a dozen ways you can use the app.

- Schedule payments

- Set up automatic payments

- View policy and coverage details

- Pull up proof of your car insurance

Those are just four.

Is the design a plus or minus?

According to some of the reviewers on Google Play, it’s easy to access your insurance card, pay your bill, and see insurance information. Some people also say it’s easy to navigate.

Others have reported problems with the app, such as not being able to access different features or not being able to log in at all.

KnowYourDrive

We know discounts are important too. KnowYourDrive, as previewed earlier, is American Family’s driving discount program. With it, you can get discounts on your premium up to 20 percent.

Unfortunately, reviewers are not as positive about the KnowYourDrive app compared to MyAmFam.

iOS (98 reviews, 2 overall rating):

Most customers are not happy.

Mpd239 (1-star review) writes, “This app is garbage. You get dinged if you’re going too fast, dinged if you’re going to slow, dinged if you drive at night, dinged if you use a hands-free phone device….”

hockeyohan19 (1-star review) writes, “SECOND of all I get a very low score for “driving to slow” because that means I “drive in congested zones” MAYYBEE it means I drive in the neighborhood I live in which isn’t congested?”

Google Play (151 reviews, 1.6 rating):

Customers here are not happy either.

Kenny Shimmel (1-star review) writes, “Horribly built app. Pretty much like all the other 1 star reviews. It will start you out blocks if not a few miles from where you strarted, hard brakes “dings” are always in the same spot….”

Anita Plamman (1-star review) writes, “Horrible app. in the 2 weeks I have had it it has only let me log in once, literally every other time it says no internet connection no matter if it is true or not.”

Is the app accurate?

Many of these apps from different companies have trouble with determining braking speed, hard turns, and distracted driving. Is this the case with KnowYourDrive?

A quick perusal of reviews on iOS and the Google Play store shows a variety of complaints, most stemming from inaccuracy.

- Inaccurate detection of speed

- Inaccurate detection of hard-braking incidents

- Problems with the app determining congestion

- Dings for driving at night

These are fairly typical with the driving recording apps of some other car insurance companies. KnowYourDrive does seem to penalize you for hands-free calls, as they are linked to distracted driving.

Overall, it may be worth trying, as you could get a discount. Keep in mind, however, that you can’t shut off the device when driving. It also drains battery life very, very quickly.

Pros and Cons

| Pros | Cons |

|---|---|

| Strong financial ratings | Economic outlook was graded as negative recently |

| Growth in premiums written | Small market share |

| Affordable rates | Only available in 19 states |

| Has a driving discount program | App has technical and accuracy issues |

The Bottom Line

The bottom line is this.

American Family is a good company. It has strong financial ratings, very good customer service, and solid in the customer satisfaction ratings for the claims process.

Its rates are in the middle, evenly divided between the higher-priced companies and lower. And it does good work in the community, backing up its claim to fund and protect the dreams of Americans.

It also has a good amount of discounts, including a driving discount app.

However — and there’s always a however.

American Family is a small company, just 10th overall in premiums written for private passenger auto. It’s available only in 19 states, which can make it difficult to get a plan and keep it if you’re planning to move.

Fitch Ratings graded American Family’s economic outlook as negative recently. And there are larger, cheaper, financially stronger companies out there.

It’s a tough call.

If you want middle-of-the-road, American Family’s your choice. If you want something else?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family Car Insurance FAQs

Everyone has questions they’d like to ask about a prospective car insurance company. Here are eight about American Family.

Who Owns American Family Insurance?

According to Fortune, American Family is a privately-owned mutual insurance group. A mutual insurance group’s policyholders technically own the company, as the company is supposed to work directly for the policyholders rather than for profit.

Where Is American Family Insurance Headquarters?

American Family Insurance’s main headquarters are at 6000 American Parkway, Madison, Wisconsin 53783. It also has regional headquarters in Minnetonka, Minnesota; Saint Joseph, Missouri; Denver, Colorado; and Columbus, Ohio.

Is American Family Insurance a Mutual Company?

Yes. The technical full name of American Family is American Family Insurance Group. This means that its policyholders own the company and that the company is supposed to work for their benefit, not solely or necessarily for profit.

Does American Family Insurance Cover Rental Cars?

Yes. American Family has a special auto coverage called Rental Car Expense, a coverage that applies to customers whose cars are in the shop for a claim. The rental car, if the process is like those for other companies, is either paid for upfront or the expenses are reimbursed.

Will American Family Insurance Salvage Title?

Yes, they will. When a car is deemed a total loss, American Family salvages the title and cuts to you for the actual value of the car. This is unless you owe money on the car, in which it’d go to the loan company or the financer. American Family then sells the car to a salvage buyer. (For more information, read our “Auto Insurance Companies That Accept Salvage Titles“).

What Is American Family Insurance Connect?

American Family Insurance Connect is insurance for small businesses such as veterinarians, beauty parlors, and sporting good stores. Coverages offered include general liability, business property protection, and employee-related optional coverages.

Who Is In American Family Insurance Commercial?

The two most famous people in American Family commercials are Derek Jeter, a longtime New York Yankee player, and J.J. Watt, a player for the Houston Texans. Other commercials feature regular people who have big dreams.

What Is the Salary of an American Family Insurance Agent?

According to PayScale, the average salary for an insurance agent at American Family is $37,005. This is less than the average salary of $38,960 for all insurance agents in America. It’s higher than agents at State Farm, Nationwide, and Farmers. But it’s lower than agents at Geico, USAA, and Allstate.

https://www.youtube.com/watch?v=5muTOswA1jQ

There you go! You should have all the information needed to make a decision about going with American Family as your car insurance company or not. Clear eyes, full hearts. Happy driving.

Ready to compare rates? Try our FREE online tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.