Michigan Car Insurance (The Only Guide You’ll Ever Need)

Michigan is a no-fault state and requires you to purchase personal injury protection (PIP) and property protection insurance (PPI) along with standard liability insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

The car capital of the world. The world’s largest cement plant. The birthplace of dried cereal.

Michigan is known for muscle and intellect, the home of major car companies like Ford and General Motors and major research institutions like the University of Michigan.

They are also known for another, less fortunate aspect. It is a state with some of the highest average car insurance rates in the country.

If you’re on this page, you’re likely looking for car insurance. This is for yourself, a family member, or a friend. You may have noticed in your research that car insurance is confusing. All the technical terms, the nomenclature, the numbers.

We understand. We’ve got you covered.

In this guide, we take the complicated and make it simple. The technical terms and make them laymen. We do the research so you don’t have to.

Get ready to start that engine. We’re heading out.

Ready to compare rates? Try our FREE online tool.

| Michigan Overview | Details |

|---|---|

| Road Miles | Total in State: 122,286 Vehicle Miles Driven: 97,843 |

| Vehicles | Registered: 8,036,643 Total Stolen: 15,764 |

| State Population | 9,995,915 |

| Most Popular Vehicle | Ford Escape |

| Uninsured Motorists | 20.3% State Rank: 4th |

| Total Driving Fatalities | 2008-2017 Speeding: 2,397 Drunk Driving: 2,562 |

| Average Premiums by Coverage Type | Liability: $795.32 Collision: $413.83 Comprehensive: $154.85 |

| Cheapest Providers | USAA Progressive |

Michigan Car Insurance Coverage and Rates

Industry terms can be confusing. There’s med pay, personal injury protection, core coverage, comprehensive, collision, and suddenly your head might start to hurt.

We get it. We’re here to help.

In this chapter, you’ll learn all about those terms, what they mean, and how they apply to you. You’ll also see the statistics behind them. For instance, what is the average cost of collision coverage? Or are the insurance companies paying on claims for med pay?

It’s your crash course in car insurance. Let’s get on the road.

Michigan’s Car Culture

This information about car culture in Michigan comes from The Hartford, in partnership with AARP.

Detroit is the epicenter of car culture in America, home to some of the largest car companies in the world. It and the state as a whole owe a great of infrastructure and economy to the car industry.

Says James Doherty, who lived in Detroit for 15 years, “Michigan is the only place I’ve been where people will actually confront you for not driving an American car.”

Every year, the North American International Auto Show brings 800,000 attendees to Detroit for about $450,000 million in revenue.

Car culture in Michigan affects everything from your vehicle, your education, your entertainment, and, of course, your economy.

Michigan Minimum Coverage

Michigan is a no-fault state and requires you to purchase personal injury protection (PIP) and property protection insurance (PPI) along with standard liability insurance.

The liability insurance, according to the Insurance Information Institute, is 20/40/10. This means you must have insurance that covers you for

- $20,000 for the injuries or death of one person

- $40,000 for the injuries or deaths of more than one person

- $10,000 for the destruction of property

Your PIP plan covers your medical expenses and lost wages if you were to be in an accident. It also covers any passengers in the car and can cover any family members living in your house.

PIP is important in a no-fault state as the other driver won’t be covering your medical expenses or lost wages unless you sue them.

PPI is another safeguard, this time of the other drivers and property owners in Michigan. If you were to hit and damage another’s property with your car, PPI would kick in. It’s an up to $1 million insurance coverage and necessary to get a license plate.

This, according to Allstate and Nolo (a legal authority). There is also a new set of car insurance reform laws that may allow Michigan residents to partially or completely opt-out of PIP, depending on if their health insurance covers auto accidents.

There’s uncertainty about these new laws and their impacts. We’ll cover more in the following sections.

Forms of Financial Responsibility

When you are pulled over by an officer, you have two options easily available to prove you have insurance:

- An insurance card

- An electronic insurance card

An electronic card is a good option. It saves paper, is easily accessible, and contains all the information you need.

And, fortunately, Michigan law prohibits officers from accessing other apps or other personal information when confirming the card’s validity, according to Michigan Injury Attorneys.

If you don’t have proof of insurance, the consequences will be fairly mild. You’ll be given a fix-it-ticket, according to law firm Kershaw, Vititoe, & Jedinak. If you provide proof that you have insurance to the court, you may get a fine as little as $25.

Premiums as a Percentage of Income

We know that car insurance can be expensive. It can take money away from groceries, rent, and house repairs, among other things. The money listed on the bill isn’t enough to quantify the impact.

The question is, what percentage of your income are you paying on car insurance?

We have partnered with Quadrant Data to provide hard numbers about car insurance, everything ranging from the differences in male and female rates to the differences in price by Michigan ZIP codes. Its data comes directly from companies.

That’s where our premium as a percentage of income statistic comes from.

| Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Michigan | 3.37% | 3.63% | 3.71% |

| Nationwide | 2.34% | 2.43% | 2.40% |

Michigan residents pay a much larger percentage of their income on car insurance compared to the national average.

How does this stack up compared to neighboring states?

| Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Indiana | 2.06% | 2.00% | 2.00% |

| Ohio | 1.98% | 2.04% | 2.04% |

| Wisconsin | 1.75% | 1.82% | 1.82% |

Still much much larger. The cost of car insurance in Michigan is much higher than many states, in part because it is a no-fault state, which we will cover later.

Average Monthly Car Insurance Rates in MI (Liability, Collision, Comprehensive)

Core coverage for car insurance is like an HE3 atom. There is the neutron, the heaviest component. This is your liability insurance. And then there are the two protons. These are your auxiliary components. These are your collision and comprehensive insurances.

Whereas liability takes care of the other person, such as their medical payments and property damage, collision and comprehensive take care of you and your vehicle.

- Collision: pays for damage to your vehicle in an accident

- Comprehensive: pays for damage to your vehicle in anything other than an accident

Each has its own price.

| Core Coverage Costs | Michigan | National Average |

|---|---|---|

| Liability | $795.32 | $538.73 |

| Collision | $413.83 | $322.61 |

| Comprehensive | $154.85 | $148.04 |

| Foll Coverage | $1,364.00 | $1,009.38 |

Liability is more expensive than collision, which is more expensive than comprehensive. Michigan full coverage cost is more than $350 higher than the national average.

Additional Liability

You might want additional coverage in Michigan. We’ve already talked about two of those coverages, which are mandatory: personal injury protection and property protection insurance.

Medical payments and uninsured/underinsured motorist are two that are useful in Michigan.

Medical payments (Med Pay) covers your medical bills if you’re in an accident. It is similar to PIP but doesn’t cover your lost wages. You might choose to get Med Pay even if you have PIP.

Uninsured/underinsured motorist (UM/UIM) covers your vehicle if you’re hit by a motorist who doesn’t have insurance.

Twenty percent of Michigan motorists are uninsured, which ranks fourth in the country.

But there’s always the question about whether insurance companies will pay out on claims. For an answer, we turn to the National Association of Insurance Commissioners and its auto insurance database report.

There, it shows the loss ratios for PIP, Med Pay, and UM/UIM for Michigan. A loss ratio is the number of premiums written divided by the number of claims that are approved.

- Anything over 1 and the companies are losing money

- Anything below .5 and the companies might not be paying on claims

- Between .6 and .8 is the good spot

Let’s check out the numbers.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 1.09 | .84 | 1.12 |

| Medical Payment (Med Pay) | 4.15 | 1.03 | .76 |

| Uninsured/Underinsured Motorist | .76 | .77 | .75 |

With Med Pay and PIP, companies lost money two out of three years. UM/UIM was fine throughout.

Add-ons, Endorsements, and Riders

If you want additional coverages, there are some that many companies offer, to fit many needs.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Read more: Auto Insurance Companies That Cover Modified Cars

Average Monthly Car Insurance Rates by Age & Gender in MI

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

The Insurance Institute for Highway Safety looked into whether this was true. In its study, it looked through decades of data to determine which gender was the safer driver. It writes,

“Many more men than women die each year in motor vehicle crashes. Men typically drive more miles than women and more often engage in risky driving practices including not using safety belts, driving while impaired by alcohol, and speeding.”

Insurance companies back that up. Traditionally, rates are lower for women. Ditto for the elderly and ditto for the married.

In general, being responsible matters. In Michigan, however, it appears rates are slightly different.

| Company | Married 35-year old Female | Married 35-year old Male | Married 60-year old Female | Married 60-year old Male | Single 17-year old Female | Single 17-year old Male | Single 25-year old Female | Single 25-year old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $16,754.82 | $16,754.82 | $15,575.00 | $15,575.00 | $41,309.06 | $41,309.06 | $17,646.81 | $17,646.81 |

| Farmers Ins Exch | $6,307.90 | $6,307.90 | $5,856.52 | $5,856.52 | $13,831.87 | $13,831.87 | $7,104.64 | $7,104.64 |

| Geico Ind | $4,453.35 | $4,453.35 | $4,533.10 | $4,533.10 | $12,291.51 | $12,291.51 | $4,252.21 | $4,252.21 |

| Liberty Mutual Fire | $14,880.96 | $14,880.96 | $14,732.64 | $14,732.64 | $35,157.81 | $35,157.81 | $14,880.96 | $14,880.96 |

| Nationwide Mutual Fire | $4,477.30 | $4,477.30 | $3,979.03 | $3,979.03 | $11,785.55 | $11,785.55 | $4,907.85 | $4,907.85 |

| Progressive Marathon | $3,156.54 | $2,932.15 | $2,785.12 | $3,113.99 | $11,516.82 | $12,259.07 | $3,676.55 | $3,393.23 |

| State Farm Mutual Auto | $7,556.15 | $7,556.15 | $7,010.11 | $7,010.11 | $26,491.15 | $26,491.15 | $8,869.85 | $8,869.85 |

| Travelers Affinity | $5,839.83 | $5,839.83 | $5,012.52 | $5,012.52 | $17,631.16 | $17,631.16 | $6,344.88 | $6,344.88 |

| USAA CIC | $2,649.82 | $2,508.37 | $2,491.74 | $2,352.36 | $6,472.15 | $6,145.20 | $3,229.01 | $3,095.85 |

Within Michigan, rates for most companies are set between males and females. Progressive and USAA are the two exceptions.

- The highest rates come from Allstate: over $41,000 for both 17-year-old males and females

- The lowest rates come from USAA: $2,500 for a 60-year-old female and $2,350 for a 60-year-old female

That’s a $38,000 difference between companies, ages, and marital statuses.

Likely the Quadrant data reflects the current climate about car insurance in Michigan. As with some changes to the mandatory car insurance requirements, the new laws prohibit companies from using demographic information, such as gender.

Cheapest Rates by ZIP Code

The Consumer Federation of America found in a study that insurance companies set prices different, sometimes drastically, based on the ZIP codes of their consumers. Even adjacent ZIP codes might have differences in hundreds of dollars.

Under the new car insurance reform law, insurance companies are banned from using ZIP codes to set rates. There are loopholes, ones that were quickly criticized, including the use of other territorial measures like census tracts or political district.

Find your ZIP code on the map above to see the average rates.

Like with the implementation of all laws, it is uncertain how much the information will be changed. Still, you might still find it helpful.

Cheapest Rates by City

Like with ZIP codes, census tracts, or political district, rates will vary according to the city.

The reason for the changes is often cited as risk. Some areas have higher probabilities of accidents, tickets, thefts, and other factors that raise the number of claims that are filed.

This risk raises the rates overall for a ZIP code, census tract, political district, or city.

Let’s take a look at the 10 cheapest cities in Michigan:

| 10 Least Expensive Cities in Michigan | Average Rate in City | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|

| St. Louis | $7,916.29 | Allstate | $17,625.93 | USAA | $3,489.43 |

| Shepherd | $7,958.69 | Allstate | $17,642.89 | USAA | $3,630.14 |

| Westphalia | $8,036.93 | Allstate | $17,180.01 | USAA | $3,356.40 |

| Midland | $8,131.32 | Allstate | $18,996.62 | USAA | $3,157.97 |

| Grand Ledge | $8,153.32 | Allstate | $17,357.46 | USAA | $3,581.27 |

| Sanford | $8,231.24 | Allstate | $18,874.11 | USAA | $3,397.49 |

| Auburn | $8,242.98 | Allstate | $19,119.13 | USAA | $3,368.16 |

| Breckenridge | $8,248.57 | Allstate | $17,625.93 | USAA | $3,397.49 |

| Dimondale | $8,262.31 | Allstate | $17,665.20 | USAA | $3,288.33 |

| Allendale | $8,267.02 | Allstate | $20,296.94 | USAA | $3,449.84 |

And, conversely, here are the 10 most expensive:

| 10 Most Expensive Cities in Michigan | Average by City | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|

| Detroit | $26,301.11 | Farmers | $48,386.05 | USAA | $5,711.92 |

| Dearborn | $20,920.85 | Farmers | $43,870.92 | USAA | $4,558.38 |

| River Rouge | $19,405.58 | Farmers | $38,258.61 | USAA | $4,904.33 |

| Harper Woods | $19,225.22 | Farmers | $40,532.15 | USAA | $4,601.02 |

| Oak Park | $18,716.04 | Allstate | $40,770.62 | USAA | $4,786.60 |

| Ecorse | $18,154.01 | Farmers | $31,827.17 | USAA | $4,904.33 |

| Southfield | $17,774.85 | Allstate | $43,653.03 | USAA | $4,542.02 |

| Inkster | $16,984.97 | Allstate | $32,881.20 | USAA | $4,405.52 |

| Lathrup Village | $16,742.91 | Allstate | $33,371.80 | USAA | $4,294.61 |

| Melvindale | $16,544.22 | Allstate | $28,635.20 | USAA | $4,904.33 |

Rates in State’s 10 Largest Cities

Often, some of the biggest cities have the highest overall rates. Is this the case for Michigan?

| City | Population | County | Rates |

|---|---|---|---|

| Detroit | 680,250 | Wayne | $26,966.81 |

| Grand Rapids | 193,792 | Kent | $9,020.04 |

| Warren | 135,099 | Macomb | $15,080.65 |

| Sterling Heights | 131,741 | Macomb | $13,315.84 |

| Ann Arbor | 117,770 | Washtenaw | $8,395.25 |

| Lansing | 114,620 | Clinton/Eaton | $9,273.92 |

| Flint | 99,002 | Genesee | $16,343.93 |

| Dearborn | 95,535 | Wayne | $20,920.85 |

| Livonia | 94,958 | Wayne | $11,256.51 |

| Troy | 83,107 | Oakland | $11,806.87 |

Mostly, no. There are three tiers of cities based on their insurance rates.

- $20,000 or over: Detroit, Dearborn

- $16,000-$13,000: Flint, Warren, Sterling Heights

- $11,000 or under: Troy, Livonia, Lansing, Grand Rapids, Ann Arbor

Detroit, Dearborn, and Livonia are all in Wayne County. Warren and Sterling Heights are both in Macomb.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best State Car Insurance Companies

Progressive has Flo. Geico has the gecko. State Farm has half the former Houston Rockets team. You know their mascots and they bring the funny, all while telling you their latest deals. But how much do you know about them really?

Insurance companies can be something of a mystery. Many have been around for one hundred years, but they are something of a monolith. Here, we dispel that mystery.

In this section, you’ll find parts of the companies that are difficult to find.

- Financial ratings

- Customer satisfaction ratings

- Total complaints and complaint indexes

And, of course, their rates by five different factors. We’re heading around bend two. Give it a little gas.

The Largest Companies’ Financial Ratings

Just like you have a credit score, companies have financial ratings. These financial ratings show how trustworthy companies are in repaying their debts and how solvent they are. Solvent means the financial health of the company.

These ratings come from AM Best, which is a major worldwide credit rating agency. An A stands for an excellent ability in meeting their financial obligations. Anything above an A is a superior ability.

| Company | AM Best Rating |

|---|---|

| Allstate | A+ |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | A++ |

| Travelers | A |

| USAA | A++ |

Every major company in Michigan has at least an excellent rating. Geico, State Farm, and USAA all have the highest rating possible at A++.

Companies With Best Ratings

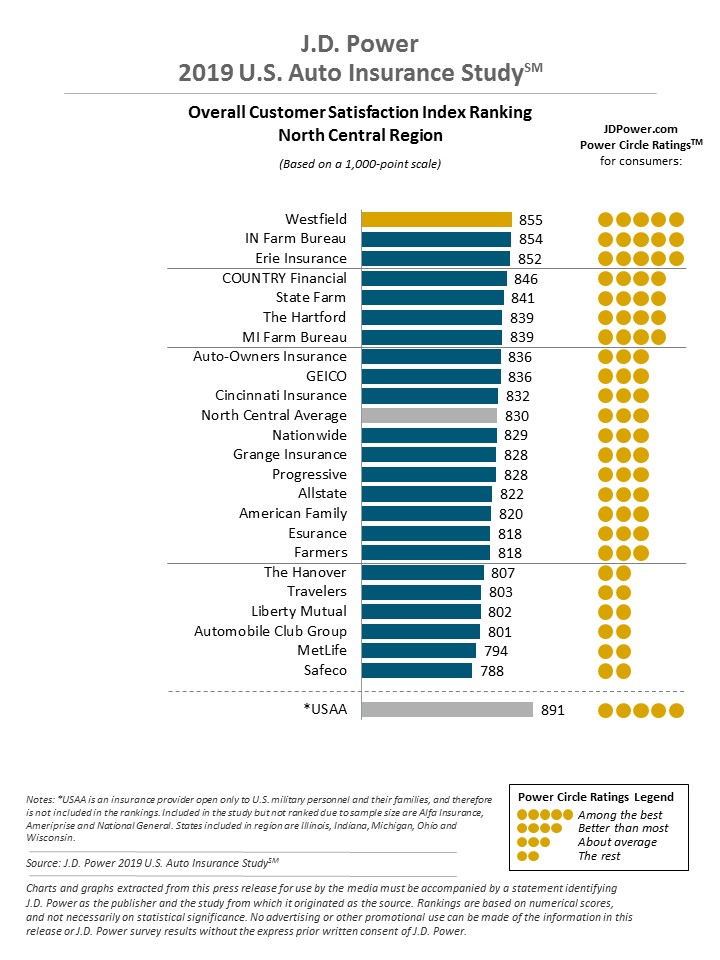

Along with financial ratings are customer satisfaction. These come from J.D. Power, which does a car insurance study every year. In this study, they look at customer satisfaction for different regions around the country.

We’ll look at the North Central Region, which includes Michigan.

Of the companies we’re looking at, only USAA, State Farm, and Geico are above average. Nationwide and Progressive are around average. All other companies are lower.

As a cross-reference, USAA, State Farm, and Geico are the three companies with the highest financial ratings. The three lowest companies in the J.D. Power survey are Farmers, Travelers, and Liberty Mutual. They have the lowest financial ratings.

Companies with Most Complaints in Michigan

There are financial ratings and customer satisfaction ratings. Then there are consumer complaints.

These numbers come from the National Association for Insurance Commissioners and its section for consumers. All are a complaint index, meaning the number of complaints is weighed against the number of premiums written.

The complaints are taken from available data from state insurance departments around the country.

| Company | Complaint Index | Total Complaints |

|---|---|---|

| Allstate | 1.26 | 226 |

| Farmers | 0.95 | 73 |

| Geico | 0.92 | 600 |

| Liberty Mutual | 0.94 | 146 |

| Nationwide | 0.43 | 37 |

| Progressive | 0.88 | 84 |

| State Farm | 0.57 | 1,397 |

| Travelers | 0.20 | 31 |

| USAA | 1.15 | 328 |

Some have very few complaints. Others have a great deal. Complaint indexes range from .20 to 1.26.

- Best three: Travelers, Nationwide, State Farm

- In the middle: Progressive, Geico, Liberty Mutual

- Worst three: Farmers, USAA, Allstate

USAA, State Farm, and Geico are scattered between the three sections. USAA, which had the highest customer satisfaction rating of all companies, has the second-worst complaint index.

Travelers, which had the second-worst customer satisfaction rating had the best complaint index.

Cheapest Companies in Michigan

Rates in Michigan are some of the highest in the country. Which company is the cheapest?

The data below comes from our partner Quadrant Data. This will be the case for the next six sections as we cover rates based on different factors like coverage level and commute times.

| Company | Annual Average | Compared to State Average (+/-) | Compared to Srate Average (%) |

|---|---|---|---|

| Allstate F&C | $22,821.42 | $12,394.66 | 54.31% |

| Farmers Ins Exch | $8,275.23 | -$2,151.53 | -26.00% |

| Geico Ind | $6,382.54 | -$4,044.22 | -63.36% |

| Liberty Mutual Fire | $19,913.09 | $9,486.33 | 47.64% |

| Nationwide Mutual Fire | $6,287.43 | -$4,139.33 | -65.84% |

| Progressive Marathon | $5,354.18 | -$5,072.58 | -94.74% |

| State Farm Mutual Auto | $12,481.81 | $2,055.05 | 16.46% |

| Travelers Affinity | $8,707.10 | -$1,719.67 | -19.75% |

| USAA CIC | $3,618.06 | -$6,808.70 | -188.19% |

The annual averages range from $3,600 to $22,800. The cheapest is USAA, nearly 190 percent below average. The most expensive is Allstate, about 54 percent above average.

There are six below $10,000: USAA, Progressive, Nationwide, Geico, Farmers, and Travelers.

The other three are well above $10,000 and the annual average.

Commute Rates by Companies

Commute rates and your average annual mileage can affect your rates. Some companies change rates depending on those factors and some don’t. Which companies do for Michigan?

| Company | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute | 6,000 annual mileage | $22,821.42 |

| Allstate | 25 miles commute | 12,000 annual mileage | $22,821.42 |

| Farmers | 10 miles commute | 6,000 annual mileage | $8,275.23 |

| Farmers | 25 miles commute | 12,000 annual mileage | $8,275.23 |

| Geico | 10 miles commute | 6,000 annual mileage | $6,236.05 |

| Geico | 25 miles commute | 12,000 annual mileage | $6,529.03 |

| Liberty Mutual | 10 miles commute | 6,000 annual mileage | $19,223.85 |

| Liberty Mutual | 25 miles commute | 12,000 annual mileage | $20,602.33 |

| Nationwide | 10 miles commute | 6,000 annual mileage | $6,287.43 |

| Nationwide | 25 miles commute | 12,000 annual mileage | $6,287.43 |

| Progressive | 10 miles commute | 6,000 annual mileage | $5,354.18 |

| Progressive | 25 miles commute | 12,000 annual mileage | $5,354.18 |

| State Farm | 10 miles commute | 6,000 annual mileage | $12,142.23 |

| State Farm | 25 miles commute | 12,000 annual mileage | $12,821.40 |

| Travelers | 10 miles commute | 6,000 annual mileage | $8,657.15 |

| Travelers | 25 miles commute | 12,000 annual mileage | $8,757.05 |

| USAA | 10 miles commute | 6,000 annual mileage | $3,576.60 |

| USAA | 25 miles commute | 12,000 annual mileage | $3,659.52 |

USAA, Geico, Travelers, State Farm, and Liberty Mutual change their rates. Liberty Mutual changes them the most, about a $1,400 difference. USAA changes them the least, about an $85 difference.

Coverage Level Rates by Companies

Coverage levels vary according to the coverage limits and type of coverage.

Coverage limits are the amounts a company will pay out if you’re in an accident. A $40,000 bodily injury liability plan will cost less than an $80,000 bodily injury liability plan.

Types of coverage include adding more coverage to the mandatory minimum. Adding comprehensive and collision will cost more than if you just went with liability.

Some companies charge over $1000 more for a high-level plan. For some companies, the price difference between a high-level plan and a low-level plan is less than $500.

| Company | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $23,352.73 |

| Allstate | Medium | $22,873.48 |

| Allstate | Low | $22,238.06 |

| Farmers | High | $8,523.10 |

| Farmers | Medium | $8,253.96 |

| Farmers | Low | $8,048.64 |

| Geico | High | $6,832.27 |

| Geico | Medium | $6,327.85 |

| Geico | Low | $5,987.51 |

| Liberty Mutual | High | $20,418.71 |

| Liberty Mutual | Medium | $19,868.02 |

| Liberty Mutual | Low | $19,452.55 |

| Nationwide | High | $6,101.40 |

| Nationwide | Medium | $6,181.29 |

| Nationwide | Low | $6,579.61 |

| Progressive | High | $5,512.79 |

| Progressive | Medium | $5,360.96 |

| Progressive | Low | $5,188.80 |

| State Farm | High | $13,040.02 |

| State Farm | Medium | $12,560.38 |

| State Farm | Low | $11,845.05 |

| Travelers | High | $8,788.45 |

| Travelers | Medium | $8,716.50 |

| Travelers | Low | $8,616.35 |

| USAA | High | $3,716.05 |

| USAA | Medium | $3,626.86 |

| USAA | Low | $3,511.28 |

The most expensive companies overall charge at least $1,000 more for a high-level plan. Many of the cheapest companies charge $200 or less for a high-level plan.

State Farm has the biggest price difference at around $1,200. Travelers has the smallest at around $170.

Credit History Rates by Companies

Your credit score affects your rates, sometimes drastically. As Consumer Reports notes in its Good Morning America video, a poor credit score often causes higher rates than a DUI infraction.

Under new Michigan law, insurance companies are prohibited from using credit scores to set customer rates. However, as the Detroit Free Press writes, “they can use credit reports, which would show whether a person has a history of making late payments.”

It’s one of the loopholes in the new Michigan reform law.

| Company | Credit History | Annual Average |

|---|---|---|

| Allstate | Good | $14,598.09 |

| Allstate | Fair | $19,170.49 |

| Allstate | Poor | $34,695.69 |

| Farmers | Good | $6,364.70 |

| Farmers | Fair | $6,881.67 |

| Farmers | Poor | $11,579.33 |

| Geico | Good | $4,903.24 |

| Geico | Fair | $6,031.66 |

| Geico | Poor | $8,212.73 |

| Liberty Mutual | Good | $10,042.90 |

| Liberty Mutual | Fair | $18,192.56 |

| Liberty Mutual | Poor | $31,503.82 |

| Nationwide | Good | $5,041.07 |

| Nationwide | Fair | $5,932.40 |

| Nationwide | Poor | $7,888.82 |

| Progressive | Good | $4,678.78 |

| Progressive | Fair | $5,198.94 |

| Progressive | Poor | $6,184.82 |

| State Farm | Good | $6,948.71 |

| State Farm | Fair | $10,240.44 |

| State Farm | Poor | $20,256.29 |

| Travelers | Good | $8,544.17 |

| Travelers | Fair | $8,653.62 |

| Travelers | Poor | $8,923.51 |

| USAA | Good | $2,350.18 |

| USAA | Fair | $3,088.55 |

| USAA | Poor | $5,415.46 |

The company with the largest price difference between a poor credit score and a good credit score is Liberty Mutual for about $21,500. The company with the smallest price difference is Travelers at a little less than $400.

Averaged, a poor credit score raises rates by about $8,000 compared to a good score.

| Fair | Good | Poor | Average |

|---|---|---|---|

| $9,265.59 | $7,052.43 | $14,962.28 | $10,426.77 |

From good to fair, the rate raise is about $2,200. From fair to poor, it is almost $6,000. And a poor score increases rates about $4,500 above the average.

Driving Record Rates by Companies

Your driving record affects your rates. But by how much?

| Company | Driving Record | Annual Average |

|---|---|---|

| Allstate | Clean record | $11,113.69 |

| Allstate | With 1 accident | $14,863.20 |

| Allstate | With 1 DUI | $49,760.80 |

| Allstate | With 1 speeding violation | $15,547.99 |

| Farmers | Clean record | $6,933.96 |

| Farmers | With 1 accident | $8,878.82 |

| Farmers | With 1 DUI | $8,748.36 |

| Farmers | With 1 speeding violation | $8,539.80 |

| Geico | Clean record | $2,247.29 |

| Geico | With 1 accident | $4,746.86 |

| Geico | With 1 DUI | $14,384.88 |

| Geico | With 1 speeding violation | $4,151.13 |

| Liberty Mutual | Clean record | $13,939.21 |

| Liberty Mutual | With 1 accident | $16,814.63 |

| Liberty Mutual | With 1 DUI | $31,057.16 |

| Liberty Mutual | With 1 speeding violation | $17,841.37 |

| Nationwide | Clean record | $5,376.80 |

| Nationwide | With 1 accident | $7,181.07 |

| Nationwide | With 1 DUI | $6,532.75 |

| Nationwide | With 1 speeding violation | $6,059.11 |

| Progressive | Clean record | $4,533.62 |

| Progressive | With 1 accident | $5,964.06 |

| Progressive | With 1 DUI | $5,361.42 |

| Progressive | With 1 speeding violation | $5,557.63 |

| State Farm | Clean record | $7,942.35 |

| State Farm | With 1 accident | $9,521.29 |

| State Farm | With 1 DUI | $20,573.92 |

| State Farm | With 1 speeding violation | $11,889.70 |

| Travelers | Clean record | $5,891.56 |

| Travelers | With 1 accident | $8,413.93 |

| Travelers | With 1 DUI | $13,556.16 |

| Travelers | With 1 speeding violation | $6,966.74 |

| USAA | Clean record | $2,910.44 |

| USAA | With 1 accident | $3,631.64 |

| USAA | With 1 DUI | $4,758.07 |

| USAA | With 1 speeding violation | $3,172.10 |

The first 12 rows are above $10,000. This includes Liberty Mutual and Allstate at clean records. In comparison to this number, some people will pay less in mortgage payments per year than that.

A DUI seems to be the most costly, with the three highest rates for DUI infractions. The big leaper is Geico, which has the fourth-lowest annual rates. It jumps into the top 12 with a rate of $14,400 for a DUI infraction.

How does this all average out?

| Clean Record | 1 Accident | 1 DUI | 1 Speeding Ticket |

|---|---|---|---|

| $6,765.44 | $8,890.61 | $17,192.61 | $8,858.40 |

A DUI raises rates about $10,000 from a clean record. Rates for 1 Accident and 1 Speeding Ticket are about even, $2,000 above a clean record.

Largest Car Insurance Companies in Michigan

The largest companies in Michigan show the influence of state-wide groups and lesser-known companies.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $1,662,966 | .53 | 18.54% |

| Automobile Club MI Group | $1,421,253 | 1.09 | 15.84% |

| Progressive Group | $1,261,150 | .69 | 14.06% |

| Auto-Owners Group | $888,716 | .91 | 9.91% |

| Allstate Insurance Group | $731,916 | 1.10 | 8.16% |

| The Hanover Insurance Group | $535,020 | .68 | 5.96% |

| Michigan Farm Bureau Group | $410,895 | .66 | 4.58% |

| Liberty Mutual Group | $390,079 | .67 | 4.35% |

| USAA Group | $271,157 | .89 | 3.02% |

| Frankenmuth Group | $157,962 | .66 | 1.76% |

State Farm is the top company with 18.5 percent of the market share. But within the top 10, there are four groups with little national presence. Those are the Automobile Club, Michigan Farm Bureau, Hanover, and Frankenmuth.

None of those four is in the top 10 of insurance providers nationwide. Geico, Nationwide, Travelers, and Farmers are all missing from the top 10 in Michigan.

Number of Insurers by Michigan

A domestic insurer is a company that was founded and does business solely in its state. Think of your mom and pop insurance company. There are 65 in Michigan.

A foreign insurer is a company that was founded out-of-state and does business in multiple states. These include big chains like State Farm and Geico. There are 786 in Michigan.

For legal purposes, there is no difference. However, if you planning to move out of state and want to take your plan with you, you’ll have better luck with a foreign insurer.

Michigan Laws

State laws can be confusing. Poring over the legal documents, parsing through the text on city websites, and researching dozens of sources can be difficult. We understand.

We’ve put together this section to take the complexity out of state laws. We strive to make this easier to understand.

In this section, we cover car insurance laws, vehicle licensing laws, rules of the road, and safety laws. Essentially, everything from high-risk insurance to penalties for DUIs. And a lot in-between.

Car Insurance Laws

Car insurance laws are like the roast beef of state laws: delicious, filling, and good for building protein.

Here, you’ll learn how insurance commissioners protect consumers, high-risk insurance options, fraud, and how long you have to file a civil suit after an accident.

Grab a fork and get ready to dig in.

How State Laws for Insurance Are Determined

According to the National Association of Insurance Commissioners, there are seven ways in which states regulate rates. In Michigan, the method is called file and use.

This means that an insurance company must file new rates with the state department before putting them into action. This keeps rates from running rampant, although Michigan drivers might disagree with this.

While this is a method, a state may also pass new laws to regulate car insurance rates. Michigan has done this over the past year. Hopefully, there will be some relief for drivers.

Windshield Coverage

Carwindshields.info puts together all the state laws regulating replacements of windshields for easy reading. It cites two Michigan statutes: 500.2110b and 257.1363.

From 500.2110b, an insurance company may not unreasonably restrict you from choosing your own repair shop. But you may have to pay extra for the repairs and products.

From 257.1363, an insurance company may request after-market products, but the repair shop must provide an estimate in writing.

High-Risk Insurance

If you’re in an accident and have no insurance, your license may be suspended and you might be required to get high-risk insurance.

This high-risk insurance is called financial responsibility insurance in Michigan. There are two types: owner’s and operator’s. Owner’s insurance protects the owner of a vehicle. Operator’s protects the operator in any vehicle they don’t own.

This is according to Michigan’s Office of Secretary of State.

To get approved for financial responsibility insurance, you must apply through your insurance company. They will gather the documents and file with the state department. This process takes two to four weeks.

If you aren’t approved, there is one last-ditch market available: the Michigan Automobile Insurance Placement Facility. Prices will be higher here, most likely, than the voluntary market. This because the applicants are all high-risk drivers.

If you get financial responsibility insurance, you are eligible for a financial-responsibility restricted license.

Low-Cost Insurance

Michigan does not have a low-cost insurance plan. Only California, Hawaii, and New Jersey do.

Automobile Insurance Fraud in Michigan

Fraud costs property and casualty insurance companies $30 billion per year, according to the Insurance Information Institute.

The penalty for committing insurance fraud in Michigan is a felony charge, up to four years and jail and a $50,000 fine.

The Department of Insurance and Financial Services (DIFS) is the fraud reporting bureau in Michigan.

They list several ways in which a person might commit fraud. These include fake bodily injury claims, misreported mileage, and exaggerated medical expenses.

If you suspect fraud and would like to report, you can visit this fraud reporting page or call the DIFS at 877-999-6442.

Statute of Limitations

When you’re in an accident, you have a certain amount of time to file a lawsuit. This is called the Statute of Limitations and is covered in Michigan Statute 600.8505. It reads,

“Except as otherwise provided in this section, the period of limitations is three years after the time of the death or injury for all actions to recover damages for the death of a person or for injury to a person or property.”

This three-year limit for filing personal injury or property damage lawsuits is useful to know in Michigan. Because of its no-fault rules, damages in major accidents can only be recouped in a lawsuit.

State Specific Laws

Aside from its sudden overhaul of the car insurance system in Michigan, there is one unique aspect to Michigan car insurance since 1978. It’s called the Michigan Catastrophic Claims Association (MCCA).

It was started because insurance companies had trouble obtaining reinsurance for no-fault policies, which provided unlimited lifetime medical benefits for people in catastrophic accidents.

Today, the MCCA collects assessments from every auto or motorcycle insurer in Michigan. This assessment is per $220 per vehicle as of the 2019-2020 year. However, this assessment often gets passed to consumers in the mandatory PIP coverage.

The new law makes PIP coverage an option if you have medical insurance that covers accidents. However, you will still have to pay your share into the fund according to Michigan Auto Law.

Vehicle Licensing Laws

Vehicle licensing laws are like the potatoes of state laws: they are filling, nutritious, and kind of bland.

In this section, we’ll cover topics that may be a little less exciting but are still important to know. They can keep you away from fines and hassle. The last topic can keep you out of jail time.

Real ID

In 2005, as a result of September 11th, Congress passed the REAL ID Act. It set out minimum identification requirements for people looking to access federal facilities, such as nuclear plants and airplanes.

The Department of Homeland Security eventually took over to enforce the REAL ID Act. It pushed forth numerous deadlines that provided a timeline for states to comply with the Act. Today, all but four states have complied.

Michigan is one that has. This gives residents of Michigan access to the new, security-enhanced driver’s licenses. These are needed to fly domestically beginning October 1, 2020.

Written on the Michigan Secretary of State’s website,

“To apply for a REAL ID-compliant driver’s license or ID card, you’ll need to bring your valid U.S. passport or certified birth certificate with a raised seal or stamp to any Secretary of State office. Other documents verifying legal presence are accepted.”

If you apply for the security-enhanced driver’s license in-between renewals, there will be a duplicate card fee charged.

Penalties for Driving Without Insurance

Penalties for driving without insurance are stiff in many states. Is it the same in Michigan?

| Offense | Fine | License Suspension (if in an accident/traffic violation) | Jail Time |

|---|---|---|---|

| Misdemeanor | $200 - $500 | 30 days or until proof of insurance | Up to one year |

They are and there are possible reasons for this. Uninsured motorists can cost the state a great deal of money. They might not be able to pay for property damage caused in an accident. They might not be able to pay for their own car or medical bills.

This can lead to serious financial damage. The penalties are stiff accordingly.

Teen Driver Laws

Every teen thinks about the day they will get a car. A car means freedom, the ability to go where they want to go, to spend time away from their parents’ house.

In Michigan, there are regulations for both the learner’s permit and the unrestricted driver’s license. This data on driver’s license graduating requirements comes from the Insurance Institute for Highway Safety (IIHS).

| Minimum Age | Mandatory Holding Period | Minimum Amount of Supervised Driving | Minimum Age for DL |

|---|---|---|---|

| 14 years, 9 months | 6 months | 50 hours, 10 at night | 16 |

A teen can get a learner’s permit earlier than in many other states but still most wait until 16 to get a driver’s license. Someone who starts their learner’s permit must wait six months before applying for a driver’s license.

| Unsupervised Driving Prohibited | Restrictions on Passengers | Nighttime Restrictions | Passenger Restrictions |

|---|---|---|---|

| 10pm - 5am | No more than 1 passenger under 21 | 6 months and age 17 or until age 18 | 6 months and age 17 or until age 18 |

Michigan has strict regulations regarding nighttime driving for those on a restricted license. The restrictions lift after a person has had the license for six months and turns 17. For everyone, the restrictions lift at age 18. (For more information, read our “Ohio Has Strict Driving Safety Laws: A Breakdown and Explanation“).

Older Driver License Renewal Procedures

Older drivers have challenges on the road that many younger persons don’t face. The National Institute on Aging lists six: stiff joints and muscles, trouble seeing, trouble hearing, dementia, slower reaction time and reflexes, and medications.

Possibly for these reasons, companies offer specific insurance plans for people over 50.

Now, in Michigan, do they have different renewal procedures than the younger population? This data on license renewal procedures also comes from the IIHS.

| Renewal Cycle | Proof of Adequate Vision Required | Mail/Online Renewal Permitted |

|---|---|---|

| 4 years | Every renewal | No |

Stringent procedures. We’ll see if this varies compared to the general population two sections down.

New Residents

Congratulations: You’ve moved to Michigan. You’re ready to see all the amazing lakes, the state parks, the Motown record studios, and the car manufacturing museums. But first, there’s some red-tape you have to walk through.

On the car insurance side, there is the vehicle titling, vehicle licensing, and driver’s license procedures. The good news? You won’t have time to procrastinate. The bad news? You must do these things the moment you establish residency.

As written on the Secretary of State’s website, “New Michigan residents must title and register their vehicles immediately. There is no grace period provided in Michigan law.”

This includes the driver’s license. But, once you’re finished, you’ll have time to take in some of the sites like The Great Lakes.

License Renewal Procedures

Back to that question: are older driver license renewal procedures different than the general population?

| Renewal Cycle | Proof of Adequate Vision Required | Mail/Online Renewal Permitted |

|---|---|---|

| 4 years | Every renewal | No |

The answer is no. The procedures are strict for everyone.

Reckless Driving

We know it when we see it: that car driving at 90 miles per hour, weaving in and out of traffic. We think, that person’s driving recklessly. Usually, there are steep penalties for that. So how about in Michigan?

Statute 257.626 defines reckless driving as “a person who operates a vehicle upon a highway or a frozen public lake, stream, or pond or other place open to the general public…in willful or wanton disregard for the safety of persons or property….”

What is willful or wanton disregard? Generally, we know it when we see it.

The violation is a misdemeanor with a penalty of up to 93 days in jail and a fine of not more than $500.

The Dave J. Kramer Law Firm notes additional punishments for the misdemeanor charge. These include six points off your driving record, license suspension for 90 days, $1,000 in driver responsibility fees, and vehicle forfeiture or immobilization.

If a person’s reckless driving causes serious bodily or death, the violation moves up to a felony with fines up to $10,000 and jail time up to 15 years. The additional punishments are more severe as well, including license revocation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rules of the Road

Rules of the road are like the minestrone soup of state laws: easy to eat and with a variety of vegetables. Meaning, there is something for everyone.

There is the section on seat belts, which save lives. There is a section on speed limits, which can keep you from getting a ticket. And there’s the ridesharing section, for you busy drivers.

We start with the reason Michigan’s insurance is so high: fault versus no-fault.

Fault vs. No-Fault

Michigan car insurance is high. It consistently ranks in the top two states for the highest car insurance. Why is this so?

Michigan is a no-fault state. This means that when an accident occurs, every driver contacts their own insurance company for damages. With the minimum insurance coverage, that just means your medical bills.

The other driver in a no-fault state or their insurance company is not responsible for damages to your car. There is just one exception: when your car is properly parked. This means for your car to be repaired, you’d need collision insurance.

Why is liability insurance mandatory then, you might ask? In a no-fault state, there is still the chance you might be sued and found responsible for an accident in a court of law. Then you’d be responsible for the other person’s medical bills and property damage.

That’s when the liability would kick in. Confused yet?

The confusion is one of the reasons some people are not happy with no-fault states. And to top it off, these states have some of the highest car insurance rates in the country. Why?

A few reasons. No-fault states can lead to rampant fraud, as you file directly with your company to get damages. One of these types of fraud is through the personal injury protection policy. As the Insurance Information Institute writes,

“In a number of no-fault states, PIP coverage is being exploited by fraud rings that include phony pain clinics and corrupt physicians, chiropractors and lawyers, particularly in states where PIP benefits are generous.”

There is also a high-cost to filing no-fault claims, which gets passed down to consumers. The MCCA assessment also gets passed down to consumers, often in the form of their PIP premiums. This is an additional couple hundred dollars.

With high premiums come issues, including more uninsured motorists. Michigan is ranked fourth in the nation. The leader is Florida, another no-fault state.

The fortunate part?

This reform law is being touted as lowering rates and providing relief to residents of Michigan. It provides stricter measures on companies for when they set rates.

It doesn’t do away with the no-fault system. But it provides boundaries that should keep some elements in check.

Seat Belt and Car Seat laws

The National Highway Traffic Safety Administration (NHTSA) is an organization that looks at everything from risky driving behaviors to total traffic fatalities in the country. According to it, in 2017 seat belts saved around 15,000 lives. It writes,

“One of the safest choices drivers and passengers can make is to buckle up.”

So what is the law in Michigan? This seat belt and car seat data come from the Insurance Institute for Highway Safety (IIHS).

| Initial Effective Date | Primary Enforcement | Who Is Covered/What Seats | Maximum 1st Fine |

|---|---|---|---|

| July 1st, 1985 | Yes | 16+ years in front seat | $25 |

Everyone over 16 years of age must be buckled up in the front seats. There are other laws for people age 15 or under.

| Child Restraint Facing Rear | Adult Belt Permissible | Maximum Fine | Preference for Rear Seat |

|---|---|---|---|

| 7 years and younger and less than 57 inches | 8 through 15 years; children who are at least 57 inches tall | $10 | 3 years and younger must be in the rear seat if available |

There are a few rules for small children. And kids and young teenagers must be buckled up regardless of where they’re sitting. At least the seat belt law is primary enforcement. This means that the police can pull you over for just that, without another crime.

Keep Right and Move Over Laws

No one likes a slowpoke. In Michigan, drivers are required to keep right, with a few exceptions. These are spelled out in Statute 257.634.

- When overtaking or passing another vehicle

- When the right lane is closed to traffic or an obstruction

- When police or a government agency is on the side of the road

- When there are three or more lanes of traffic

There is one last exception: when a driver is making a left turn ahead.

Speed Limits

Speed kills. In 2017, speeding was implicated in 26 percent of fatal crashes according to the NHTSA. This amounted to nearly 10,000 deaths. So, what is the speed limit law in Michigan? These speed limit regulations come from the IIHS.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstate | 70, 75 on specified segments |

| Urban Interstate | 70 |

| Other Limited Access Roads | 70 |

| Other Roads | 55 |

On interstates and limited access roads, it’s generally 70 miles per hour. The only exception is on certain portions of rural interstates.

For non-interstate roads, the speed limit is 55 miles per hour. However, in 2017, the Department of Transportation raised the speed limits on some of the non-interstate due to the results of an engineering study. The new limits were put into place in early 2018.

Ridesharing

There are no specific companies listed for ridesharing insurance in Michigan. However, you can always check around. Certain companies like USAA, State Farm, and Nationwide already have coverages. Others are likely rolling them out.

It’s on a state by state basis so make sure to ask your agent or call around.

Automation on the Road

Autonomous cars are a thing of the future, quickly becoming the present. With companies like Tesla, GM, Ford, and Honda all looking to roll out autonomous cars soon, states are putting in regulations for their use. So, what are the laws in Michigan?

| Type of Automation That Is Permitted on Public Roads? | Operator Required To Be Licensed? | Operator Required To Be in the Vehicle? | Liability Insurance Required? |

|---|---|---|---|

| Depends on vehicle | Yes | No | Yes |

No operator required in the vehicle, but liability insurance is required and the operator must be licensed.

Safety Laws

Safety laws are like the swordfish of state laws: good and tasty but eat too much and you’ll get mercury poisoning.

The following sections cover the major causes leading to car accidents fatalities. They are about excess. Do them once and it’s a problem. Do them four or five times and a serious situation could occur.

OWIs, marijuana-impaired driving, and driving distracted. Put that napkin over your shirt. We’re about to eat some delicious fish.

OWI Laws

Mothers Against Drunk Driving (MADD) has been around since the 1970s. It has fought for tougher laws against drunk driving and more awareness about the dangers of drinking and driving.

According to it, drunk driving leads to 30 deaths and 300,000 incidents per day. It is still the number one cause of deaths on the roadways.

In Michigan, the legal term for a drunk driving charge is an OWI or operating while intoxicated. The first violation starts at .8. The second and more serious charge starts at .17.

The first two convictions for an OWI are unclassified offenses but are misdemeanors. The third and over are felonies.

The washout or look back period is seven years for the second offense and unlimited or lifetime for the third or more. The penalties overall in Michigan are steep. The following information comes from Michigan’s page on drinking and driving.

| Michigan OWI Penalties | 1st OWI | 2nd OWI | 3rd OWI |

|---|---|---|---|

| Community Service | 30-90 days (in lieu of jail time) | 30-90 days (in lieu of jail time) | - |

| Licension Suspension | mandatory 6 months may be eligible for restricted license after 30 days | 1 year minimum 5 year minimum if prior revocation in 7 years | 1 year minimum 5 year minimum if prior revocation in 7 years |

| Jail Time | 5 days - 1 year | 5 days - 1 year | 1-5 years |

| Fines | $100-$500 | $200-$1000 $1000 driver responsibility fee | $500-$5000 $1000 driver responsibility fee |

| Other | 6 points on record possible IID | license plate confiscation vehicle immobilization 90-180 days 6 points on license | license plate confiscation vehicle immobilization 1-3 years vehicle registration denial possible vehicle forfeiture 6 points on license |

There are quadruple hits, including jail time, fines, license suspensions, and punishments like vehicle immobilization. All of these punishments grow more severe if a drunk driver is in a car that seriously injures or kills someone.

Michigan, fortunately, is not high in the ranks fo OWI arrests compared to other states. This information comes from the FBI.

| Total Arrests | Rate Per 1 Million | State Rank |

|---|---|---|

| 27,571 | 3,563 | 30 |

There are sub-groups more susceptible to this kind of behavior. One of them is teenagers, which we’ll be talking about later.

Marijuana-Impaired Driving Laws

Marijuana can impair senses, slow reaction time, and make it difficult to focus on the road. According to Responsibility.org, Michigan has a zero-tolerance policy for THC. Driving while under the influence of CBD is not a crime.

Distracted Driving Laws

Distracted driving can cost lives. According to the NHTSA, over 3,000 people lost their lives due to distracted driving in 2017. Some states are reacting accordingly, creating hand-held bans in cars and texting bans.

In Michigan, the laws are standard. This information on cell phone regulations comes from the Insurance Institute for Highway Safety.

| Hand-held Ban | Young Drivers All Cellphone Ban | Texting Ban | Primary Enforcement |

|---|---|---|---|

| No | learner's permit and intermediate license holders (level 1 and 2) integrated voice-operated systems excepted | all drivers | primary |

There is a texting ban, but there is no handheld ban. This can make the texting ban harder to enforce, as a person can say they were doing something else with their phone.

The regulations are in line with many other states.

Driving Safely in Michigan

There are many factors that influence safety on the road. Low visibility, speeding, drunk drivers, weather conditions can all impact how you drive and how safe you are.

This chapter tries to illuminate these issues. We show you the statistics on vehicle fatalities based on cause and context. We share the most dangerous road in Michigan. And we cover vehicle theft so that you can be more protected.

At the end, we touch on transportation, such as commute times and traffic.

We’re in the final section now.

Vehicle Theft in Michigan

Vehicle theft is a serious crime and a stressful experience for the victims. In Michigan, some cars are stolen more than others.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Impala | 2008 | 733 |

| Chevrolet Pickup (Full Size) | 1999 | 585 |

| Ford Pickup (Full Size) | 2006 | 530 |

| Dodge Caravan | 2003 | 528 |

| Dodge Charger | 2015 | 477 |

| Chevrolet Trailblazer | 2007 | 462 |

| Chevrolet Malibu | 2013 | 451 |

| Pontiac Grand Prix | 2004 | 418 |

| Jeep Cherokee/Grand Cherokee | 2000 | 407 |

| Ford Fusion | 2014 | 355 |

Chevy vehicles occupy four out of the top seven spots. Some cities in Michigan have more car thefts than others as well.

| City | Population | Motor Vehicle Thefts |

|---|---|---|

| Addison Township | 6,542 | 5 |

| Adrian Township | 6,289 | 1 |

| Akron | 387 | 0 |

| Albion | 8,293 | 15 |

| Allegan | 5,085 | 2 |

| Allen Park | 27,062 | 60 |

| Alma | 9,113 | 2 |

| Almont | 2,780 | 3 |

| Alpena | 10,066 | 4 |

| Ann Arbor | 121,930 | 99 |

| Argentine Township | 6,544 | 2 |

| Armada | 1,742 | 1 |

| Au Gres | 848 | 0 |

| Auburn Hills | 23,034 | 26 |

| Bad Axe | 2,956 | 3 |

| Bancroft | 515 | 0 |

| Bangor | 1,839 | 2 |

| Baroda-Lake Township | 3,762 | 3 |

| Barry Township | 3,431 | 2 |

| Barryton | 360 | 0 |

| Bath Township | 12,759 | 4 |

| Battle Creek | 60,852 | 94 |

| Bay City | 33,286 | 59 |

| Beaverton | 1,044 | 0 |

| Belding | 5,772 | 3 |

| Bellaire | 1,061 | 0 |

| Belleville | 3,832 | 7 |

| Bellevue | 1,298 | 0 |

| Benton Harbor | 9,899 | 33 |

| Benton Township | 14,354 | 47 |

| Berkley | 15,322 | 8 |

| Berrien Springs-Oronoko Township | 9,039 | 2 |

| Beverly Hills | 10,504 | 0 |

| Big Rapids | 10,437 | 1 |

| Birch Run | 1,452 | 0 |

| Birmingham | 21,162 | 5 |

| Blackman Township | 36,908 | 43 |

| Blissfield | 3,229 | 1 |

| Bloomfield Hills | 4,021 | 3 |

| Bloomfield Township | 42,291 | 24 |

| Boyne City | 3,741 | 7 |

| Brandon Township | 15,752 | 4 |

| Breckenridge | 1,296 | 1 |

| Bridgeport Township | 9,909 | 5 |

| Bridgman | 2,247 | 4 |

| Brighton | 7,631 | 3 |

| Bronson | 2,315 | 2 |

| Brown City | 1,246 | 1 |

| Brownstown Township | 31,102 | 35 |

| Buchanan | 4,314 | 4 |

| Buena Vista Township | 8,084 | 14 |

| Burton | 28,439 | 51 |

| Cadillac | 10,473 | 10 |

| Calumet | 702 | 0 |

| Cambridge Township | 5,643 | 1 |

| Canton Township | 90,294 | 57 |

| Capac | 1,834 | 0 |

| Carleton | 2,342 | 2 |

| Caro | 4,037 | 4 |

| Carrollton Township | 5,728 | 2 |

| Carson City | 1,107 | 0 |

| Caseville | 732 | 0 |

| Caspian-Gaastra | 1,173 | 0 |

| Cass City | 2,322 | 2 |

| Cassopolis | 1,717 | 1 |

| Center Line | 8,304 | 30 |

| Central Lake | 929 | 0 |

| Charlevoix | 2,515 | 5 |

| Charlotte | 9,053 | 9 |

| Cheboygan | 4,705 | 1 |

| Chelsea | 5,225 | 1 |

| Chesaning | 2,253 | 0 |

| Chesterfield Township | 45,212 | 32 |

| Chikaming Township | 3,083 | 1 |

| Chocolay Township | 5,948 | 3 |

| Clare | 3,058 | 5 |

| Clarkston | 893 | 0 |

| Clawson | 11,994 | 3 |

| Clay Township | 8,845 | 3 |

| Clayton Township | 7,113 | 3 |

| Clinton | 2,253 | 2 |

| Clinton Township | 100,999 | 155 |

| Clio | 2,495 | 1 |

| Coldwater | 10,750 | 5 |

| Coleman | 1,191 | 1 |

| Coloma Township | 6,362 | 1 |

| Colon | 1,150 | 0 |

| Columbia Township | 7,379 | 3 |

| Commerce Township | 38,342 | 11 |

| Constantine | 2,042 | 4 |

| Corunna | 3,386 | 1 |

| Covert Township | 2,831 | 3 |

| Croswell | 2,278 | 3 |

| Crystal Falls | 1,380 | 0 |

| Davison | 4,891 | 4 |

| Davison Township | 19,029 | 4 |

| Dearborn | 93,889 | 278 |

| Dearborn Heights | 55,454 | 132 |

| Decatur | 1,755 | 0 |

| Denton Township | 5,324 | 1 |

| Detroit | 670,792 | 8,155 |

| Dewitt | 4,754 | 2 |

| Dewitt Township | 14,799 | 4 |

| Dryden Township | 4,767 | 2 |

| Durand | 3,312 | 2 |

| East Grand Rapids | 11,812 | 4 |

| East Jordan | 2,348 | 0 |

| East Lansing | 48,920 | 137 |

| Eastpointe | 32,712 | 181 |

| Eaton Rapids | 5,230 | 5 |

| Eau Claire | 613 | 1 |

| Ecorse | 9,132 | 46 |

| Elk Rapids | 1,610 | 0 |

| Elkton | 763 | 1 |

| Elsie | 974 | 0 |

| Emmett Township | 11,619 | 17 |

| Erie Township | 4,359 | 0 |

| Escanaba | 12,280 | 8 |

| Essexville | 3,340 | 0 |

| Evart | 1,858 | 1 |

| Fair Haven Township | 1,037 | 0 |

| Farmington | 10,537 | 6 |

| Farmington Hills | 81,359 | 77 |

| Fennville | 1,402 | 0 |

| Fenton | 11,306 | 11 |

| Ferndale | 20,131 | 57 |

| Flat Rock | 9,821 | 15 |

| Flint | 96,605 | 274 |

| Flint Township | 30,284 | 95 |

| Flushing | 7,972 | 0 |

| Flushing Township | 10,172 | 2 |

| Forsyth Township | 6,189 | 5 |

| Fowlerville | 2,922 | 2 |

| Frankenmuth | 5,159 | 2 |

| Frankfort | 1,291 | 1 |

| Franklin | 3,260 | 3 |

| Fraser | 14,645 | 27 |

| Fremont | 4,020 | 6 |

| Fruitport Township | 14,138 | 11 |

| Gaines Township | 6,139 | 3 |

| Galesburg | 2,055 | 0 |

| Galien | 528 | 0 |

| Garden City | 26,571 | 38 |

| Garfield Township | 812 | 0 |

| Gaylord | 3,697 | 6 |

| Genesee Township | 20,253 | 11 |

| Gerrish Township | 2,902 | 1 |

| Gibraltar | 4,472 | 9 |

| Gladstone | 4,767 | 2 |

| Gladwin | 2,865 | 1 |

| Grand Beach | 279 | 0 |

| Grand Blanc | 7,904 | 5 |

| Grand Blanc Township | 36,630 | 24 |

| Grand Haven | 11,004 | 11 |

| Grand Ledge | 7,809 | 4 |

| Grand Rapids | 197,868 | 363 |

| Grandville | 16,108 | 23 |

| Grant | 879 | 1 |

| Grayling | 1,830 | 1 |

| Green Oak Township | 18,839 | 7 |

| Greenville | 8,418 | 6 |

| Grosse Ile Township | 10,084 | 1 |

| Grosse Pointe | 5,151 | 5 |

| Grosse Pointe Farms | 9,106 | 3 |

| Grosse Pointe Park | 11,061 | 13 |

| Grosse Pointe Shores | 2,904 | 0 |

| Grosse Pointe Woods | 15,566 | 20 |

| Hamburg Township | 21,897 | 5 |

| Hampton Township | 9,522 | 9 |

| Hamtramck | 21,654 | 118 |

| Hancock | 4,576 | 2 |

| Harbor Beach | 1,602 | 1 |

| Harbor Springs | 1,208 | 0 |

| Harper Woods | 13,653 | 73 |

| Hart | 2,080 | 0 |

| Hartford | 2,602 | 6 |

| Hastings | 7,272 | 1 |

| Hazel Park | 16,551 | 60 |

| Highland Park | 10,757 | 104 |

| Highland Township | 19,912 | 14 |

| Hillsdale | 8,147 | 6 |

| Holland | 33,613 | 27 |

| Holly | 6,156 | 2 |

| Hopkins | 609 | 0 |

| Houghton | 8,031 | 4 |

| Howell | 9,538 | 6 |

| Hudson | 2,225 | 0 |

| Huntington Woods | 6,343 | 3 |

| Huron Township | 15,636 | 18 |

| Imlay City | 3,577 | 1 |

| Independence Township | 36,836 | 11 |

| Inkster | 24,324 | 89 |

| Ionia | 11,287 | 9 |

| Iron Mountain | 7,397 | 0 |

| Iron River | 2,838 | 0 |

| Ironwood | 4,887 | 5 |

| Ishpeming | 6,471 | 9 |

| Jackson | 32,822 | 108 |

| Jonesville | 2,208 | 3 |

| Kalamazoo | 76,263 | 332 |

| Kalamazoo Township | 24,590 | 57 |

| Kalkaska | 2,043 | 1 |

| Keego Harbor | 3,030 | 2 |

| Kentwood | 52,197 | 76 |

| Kinde | 422 | 0 |

| Kingsford | 5,003 | 0 |

| Kinross Township | 7,396 | 1 |

| Laingsburg | 1,284 | 0 |

| Lake Angelus | 297 | 0 |

| Lake Linden | 990 | 0 |

| Lake Odessa | 2,035 | 1 |

| Lake Orion | 3,058 | 2 |

| Lakeview | 1,011 | 0 |

| Lansing | 116,302 | 399 |

| Lansing Township | 8,150 | 20 |

| Lapeer | 8,735 | 15 |

| Lapeer Township | 5,058 | 0 |

| Lathrup Village | 4,126 | 2 |

| Laurium | 1,941 | 0 |

| Lawton | 1,860 | 1 |

| Lennon | 498 | 0 |

| Leslie | 1,875 | 0 |

| Lexington | 1,101 | 0 |

| Lincoln Park | 36,502 | 156 |

| Lincoln Township | 14,460 | 5 |

| Linden | 3,842 | 0 |

| Litchfield | 1,343 | 0 |

| Livonia | 93,603 | 129 |

| Lowell | 4,089 | 3 |

| Ludington | 8,068 | 3 |

| Luna Pier | 1,368 | 1 |

| Lyon Township | 19,890 | 4 |

| Mackinac Island | 475 | 0 |

| Mackinaw City | 801 | 0 |

| Madison Heights | 30,152 | 59 |

| Madison Township | 8,470 | 8 |

| Mancelona | 1,359 | 0 |

| Manistee | 6,030 | 0 |

| Manistique | 2,890 | 1 |

| Marenisco Township | 1,599 | 0 |

| Marine City | 4,108 | 2 |

| Marlette | 1,762 | 0 |

| Marquette | 20,442 | 13 |

| Marshall | 7,028 | 7 |

| Marysville | 9,702 | 3 |

| Mason | 8,418 | 11 |

| Mattawan | 1,936 | 3 |

| Mayville | 905 | 0 |

| Melvindale | 10,262 | 43 |

| Mendon | 854 | 0 |

| Menominee | 8,230 | 4 |

| Meridian Township | 42,878 | 30 |

| Metamora Township | 4,250 | 2 |

| Metro Police Authority of Genesee County | 20,001 | 7 |

| Michiana | 181 | 0 |

| Midland | 42,131 | 10 |

| Milan | 6,044 | 4 |

| Milford | 16,726 | 2 |

| Millington | 1,016 | 1 |

| Monroe | 19,868 | 32 |

| Montague | 2,358 | 1 |

| Montrose Township | 7,466 | 5 |

| Morenci | 2,174 | 0 |

| Morrice | 891 | 0 |

| Mount Morris | 2,918 | 6 |

| Mount Morris Township | 20,365 | 34 |

| Mount Pleasant | 26,366 | 18 |

| Munising | 2,232 | 1 |

| Muskegon | 38,375 | 197 |

| Muskegon Heights | 10,786 | 47 |

| Muskegon Township | 17,842 | 25 |

| Napoleon Township | 6,727 | 2 |

| Nashville | 1,644 | 1 |

| Negaunee | 4,576 | 2 |

| New Baltimore | 12,401 | 4 |

| New Buffalo | 1,870 | 1 |

| New Era | 443 | 0 |

| New Lothrop | 555 | 0 |

| Newaygo | 2,045 | 5 |

| Niles | 11,202 | 39 |

| North Muskegon | 3,794 | 1 |

| Northfield Township | 8,634 | 1 |

| Northville | 5,981 | 2 |

| Northville Township | 28,751 | 15 |

| Norton Shores | 24,402 | 27 |

| Norway | 2,757 | 0 |

| Novi | 59,895 | 32 |

| Oak Park | 29,698 | 74 |

| Oakland Township | 19,241 | 2 |

| Olivet | 1,707 | 0 |

| Ontwa Township-Edwardsburg | 6,487 | 8 |

| Orchard Lake | 2,431 | 0 |

| Orion Township | 35,857 | 11 |

| Oscoda Township | 6,831 | 2 |

| Otisville | 821 | 1 |

| Otsego | 4,005 | 3 |

| Ovid | 1,615 | 0 |

| Owendale | 227 | 0 |

| Owosso | 14,587 | 9 |

| Oxford | 3,548 | 2 |

| Oxford Township | 18,365 | 3 |

| Paw Paw | 3,435 | 3 |

| Peck | 598 | 0 |

| Pentwater | 839 | 0 |

| Perry | 2,094 | 2 |

| Petoskey | 5,764 | 0 |

| Pigeon | 1,143 | 0 |

| Pinckney | 2,463 | 1 |

| Pinconning | 1,249 | 0 |

| Pittsfield Township | 39,061 | 31 |

| Plainwell | 3,825 | 1 |

| Pleasant Ridge | 2,555 | 2 |

| Plymouth | 9,072 | 5 |

| Plymouth Township | 26,779 | 22 |

| Pontiac | 59,731 | 222 |

| Port Austin | 628 | 0 |

| Port Huron | 29,092 | 37 |

| Port Sanilac | 591 | 0 |

| Portage | 48,876 | 59 |

| Portland | 3,943 | 0 |

| Potterville | 2,634 | 0 |

| Prairieville Township | 3,452 | 0 |

| Quincy | 1,627 | 0 |

| Raisin Township | 7,619 | 0 |

| Reading | 1,046 | 1 |

| Redford Township | 46,867 | 212 |

| Reed City | 2,379 | 0 |

| Reese | 1,383 | 1 |

| Richfield Township, Genesee County | 8,270 | 4 |

| Richfield Township, Roscommon County | 3,607 | 1 |

| Richland | 809 | 2 |

| Richland Township, Saginaw County | 3,934 | 0 |

| Richmond | 5,893 | 2 |

| River Rouge | 7,417 | 27 |

| Riverview | 12,045 | 35 |

| Rochester | 13,068 | 2 |

| Rochester Hills | 73,827 | 18 |

| Rockford | 6,316 | 1 |

| Rockwood | 3,159 | 1 |

| Rogers City | 2,676 | 1 |

| Romeo | 3,616 | 2 |

| Romulus | 23,174 | 114 |

| Roosevelt Park | 3,826 | 9 |

| Roseville | 47,651 | 119 |

| Rothbury | 425 | 0 |

| Royal Oak | 59,303 | 51 |

| Saginaw | 48,589 | 75 |

| Saginaw Township | 39,319 | 26 |

| Saline | 9,207 | 3 |

| Sand Lake | 527 | 0 |

| Sandusky | 2,545 | 2 |

| Saugatuck-Douglas | 2,303 | 1 |

| Sault Ste. Marie | 13,630 | 9 |

| Schoolcraft | 1,571 | 1 |

| Scottville | 1,222 | 0 |

| Sebewaing | 1,655 | 0 |

| Shelby Township | 79,217 | 31 |

| Shepherd | 1,516 | 2 |

| Somerset Township | 4,556 | 0 |

| South Haven | 4,362 | 8 |

| South Lyon | 11,777 | 4 |

| South Rockwood | 1,638 | 1 |

| Southfield | 73,324 | 263 |

| Southgate | 28,939 | 78 |

| Sparta | 4,370 | 1 |

| Spring Arbor Township | 7,974 | 1 |

| Springfield Township | 14,341 | 8 |

| St. Charles | 1,925 | 1 |

| St. Clair | 5,350 | 1 |

| St. Clair Shores | 59,782 | 45 |

| St. Ignace | 2,366 | 2 |

| St. Johns | 7,938 | 2 |

| St. Joseph | 8,276 | 4 |

| St. Joseph Township | 9,813 | 6 |

| St. Louis | 6,994 | 1 |

| Stanton | 1,415 | 0 |

| Sterling Heights | 132,882 | 107 |

| Stockbridge | 1,237 | 0 |

| Sturgis | 10,858 | 16 |

| Sumpter Township | 9,215 | 8 |

| Sylvan Lake | 1,841 | 1 |

| Tawas | 4,522 | 1 |

| Taylor | 60,882 | 181 |

| Tecumseh | 8,345 | 4 |

| Thetford Township | 6,656 | 1 |

| Thomas Township | 11,450 | 2 |

| Three Rivers | 7,695 | 15 |

| Tittabawassee Township | 9,776 | 3 |

| Traverse City | 15,617 | 14 |

| Trenton | 18,161 | 18 |

| Troy | 84,086 | 67 |

| Tuscarora Township | 2,946 | 2 |

| Ubly | 811 | 0 |

| Unadilla Township | 3,435 | 3 |

| Utica | 4,960 | 6 |

| Van Buren Township | 27,911 | 69 |

| Vassar | 2,580 | 1 |

| Vernon | 752 | 0 |

| Vicksburg | 3,350 | 1 |

| Walker | 24,987 | 15 |

| Walled Lake | 7,104 | 2 |

| Warren | 135,303 | 437 |

| Waterford Township | 73,060 | 68 |

| Watervliet | 1,671 | 2 |

| Wayland | 4,228 | 2 |

| Wayne | 16,857 | 43 |

| West Bloomfield Township | 65,948 | 16 |

| West Branch | 2,052 | 0 |

| Westland | 81,158 | 139 |

| White Cloud | 1,372 | 0 |

| White Lake Township | 31,016 | 12 |

| White Pigeon | 1,509 | 1 |

| Whitehall | 2,726 | 0 |

| Williamston | 3,892 | 0 |

| Wixom | 13,801 | 17 |

| Wolverine Lake | 4,586 | 1 |

| Wyandotte | 24,817 | 48 |

| Wyoming | 76,153 | 210 |

| Yale | 1,889 | 2 |

| Ypsilanti | 21,267 | 43 |

| Zeeland | 5,594 | 3 |

| Zilwaukee | 1,546 | 1 |

Often, the most populous cities have the most vehicle thefts. That is no different in Michigan with Detroit leading the way at over 8,100, the only city in the thousands. Grand Rapids, Warren, Kalamazoo, and Warren are also big cities with leading theft counts.

Search for your city in the bar above the table.

Road Fatalities in Michigan

There are numerous factors that affect vehicle fatality rates. We’re going to go over eight, with looks at the most fatal highway in the state and trends by county.

Let’s start with the most fatal highway.

Most Fatal Highway in Michigan

This information comes from Geotab, which created a list of the most dangerous roadways per state in America. To do this, it analyzed data from the NHTSA and the Federal Highway Administration.

Michigan’s most fatal highway is 33rd on the list. What is it? I-31.

I-31 has a .5 fatal crash rate. From a 10-year-period ending in 2017, there were 111 crashes for 123 fatalities.

I-31 runs alongside Lake Michigan. Many of the highways in the list run along-side bodies of water, where the view can be pretty, distracting, and cause crashes.

Fatal Crashes by Weather Condition and Light Condition

Even though there is 60 percent less traffic, 40 percent of fatal crashes happen at night. This, according to Pines Salomon Injury Lawyers. Nighttime driving poses challenges such as limited visibility, drowsiness, and drunk drivers.

Do these statistics include Michigan as well? This data comes from WPMU.

| Weather Condition | Daylight | Dark, But Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 413 | 140 | 195 | 30 | 2 | 780 |

| Rain | 29 | 27 | 27 | 3 | 0 | 86 |

| Snow/Sleet | 22 | 8 | 14 | 4 | 0 | 48 |

| Other | 7 | 6 | 7 | 1 | 0 | 21 |

| Unknown | 0 | 0 | 2 | 0 | 2 | 4 |

| TOTAL | 471 | 181 | 245 | 38 | 4 | 939 |

Fatal crashes during the daylight and during times with limited visibility were about even. There were 155 accidents that occurred during inclement weather conditions. Overall, 939 fatal crashes occurred.

Fatalities (All Crashes) by County

Certain counties have more fatalities than others. This data comes from the National Traffic Safety Administration STSI report for Michigan.

| County | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Alcona County | 1 | 0 | 1 | 2 | 2 | 6 |

| Alger County | 6 | 0 | 2 | 2 | 1 | 11 |

| Allegan County | 16 | 14 | 14 | 16 | 13 | 73 |

| Alpena County | 2 | 2 | 2 | 1 | 3 | 10 |

| Antrim County | 3 | 3 | 3 | 5 | 4 | 18 |

| Arenac County | 7 | 2 | 2 | 1 | 7 | 19 |

| Baraga County | 3 | 0 | 1 | 1 | 0 | 5 |

| Barry County | 11 | 12 | 7 | 4 | 11 | 45 |

| Bay County | 10 | 10 | 15 | 10 | 5 | 50 |

| Benzie County | 3 | 5 | 4 | 2 | 0 | 14 |

| Berrien County | 24 | 14 | 18 | 20 | 20 | 96 |

| Branch County | 4 | 7 | 8 | 9 | 2 | 30 |

| Calhoun County | 18 | 14 | 25 | 26 | 19 | 102 |

| Cass County | 12 | 7 | 15 | 9 | 15 | 58 |

| Charlevoix County | 3 | 2 | 2 | 1 | 3 | 11 |

| Cheboygan County | 5 | 4 | 0 | 5 | 3 | 17 |

| Chippewa County | 7 | 3 | 6 | 4 | 2 | 22 |

| Clare County | 5 | 2 | 3 | 8 | 3 | 21 |

| Clinton County | 5 | 9 | 5 | 13 | 2 | 34 |

| Crawford County | 3 | 4 | 1 | 2 | 4 | 14 |

| Delta County | 5 | 2 | 3 | 2 | 10 | 22 |

| Dickinson County | 1 | 0 | 1 | 3 | 5 | 10 |

| Eaton County | 12 | 11 | 15 | 11 | 14 | 63 |

| Emmet County | 4 | 3 | 4 | 5 | 2 | 18 |

| Genesee County | 29 | 33 | 33 | 50 | 38 | 183 |

| Gladwin County | 2 | 3 | 6 | 2 | 3 | 16 |

| Gogebic County | 1 | 1 | 1 | 2 | 3 | 8 |

| Grand Traverse County | 14 | 7 | 11 | 15 | 8 | 55 |

| Gratiot County | 3 | 4 | 8 | 2 | 5 | 22 |

| Hillsdale County | 3 | 10 | 3 | 5 | 5 | 26 |

| Houghton County | 3 | 1 | 3 | 1 | 2 | 10 |

| Huron County | 9 | 6 | 4 | 7 | 6 | 32 |

| Ingham County | 17 | 21 | 17 | 25 | 26 | 106 |

| Ionia County | 8 | 3 | 6 | 7 | 10 | 34 |

| Iosco County | 3 | 1 | 3 | 1 | 3 | 11 |

| Iron County | 2 | 2 | 0 | 4 | 1 | 9 |

| Isabella County | 4 | 12 | 16 | 6 | 12 | 50 |

| Jackson County | 14 | 17 | 15 | 18 | 20 | 84 |

| Kalamazoo County | 36 | 16 | 27 | 35 | 38 | 152 |

| Kalkaska County | 8 | 2 | 3 | 4 | 3 | 20 |

| Kent County | 48 | 55 | 64 | 57 | 69 | 293 |

| Keweenaw County | 0 | 0 | 0 | 0 | 0 | 0 |

| Lake County | 1 | 3 | 1 | 3 | 1 | 9 |

| Lapeer County | 11 | 12 | 8 | 11 | 11 | 53 |

| Leelanau County | 0 | 2 | 4 | 7 | 3 | 16 |

| Lenawee County | 14 | 10 | 9 | 16 | 16 | 65 |

| Livingston County | 15 | 19 | 12 | 22 | 23 | 91 |

| Luce County | 0 | 2 | 2 | 1 | 3 | 8 |

| Mackinac County | 4 | 0 | 1 | 1 | 4 | 10 |

| Macomb County | 53 | 46 | 61 | 63 | 42 | 265 |

| Manistee County | 5 | 2 | 0 | 3 | 3 | 13 |

| Marquette County | 3 | 6 | 2 | 5 | 4 | 20 |

| Mason County | 6 | 4 | 3 | 5 | 9 | 27 |

| Mecosta County | 8 | 7 | 4 | 2 | 4 | 25 |

| Menominee County | 2 | 5 | 2 | 2 | 2 | 13 |

| Midland County | 5 | 6 | 9 | 3 | 18 | 41 |

| Missaukee County | 3 | 1 | 5 | 5 | 0 | 14 |

| Monroe County | 27 | 27 | 13 | 18 | 23 | 108 |

| Montcalm County | 6 | 10 | 6 | 6 | 23 | 51 |

| Montmorency County | 4 | 1 | 0 | 2 | 1 | 8 |

| Muskegon County | 11 | 19 | 18 | 21 | 17 | 86 |

| Newaygo County | 7 | 7 | 7 | 6 | 12 | 39 |

| Oakland County | 56 | 63 | 67 | 80 | 69 | 335 |

| Oceana County | 2 | 1 | 4 | 5 | 2 | 14 |

| Ogemaw County | 4 | 4 | 5 | 5 | 5 | 23 |

| Ontonagon County | 0 | 1 | 1 | 1 | 1 | 4 |

| Osceola County | 6 | 3 | 7 | 2 | 6 | 24 |

| Oscoda County | 0 | 0 | 0 | 3 | 2 | 5 |

| Otsego County | 3 | 4 | 7 | 3 | 7 | 24 |